"The AI Super Bowl" is coming to Washington! Jensen Huang is about to take the stage as Wall Street bets on "new AI magic" igniting NVIDIA

NVIDIA investors are hoping that Washington's "AI Super Bowl" can inject new momentum into the sluggish stock price. The market anticipates that new positive catalysts will drive the stock price up, and analysts are generally optimistic about NVIDIA's future performance, with target prices being continuously raised. HSBC has raised its target price from $200 to $320, indicating that NVIDIA's market value is expected to exceed $5 trillion, and even approach $8 trillion. CEO Jensen Huang will deliver an important speech at the GTC conference, attracting market attention

NVIDIA (NVDA.US), known as the "AI chip leader" and "the most important stock on Earth," is undoubtedly the strongest engine driving the U.S. stock market into this round of super bull market since the beginning of 2023. However, the sharp rise in NVIDIA's stock price paused this summer. Now, Wall Street's bullish forces on NVIDIA are eagerly anticipating "new AI magic" (i.e., new dynamic news) from Washington to reignite the stock's powerful upward momentum, aiming for the coveted $5 trillion market cap, thus entering a new round of bull market.

According to top Wall Street institutions like Cantor Fitzgerald, HSBC, and Morgan Stanley, NVIDIA will still be the core beneficiary of the trillion-dollar wave of AI spending. These institutions believe that the trend of NVIDIA's stock price repeatedly hitting historical highs is far from over. Recently, Wall Street analysts have continuously raised their 12-month target price for NVIDIA, with the latest average target price from Wall Street indicating that NVIDIA's total market cap will break the $5 trillion milestone within a year. More significantly, HSBC raised its target price for NVIDIA from $200 to $320, the highest level on Wall Street.

HSBC's new target implies that NVIDIA, the world's number one by market cap, has nearly 70% upside potential left in its stock price. If it reaches HSBC's target, NVIDIA's market cap will approach an astonishing approximately $8 trillion, while NVIDIA's current market cap is about $4.65 trillion, consistently ranking first in the global market cap leaderboard. This year, NVIDIA's stock price has repeatedly hit new highs, with a year-to-date increase of 43% as of 2025.

The three-day AI conference "GTC Conference" opened on Monday in the U.S. capital, with all eyes focused on CEO Jensen Huang's keynote speech scheduled for Tuesday noon Eastern Time. Although GTC has been held in Washington before, this is the first time a CEO has been scheduled to give a keynote speech. Therefore, some professional institutional investors believe that the choice of venue is significant.

"GTC is somewhat like the Super Bowl of the global AI field," said Gerry Sparrow, Chief Investment Officer of Sparrow Growth Fund, which manages about $120 million and has long held NVIDIA stock. "The fact that it is being held in Washington may indicate that some unexpected good news will be announced."

Earlier on Tuesday, U.S. President Donald Trump, who is visiting Japan, expressed his desire to congratulate Jensen Huang, although it is unclear for what specific reason. While speaking to business leaders in Tokyo, he also mentioned that he would meet with the NVIDIA CEO tomorrow. NVIDIA's stock price responded by rising, increasing by more than 1% in pre-market trading, heading towards another historical high.

NVIDIA's Bull Market Momentum Clearly Slowed This Summer

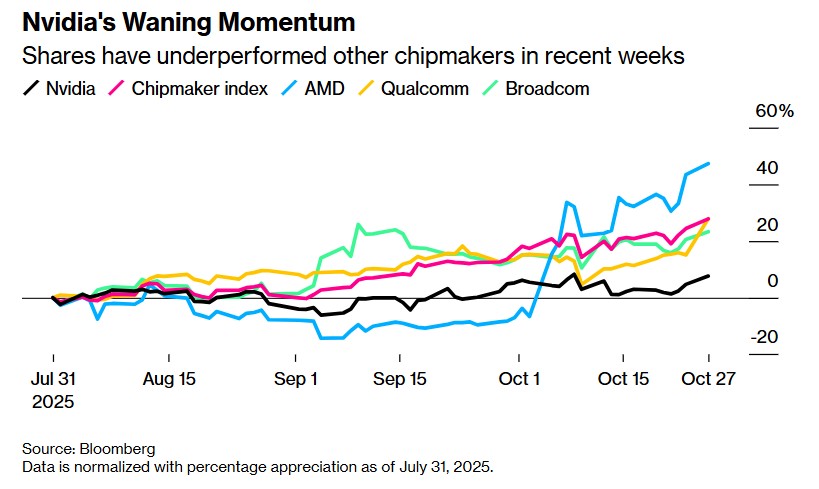

Not long ago, catalysts related to NVIDIA seemed to be the least needed for its stock price, as the AI boom swept the global market and placed this chip giant at the center of this AI prosperity, with any dynamic news related to AI serving as a catalyst for NVIDIA. Since 2022, the stock has been one of the best performers among S&P 500 constituents each year, and as of the end of July 2025, it has risen by 32% However, since then, the stock has shifted from sprinting to jogging, rising 7.7%, while other large chip companies in the U.S. stock market have accelerated, with the Philadelphia Semiconductor Index jumping 28% as of the last closing point.

