New Stock Interpretation | The actual circulating chips are expected to account for only 2.7%. Can Tencent's increased investment in MININGLAMP-W show any performance?

Mininglamp Technology ended its IPO subscription on October 28, with a public offering oversubscription of 3,399 times, and is expected to be listed on November 3, 2025. This IPO plans to globally offer 7.219 million Class A shares at a price of HKD 141 per share, with a valuation of approximately HKD 20.357 billion. Despite having well-known shareholders such as Tencent, the actual circulating chips after listing will only account for 2.745%, and investors are paying attention to its performance in the hot new stock market

Since the implementation of the new pricing rules for Hong Kong IPOs on August 4, 2025, the significant profit-making effect has made IPOs the market focus. From August 4 to October 22, a total of 24 companies went public, with only 2 experiencing a decline in share price, and as many as 10 companies saw their share prices increase by over 100% on the first day of trading, accounting for 41.66%.

This has led to an unprecedented surge in IPO enthusiasm, with Golden Leaf International Group (08549) setting a historical record with over 11,000 times subscription. In such a booming IPO market, the offering situation of MININGLAMP-W (02718), China's largest data intelligence application software provider, has attracted particular attention from investors. According to Zhitong Finance APP, MININGLAMP-W concluded its offering on October 28, with the public offering being oversubscribed by 3,399 times, and the shares are expected to begin trading on the Hong Kong Stock Exchange at 9:00 AM on November 3, 2025 (Monday).

In this IPO, MININGLAMP-W plans to globally issue 7.219 million Class A shares, with 10% allocated for public offering in Hong Kong and 90% for international offering, along with an additional 15% over-allotment option. The offering price is set at HKD 141 per share, with a minimum purchase of 40 shares, resulting in an entry fee of approximately HKD 5,696.88.

After this offering, the shares sold will account for 5% of the company's total share capital, which means that MININGLAMP-W's IPO valuation is approximately HKD 20.357 billion, representing a 56% premium compared to the company's F-3 round financing on January 25, 2024.

Given the current IPO valuation level and the presence of well-known shareholders such as Tencent, Kuaishou, Sequoia China, and Temasek, as well as cornerstone investment from Tencent, can MININGLAMP-W perform well in the current hot IPO market? This is a key focus for investors.

Actual circulating shares after listing are only about 2.745%, E-2 round investors are still at a loss

From MININGLAMP-W's various actions during the offering phase, it is evident that there is a strong demand for stabilizing the stock price after listing. First, MININGLAMP-W adopted a "low-end issuance" in this IPO, with the global offering of 7.219 million Class A shares accounting for only 5% of the total share capital after the issuance. "Low-end issuance" is not uncommon in the Hong Kong market; this model reduces the fundraising amount to compress the circulating share size, stabilize the stock price in the initial listing period, and maintain valuation to avoid "bleeding on listing."

Secondly, MININGLAMP-W adopted Mechanism B for this offering. Mechanism B requires the issuer to fix the public offering ratio in advance (between 10% and 60%), with no backtracking regardless of the popularity of the public offering. MININGLAMP-W directly set the public offering ratio at the minimum limit of 10%. This helps MININGLAMP-W clarify issuance expectations, secure institutional shares, and further reduce retail investors to stabilize the stock price in the future.

