"Trillion-level" fluctuations have become the norm, the "leverage boom and fragility" of the US stock market

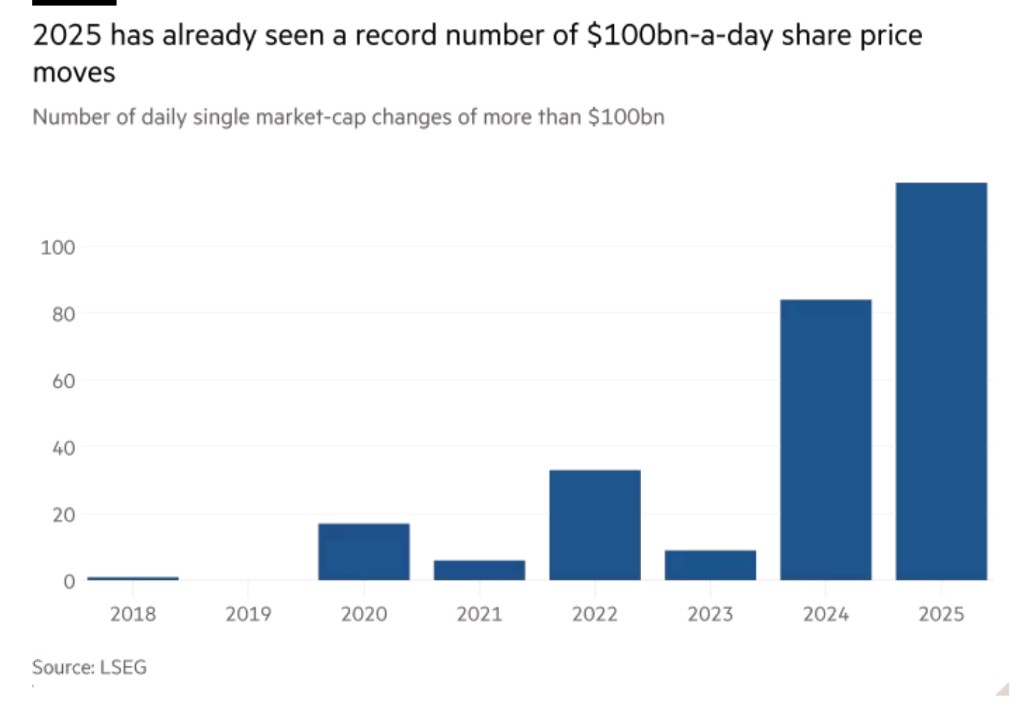

The phenomenon of daily market value fluctuations exceeding $100 billion among major U.S. tech companies has occurred 119 times this year, setting a historical record and highlighting the vulnerabilities hidden in a market boom driven by leverage and options trading. Although individual stock volatility has not significantly raised overall market volatility due to divergent trends, once macro shocks lead to synchronized fluctuations among the giants, the forced liquidation mechanisms of leveraged ETFs and derivatives could trigger the risk of a "liquidity waterfall."

Under the current record-breaking bull market in the U.S. stock market, a striking phenomenon is frequently emerging: the daily market value fluctuations of individual giant companies reaching hundreds of billions are occurring with unprecedented frequency. This intense volatility not only highlights the dominant position of tech giants in the market but also reveals the potential fragility beneath the surface of market prosperity driven by options and leveraged products, bringing new risks to investors.

