Every day there are significant AI trades, Goldman Sachs traders: the market has clearly become "tired"

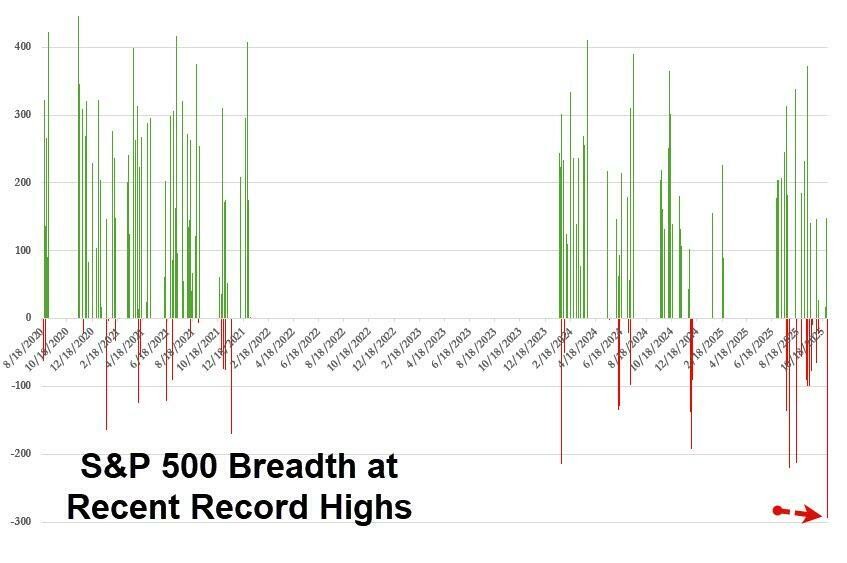

Goldman Sachs TMT trader Peter Bartlett warned that, in contrast to stock price performance, skepticism in the market regarding this transaction is accumulating, with the issue of "circular investment" becoming the biggest point of contention. Although the S&P 500 index has reached a new high, a record 398 constituent stocks have declined, and the market's gains are highly concentrated among a few AI giants, leading to significant internal divergence

Despite NVIDIA's market value soaring by $245 billion in a single day, signs of fatigue in the AI trading frenzy are becoming apparent. Goldman Sachs Technology, Media and Telecom (TMT) trader Peter Bartlett warned that market participants are feeling a noticeable fatigue in the face of seemingly endless new deals, collaborations, and investments in the AI sector.

On October 28 alone, NVIDIA announced over 15 significant collaborations, ranging from a $1 billion equity investment in Nokia to strategic partnerships with companies like Microsoft, OpenAI, Eli Lilly, and Uber. These announcements drove NVIDIA and Microsoft's stock prices up significantly, adding $245 billion and $80 billion to their market values, respectively, while the Nasdaq 100 Index and the Philadelphia Semiconductor Index both reached all-time highs.

However, Goldman Sachs trader Bartlett pointed out that in contrast to stock performance, skepticism about these deals is accumulating, with the issue of "circular investments" becoming the biggest point of contention. Although NVIDIA CEO Jensen Huang denied concerns about an AI bubble during his keynote speech at the GTC conference, claiming visibility of $500 billion in revenue, this did not fully dispel market doubts.

Notably, the S&P 500 Index closed at a historic high that day, but 398 stocks within the index fell, setting a record for the number of declining stocks when the index closed at a historical peak. The divergence between the equal-weighted S&P 500 Index and the market-cap-weighted index reached historic levels, highlighting the concentration of market gains among a few AI-related giants.

One-Day AI Trading "Frenzy": NVIDIA-Driven Collaboration Wave

October 28 can be regarded as a "trading day" in the AI sector. According to Bartlett's statistics, some of the major deals announced that day were anticipated, but many came as a surprise to the market.

At the start of the day, Microsoft and OpenAI revealed details of a new collaboration agreement, and NVIDIA announced a $1 billion equity investment in Nokia. Nokia's stock price surged by 23%, adding $10 billion to its market value. Subsequently, NVIDIA's collaboration announcements followed in quick succession.

PayPal partnered with OpenAI to expand payment and business functionalities in ChatGPT, with its stock price rising by 4% and market value increasing by $3 billion.

Cybersecurity company CrowdStrike collaborated with NVIDIA to develop AI agents, resulting in a 3% stock price increase and a $5 billion market value boost. Oracle partnered with NVIDIA to build an AI supercomputer for the U.S. Department of Energy, with its stock price remaining flat.