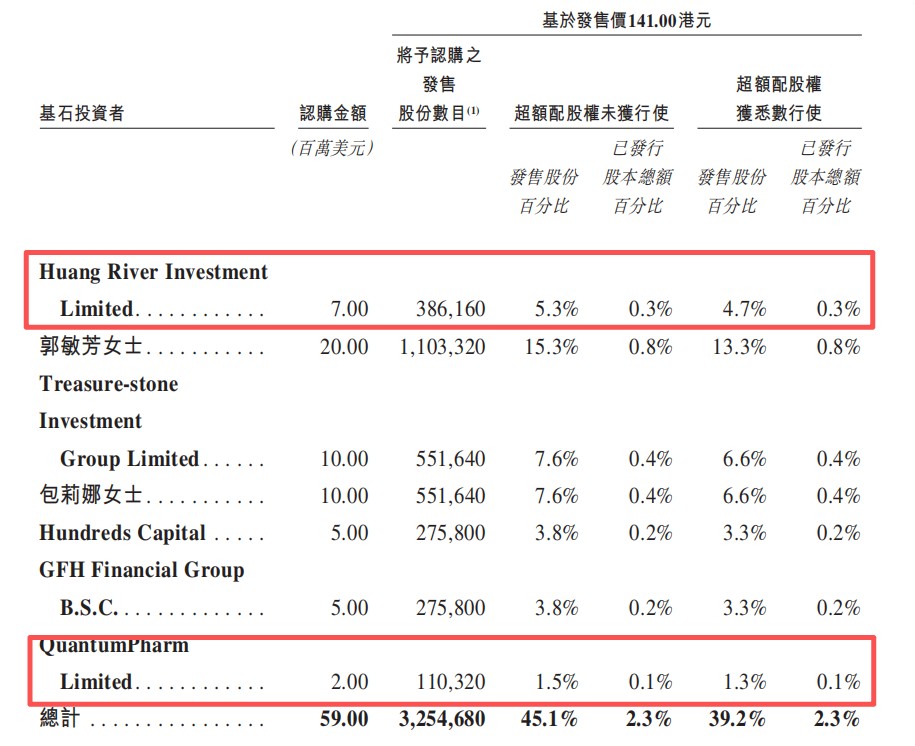

In addition, MININGLAMP-W has introduced multiple cornerstone investors to further lock in the circulation of the offered shares. Zhitong Finance APP observed that MININGLAMP-W introduced seven cornerstone investors in this IPO, who will collectively subscribe for approximately USD 59 million (about HKD 460 million) of shares, accounting for about 45.1% of the shares offered (if the over-allotment option is not exercised) Among them, Tencent, as the largest external shareholder of MININGLAMP-W, also participated in this cornerstone investment. It subscribed for approximately 386,200 shares through Huang River Investment Limited, accounting for about 5.3% of the shares offered in this issuance. Tencent's shareholding in MININGLAMP-W has reached 25.96%. At the same time, Jingtai Holdings also subscribed for 110,300 shares through its affiliated company, accounting for about 1.5% of the shares offered in this issuance.

It is worth noting that the cornerstone investors have agreed not to sell any of their shares within 270 days from the listing date of MININGLAMP-W. This means that the shares directly tradable after MININGLAMP-W's listing will account for 54.9% of the total shares offered, which is only about 2.745% of the company's total equity. Based on the issue price of HKD 141, the directly tradable market value is only HKD 559 million, indicating a relatively small tradable float.

The various methods employed by MININGLAMP-W to compress the tradable float after listing may be aimed at facilitating the exit of shareholders in the future. After all, with MININGLAMP-W's current IPO valuation, some shareholders who have invested for five years are still in a loss position.

According to the prospectus, MININGLAMP-W has completed a total of 27 rounds of financing since its establishment, raising over USD 627 million, which has resulted in a very luxurious shareholder structure. Before the listing, Tencent, Sequoia China, Temasek, and Kuaishou held approximately 26.96%, 7.46%, 4.1%, and 2.48% of MININGLAMP-W's shares, respectively.

However, it is noteworthy that MININGLAMP-W's market valuation has experienced significant fluctuations. Its valuation during the E2 round of financing on November 20, 2020, once reached approximately USD 3.05 billion, but it dropped to around USD 542 million in 2023, only recovering to USD 1.666 billion during the F-3 round of financing on January 25, 2024. Although this IPO valuation of approximately USD 2.62 billion is at a premium compared to the F-3 round of financing, it still represents a decline of about 15% from its peak valuation, indicating significant losses for E-2 investors over the five years.

For this reason, compressing the size of the tradable float and stabilizing the stock price after listing may have become a pressing need for MININGLAMP-W to "liberate" early shareholders. Supported by the currently hot market conditions, this strategy may have certain feasibility. However, it is important to note that there are multiple factors that determine stock prices, including valuation and fundamentals. Given that MININGLAMP-W has numerous shareholders after multiple rounds of financing, once the lock-up shares are released, if there is no strong fundamental support, its stock price will still face significant pressure

After Continuous Loss Reduction, Revenue Growth Becomes Key to Maintaining Valuation

As a leading data intelligence application software company in China, MININGLAMP's main data intelligence products and solutions cover marketing and operational intelligence, involving both online and offline scenarios. It is committed to transforming enterprise marketing, operational strategy design, and decision-making processes through large models, industry-specific knowledge, and multimodal data. According to Frost & Sullivan, MININGLAMP is the largest data intelligence application software supplier in China based on total revenue in 2023.

