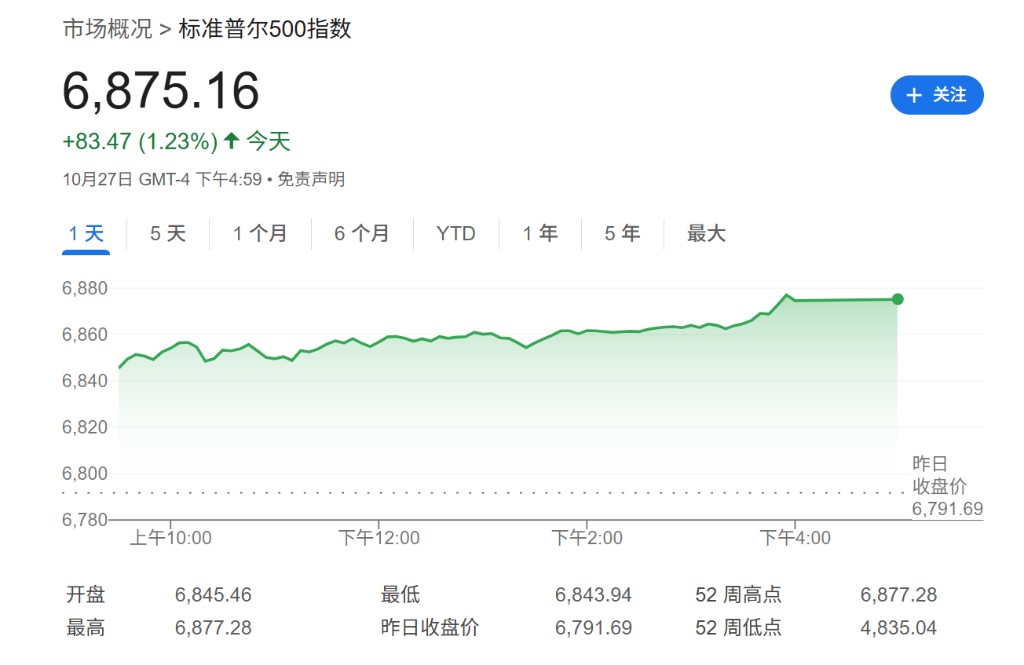

Wall Street bullish sentiment surges: S&P 500 may break through the 7000 mark this week, aiming for 7500 points by year-end

The S&P 500 index has closed at a historic high of 6,875 points, and strategists believe the index is heading towards 7,000 points. This week, the market will face a severe test, as the five major tech giants will release their earnings reports, along with key central banks' interest rate decisions. If the tech giants' earnings reports perform strongly, it could become the "spark that ignites the rally," with 7,500-7,700 points becoming the next target

Under the combined effects of favorable macroeconomic conditions, continuous capital inflows, and seasonal trends, bullish sentiment on Wall Street is heating up at an unprecedented pace.

On Monday, buoyed by positive trade signals, expectations of interest rate cuts, and strong corporate earnings reports, the S&P 500 index closed strongly at a record 6,875 points. This performance injected a strong dose of confidence into the market, and strategists from multiple institutions believe that the market is ready to break through the 7,000-point barrier, with 7,500-7,700 points becoming the next target.

Michael Romano, head of hedge fund equity derivatives sales at UBS Securities, wrote in a report to clients on Sunday:

“There is no shortage of catalysts driving risk assets higher. The previously distant year-end target of 7,100 points is quickly becoming a fundamental expectation for the market.”

However, this wave of optimism will face a severe test this week. Five tech giants, including Microsoft, Alphabet, Meta, Amazon, and Apple, will release their earnings reports intensively on Wednesday and Thursday. Additionally, the interest rate decisions from major central banks such as the Federal Reserve, the Bank of Japan, and the European Central Bank will also be finalized. Dave Mazza, CEO of Roundhill Financial Inc., stated that if the tech giants' earnings reports are outstanding, it could become “the spark that ignites this rally,” pushing the S&P 500 index to reach 7,000 points within the week.

Historical Data Provides Support, Funds Pour In

Historically, the current market environment is extremely favorable for bulls. According to UBS Securities' statistics on the rolling weekly average returns of the S&P 500 index since 1950, the last week of October is the best time to hold stocks.

Seasonal benefits are not limited to this week. According to data from Goldman Sachs' trading department, since 1985, the period from October 20 to the end of the year has often seen strong performance in risk assets. Data shows that the average increase of the Nasdaq 100 index during this period is 8.5%, while the average return of the S&P 500 index also reaches 4.2%.

Capital flows also show positive signals, as major investor groups are working together to “add fuel” to this rally.

According to Citadel Securities, retail investors, who account for 22% of U.S. stock trading volume, have been net buyers in 23 out of the past 27 weeks, indicating sustained participation enthusiasm. Meanwhile, as the earnings season window closes, corporate stock buyback activities are allowed to resume. Goldman Sachs traders noted that the fourth quarter has historically been an active period for corporate buybacks, which will provide new support for the market.

Even hedge funds, which had previously sold off U.S. stocks heavily for two consecutive weeks, have changed their stance. After last Friday's mild inflation data enhanced market bets on interest rate cuts, hedge funds have turned into net buyers of U.S. stocks

Technical Analysis and Analyst Targets

From a technical analysis perspective, there is limited upward resistance for the stock index. John Kolovos, Chief Technical Strategist at Macro Risk Advisors, pointed out that the next resistance level for the S&P 500 index is around 7000 points, with only a 1.8% upside from Monday's closing price. He stated:

“This will be an important milestone, and if the index successfully breaks through, then 7500-7700 points will become the next target.”

Other analysts on Wall Street have also provided optimistic forecasts. Alexander Altmann, Head of Global Equity Tactical Strategy at Barclays, expects that considering the index's average absolute volatility of 23% over the past five years, the S&P 500 index will reach 7250 points by the end of December.

Earnings Reports from Tech Giants and High Valuations Pose Severe Challenges

Despite the bullish sentiment, the market is not without risks. Since the low in April, the S&P 500 index has surged 38%, pushing valuations to levels typically seen only during bubble periods. The upcoming earnings reports from tech giants this week will be the most direct test of market optimism.

The combined market capitalization of Microsoft, Alphabet, Meta, Amazon, and Apple accounts for about a quarter of the S&P 500 index. Dave Mazza warned:

“If there are any disappointing signs in the earnings reports, or if the market questions the returns on artificial intelligence spending, I expect investors will quickly punish these stocks.”