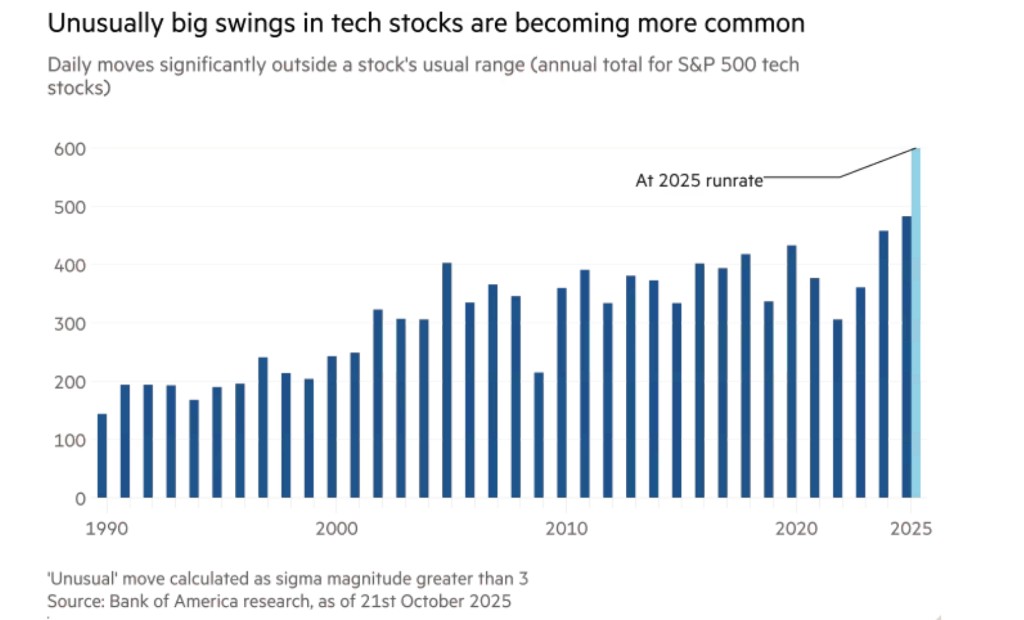

According to the latest statistics from Bank of America, there have been 119 instances this year where the market value of individual stocks on Wall Street has increased or decreased by more than $100 billion in a single day. This figure not only sets a record for the highest annual total in history but also indicates that the number of "fragility events" (i.e., stock prices far exceeding normal volatility ranges) encountered by tech giants this year has already surpassed the total for the entire year of 2024 within just 10 months.

However, in stark contrast to the intense fluctuations of individual stocks, overall market volatility has remained low for most of the time. Since the significant sell-off in April, the S&P 500 index has rebounded and repeatedly set historical highs. Analysts point out that this is mainly because the fluctuations of large stocks often do not occur in the same direction, thereby offsetting their overall impact on the index. But the real "warning signal" lies in the fact that once macro shocks lead to these giants moving in the same direction, the market will face a completely different situation.

Record-breaking "fragility events," derivatives and leveraged products exacerbate market volatility

According to Bank of America data, the number of instances this year where market value fluctuations exceeded $100 billion in a single day has reached 119, far exceeding last year's 84 and the 33 during the bear market of 2022. Abhi Deb, head of global cross-asset quantitative investment strategy at Bank of America, stated:

We are seeing large-cap stocks fluctuate by 10%, 20%, or even 30% in a single day, which was very rare in the past.

This underscores the potential "fragility" of the market. Due to the significant weight of these large tech stocks in the index, their intense fluctuations are amplifying market risks. With the five major tech giants set to release earnings this Friday, investors are closely monitoring their performance, as any slight movement could trigger massive changes in market value.

