Chongqing Bank was fined 2.2 million for inadequate due diligence in the "three checks" of loans and imprudent investment business

Bank of Chongqing was fined 2.2 million yuan for inadequate "three checks" in loan management and imprudent investment practices. The bank has encountered issues in its loan management system, and relevant responsible personnel have also received warnings. Established in 1996, Bank of Chongqing is a local state-owned joint-stock commercial bank in the western region and is listed on the Hong Kong Stock Exchange and the Shanghai Stock Exchange. The chairman stated that 2025 is a critical year for the bank's development, with total assets expected to exceed 1 trillion yuan

The leading city commercial bank in the southwest region has been penalized for imprudent business practices.

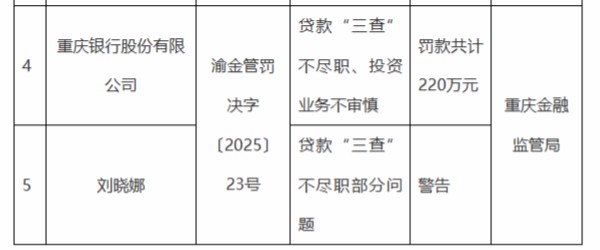

According to the administrative penalty information disclosed by the Chongqing Regulatory Bureau of the National Financial Supervision and Administration in late October, Chongqing Bank Co., Ltd. was fined a total of 2.2 million yuan for violations related to negligence in the "three checks" of loans and imprudent investment business.

The so-called "three checks" of loans refer to a full-process management system for bank credit, including pre-loan investigation, in-loan review, and post-loan inspection. By implementing the "three checks," banks can comprehensively understand and grasp the borrower's operating conditions and the risks associated with the loan, timely identify potential risks, and take corresponding risk prevention and control measures to ensure the safety of bank credit funds. However, Chongqing Bank encountered problems specifically in this basic management system of the "three checks."

In addition to the institution being fined, the relevant person in charge, Liu Xiaona, was warned for negligence in the "three checks" of loans.

According to public information, Chongqing Bank was established in 1996 and is one of the earliest local state-owned joint-stock commercial banks in the western and upper reaches of the Yangtze River. Chongqing Bank successfully listed on the Hong Kong Stock Exchange on November 6, 2013, becoming the first mainland city commercial bank to be successfully listed on the main board of the Hong Kong Stock Exchange. On February 5, 2021, the bank was listed on the Shanghai Stock Exchange, becoming the third city commercial bank in the country and the first in the Yangtze River Economic Belt to achieve "A+H" listing.

At the 2024 performance briefing, Chongqing Bank Chairman Yang Xiuming clearly stated that 2025 is a key year for the bank's steady development and the pursuit of a "trillion" new journey. In August 2025, Chongqing Bank released a voluntary announcement regarding its operating conditions, stating that as of July 31, 2025, the bank's total assets reached 1,008.7 billion yuan, an increase of 152.1 billion yuan compared to the end of the previous year, with a growth rate of 17.76%, surpassing one trillion yuan in asset scale and achieving the strategic planning target ahead of schedule.

Financial report data shows that in the first half of 2025, Chongqing Bank achieved operating income of 7.659 billion yuan, a year-on-year increase of 7.00%; and realized net profit attributable to shareholders of 3.19 billion yuan, a year-on-year increase of 5.39%.

From the revenue structure, in the first half of 2025, the bank's net interest income was 5.863 billion yuan, a year-on-year increase of 12.22%, becoming the main support for revenue growth; while net income from fees and commissions was only 365 million yuan, a year-on-year decrease of 28.62%, accounting for only 4.76% of operating income.

In terms of asset quality, as of the end of the first half of 2025, the bank's non-performing loan ratio was 1.17%, a decrease of 0.08 percentage points compared to the end of 2024; the provision coverage ratio was 248.27%, an increase of 3.19% compared to the end of 2024. The core tier one capital adequacy ratio, tier one capital adequacy ratio, and total capital adequacy ratio were 8.80%, 9.94%, and 12.93%, respectively—these three indicators decreased by 1.08%, 1.26%, and 1.53% compared to the end of 2024 As of the close on October 24, the stock price of Bank of Chongqing was reported at 10.20 CNY/share, with a total market value of 35.441 billion CNY.

Risk Warning and Disclaimer

The market carries risks, and investments should be made cautiously. This article does not constitute personal investment advice and does not take into account the specific investment goals, financial conditions, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article are suitable for their specific circumstances. Investment based on this is at one's own risk