The market bets that the European Central Bank will remain steady this week, while there are still differences in the outlook for interest rate cuts next year

The market generally expects the European Central Bank to maintain interest rates this week, although there are differing views on the prospects for rate cuts next year. MUFG economist Cook believes that further monetary easing may occur in 2026. Recent economic data has shown strong performance, but uncertainty in trade policy continues to affect market sentiment. The interest rate futures market indicates that the probability of resuming rate cuts by the end of 2026 is slightly below 50%

According to the Zhitong Finance APP, current market pricing indicates a very high probability that the European Central Bank (ECB) will remain on hold this Thursday. After all, the recent resilient economic data from the Eurozone, the tariff policies initiated by the Trump administration, and the ongoing trade tensions and confrontations between China and the United States have yet to show substantial impacts on the Eurozone economy. However, the interest rate futures market remains uncertain about whether the ECB will restart the rate cut process next year, with significant divergence among traders regarding the ECB's monetary policy expectations for 2026.

Henry Cook, a senior economist at Mitsubishi UFJ Financial Group (MUFG) based in London, recently released a research report stating that the upcoming interest rate decision is expected to remain unchanged, mainly due to inflation being close to the target, interest rates being on a neutral trajectory, and the latest PMI being robust. Market attention will focus on the assessment of inflation risks. For 2026, MUFG's senior economist Cook maintains expectations for further easing of the ECB's monetary policy.

It is understood that current traders in the interest rate futures market are indecisive about whether the ECB will restart its easing policy next year, but these traders generally bet that the ECB is likely to announce another hold on Thursday, continuing to pause the rate cut pace.

Earlier this month, U.S. President Donald Trump announced additional tariffs on Chinese imports, initially raising market concerns about a significant escalation in trade risks. As a result, compared to September, there was a huge shift, with traders pricing in about an 80% probability of restarting the rate cut cycle in 2026; however, the ECB's previous hawkish statements led some traders to eliminate such expectations.

Recent economic data released last week showed that the Eurozone economy is regaining growth momentum, and Trump indicated that he hopes to reach a positive trade agreement with China this week that aligns with both parties' consensus, prompting traders to lower their bets on restarting the rate cut cycle in 2026. The latest pricing in the interest rate futures market shows that the probability of the ECB restarting the rate cut cycle by the end of 2026 is slightly below 50%.

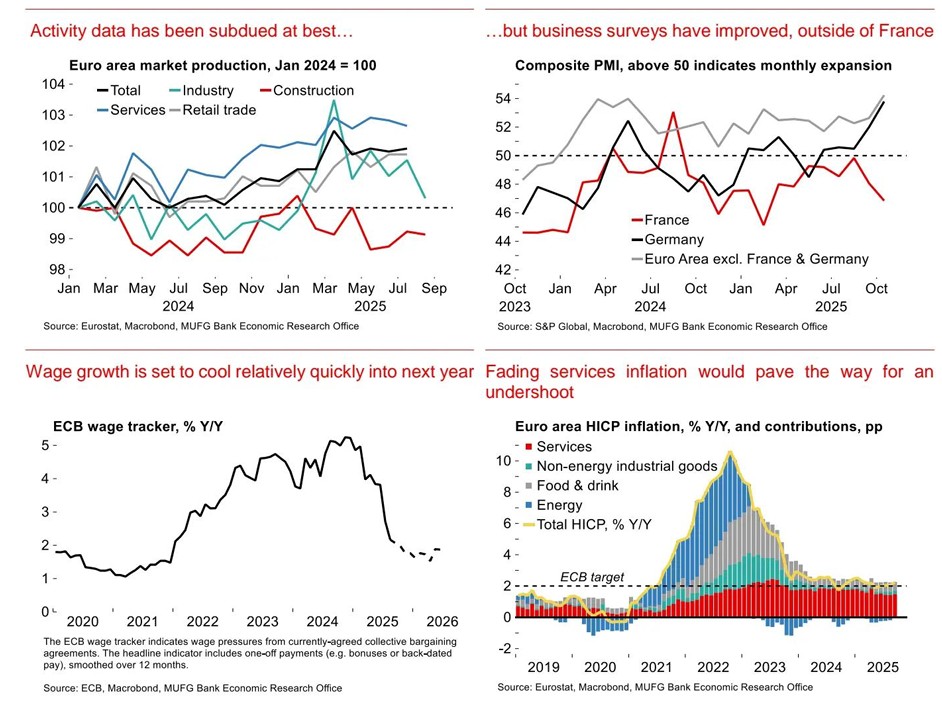

Unlike some interest rate futures traders betting on the ECB possibly pausing rate cuts throughout 2026, MUFG's economist Cook stated that he maintains expectations for further easing of the ECB's monetary policy in 2026. MUFG noted that Germany's fiscal stimulus may gradually take effect starting in 2026, the strengthening of the euro alongside the ongoing U.S. tariff policies, global trade uncertainties continuing to suppress economic growth, and the rapid cooling of wage growth in the Eurozone, along with a continued decline in service sector inflation, all pave the way for inflation to remain below the ECB's target, thereby prompting the ECB to restart rate cuts in 2026 to stimulate economic expansion.

Economist Cook stated that ECB policymakers are clearly satisfied with the current state of the European economy and the monetary policy path, as inflation continues to hover near the target and interest rates are neutral, especially since healthy PMI readings have alleviated their concerns about recent downside risks to Eurozone economic activity. Economist Cook expects this meeting to be a "low-key monetary policy meeting," with the focus likely on inflation risk assessment and the Q&A session with ECB President Christine Lagarde Cook stated that the preliminary GDP for the Eurozone in the third quarter will be released just before the European Central Bank's interest rate decision, along with Germany's October inflation and the overall HICP (Harmonized Index of Consumer Prices) for the Eurozone. MUFG's London economist Cook believes that the European Central Bank is aware of these data and it may not affect Thursday's monetary policy decision. "Any degree of GDP weakness (we track a quarter-on-quarter rate of about 0.0%—in line with the European Central Bank's expectations) will be offset by the unexpectedly strong PMI data for October, which indicates that the downside risks for the Eurozone may significantly diminish. The Eurozone composite output index (i.e., composite PMI) rose to a 17-month high of 52.2 despite political turmoil in France and weak data from Germany, highlighting a significant rebound in the Eurozone's output price indicators," Cook wrote in the research report.

Cook further added in the research report that looking ahead, Germany's fiscal support is expected to take effect from 2026, but the overall fiscal stance of the Eurozone may appear more neutral, as France, Italy, and other countries will undertake budget consolidation. Meanwhile, the economic growth drag caused by U.S. tariff policies is expected to persist. Therefore, economist Cook anticipates that forward-looking inflation indicators clearly point downward, and the stronger euro trend will also suppress import prices. As a result, this economist expects that at some point in 2026, the European Central Bank may restart the rate-cutting process under a macro environment where inflation continues to remain below the 2% anchor target and the labor market is relatively weak