Wall Street looks at Chinese internet: there are "unique investment opportunities," embrace AI and gaming, avoid e-commerce

Bank of America Merrill Lynch believes that Chinese internet giants are in the "best position" for AI applications and commercialization. Despite rising over 50% since the beginning of the year, the sector's valuation remains at a "non-demanding level." Analysts strongly recommend embracing AI applications and the online gaming sector, while remaining cautious about e-commerce platforms, especially companies impacted by competition from instant retail (quick commerce). Tencent is currently the top choice in the sector

Bank of America Merrill Lynch believes that despite rising over 50% year-to-date, the Chinese internet sector remains a "must-hold" asset, presenting unique investment opportunities in the fields of AI and gaming.

According to news from the Chasing Wind Trading Desk, Bank of America Merrill Lynch stated in a report on October 28 that Chinese internet companies have a distinct path in the AI field, focusing more on efficiency, practical use cases, and ecosystem strength. The current valuation of the Chinese internet sector is still at a "non-demanding level," with a forward price-to-earnings ratio of only 17 times. As regulatory tail risks decrease, choosing the right track will be key to obtaining returns.

In terms of specific tracks, analysts strongly recommend embracing AI applications and online gaming, while remaining cautious about e-commerce platforms, especially companies impacted by competition from instant retail (quick commerce).

New Track: The Value of AI Applications and Gaming Highlights

Bank of America Merrill Lynch believes that Chinese internet giants are in the "best position" for AI applications and commercialization. This is mainly due to four advantages: a closed-loop ecosystem that can achieve direct conversion, commercialization expertise validated in the mobile internet era, massive user data, and lower token costs.

In the view of Bank of America analysts, Tencent is currently the top choice in the sector: the company perfectly combines AI-driven growth, a stable competitive landscape, top-notch shareholder returns, and attractive valuations.

Bank of America appreciates Tencent's "selective battle" strategy—avoiding excessive cash flow consumption on cloud infrastructure scale, while emphasizing AI application development and product-user fit, and maintaining a close follower position in the development of foundational AI models.

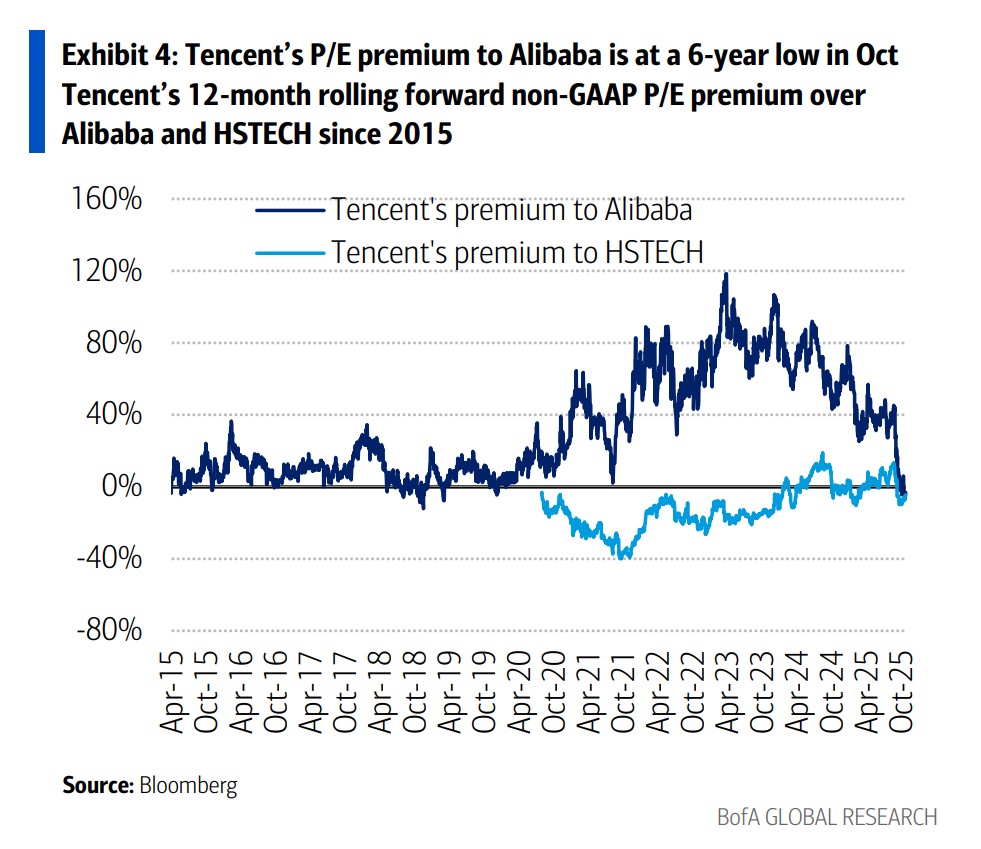

In terms of valuation, Tencent's price-to-earnings ratio premium over Alibaba is nearing a six-year low, close to the period of strict regulation in the gaming industry from 2018 to 2019.

