U.S. Stock Outlook | Futures for the three major indices rise together, daily large investments in the U.S. may become a catalyst for the U.S. stock bull market

U.S. stock index futures are all up as the market anticipates the announcement of a major investment deal from Japan to the U.S. Trump plans to have dinner with several business leaders, during which he will announce Japan's $550 billion investment plan, covering areas such as nuclear energy, AI, and semiconductors. This investment is seen as a catalyst for a bull market in U.S. stocks and may alleviate concerns about an "AI bubble."

- As of October 28 (Tuesday) before the US stock market opens, the three major US stock index futures are all up. As of the time of writing, Dow futures are up 0.27%, S&P 500 futures are up 0.03%, and Nasdaq futures are up 0.12%.

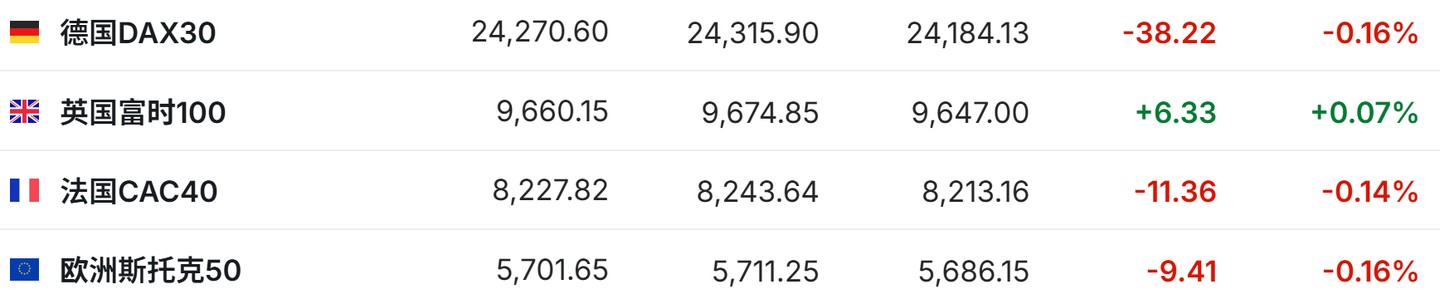

- As of the time of writing, the German DAX index is up 0.16%, the UK FTSE 100 index is down 0.07%, the French CAC40 index is up 0.14%, and the Euro Stoxx 50 index is up 0.16%.

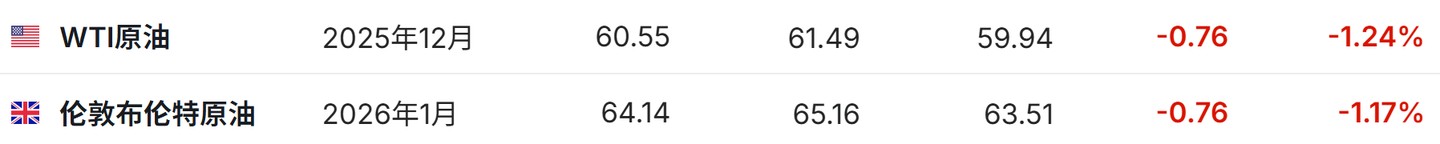

- As of the time of writing, WTI crude oil is down 1.24%, at $60.55 per barrel. Brent crude oil is down 1.17%, at $64.14 per barrel.

Market News

Trump's Tokyo dinner invites OpenAI and Salesforce (CRM.US) CEO to celebrate Japan's large investment in the US. Before concluding his visit to Tokyo, US President Trump plans to have dinner with several business leaders, during which he will announce the results of Japan's investment in the US. Invited guests include Salesforce CEO Marc Benioff, Toshiba CEO Taro Shimada, and Rakuten founder Hiroshi Mikitani. The dinner will be held at the residence of US Ambassador to Japan, George Glass, and attendees will also include OpenAI co-founder Greg Brockman, Honda Motor (HMC.US) President Toshihiro Mibe, and Anduril Industries founder Palmer Luckey. This dinner coincides with the White House's announcement of a new round of commitments to invest in the US economy. According to a previous trade framework, Trump lowered and set a cap on tariffs for Japanese goods, in exchange for Japan's commitment to provide $550 billion in funding support for US projects.

