Bessent "guides" the Japanese government to "intervene less," with a rate hike by the Bank of Japan on the horizon?

U.S. Treasury Secretary Janet Yellen has unusually urged the Japanese government to give the central bank policy space, coinciding with pressure from high-ranking officials on the central bank to maintain low interest rates. Although Japan's Finance Minister tried to downplay Yellen's "verbal intervention," the market has interpreted this as external support for the Bank of Japan to raise interest rates, causing the yen to strengthen. This Thursday, the Bank of Japan will announce its latest interest rate decision

On the eve of the Bank of Japan's monetary policy meeting, a rare statement from U.S. Treasury Secretary Janet Yellen has once again stirred the market's sensitive nerves regarding Japan's monetary policy direction.

Yellen publicly urged the Japanese government to provide the Bank of Japan with sufficient policy space to stabilize inflation expectations and exchange rates. On Wednesday, October 29, Yellen posted on social media:

The Japanese government's willingness to allow the Bank of Japan to have policy space will be key to anchoring inflation expectations and avoiding excessive exchange rate fluctuations.

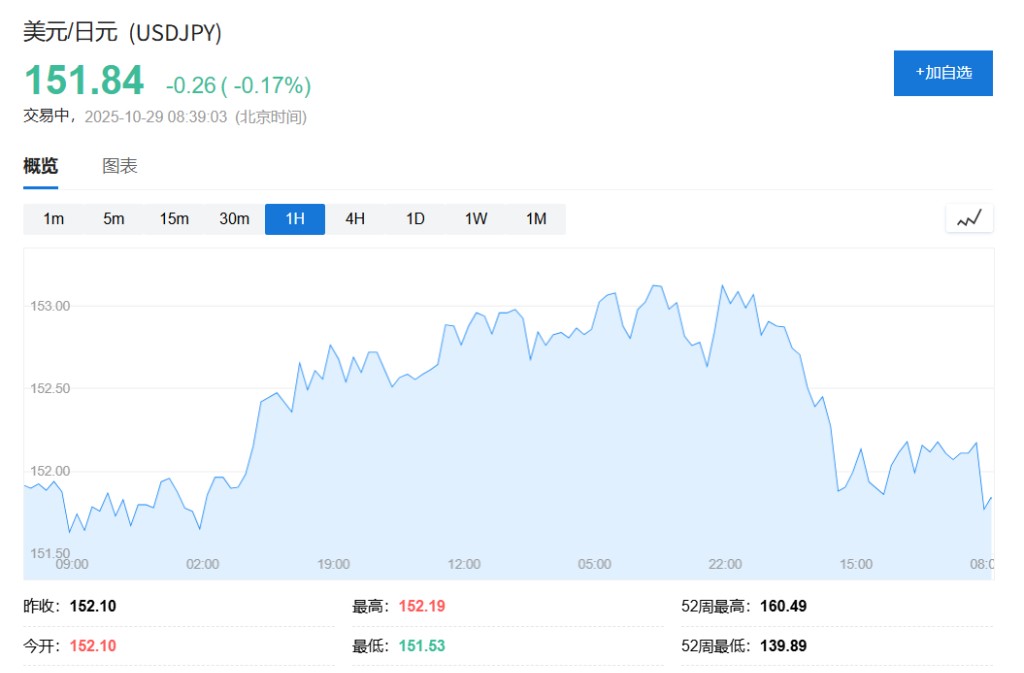

This statement directly pointed to Japan's new Prime Minister, Sanae Takaichi, who advocates for low interest rates. It was interpreted by the market as external support for the Bank of Japan to tighten monetary policy, increasing expectations that the Bank of Japan will soon raise interest rates. Following the post, the yen strengthened against the dollar, rising from 152.12 to around 151.54.

This public call came two days after Yellen's meeting with Japan's Finance Minister, Shunichi Suzuki. According to a statement released by the U.S. Treasury Department after the meeting, Yellen emphasized the importance of "robust monetary policy formulation and communication" in stabilizing inflation expectations and preventing excessive exchange rate fluctuations during the talks on Monday.

Although the market generally expects the Bank of Japan to maintain interest rates at its meeting on Thursday, October 30, Yellen's consecutive statements undoubtedly add weight to the view that the Bank of Japan will raise interest rates.

Rare Pressure from the U.S.

Yellen's remarks are seen as a direct response to the monetary policy tendencies of Japan's new government. Japan's new Prime Minister, Sanae Takaichi, is an advocate of "Abenomics," and she has urged the Bank of Japan to work with the government to boost demand, which analysts view as resistance to the central bank's interest rate hike plans.

Yellen's statements stand in stark contrast to this. During the talks, she pointed out that Japan's current economic situation is very different from when "Abenomics" was implemented 12 years ago. This is not the first time she has expressed her views on Japan's monetary policy.

In August of this year, she stated that the Bank of Japan was "behind the curve" in addressing inflation risks; earlier this month, she reiterated that if the Bank of Japan follows "appropriate monetary policy," the yen exchange rate will find its own level.

These remarks have reignited market expectations that Washington may continue to pressure Tokyo to tighten monetary policy more quickly. Some analysts believe that Washington may be pursuing a weak dollar policy to promote U.S. exports, which puts pressure on Japan to allow the yen to appreciate.

Japan's Official Attempts to Cool Down

In response to U.S. "guidance," Japanese officials are attempting to downplay its impact and maintain the independence of the central bank. Finance Minister Shunichi Suzuki stated to the media on Tuesday that her meeting with Yellen did not directly discuss how the Bank of Japan should guide monetary policy "I believe Mr. Besant spoke under the premise of independent decision-making authority for central banks in various countries," said Katayama Satsuki. She added, "I don't think he intends to urge the Bank of Japan to raise interest rates."

Meanwhile, there seems to be a divergence of views within the Japanese government regarding the weak yen. According to Reuters, Japan's Minister of Economic Revitalization Minoru Kiuchi stated on Tuesday that a weak yen is beneficial for the economy, suggesting an optimistic attitude from the government regarding the costs of the yen's continued depreciation.

Market Bets on Interest Rate Hike Prospects

Despite cautious official statements, the market has reacted with action. Besant's remarks provided new ammunition for yen bulls and reinforced market expectations for a rate hike by the Bank of Japan.

Japan's core inflation rate has been above the central bank's 2% target for more than three consecutive years, raising concerns among some central bank policymakers about the risk of a second-round price effect. The Bank of Japan has raised interest rates twice since exiting its massive stimulus policy in 2024, but the benchmark rate remains at a low of 0.5%.

Reports indicate that most economists predict that the Bank of Japan will raise interest rates again in December this year or January next year.

Shota Ryu, a foreign exchange strategist at Mitsubishi UFJ Morgan Stanley Securities, stated, "If Japan wants to correct the yen's weakness, it must do so through currency intervention or monetary policy." He believes the market consensus is that the Bank of Japan's next step will be to raise interest rates by the end of the year or early next year, pushing borrowing costs up to 1% after a pause.

However, Bank of Japan Governor Kazuo Ueda also faces a dilemma. While he has expressed determination to continue raising interest rates, he has also emphasized the need for caution given the slowdown in U.S. economic growth and the uncertainties that President Trump's tariff policies may bring