In the AI and cloud business sector, the report is more optimistic about Alibaba.

Analysts believe that with its leading market share in the cloud market and full-stack AI/cloud products, Alibaba is the best representative for the "Investing in Chinese AI" theme, with accelerated growth in cloud revenue expected to support market sentiment.

In the digital entertainment sector, the report clearly favors online gaming, as classic games in the industry have lasting vitality, a stable competitive landscape, and reasonable valuations. In this field, Tencent outperforms NetEase due to the short-term revenue growth prospects brought by new gaming models; Bilibili is favored for its fastest expected earnings per share (EPS) growth in the entertainment sector by 2026.

Old Battlefield: E-commerce "Protracted War" Erodes Profitability

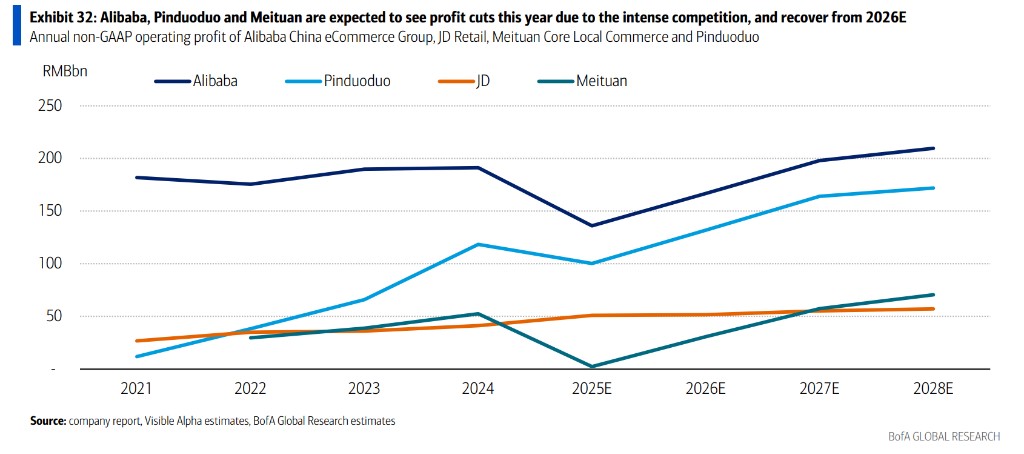

In stark contrast to the optimistic attitude towards AI and gaming, Bank of America Merrill Lynch generally holds a cautious stance on trading platforms (i.e., e-commerce and local services). The report describes the competition in the "instant retail" sector as a "protracted war rather than a blitzkrieg," and expects this war to last until 2026, thereby lowering the profit margins of the entire industry.

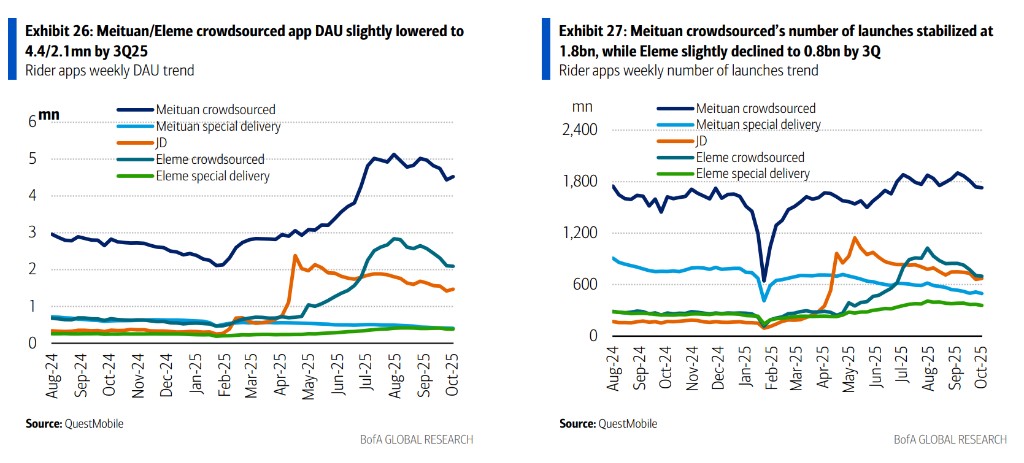

Data shows that due to intensified competition, the total operating profit growth rate of the e-commerce sector has sharply slowed from a year-on-year increase of 2% in the first quarter of 2025 to a year-on-year decline of 23% in the second quarter. Since June 2025, the 12-month rolling EPS forecasts for most trading platforms have been downgraded, with Meituan experiencing the most significant reduction.

Based on the assessment of the competitive landscape, the report downgraded Meituan's rating from "Buy" to "Neutral." Analysts pointed out that the earnings visibility for Meituan in 2026 is very low, with high uncertainty. They are more pessimistic about the industry's earnings in 2026 than the general market expectations.

Nevertheless, among trading platforms, analysts are relatively more optimistic about Alibaba. The core reasons include: (1) Cloud revenue is expected to continue accelerating; (2) It has become a major share gainer in the instant retail sector; (3) The momentum of traditional e-commerce business is improving.