From the revenue structure perspective, MININGLAMP's products and solutions can be mainly divided into three major segments: marketing intelligence, operational intelligence, and industry AI solutions. Specifically, marketing intelligence products mainly include the Miaozhen System, Jin Data, and private domain tools (Weibanjiaoshou) based on the Tencent ecosystem. Among them, the Miaozhen System is its earliest launched product and a major component of MININGLAMP's revenue, consisting of three sub-products: media spending optimization software, social media management software, and user growth software; Weibanjiaoshou is a private domain tool based on the Tencent ecosystem that helps enterprises manage interactions with private and public domain customers through WeChat for Work and WeChat.

The operational intelligence products mainly include the smart store operation system, which digitizes and automates the service processes of "people, goods, and venues" in stores; and utilizes the company's unique industry knowledge graph and self-developed operational large model based on industry data. Additionally, industry AI solutions mainly provide customized solutions, enabling clients to manage data in a centralized manner and discover hidden patterns within the data, allowing them to make more informed decisions.

As of December 31, 2024, MININGLAMP's operational intelligence products and solutions have been deployed in over 20,000 restaurants and more than 46,000 offline retail stores. During this period, the company has served 135 Fortune Global 500 companies, with clients spanning industries such as retail, consumer goods, food and beverage, automotive, 3C, cosmetics, and maternal and infant products.

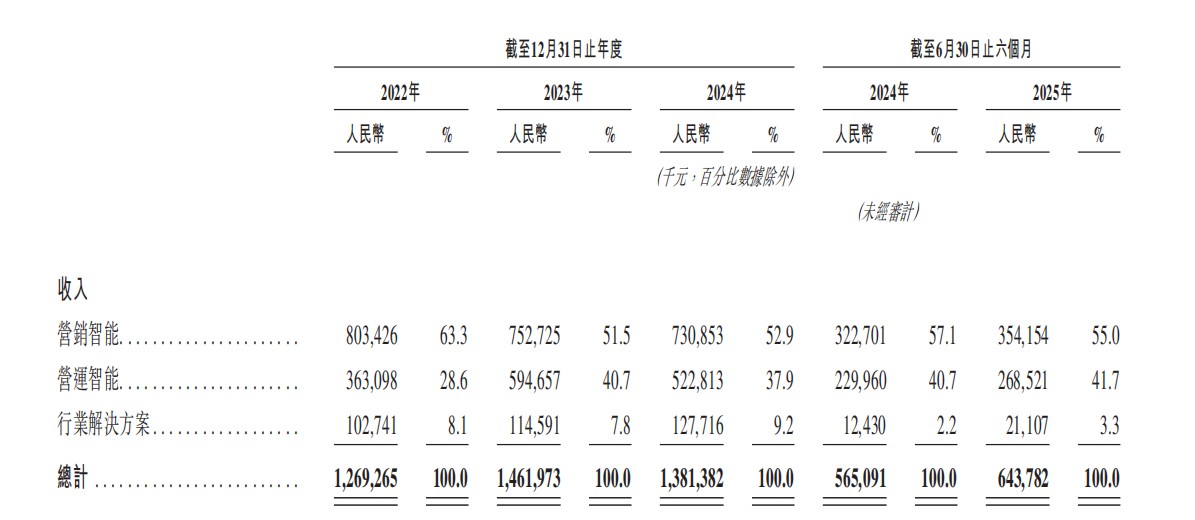

From the revenue performance perspective, MININGLAMP has shown volatility in its past revenues. According to the prospectus, MININGLAMP's revenues from 2022 to 2024 were RMB 1.269 billion, RMB 1.462 billion, and RMB 1.381 billion, respectively, indicating relatively weak growth.

The revenue fluctuations are mainly due to two reasons. First, marketing intelligence services primarily cater to clients' marketing needs, and due to the ongoing economic downturn, clients' marketing demands have weakened, which has inevitably impacted MININGLAMP's marketing intelligence business. From 2022 to 2024, the revenue from the marketing intelligence business continued to decline, dragging down overall revenue performance.