NVIDIA's momentum seems to be waning — the stock has underperformed other chip giants in recent weeks

In the past three months, Intel (INTC.US), a long-time competitor of NVIDIA in the PC space, has emerged as the biggest winner, benefiting from a massive capital injection including an $8.9 billion investment from the White House for a 10% stake in the company, as well as NVIDIA's investment of up to $5 billion in Intel, which has surged over 100%. However, the stock has roughly declined about 1% this year as of July.

Competitors in the AI chip sector, such as Broadcom, as well as semiconductor equipment giant Applied Materials and chip design leader ARM, have also significantly outperformed NVIDIA since early August. On Monday, Qualcomm's stock saw a rare significant increase of 11%, reaching its highest level since July 2024 after launching high-performance AI chips aimed at challenging NVIDIA's AI computing power systems.

The Chinese market has always been a major uncertainty for NVIDIA. In August, the company agreed to a controversial deal with AMD to pay 15% of its AI chip sales revenue in China to the U.S. government. Sparrow stated that from a long-term perspective, if NVIDIA can gain greater access to the Chinese market, its market value of approximately $4.65 trillion could increase by at least 10%.

Therefore, as U.S. President Donald Trump visits Asia this week and plans to hold a U.S.-China meeting on Thursday, investors are looking forward to some strong catalysts that could reignite the stock. This is also why NVIDIA's GTC conference, held not far from the White House this week, is considered symbolic.

“I am looking for a catalyst, whether it’s a large-scale deal like we’ve seen in countries like Saudi Arabia, or a clear positive signal regarding China policy, those would represent a huge opportunity,” Sparrow said.

Wall Street Discussion: What new things will "AI Father" Jensen Huang bring this time?

According to a spokesperson for NVIDIA, this GTC event “will bring together government leaders, industry representatives, top researchers, AI developers, and academia for timely discussions on AI innovation and the role of the U.S. in the global AI development landscape.”

NVIDIA's stock may also receive strong momentum this week from the quarterly performances of its major clients, although the direction remains uncertain. Microsoft, Alphabet (Google's parent company), Amazon, and Meta are set to release their earnings on Wednesday and Thursday Eastern Time, with institutional compiled supply chain data showing that these four companies account for over 40% of NVIDIA's revenue. Last week, Super Micro Computer Inc., which accounts for over 8% of NVIDIA's revenue, provided weak preliminary sales data, which also contributed to the decline in NVIDIA's stock price "There is a large amount of cyclical AI investment capital in the market, and NVIDIA is overly exposed to the premise that this capital must meet expectations," said Dan Sheehan, portfolio management director at Telos Wealth Advisors, which manages about $70 million in assets. "I am very interested in what Jensen Huang would say, but for us, the real key is to see whether the astonishing AI capital expenditures of the tech giants will be reaffirmed. Once we get a guarantee of larger-scale spending, NVIDIA's stock price could fluctuate significantly."

From a valuation perspective, NVIDIA's stock price still seems to have significant upside potential. The stock has a forward price-to-earnings ratio of about 32x, lower than its five-year average of 39x for this valuation metric, and not far off from the valuation multiple of the chip benchmark index, the Philadelphia Semiconductor Index, which is about 29x. In contrast, AMD's expected price-to-earnings ratio is about 44x, and Broadcom's is about 39x.

Fundamentally, Wall Street and NVIDIA's retail investors have good expectations, anticipating that the company will see a substantial revenue growth of about 58% in the fiscal year ending in January. According to Bloomberg Intelligence statistics, this growth rate is more than double the expected growth rate of the global chip industry in 2025.

"Between GTC and the earnings reports of the major tech giants, NVIDIA could potentially receive two major positive catalysts this week," Sparrow said. "There is also the possibility of two disappointments, but given the current growth expectations, NVIDIA's valuation multiple is very reasonable. So I would choose to buy on weakness."

Regarding the "new things" or "new ideas" that Jensen Huang might release, Wall Street analysts' latest technical focus is on the Rubin architecture and silicon photonics.

The Rubin architecture is positioned as the direct successor to Blackwell, aimed for mass production in 2026, with core changes including a shift to HBM4, higher-speed NVLink, and greater rack/clustering scalability. Key upgrades include HBM4 (with bandwidth around 13 TB/s, a significant increase from Blackwell's 8 TB/s), faster NVLink (up to about 260 TB/s total bandwidth), and expansion towards higher-density racks (such as a target of 600kW racks). Additionally, the AI server cluster combination of Vera CPU + Rubin GPU will be the successor to the "Grace-Blackwell" combination.

The so-called "silicon photonic processors" are likely to be silicon photonic switching/transceiver chips for AI data center networks/high-speed interconnects, according to independent semiconductor research institutions like SemiAnalysis (not AI GPU series products). According to previous media reports, NVIDIA has successfully integrated the silicon photonic engine into its Quantum-X (InfiniBand) and Spectrum-X (Ethernet) high-performance switch ASIC devices, used for cabinet/clustering-level optical interconnect (CPO/Co-Packaged Optics concept) to support larger-scale AI GPU interconnects in the Rubin era NVIDIA has also revealed that silicon photonics technology may first be used in switch ASICs—meaning that CPO technology will initially be implemented on the switch side, while the AI GPU side will still primarily rely on high-speed copper interconnects (due to reliability/cost reasons). Therefore, the "silicon photonic processor" of the Rubin era is likely to first appear in network switching/interconnect devices, providing optical bandwidth foundations for larger-scale AI GPU pooling and flattening of AI server clusters