Valuation Discount Remains Significant

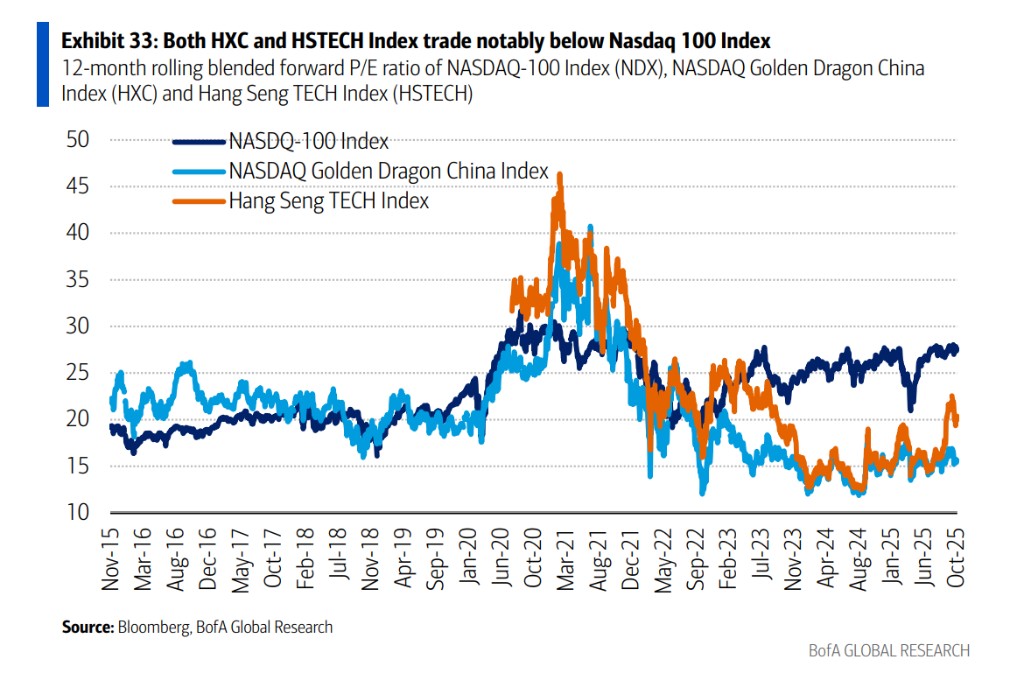

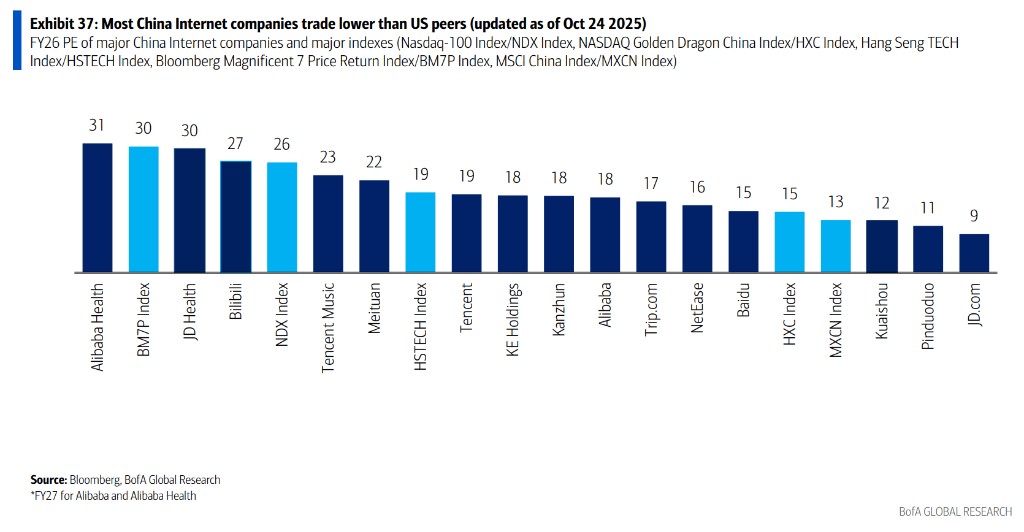

The report emphasizes that despite facing challenges, the overall valuation discount of the Chinese internet sector remains significant.

The Nasdaq Golden Dragon China Index is currently trading at a forward 12-month price-to-earnings ratio of 16 times, the Hang Seng Tech Index at 20 times, while the Nasdaq 100 Index is at 28 times, and the "Tech Seven Giants" Index at 33 times.

Historically, the Nasdaq Golden Dragon China Index traded at similar valuations to the Nasdaq 100 Index before early 2023, and even traded at a premium level in 2021. The valuation premium of Chinese internet stocks relative to the MSCI China Index is currently only 20%, compared to 40-80% over the past decade, despite the sector being a major beneficiary of AI-driven productivity improvements.

This deep discount provides a unique entry opportunity for long-term investors, especially in high-certainty growth areas such as AI applications and gaming