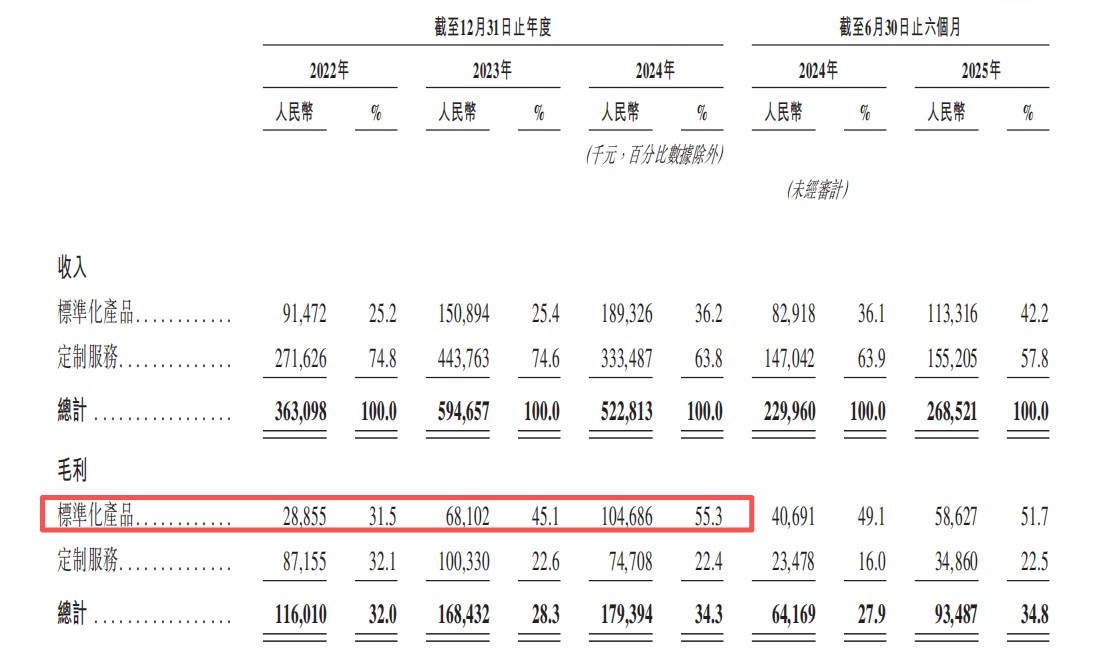

Second, MININGLAMP's strategic adjustment to operational intelligence services has somewhat affected the development pace of this business. During economic downturns, clients tend to cut marketing expenditures but have an urgent need to enhance operational efficiency, as this can further release company profits. Therefore, the market demand for operational intelligence services is relatively less affected by the business environment, and MININGLAMP has gradually shifted its strategic focus to standardized products Customized services not only have a long cycle but also relatively low gross margins. Although the initial gross margin of standardized products is also not high, once the products accelerate in volume, costs will decrease rapidly, and the scale effect will continuously enhance the gross margin level of standardized products. From 2022 to 2024, the gross margins of MingLue Technology's operational intelligence standardized products are projected to be 31.5%, 45.1%, and 55.3%, showing a clear upward trend.

It is worth noting that due to the highly customized nature of industry solutions and their relatively low gross margins, MingLue Technology has gradually phased out this business, which is also the reason for the low proportion of revenue from industry solutions.

In the first half of 2025, the revenue growth of MingLue Technology is mainly attributed to two reasons. First, in marketing intelligence services, the company has expanded its AI capabilities to a broader range of planning and strategy generation as well as content production and execution, attracting new customers through the integration of AI capabilities, thereby driving revenue growth. Second, the operational intelligence business has seen revenue growth due to the effective upgrade of conversational intelligence products that meet customer demands for real-time data access. Therefore, in the current economic situation, the upgrade and empowerment process of AI for existing products may be one of the key factors driving revenue growth for MingLue Technology.

