AI profit verification is coming: performance contradicts the bubble theory, and the earnings reports of the five major U.S. tech giants this Friday will set the tone for the next wave

The profit outlook for artificial intelligence companies has improved, alleviating investors' concerns about a stock market bubble. SK Hynix and Advantest Corporation released strong earnings reports, showing that demand and valuations are rising in tandem, indicating that AI trading is shifting towards a sustainable industry profit cycle. The five major U.S. tech giants will announce their earnings reports this week, with investors focused on whether they can continue to deliver impressive results under high expectations. The Bloomberg Asia-Pacific Semiconductor Stock Index has risen over 17% this month, with earnings expectations revised upward again

The Zhitong Finance APP noted that the market is concerned that the global stock market rally led by artificial intelligence, after reaching an all-time high, is now in a bubble zone, while the brighter profit prospects for AI companies are alleviating investors' worries.

SK Hynix and Advantest both reported stronger financial performance on Wednesday, joining a series of companies showing synchronized increases in demand and valuations.

This synchronized strength—covering chip designers, memory suppliers, and test equipment manufacturers—indicates that AI trading is evolving from speculative rises in a few stocks into a sustainable industry profit cycle. For global investors, this means that the range of AI-supported gains may be narrower but will continue to support the global stock market.

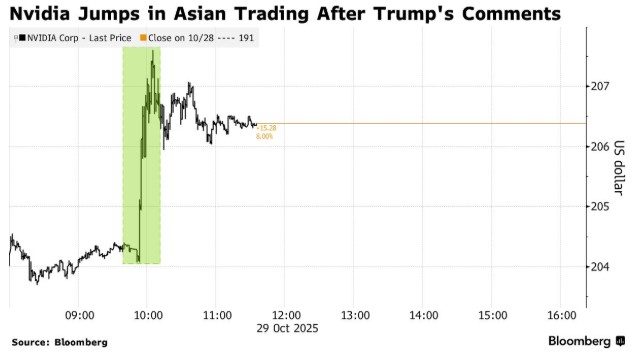

Vey-Sern Ling, Managing Director of French private bank Union Bancaire Privee, stated, "There is good news everywhere," adding that "the meeting between the US and Chinese leaders could enable NVIDIA to sell more powerful AI chips to China."

The focus now shifts to American tech giants—five companies that will report earnings this week account for about a quarter of the S&P 500 index constituents—whose performance this week will reveal whether the massive capital expenditure boom in the AI sector is translating into higher returns. The five major tech giants—Microsoft (MSFT.US), Amazon (AMZN.US), Apple (AAPL.US), Alphabet (GOOGL.US), and Meta (META.US)—will all report earnings this week. Investors will closely watch whether these large tech companies can continue to deliver impressive results under the high expectations driven by the AI boom.

Meanwhile, as a model for AI trading in Asia, South Korea and Taiwan have seen earnings expectations revised upward again after a mid-year lull.

The Bloomberg Asia-Pacific Semiconductor Stock Index has risen over 17% this month, poised for its largest monthly gain since November 2022. The index has a price-to-earnings ratio based on expected earnings for the next year of 19.2 times, while the global comparable index has a P/E ratio of 22.7 times.

Nevertheless, not everyone is convinced. Billionaire and Bridgewater founder Ray Dalio recently warned that speculation surrounding AI has bubble characteristics.

Saxo Bank's Chief Investment Strategist, Charu Chanana, stated, "The discussion about an AI bubble is like two sides of a coin," with one side being the solid profits of companies like NVIDIA and the other side being inflated valuations and cyclical funds.

She added, "What is needed now is for all this massive capital expenditure to translate into actual applications and monetization—providing more support for core areas and grounding the AI growth story in fundamentals."