From the chairman of securities firm asset management to the general manager of a frontline public fund, a senior female asset management executive "takes on" a new position

Cui Chun, the new general manager of Huatai-PineBridge Fund, officially took office on October 28. Prior to this, she resigned from the position of chairman of Huatai Securities Asset Management on October 24. Cui Chun has extensive experience in the financial industry and has held important positions in several financial institutions. Her appointment marks a generational transition in the public fund industry and is expected to promote the further development of Huatai-PineBridge Fund

The top ten industry scale Huatai-PB Fund welcomes a new general manager, and this time it is an experienced female leader.

On October 28, Huatai-PB Fund announced that Cui Chun has officially taken over as the general manager of the company. Prior to this, on October 24, Cui Chun left her position as chairman of the asset management division of Huatai Securities due to job changes. Four days later, her "direction of change" was officially revealed.

Cui Chun's appointment makes her the third general manager to take office this year among the "top ten public fund institutions." This adds a sense of transition and generational change to this year's public fund industry.

Graduated from "Wudaokou"

Public information shows that Cui Chun graduated from Tsinghua University’s Wudaokou School of Finance with a master's degree in Monetary Banking.

After graduation, Cui Chun has a wealth of professional experience. She has served as the manager of the Securities Department at China Everbright International Trust Investment Company, a senior manager in the President's Office of Everbright Securities, deputy director of the Planning and Finance Department and the Financial Institutions Department at the head office of China Construction Bank, director of the Fixed Income Department at Harvest Fund, and deputy general manager, executive general manager, and managing director of the Asset Management Department at China International Capital Corporation, while also serving as a director at CICC Hong Kong Asset Management Limited.

Joined Huatai Securities Asset Management

In May 2015, Cui Chun joined Huatai Securities Asset Management and took on the role of general manager, marking the beginning of her long career within the Huatai Securities system.

Cui Chun should have performed quite well in her role as general manager. In October 2016, after Zhang Haibo resigned as chairman of Huatai Asset Management, Cui Chun acted as the company's legal representative and chairman. In June 2017, Cui Chun officially transitioned to the role of chairman until her recent departure from Huatai Asset Management to take over at Huatai-PB Fund.

Previously served as head for nearly a decade

Public information indicates that Cui Chun was the first general manager of Huatai Securities Asset Management and has served as chairman for the longest time to date.

Industry insiders say that Cui Chun has a clear strategic vision for the asset management industry. During her time at Huatai Securities Asset Management, she actively promoted breakthroughs in the entire chain of asset management business through financial technology. By mid-2025, Huatai Securities Asset Management's asset management scale reached 627 billion yuan, maintaining industry leadership in innovative businesses such as ABS, with public fund business continuing to grow and scale surpassing 160 billion yuan, and FOF management scale also reaching a historic high.

At the same time, in the first half of 2025, Huatai Asset Management's revenue exceeded 1.2 billion yuan, with a net profit of 713 million yuan, making it one of the few institutions in the brokerage asset management sector with operating income exceeding 1 billion yuan and net profit exceeding 500 million yuan.

Shouldering important responsibilities

Unlike her "pioneering" start at Huatai Securities Asset Management, Huatai-PB Fund is already a leading fund company in the industry, and as general manager, Cui Chun needs to elevate such a fund company to a higher level.

Wind data shows that as of mid-2025, Huatai-PB Fund's public fund scale reached 707.621 billion yuan, with non-monetary scale at 620.183 billion yuan, ranking in the top ten in the industry for non-monetary scale.

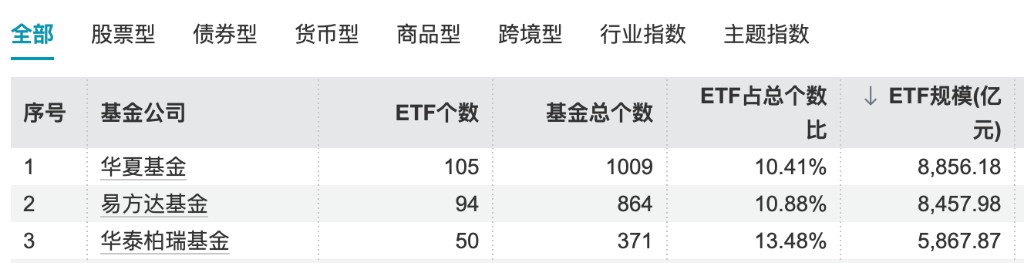

Moreover, Huatai-PB Fund has distinctive characteristics in ETFs. Wind data shows that the latest ETF scale of Huatai-PB Fund even exceeds 586.7 billion yuan, ranking among the top three in the industry (statistics include the scale of established ETFs as of the second quarter of 2025, including funds that have not yet been listed at that time)

Risk Warning and Disclaimer

The market has risks, and investment requires caution. This article does not constitute personal investment advice and does not take into account the specific investment goals, financial situation, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article align with their specific circumstances. Investment based on this is at one's own risk