Valuation surpasses NVIDIA! Japan's new "number one" AdvanTest faces a "big test" with financial report

Edwards Lifesciences faces significant challenges in this earnings season, with its stock price soaring nearly 80% this year, surpassing the valuation of its major client NVIDIA. The company's market capitalization has reached over $80 billion, making it the largest weighted stock in the Nikkei 225 index. Analysts expect the stock price may experience significant volatility after its earnings report on October 28, with an anticipated fluctuation range of 6.4%. Despite the market raising its future earnings expectations by over 50%, analysts still find it difficult to keep up with the stock price momentum

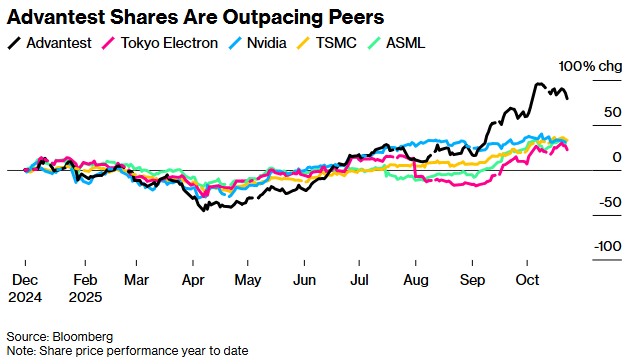

According to Zhitong Finance APP, Advantest (ATEYY.US) is facing significant challenges this earnings season, with its stock price soaring nearly 80% this year, pushing its valuation level above that of major client NVIDIA (NVDA.US). Driven by the artificial intelligence boom, the world's largest chip testing equipment manufacturer has seen its market capitalization surge to over $80 billion, firmly entering the sights of global investors. As of the end of September, it was the largest weighted stock in the Nikkei 225 index, surpassing SoftBank and Fast Retailing.

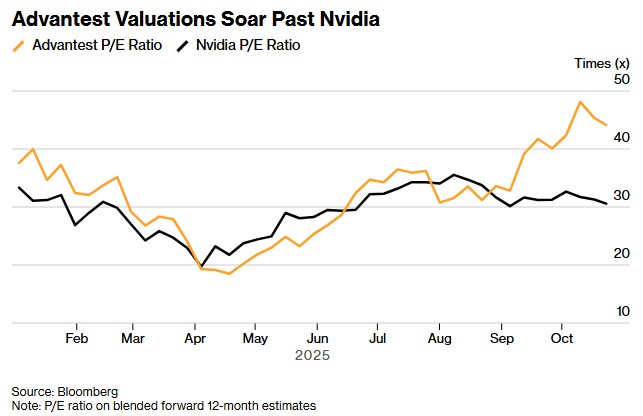

In the past two months, the company's stock price has accelerated, gaining attention amid recent discussions about the AI stock bubble. The current stock price has exceeded analysts' target prices, with a price-to-earnings ratio of 44 times, compared to NVIDIA's 31 times. Options data indicates that after Advantest releases its earnings report on October 28, the stock price may experience significant volatility, with an expected fluctuation range of 6.4%, more than double the average post-earnings increase over the past two years.

Figure 1

Kazunori Ito, a director at investment research firm Morningstar, pointed out that driven by optimistic sentiment around artificial intelligence, Advantest's stock price has risen much faster than expected, despite sluggish performance in other chip sectors. He downgraded the stock to "sell" last month but acknowledged that the company will be a major beneficiary of artificial intelligence in the long term.

Market expectations for Advantest's earnings per share over the next 12 months have been raised by more than 50% since the beginning of the year, reflecting extremely high expectations. However, analysts are still struggling to keep up with the stock price, which is currently 18% higher than the market's general expectations.

The optimism partly stems from the performance of other members of NVIDIA's supply chain, such as Taiwan Semiconductor Manufacturing Company (TSMC) (TSM.US) and ASML (ASML.US). However, Texas Instruments (TXN.US) has raised concerns about non-AI chip demand.

Advantest's earnings report and outlook comments are highly anticipated following the significant rise in its stock price. Maito Yamamoto, chief analyst at Nissay Asset Management Corp., stated that the AI hype has already been reflected in the stock price, and the current focus is on whether new catalysts will emerge to further push up next year's market consensus expectations, especially whether the company will indicate that demand for AI-related testing equipment remains strong.

Figure 2

NVIDIA's earnings next month will be a key event for the industry, revealing the spending frenzy of hyperscale enterprises and its own equipment demand. Index events are another potential driving factor for Advantest, as the company was included in the Tokyo Stock Exchange Core 30 Index this month, which will attract inflows from passive tracking funds. In recent weeks, its weight in the Nikkei 225 index briefly reached 10%, potentially limiting future adjustment space for blue-chip indices As one of the best-performing semiconductor stocks globally in 2025, Advantest is also one of the highest-valued stocks. However, some investors believe that given its 58% market share in the global chip testing market, its dominant position warrants a premium investment.

Mitsui Ikuo, a fund manager at Aizawa Securities, stated that investors are aware of the stock's high price but accept this premium when dealing with it, considering it one of the companies worth trading at a premium