Pre-market movements in US stocks | Most semiconductor stocks rose, with NVIDIA and Micron Tech up over 3%, AMD up over 2%, and Intel and Arm up over 1%

In terms of sectors: On October 29th, during the pre-market session of U.S. stocks, the semiconductor sector mostly rose, with NVIDIA and Micron Tech up over 3%, AMD up over 2%, and Intel and Arm up over 1%; in terms of news: NVIDIA launched the NVQLink product at the GTC Data Center Conference, and CEO Jensen Huang delivered a speech on the frontier outlook of the AI industry. If NVIDIA maintains its current gains, its market capitalization is expected to reach $5 trillion after the opening, with the stock having risen nearly 50% this year, adding approximately $1.6 trillion in market value. Quantum computing concept stocks rose broadly in pre-market trading, with LAES up over 4%, ARQQ up over 3%, and RGTI and IONQ up over 2%; cryptocurrency concept stocks mostly saw slight increases, with APLD up over 2%, HUT and CLSK up over 1%, and CIFR, BITF, and WULF all slightly following suit. In terms of individual stocks: Nokia sharply fell nearly 6% in pre-market trading after a nearly 23% surge overnight; NVIDIA plans to invest $1 billion in Nokia to collaborate on AI 6G networks; Joby Aviation rose nearly 8%, announcing its selection as the first aviation partner for NVIDIA's new IGX Thor platform; Teradyne surged over 20%! Strong demand for artificial intelligence drove Q3 performance and Q4 guidance, both exceeding market expectations; Bloom Energy rose 19%!

Sector Overview:

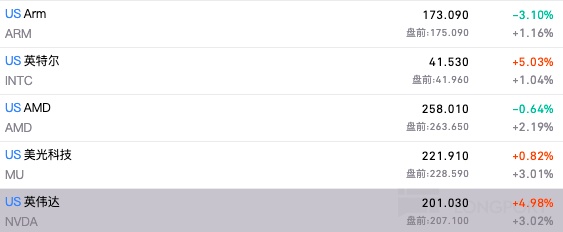

On October 29, in the pre-market session of U.S. stocks, the semiconductor sector mostly rose, with NVIDIA and Micron Tech up over 3%, AMD up over 2%, and Intel and ARM up over 1%;

In terms of news:

NVIDIA launched the NVQLink product at the GTC Data Center Conference, with CEO Jensen Huang delivering a speech on the frontiers of the AI industry. If NVIDIA maintains its current gains, its market capitalization is expected to reach $5 trillion after the opening, having risen nearly 50% this year, adding approximately $1.6 trillion in market value.

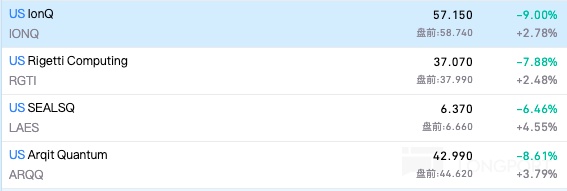

Quantum computing concept stocks rose broadly in pre-market trading, with LAES up over 4%, ARQQ up over 3%, and RGTI and IONQ up over 2%;

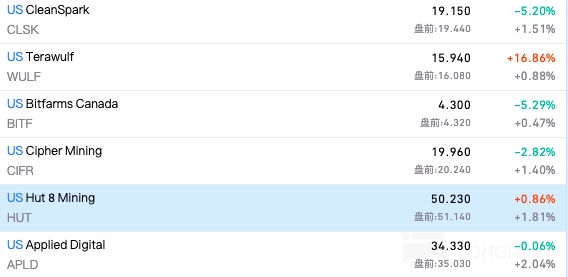

Most cryptocurrency concept stocks saw slight increases, with APLD up over 2%, HUT and CLSK up over 1%, and CIFR, BITF, and WULF all slightly following suit.

Individual Stocks:

Nokia sharply fell nearly 6% in pre-market trading after a nearly 23% surge overnight; NVIDIA plans to invest $1 billion in Nokia to collaborate on AI 6G networks;

Joby Aviation rose nearly 8%, announcing its selection as the first aviation partner for NVIDIA's new IGX Thor platform;

Teradyne surged over 20%! Strong demand for artificial intelligence drove Q3 performance and Q4 guidance, both exceeding market expectations;

Bloom Energy rose 19%! Third-quarter revenue grew 57.1% year-over-year, exceeding expectations, marking the fourth consecutive quarter of record revenue;

PayPal continued to rise over 1%, becoming the first payment wallet for ChatGPT, and raised its full-year performance expectations;

PayPal continued to rise over 1%, becoming the first payment wallet for ChatGPT, and raised its full-year performance expectations;

Seagate Tech's gains expanded to 6%, benefiting from strong development in artificial intelligence, with Q1 performance and Q2 guidance both exceeding market expectations;

Booking rose over 2%, as U.S. travel demand remains stable, and the company's third-quarter performance exceeded market expectations;

Mondelez fell over 5%, as consumer demand weakened, and the company significantly lowered its annual profit expectations;

Enphase Energy fell over 8%! Third-quarter performance exceeded expectations, but fourth-quarter guidance was disappointing;

LRN plummeted over 36%, with first-quarter performance exceeding expectations, but revenue outlook falling short of market expectations;

Varonis System dropped over 30%, with Q3 performance and Q4 guidance both below expectations, and lowered its full-year ARR guidance.