AI continues to surge! What new information is brewing?

NVIDIA expects to achieve over $500 billion in revenue by the end of 2026, driving the application of AI technology across multiple industries. Trump will meet with the CEO of NVIDIA, which may bring favorable news for exports to the Chinese market. Microsoft has signed a new agreement with OpenAI, acquiring a 27% stake in OpenAI, further fueling market enthusiasm for AI investments. The demand for optical modules has been revised upward, with a significant increase expected in the number of 1.6T optical modules by 2025. Overall, the AI industry is in a rapid development phase

Core Conclusion: NVIDIA has provided a strong "conservative" (so far, at least) revenue guidance of $500 billion, with AI technology accelerating its empowerment in industries such as communications, quantum computing, factory manufacturing, and autonomous driving. The upward revision of 1.6T optical module revenue and a series of other factors are igniting AI's continued surge. Jensen Huang is pushing the industry to its limits, while giants like Microsoft and OpenAI continue to form strong ties. AI has become the ultimate competition where one either goes crazy or gets eliminated.

Which sub-industries will fully benefit from the upgrading wave?

1. What Happened? NVIDIA Breaks $5 Trillion

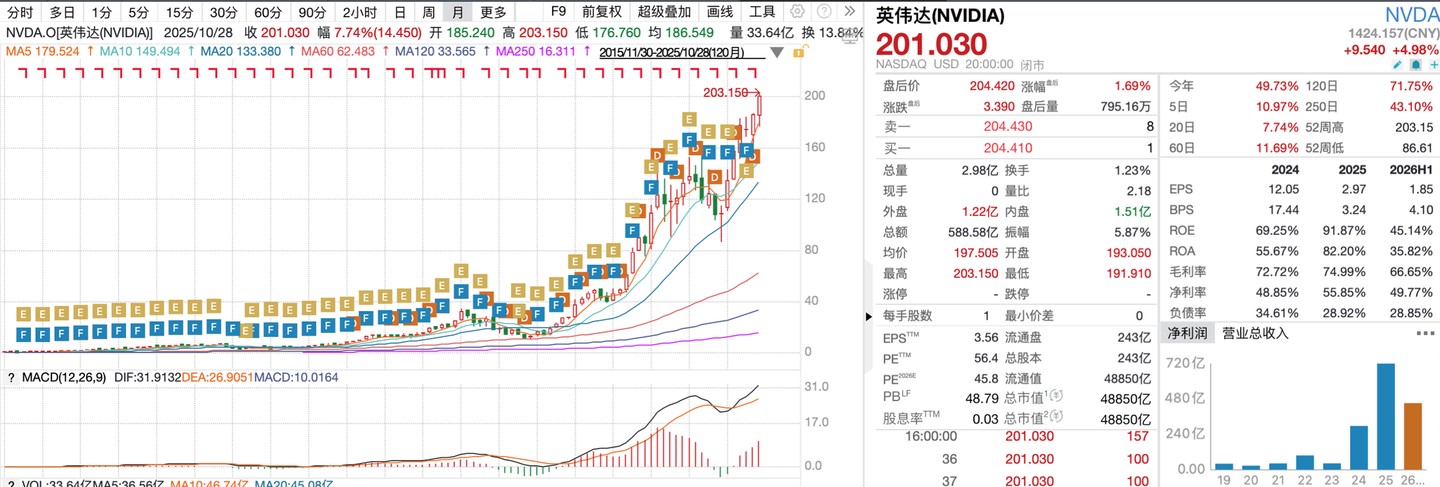

Trump stated he would "discuss exporting Blackwell chips" during his meeting in South Korea, and he will meet with NVIDIA CEO Jensen Huang on Wednesday, with the expectation that "good news" for exporting to the Chinese market will drive NVIDIA to set new historical highs, soaring 8% in after-hours trading.  Source: WIND

Source: WIND

Last night, Jensen Huang provided an astonishing performance outlook at the NVIDIA GTC conference: over $500 billion in revenue is expected over the next five quarters by the end of 2026, with approximately 20 million Blackwell chips shipped. This is five times more than the 4 million units shipped in the previous cycle with the Hopper chip.

