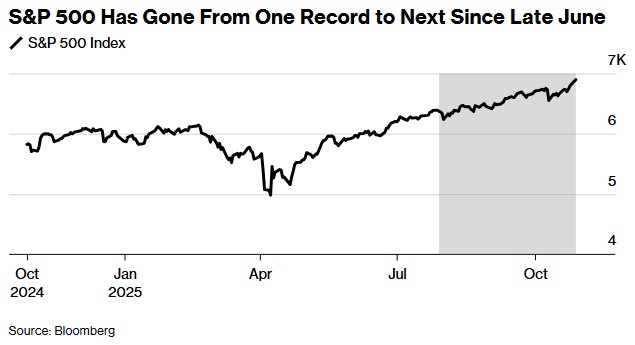

Trillions of funds may enter the market! Citadel Securities: The year-end rally in U.S. stocks may far exceed usual levels

Scott Rubner, head of stock and equity derivatives strategy at investment bank Citadel Securities, stated that the U.S. stock market appears ready to continue its record-breaking rally—potentially even accelerating its usual year-end gains. In a report to clients, the analyst pointed out that there are multiple strong drivers currently expected to push the stock market higher. He cited the strong earnings season so far, bullish retail investors, and the potential for over $7 trillion in money market funds to shift from off-market to on-market as yields decline. Additionally, there are seasonal factors that typically boost the stock market as the year-end approaches. His conclusion is that there is a risk of missing out on gains in the coming weeks, and investors should position themselves to capture profits. "Capital flows, position layouts, and seasonal factors all provide favorable support for risk assets," he wrote. "Given the resilience of corporate earnings, reduced volatility, and ample liquidity off-market, the path of least resistance for the market remains upward toward Thanksgiving—although the gains in the fourth quarter may come earlier and stronger than usual."

According to Zhitong Finance APP, Scott Rubner, head of equity and equity derivatives strategy at investment bank Citadel Securities, stated that the U.S. stock market appears ready to continue its record-breaking rally—potentially even accelerating its usual year-end gains.

In a report to clients, the analyst pointed out that there are multiple strong drivers currently expected to push the stock market higher.

He cited the strong earnings season so far, bullish retail investors, and the potential for over $7 trillion in money market funds to shift from the sidelines into the market as yields decline. Additionally, there are seasonal factors that often boost the stock market as the year-end approaches.

His conclusion is that there is a risk of missing out on gains in the coming weeks, and investors should position themselves to capture returns. "Capital flows, positioning, and seasonal factors all provide favorable support for risk assets," he wrote. "Given the resilience of corporate earnings, reduced volatility, and ample liquidity off the sidelines, the path of least resistance for the market remains upward toward Thanksgiving—although the gains in the fourth quarter may come earlier and stronger than usual."