The US stock bull market welcomes a super catalyst! Japan's $550 billion investment blueprint in the US is unveiled, covering nuclear energy, AI, and semiconductors. The Japanese government has released a list of potential investment projects for its $550 billion investment tool in the US, giving the outside world a first glimpse into the core mechanism that is a key component of the US-Japan trade agreement and what specific proposals it may fund in the US. For the current super bull market in US stocks that began in early 2023, this significant catalyst of Japan's large-scale investment in the US may lead the market to set aside the so-called "AI bubble theory." Under this massive investment catalyst, the trajectory of the US stock bull market may continue to unfold The final five candidates for the Federal Reserve "leadership change" are out! Trump loyalists and Wall Street tycoons make the cut. U.S. Treasury Secretary Becerra confirmed on Monday the final list of five candidates to succeed Federal Reserve Chairman Jerome Powell. Becerra revealed that the candidate pool has been narrowed down to five individuals: current Federal Reserve Board members Christopher Waller and Michelle Bowman, former Federal Reserve Governor Kevin Warsh, White House National Economic Council Director Kevin Hassett, and BlackRock executive Rick Rieder. Investors and Federal Reserve watchers are closely monitoring the selection process to replace Powell, whose term as Federal Reserve Chairman will end in May next year. This personnel change has attracted attention due to Trump's attempts to exert greater influence over the central bank and its interest rate decisions.

After a fierce battle between bulls and bears, Citigroup warns that gold prices may drop to $3,800. Following progress in U.S.-China trade negotiations that weakened investor demand for safe-haven assets, gold continued its downward trend on Monday. Spot gold plummeted 3.2%, falling below $4,000 per ounce for the first time since October 10. Meanwhile, U.S. Treasury yields fell—even as the market still expects the Federal Reserve to further ease monetary policy this week, rising Treasury yields diminished the appeal of gold as a non-yielding asset. Analysts at Citigroup, including Max Layton, noted in a report released on Monday that the resumption of cooperation between the U.S. and China, the waning momentum of gold prices, and the potential end of the U.S. government shutdown could drive gold prices lower in the coming days or weeks. Citigroup expects gold prices to drop to $3,800 per ounce in the next three months.

Individual Stock News

PayPal (PYPL.US) signs agreement with OpenAI to embed digital wallet into ChatGPT. PayPal announced that it has signed an agreement with OpenAI to embed its digital wallet into ChatGPT, allowing users to pay directly for products found through this leading consumer-grade AI tool. Additionally, PayPal's Q3 2025 earnings report showed revenue of $8.417 billion, up from $7.847 billion, and above the expected $8.2409 billion; earnings per share were $1.34, up from $1.20, and in line with expectations of $1.20. The stock rose nearly 15% in pre-market trading.

NXP Semiconductors (NXPI.US) Q3 performance shows recovery momentum, Q4 revenue outlook aims for positive growth. NXP's revenue decline in the third quarter is further slowing, and the company's better-than-expected guidance suggests that revenue is likely to return to positive growth in the fourth quarter. The earnings report showed that NXP's Q3 revenue fell 2% year-over-year to $3.17 billion, slightly above analysts' average expectation of $3.16 billion, with a smaller decline than the 6% drop in the second quarter. Adjusted operating profit was $1.07 billion, down 7% year-over-year, with a smaller decline than the 13% drop in the second quarter; adjusted earnings per share were $3.11, slightly below analysts' average expectation of $3.12.

Nomura (NMR.US) reports a 6% decline in net profit for Q2, with record high stock trading revenue. Nomura's net profit unexpectedly fell 6% in the second fiscal quarter ending in September, with a net profit of 92.1 billion yen ($610.82 million), compared to approximately 98.4 billion yen in the same period last year Although profits unexpectedly declined in the second fiscal quarter, some analysts believe that with Japan's new Prime Minister Sanae Takaichi preparing an economic stimulus policy that surpasses last year's scale (greater than 13.9 trillion yen), it could serve as a significant positive catalyst for the Japanese stock market. Therefore, for Japan's largest brokerage and investment bank, Nomura, a new round of fundamental performance and valuation expansion may be on the horizon. Nomura's wholesale business performed the strongest—achieving a year-on-year growth of 43% in the first half of the fiscal year, successfully supporting Nomura's net profit, primarily due to record revenues from stock trading.

New drug sales offset the impact of Entresto's patent expiration, Novartis (NVS.US) Q3 operating profit increased by 6%. Swiss pharmaceutical company Novartis has launched a wave of acquisitions this year. As new drug growth outpaces the stagnant revenue of the core heart drug Entresto, the company's operating profit achieved a 6% increase. Novartis' adjusted operating profit for the third quarter rose to $5.46 billion, slightly above the consensus expectation of $5.4 billion from analysts. The financial report showed that Novartis' third-quarter revenue was $13.91 billion, an 8.4% year-on-year increase, exceeding expectations, with a non-GAAP earnings per share of $2.25, which was $0.06 lower than expected. To strengthen its R&D pipeline and compensate for the sales decline of its flagship therapy due to patent expiration, Novartis is actively pursuing acquisition and licensing deals worth up to $30 billion this year, including the $12 billion acquisition of U.S. biotechnology company Avidity.

