A-shares fluctuated higher, with Agricultural Bank of China’s total market value approaching 3 trillion yuan, Zhongji Innolight continued to hit new highs, government bonds surged, and the RMB central parity rate reached a nearly one-year high

The Fujian Haixi sector has seen another surge in limit-up stocks, with Haixia Innovation hitting the limit-up for two consecutive days at 20%, Pingtan Development achieving 6 limit-ups in 8 days, and Fujian Cement, Xiamen Port Authority, and Xiamen Airport collectively hitting the limit-up. Zhangzhou Development and China Wuyi are also attempting to hit the limit-up. The CPO concept is experiencing a rebound, with Zhongji Innolight rising nearly 4%, setting a new historical high, and LianTe Technology increasing over 10%, while Tengjing Technology, Cambridge Technology, Dekeli, and Guangxun Technology also saw gains

On October 28, the A-shares opened lower in the morning, with the three major indices fluctuating downwards. Technology stocks corrected, with storage chips and copper-clad laminate concepts leading the declines, while CPO surged in the morning. The Hong Kong stock market opened high but fell back, with both the Hang Seng Index and the Hang Seng Tech Index turning negative. The tech stocks showed divergence, with Apple concept stocks declining and semiconductor stocks falling. In the bond market, government bond futures rebounded collectively. In terms of commodities, most domestic commodity futures rose, with polysilicon up over 2%. Core market performance:

A-shares: As of the time of writing, the Shanghai Composite Index fell 0.18%, the Shenzhen Component Index fell 0.09%, and the ChiNext Index rose 0.16%.

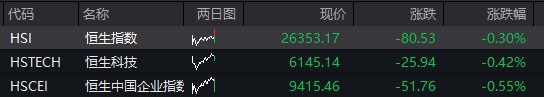

Hong Kong stocks: As of the time of writing, the Hang Seng Index fell 0.30%, and the Hang Seng Tech Index fell 0.42%.

Bond market: Government bond futures rebounded across the board. As of the time of writing, the 30-year main contract rose 0.56%, the 10-year main contract rose 0.21%, the 5-year main contract rose 0.14%, and the 2-year main contract rose 0.09%.

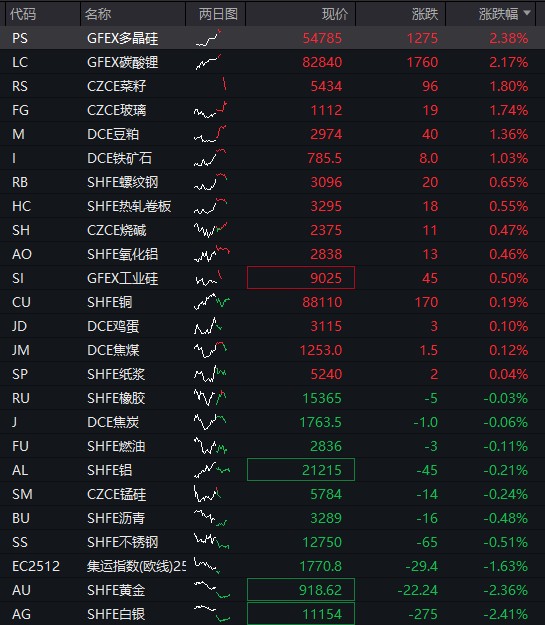

Commodities: Domestic commodity futures rose broadly. As of the time of writing, polysilicon and lithium carbonate rose over 2%, while rapeseed, glass, soybean meal, iron ore, and others rose over 1%. Rebar, hot-rolled coils, caustic soda, alumina, industrial silicon, Shanghai copper, eggs, coking coal, and pulp also increased, while rubber, coke, fuel oil, aluminum, ferrosilicon, asphalt, and stainless steel saw declines. The shipping index fell over 1%, and Shanghai gold and Shanghai silver fell over 2%.

09:54

CPO concept stocks fluctuated and rebounded, with Zhongji Innolight rising nearly 4%, continuing to set a new historical high. LianTe Technology rose over 10%, while Tengjing Technology, Cambridge Technology, Dekeli, and Guangxun Technology also followed suit.

09:50

Bank stocks showed a mixed performance, with Agricultural Bank of China rising over 1% to set a new historical high, approaching a total market value of 3 trillion yuan. Postal Savings Bank and Industrial and Commercial Bank of China followed suit, while Shanghai Pudong Development Bank plunged over 4%.

09:44

09:44

The robotics concept surged with fluctuations, Nanjing Julong rose over 12%, Yongmaotai previously hit the daily limit, Qingdao Double Star had three consecutive limit-ups, and Dayang Electric, Sanhua Intelligent Control, and Xinhan New Materials followed suit.

09:43

The Fujian Haixi sector saw another wave of limit-ups, Haixia Innovation had two consecutive 20% limit-ups, Pingtan Development had 6 limit-ups in 8 days, Fujian Cement, Xiamen Port Authority, and Xiamen Airport collectively hit the limit, while Zhangzhou Development and China Wuyi aimed for limit-ups.

09:38

In the morning session, the domestic software concept saw a surge, Rongji Software hit the daily limit, and Shuifu Co., Geer Software, Nengke Technology, and Jiuqi Software all rose sharply.

09:26

The Shanghai Composite Index opened down 0.25%, and the ChiNext Index fell 0.9%.

Technology stocks generally retreated, with storage chips and copper-clad laminate concepts leading the declines. Shenghong Technology fell nearly 6% after earnings, with Q3 net profit slightly down quarter-on-quarter; the Fujian sector remained active, with good performance in rare earths, photovoltaics, and nuclear fusion concepts.

09:21

The Hang Seng Index opened up 0.28%, and the Hang Seng Technology Index rose 0.45%.

Most tech stocks rose, with XPeng up over 4%. Precious metals generally fell, with Shandong Gold and Zhaojin Mining down nearly 2%. Eight Horses Tea had a significant opening surge of 60% on its first day of listing.

09:16

The central parity rate of the RMB against the USD was adjusted up by 25 points to 7.0856, the highest since October 15, 2024. The previous trading day's central parity rate was 7.0881, and the onshore RMB closed at 7.1109 at 16:30, with the night session closing at 7.1067