Can holding gold in one hand and U.S. stocks in the other hedge against risks? Former Chief Risk Officer of China International Capital Corporation, Li Xianglin, teaches you how to use derivatives to identify and respond to "black swans."

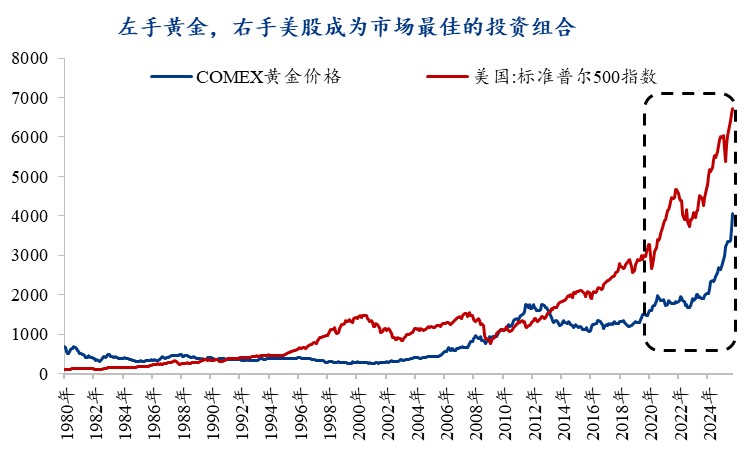

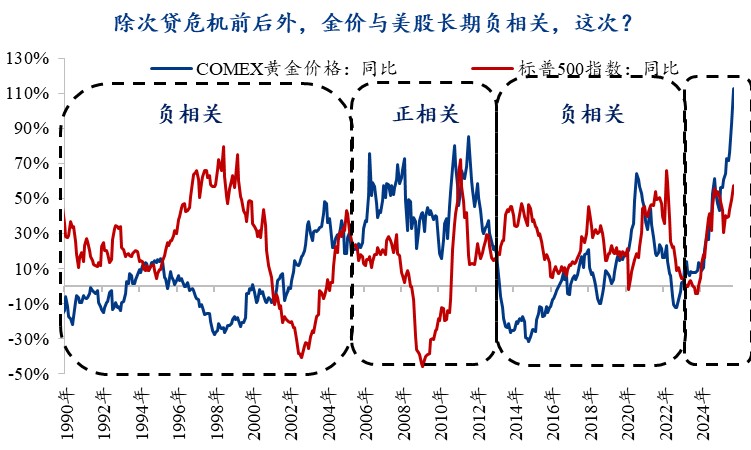

In 2025, the global market faces dramatic changes, with the AI boom coexisting with the demand for safe-haven assets like gold. Despite the stock market reaching new highs, risk appetite has sharply declined, with institutional funds pouring into gold, driving gold prices to new highs. Similar situations have historically occurred during the 2000 internet bubble and the 2008 financial crisis. The current market's fragility lies in its excessive reliance on algorithms and models, which could lead to a collapse under collective intelligence

2025 is a year full of drama. On one hand, global liquidity has restarted, and market enthusiasm has once again heated up—AI narratives continue to ferment, from computing power to applications, from chips to algorithms, every niche track is endowed with the mission of "changing the world." Global stock markets are repeatedly hitting new highs, and the "bull market" seems to bring people back to 2021. But on the other hand, risk appetite is sharply declining—institutional funds are pouring into safe-haven assets like gold, continuously increasing "defensive positions," leading to multiple historical highs in gold prices this year.

Global investors are betting on the future of AI with one hand while tightly holding onto the reality of gold with the other. This seemingly absurd situation has actually played out repeatedly in financial history.

In 2000, during the peak of the internet bubble. Global investors were obsessed with the illusion that "technology will change everything," with the Nasdaq's price-to-earnings ratio reaching a hundred times, and Silicon Valley was hailed as the "new golden age." But when the bubble burst, and the index halved within two years, the market realized—valuation is not a guarantee of growth, and stories cannot replace cash flow.

In 2008, another drama unfolded on Wall Street. CDOs and CDSs made risks seem perfectly sliced and repackaged, and financial engineering became a symbol of "modern wisdom." The market believed that risks could be controlled by models until Lehman Brothers collapsed, triggering a chain reaction that swept the globe, the models once seen as "flawless" became the fuse of the crisis.

Today's global market is similarly filled with this subtle discord— the fervor of AI narratives coexists with the rising demand for safe havens; while indices are hitting record highs, the volatility of risk assets is amplifying.

Human financial history always brews the next irrational collapse in the midst of "rational prosperity."

If the bubble of 2000 stemmed from a "new narrative," and the crisis of 2008 arose from "model illusions," then the current risk lies in intelligence itself. Algorithms make investments more precise, and models make risks more visible, but they may also make the market more fragile under the guise of "collective intelligence."

Everyone knows that as the Federal Reserve enters a rate-cutting cycle, propelled by the flood of global liquidity, we are embracing an unprecedented financial bubble. Yet, Wall Street elites have to repeatedly brace themselves, patting their chests to tell the world: "We have enough experience and tools to control risks; the current market is different from the past; we are safe now."

But little do they know, the more information there is, the more noise there will be; the more detailed the calculations, the greater the mistakes. The real danger in the market is often not "invisible risks," but "misjudged certainties." When people believe they can control risks, it may just be that "the time has not yet come"—the risk is merely delaying its outbreak.

In this cycle, what investors truly lack is not market judgment, but a framework for identifying and responding to risks. Over the past few years, you may have experienced the following:

-

Macroeconomic logic has been frequently overturned, and policy signals have continuously reversed;

-

Asset allocation has become increasingly complex, but diversification no longer means safety;

-

Models seem to explain everything, yet fail to predict "black swans";

-

You know the market is changing, but you don't know what to believe and what not to believe.