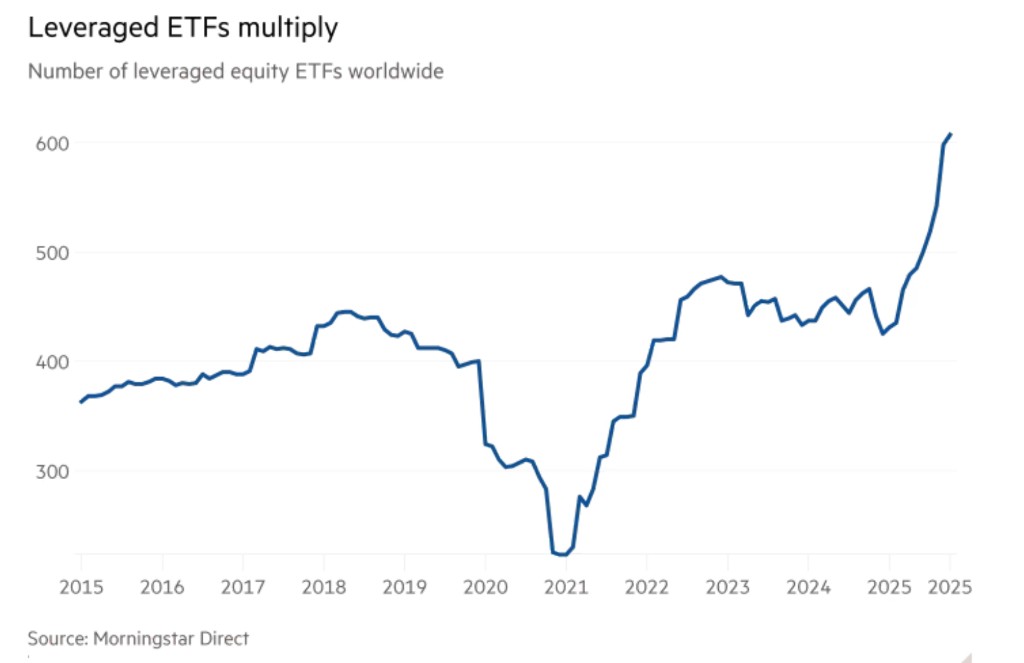

Analysts believe that the boom in the derivatives market and leveraged products is the main driving force behind the increased stock price volatility. According to Goldman Sachs, retail investors and hedge funds are heavily betting on short-term options for individual stocks around earnings reports and macro events. This forces market makers to hedge by establishing their own positions, thereby amplifying the actual volatility of stock prices.

Goldman Sachs data shows that the trading volume of individual stock options this month has reached the highest level since the "meme stock" frenzy in 2021, with retail investors accounting for 60% of the market share At the same time, single-stock leveraged exchange-traded funds (ETFs) have also attracted a large amount of capital this year. These products typically offer two or three times the daily returns of individual stocks, injecting additional leverage into the market. Valérie Noël pointed out that the rise of "quantitative trading strategies, zero-day-to-expiration options, and two or three times leveraged single-stock ETFs" has made stock price fluctuations in the hundreds of billions of dollars "far more common than in the past." These leveraged products exacerbate price volatility due to their design, as issuers must buy more stocks when prices rise and sell when prices fall to maintain the fund's set leverage ratio.

Potential Risks Hidden Under Low Correlation, May Encounter "Consistent Selling"

Despite the extreme volatility of individual stocks, the overall market volatility this year has not increased as a result. The Vix index, which measures market panic, has remained stable for most of the time, except for a brief spike earlier this month due to U.S.-China trade tensions. As of the third quarter in September, the U.S. stock market even experienced its least volatile quarter since 2018.

The underlying reason is that the correlation between stocks is at an "extremely suppressed" level. According to John Marshall, head of derivatives research at Goldman Sachs, current market themes such as artificial intelligence, tax changes, and the global trade war have boosted some stocks while hitting others, leading to a divergence in individual stock performance. UBS Group also noted that this low correlation means that the extreme volatility of individual stocks has limited impact on the overall market.

Analysts warn that the real risk lies in the possibility that once market correlation rises, these large stocks may face a coordinated sell-off, posing a greater threat to market stability.

Maxwell Grinacoff, head of U.S. equity derivatives research at UBS, sees the potential for a "flows cascade." In this scenario, traders who have built positions for further price increases may be forced to sell their positions quickly. Analysts at JP Morgan estimate that during the sharpest single-day sell-off on Wall Street since April on October 10, leveraged ETFs were forced to sell $26 billion worth of stocks at the close to meet their fixed leverage requirements.

"I think the risk is that the market becomes too euphoric, too excited, and everything starts to rise in sync," Grinacoff said. "Once an unknown event breaks this, all assets could move in the opposite direction simultaneously