Shengda Technology (SDA.US) adjusted profit of $2.5 million in the first half of 2025, with new energy vehicle insurance growing by 111%, exceeding 5 billion. U.S. listed company Shengda Technology officially released its core operating results for the first half of 2025. Data shows that the company achieved an adjusted profit of $2.5 million in the first half of the year, with its new energy vehicle insurance business scale strongly surpassing $700 million, approximately 5.1 billion yuan, a year-on-year increase of 111%, leading the second place by two times. For the six months ending June 30, 2025, total revenue grew from $203 million in the same period last year to $222.3 million, a year-on-year increase of 9.5%, maintaining the industry’s top position. Among them, automotive electronic insurance revenue grew by 33%, reaching $97.8 million; technology service revenue increased by 11%, reaching $24.3 million.

New Oriental (EDU.US) released first-quarter results, with net profit attributable to shareholders down 1.9% year-on-year to $241 million. New Oriental released its first-quarter results for the period ending August 31, 2025, showing a 6.1% year-on-year increase in net revenue to $1.523 billion for the first quarter of fiscal year 2026. The operating profit for the first quarter of fiscal year 2026 increased by 6.0% year-on-year to $311 million. The net profit attributable to shareholders for New Oriental in the first quarter of fiscal year 2026 decreased by 1.9% year-on-year to $241 million.

UnitedHealth (UNH.US) Q3 results exceeded expectations, raising full-year profit guidance. UnitedHealth's third-quarter financial report shows that the company raised its full-year adjusted earnings per share guidance for 2025 to at least $16.25 (originally $16.00) and reiterated that it will restore growth in 2026 under the leadership of new CEO Stephen Hemsley Q3 medical loss ratio is 89.9%, in line with the company's expectations; adjusted EPS is $2.92, higher than the market expectation of $2.79. Optum's revenue remained flat at $25.9 billion, with the pharmacy benefit management business Optum Rx revenue increasing by 16% to $39.7 billion, mainly driven by the growth in prescription volume.

United Parcel Service (UPS.US) Q3 revenue and profit both exceeded expectations. United Parcel Service's adjusted EPS for the third quarter reached $1.74, far exceeding the expected $1.32, with revenue also surpassing expectations; the company expects Q4 revenue to be around $24 billion. To boost profitability, United Parcel Service is accelerating its "streamlining" plan: it has laid off 34,000 employees this year, exceeding the original target of 20,000, while closing and consolidating some locations and eliminating low-profit e-commerce packages such as those from Amazon. The effects of automation in saving labor costs are beginning to show. The company warned that Trump's tariff policy still brings uncertainty to the demand for high-yield routes such as those between China and the U.S.

The trend of AI replacement intensifies, Amazon (AMZN.US) to lay off another 14,000 employees. Amazon plans to cut about 14,000 corporate positions, just months after its CEO Andy Jassy warned that artificial intelligence would reduce the company's workforce. This layoff marks the second round of layoffs initiated by Amazon in about two years. Jassy stated in June that as the company increasingly uses AI to perform tasks typically handled by humans, the number of employees may decrease. These remarks have caused panic among employees, who are searching for clues about potential layoffs in anonymous online chat rooms. Business leaders across various industries are not only increasingly exploring new AI services but also looking for ways this technology can replace human functions. According to insiders, Amazon's layoffs will involve positions across various departments, from logistics and payments to video games and cloud computing.

Tesla (TSLA.US) trillion-dollar compensation plan vote imminent, chairman warns: if rejected, Musk may leave. Tesla chairman Robyn Denholm warned in a letter to shareholders on Monday that if Elon Musk's $1 trillion compensation plan is not approved, the CEO may leave Tesla. It is reported that Tesla announced a staggering compensation plan last month, under which Musk could receive up to $1 trillion in stock rewards if he meets a series of performance targets. These targets include: Tesla's market value reaching $8.5 trillion, selling 12 million cars, delivering 1 million humanoid robots, launching 1 million autonomous taxis (Robotaxi), and increasing adjusted earnings from $16.6 billion in 2024 to $400 billion.

Important Economic Data and Event Forecast

Beijing time 22:00: U.S. October Conference Board Consumer Confidence Index.

Next day Beijing time 04:30: U.S. API crude oil inventory change for the week ending October 24 (10,000 barrels).

Next day Beijing time 02:00: NVIDIA CEO Jensen Huang delivers a keynote speech.

Earnings Forecast

Wednesday morning: Bloom Energy (BE.US), Visa (V.US), Booking (BKNG.US)

Wednesday pre-market: GlaxoSmithKline (GSK.US), Deutsche Bank (DB.US), UBS (UBS.US), United Microelectronics Corporation (UMC.US), Boeing (BA.US), Caterpillar (CAT.US), Verizon (VZ.US)