This sense of confusion is not a gap in knowledge, but a collapse of logic.

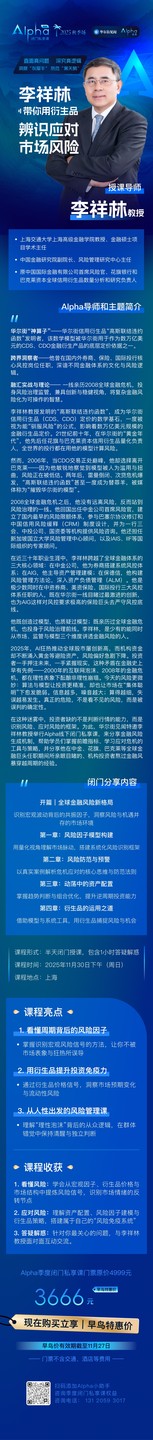

On November 30th, Professor Li Xianglin, invited by Wall Street Insights, taught a key skill necessary for the current market facing "impending storms" at this Alpha offline closed-door class held in Shanghai—how to rebuild a risk framework that remains clear-headed amidst chaos.

We hope this course will help everyone understand:

-

How does financial risk arise?

-

What signals can serve as leading indicators of risk?

-

How many means and tools do we have to respond to risks?

-

How do institutional investors navigate through major financial crises?

Course details can be found in the long poster.

Why is Professor Li Xianglin considered the most suitable expert in financial risk management in China?

Professor Li Xianglin invented a model that could change the world, only to watch it destroy half of the financial world, much like Oppenheimer.

During the golden age of Wall Street, he was the head of credit derivatives quant at Citigroup and Barclays Capital. The "Gaussian Copula Default Function" he proposed became the mathematical foundation for complex credit products such as CDS and CDO. For a time, the entire Wall Street was pricing risk using his formula, and the market believed: risk can be calculated, sliced, and tamed.

However, in 2006, Li Xianglin chose to leave. At that time, CDO trading was at its peak, but he clearly realized: "The model was overused in mortgage loans, but no one wanted to listen."

In 2008, Lehman Brothers collapsed, and the subprime mortgage crisis erupted. His formula became a scapegoat, labeled by the media as the "formula that destroyed Wall Street." Yet, he had already left Barclays four months before the crisis hit and returned to China to serve as the Chief Risk Officer at China International Capital Corporation—while the entire Wall Street was obsessed with making money using his model, he chose to withdraw.

After the crisis, he did not distance himself from risk; instead, he threw himself into the front line of risk governance. At China International Capital Corporation, he established China's earliest risk limit system; he was invited to participate in the revision of the Basel Accord and the design of China's CRM (Credit Risk Mitigation) system; He has served as an advisor to the Risk Management Center of the National University of Singapore, as well as an expert consultant for the International Association of Insurance Supervisors (IAIS) and the Institute of International Finance (IIF).

He has provided risk consulting for the "One Bank and Three Commissions," China Investment Corporation, and the State-owned Assets Supervision and Administration Commission, understanding risk transmission from a regulatory perspective while also gaining insights into risk culture from a market perspective.

Li Xianglin's uniqueness lies in his ability to traverse all boundaries of the financial system:

At China International Capital Corporation (CICC), he represented the "sell-side perspective" of Chinese brokerages;

At AIG, he led asset management modeling, representing the insurance and asset management systems;

At Prudential, he was responsible for risk management methodology, delving into asset-liability management (ALM).

He is one of the few individuals who have held core risk control positions simultaneously in Chinese brokerages, American insurance, and international investment banks. This allows him to perceive cultural distinctions under different financial civilizations: Wall Street values model efficiency, Chinese institutions emphasize regulatory compliance, while the insurance system prioritizes long-term stability—he has witnessed the most aggressive innovations and upheld the most conservative bottom lines.

Li Xianglin is one of the rare individuals who has both created models and questioned them; he has experienced the global financial crisis yet remains committed to frontline financial risk governance.

We believe he is currently one of the most suitable candidates to explain this course topic in China.

Course Value

This course does not teach you to "predict" opportunities but to "see through" risks.

The market will eventually return to rationality, and rationality must be trained—every bubble's end is a renewed pursuit of rationality. In this course, Li Xianglin will help you re-understand risk, enabling you to "live longer" in the financial market:

-

From a macro perspective on cycles: Understand the interactions of risk factors and identify the "resonance points" of assets;

-

From a micro perspective on human nature: Understand the emotional structure and herd logic behind market behavior;

-

From a systemic perspective on investment: Learn to build your own "risk immunity system."

This is not a defensive mindset but a form of rational training—keeping you calm during prosperity and able to judge during panic. The tech dreams of 2000, the financial innovations of 2008, and the AI wave of 2025—behind every great prosperity lies humanity's misunderstanding of "certainty."

A truly mature investor is not someone who is always right but someone who understands when they might be wrong.

In this noisy era, let us relearn how to see the truth of the market beneath the surface of prosperity.

Warm Reminder

This Alpha closed-door private class will be held on November 30, 2025, in Shanghai. Due to limited seats for the private class, interested friends can quickly click on the course poster above to register. If you want to know more course details, you can also scan the QR code in the image below to consult Alpha's assistant.

Risk Warning and Disclaimer

Risk Warning and Disclaimer

The market carries risks, and investment should be approached with caution. This article does not constitute personal investment advice and does not take into account the specific investment objectives, financial situation, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article are suitable for their specific circumstances. Investment based on this is at one's own risk