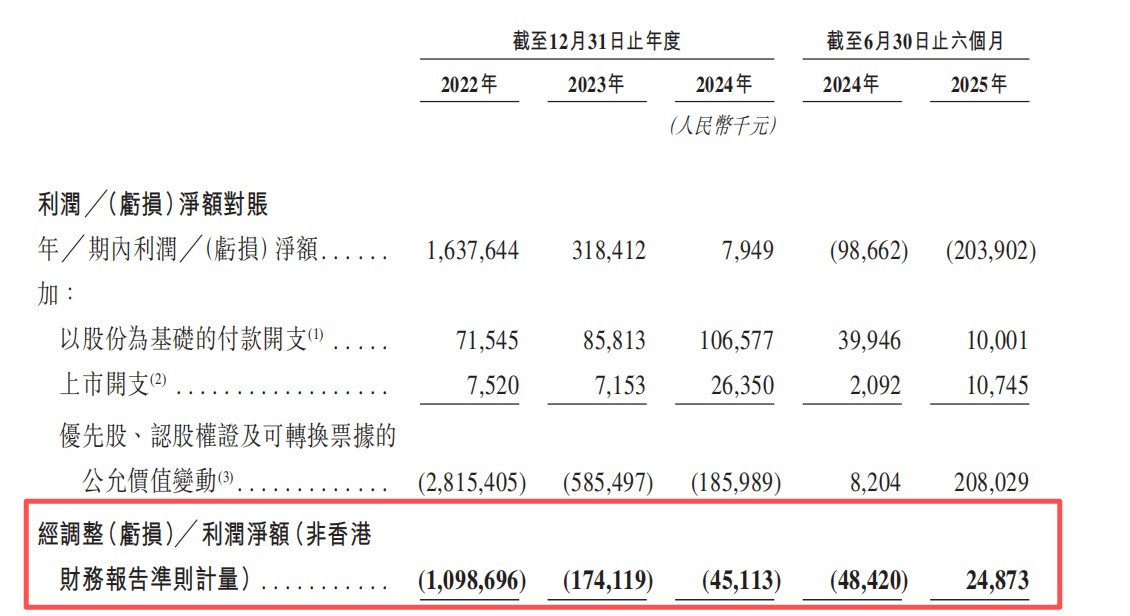

From the profit perspective, the adjusted net losses of MingLue Technology from 2022 to 2024 are projected to be 1.099 billion, 174 million, and 45.113 million yuan, respectively, with losses continuing to narrow, and achieving an adjusted net profit of 24.873 million yuan in the first half of 2025.

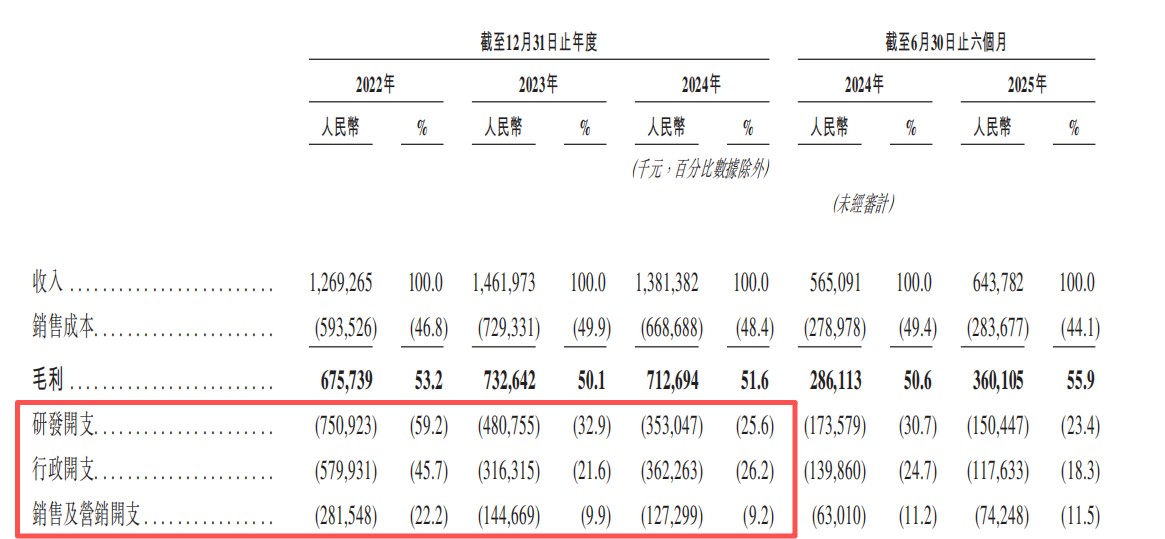

The significant narrowing of MingLue Technology's adjusted net losses can be attributed to several factors. First, the overall stability of gross margins. From 2022 to 2024, MingLue Technology's gross margins are projected to be 53.2%, 50.1%, and 51.6%; second, the peak of R&D expenditures has passed, and the natural decline in R&D spending accelerates the release of net profits. From 2022 to 2024, MingLue Technology's R&D expenditure proportions are 59.2%, 32.9%, and 25.6%, respectively. Third, by improving operational efficiency and reducing corresponding administrative and marketing expenses, profits are released. Compared to 2022, MingLue Technology's administrative expenses, marketing, and sales expenses have significantly declined in the following two years.