Other companies that announced collaborations with NVIDIA include:

Uber (expanding mobile networks), Eli Lilly (building AI supercomputers), Super Micro (expanding government solutions collaboration), Lucid (delivering L4 autonomous electric vehicles), Palantir (operationalizing AI decision-making), HPE (AI factory innovation), Zoom (federal AI architecture), ServiceNow (expanding intelligent workflows), Flex (deploying large-scale AI factories), Check Point (AI factory security solutions), Pure Storage and Cisco (enterprise AI factories), among others In addition, Booz Allen, Cisco, MITRE, ODC, and T-Mobile also announced collaborations with NVIDIA. Adobe announced the expansion of its strategic partnership with Google Cloud on the same day, while CoreWeave expressed its intention to enter the U.S. federal market to provide AI cloud services to government agencies.

Stock Price Surge Fails to Mask Market Doubts

These announcements had a significant impact on stock prices. NVIDIA's stock rose by 5%, adding $245 billion to its market value in a single day; Microsoft increased by 2%, adding $80 billion to its market value.

Goldman Sachs trader Bartlett noted that this phenomenon is particularly pronounced, as the current market largely ignores robust earnings reports while still reacting positively to AI-related news.

However, Bartlett warned that despite the strong performance of these stocks—NVIDIA, the Philadelphia Semiconductor Index, and the Nasdaq 100 Index all reached historic highs—there seems to be a growing skepticism in the market regarding this trade, with "circular investment" being the biggest driver of doubt.

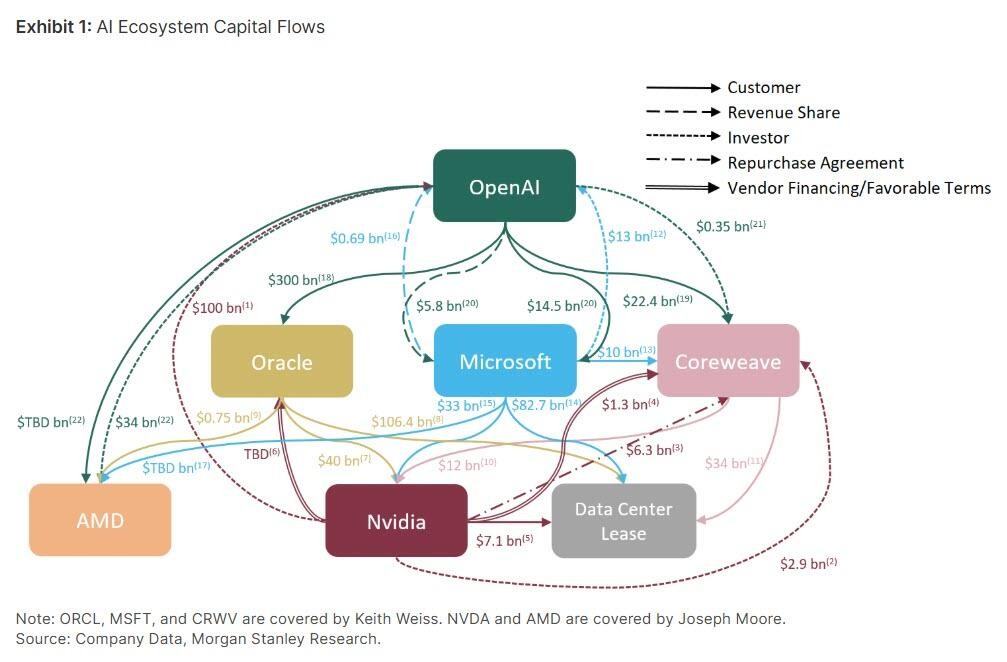

The so-called "circular investment" refers to the phenomenon of mutual investment and procurement among companies within the AI ecosystem, raising market concerns about the sustainability of revenue and the authenticity of actual demand.

Jensen Huang refuted the AI bubble theory in his speech that day. According to an article from Wall Street Insight, Huang emphasized that NVIDIA has $500 billion in revenue visibility through its Blackwell and Rubin product lines by fiscal year 2026. However, this statement did not fully alleviate market concerns.

Bartlett stated that NVIDIA and OpenAI are distinguishing themselves from other AI participants, dominating most trading activities, but this intense trading pace is exhausting market participants.

Goldman Sachs traders pointed out that the increasing internal market divergence confirms this observation. The S&P 500 Index closed at a historic high, but 398 constituent stocks fell, setting a record for the number of stocks declining when the index closed at a historic high. A historic divergence occurred between the equal-weighted S&P 500 Index and the market-cap-weighted index, indicating that the market's gains are highly concentrated among a few AI giants