Will the "Quantitative Tightening (QT)" end in October? This investment bank believes that the Federal Reserve may even "Quantitative Easing"!

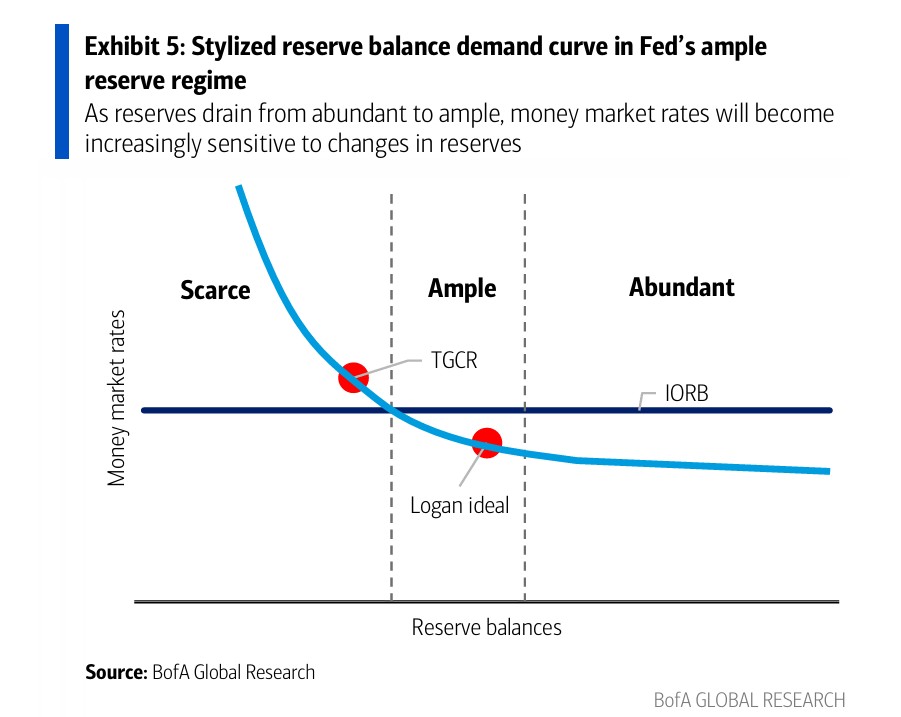

Bank of America predicts that the Federal Reserve will take more aggressive liquidity measures to supplement bank reserves. Given the severe pressure in the money market, Bank of America expects the Federal Reserve to initiate Term Open Market Operations (TOMO) or purchase government bonds at the FOMC meeting, and may lower the Interest on Excess Reserves (IOR). This move is aimed at avoiding a repeat of the 2019 repo market volatility and may be seen by the market as a signal of financial easing, boosting risk assets

As the market widely expects the Federal Reserve to announce the end of its quantitative tightening (QT) policy at this Thursday's interest rate meeting, Bank of America believes that due to increasing pressure on the funding side of the money market, the Federal Reserve may supplement bank system reserves by purchasing government bonds or initiating term open market operations (TOMO).

Bank of America analysts Mark Cabana and Katie Craig stated in a report released on the 27th that the only way for the Federal Reserve to rebuild "ample" reserves is to increase liquidity. The bank expects the Federal Reserve to launch overnight and term repurchase operations at the October FOMC meeting, with rates set 5 basis points and 10 basis points above the interest on excess reserves (IOR), respectively, with a scale of $500 billion.

This expectation stems from recent signals of financing pressure in the money market. Bank of America pointed out that the Federal Reserve needs to take action to prevent excessive depletion of reserves and avoid a repeat of the severe fluctuations in the repurchase market in 2019.

This move could have multiple impacts on the market, including widening the spread between SOFR and the federal funds rate, supporting the 2-5 year swap spread, and potentially being viewed as a signal of financial easing by risk assets.

Timing for the End of Balance Sheet Reduction: Announcement as Early as Next Week

Bank of America stated in its research report that it expects the Federal Reserve to announce the cessation of quantitative tightening (QT) at the October FOMC meeting. At the same time, the Federal Reserve will initiate a plan to reinvest in government bonds using agency mortgage-backed securities (MBS).

The bank believes that the purchase of government bonds will mainly come from the reinvestment of MBS maturities, but the Federal Reserve may also use this as a reason to supplement bank system reserves. This "balance sheet expansion" operation will offset the absorption of market liquidity from larger-scale government bond issuance.

Bank of America emphasized that although permanent open market operations (POMO) are the most robust solution, this may seem too aggressive for some Federal Reserve officials. Therefore, term open market operations have become a more likely "compromise solution."

TOMO Operations: A Replay of the 2019 Script

Bank of America currently expects the Federal Reserve to adopt TOMO as a "half-step measure" as the baseline scenario. Specifically, the Federal Reserve will launch overnight repurchase operations at a rate 5 basis points above IOR at the October FOMC meeting; the 14-day term repurchase operation rate will be set 10 basis points above IOR, with a scale set at $500 billion (effectively unlimited). At the same time, the Federal Reserve will lower IOR by 5 basis points.

This arrangement draws on operational experience from 2019. That year, after fluctuations in the repurchase market, the Federal Reserve first launched TOMO operations with IOR flat and a scale of $75 billion, followed by the gradual introduction of term TOMO and POMO. Bank of America believes that the history of 2019 will repeat itself in 2025.

The bank explained that the main difference between TOMO and the Standing Repo Facility (SRF) lies in the range of counterparties—SRF is aimed at primary dealers and deposit-taking institutions, while TOMO is only aimed at primary dealers. For banks, the "stigma effect" of using SRF is stronger

Market Impact: Widening Spreads and Boosting Risk Assets

Bank of America analysis indicates that TOMO operations at 5 basis points above IOR will limit the upward space for SOFR and the three-party general collateral repo rate (TGCR). This operation is expected to widen the spread between SOFR and the federal funds rate (especially during the period from November to January of the following year) and support the 2-5 year swap spread.

Risk assets may view TOMO or POMO as signals of financial repression and a rebound in risk appetite. The bank advises investors to maintain long positions in the January SOFR/federal funds rate spread next year.

Bank of America also pointed out that the biggest concern among clients is that the Federal Reserve's definition of "ample" reserves has changed, and the Fed is willing to accept repo rates above IOR, which can incentivize banks to participate in repos by lowering IOR. In response, Bank of America argues that banks do not have excess cash to lend, and lowering IOR would only lead to repos quickly reaching the SRF cap, with the lessons from 2019 warning against excessively draining liquidity again