The turnaround of MingLue Technology to profitability in the first half of 2025 is mainly attributed to the company's continued decline in R&D expenses and administrative expenses, stable sales and marketing expenses, along with revenue growth and product structure adjustments that increased the gross margin from 50.6% to 55.9%.

The turnaround of MingLue Technology to profitability in the first half of 2025 is mainly attributed to the company's continued decline in R&D expenses and administrative expenses, stable sales and marketing expenses, along with revenue growth and product structure adjustments that increased the gross margin from 50.6% to 55.9%.

From the analysis of MingLue Technology's past business operations, several relatively certain conclusions can be drawn. Firstly, if there is no significant improvement in the macro economy, the key factor driving revenue and gross margin growth for MingLue Technology will be its ability to upgrade and empower existing products with AI technology to enhance commercialization.

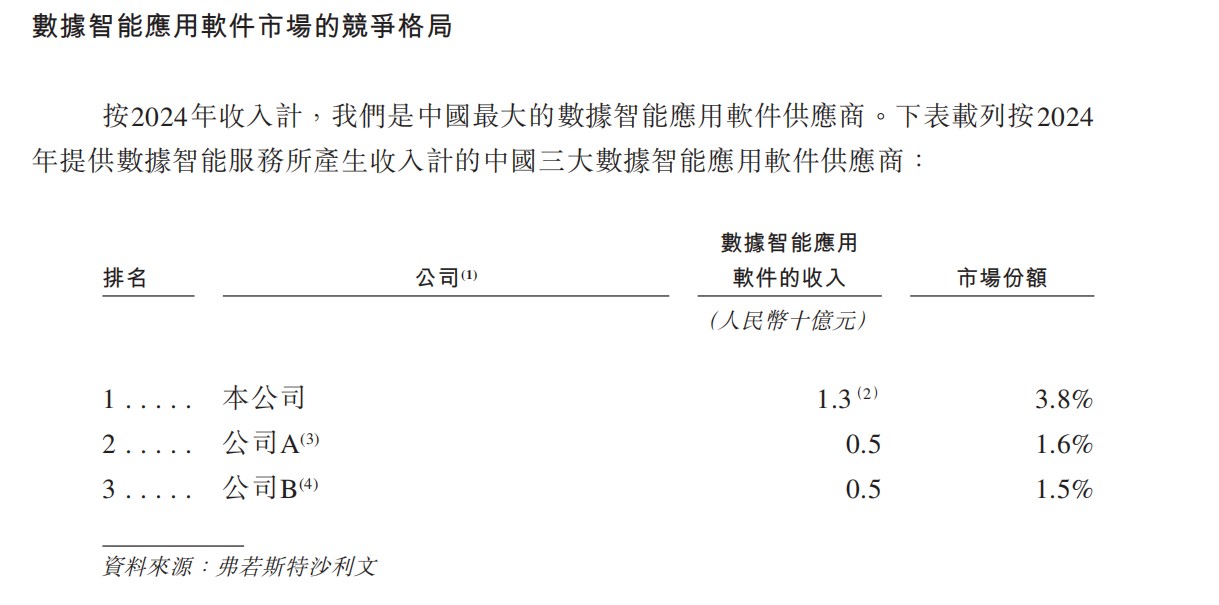

Secondly, the continued reduction in adjusted net losses for MingLue Technology is a result of lower R&D expenses and improved operational efficiency. However, the competition in the marketing intelligence and operational intelligence sectors is highly intense and fragmented. As the largest data intelligence application software provider in China, it only holds a 3.8% market share, which means that R&D expenses, administrative, and sales and marketing expenses cannot continue to decline. The core points driving profit growth in the future must return to revenue growth and gross margin improvement.

It is worth noting that MingLue Technology's IPO valuation of approximately HKD 20.357 billion corresponds to a PS valuation of 14.74 times its revenue of HKD 1.381 billion for 2024. Although the strong binding with Tencent can bring some valuation premium, if MingLue Technology's revenue does not grow rapidly, this high valuation may be difficult to maintain. In comparison, according to Frost & Sullivan's comparative metrics, the second-largest data intelligence application software provider in China has already gone public in Hong Kong, and its overall revenue for 2024 has exceeded HKD 5 billion, but the current market value corresponds to a PS valuation of less than 6 times.

It can be anticipated that by compressing the circulation scale and reducing stock supply, MingLue Technology's stock price may perform well in the short to medium term due to the hot market. However, in the long term, if the company's revenue growth does not accelerate, its high valuation may be difficult to sustain