Additionally, Microsoft announced a new agreement with OpenAI, where Microsoft will acquire a 27% stake in OpenAI, valued at approximately $135 billion; OpenAI will additionally purchase $250 billion worth of Azure services. This further drives market enthusiasm for AI investment and valuation.

Previously, in our VIP article "Surge in Optical Modules," we mentioned that several brokerages, including CITIC Securities and JP Morgan, have raised their 2026 optical module demand to 20 million units, and it is expected that the number of 1.6T optical modules will rise from the previous 1.5 million units to 2.4 million units by 2025. The main reason is that CSPs (large cloud providers) are adopting Ethernet-scale networks ESUN in their ASIC-scaled networks with near-packaging optical NPO, driving up the demand for optical modules. This aligns with Jensen Huang's optimistic statements at the GTC conference. Both buyers and sellers need to adjust their performance models based on the recent week's revenue guidance and shipment volumes.

2. Why Is It Important? The Industry Surge Continues

In addition to the optimistic guidance on GPU shipments, NVIDIA is further accelerating AI empowerment across various industries, binding core giants to solidify its chip demand and market position.

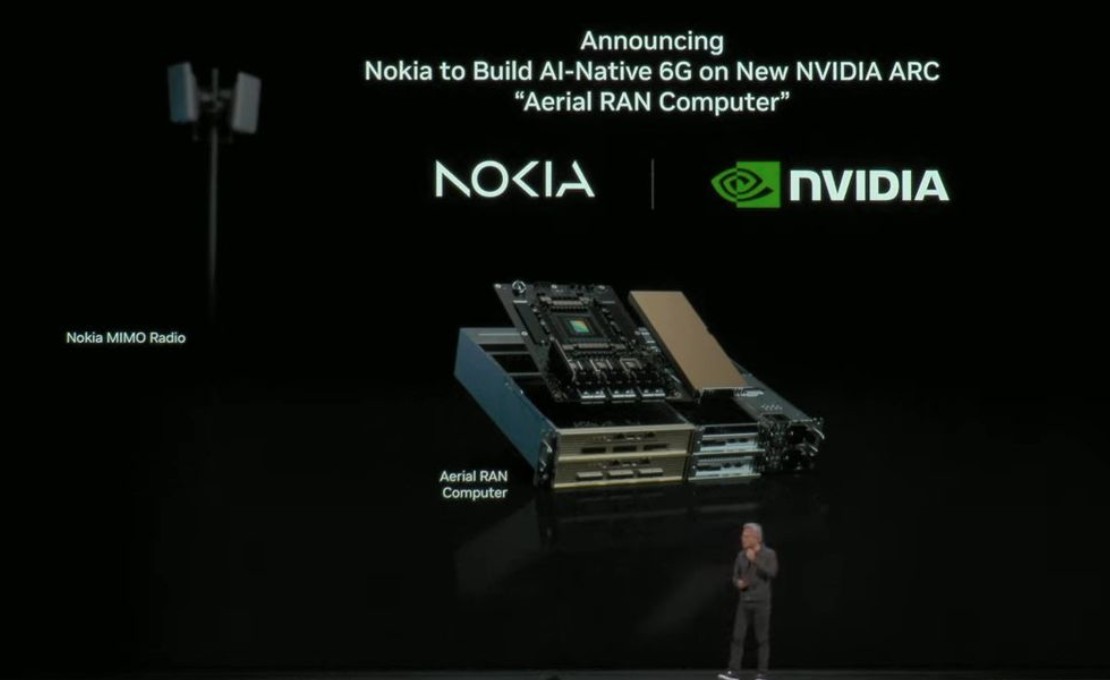

**For example, investing $1 billion in Nokia to develop AI technology for the 6G communication platform. NVIDIA aims to directly build a cloud computing platform based on 6G connectivity, disrupting traditional giants like Amazon. Institutions estimate that the AI-RAN market size is expected to exceed $200 billion by 2030. This technology will support AI-native devices such as autonomous vehicles, drones, augmented reality, and virtual reality glasses, providing local computing power support and opening new growth channels for operators in the future

**

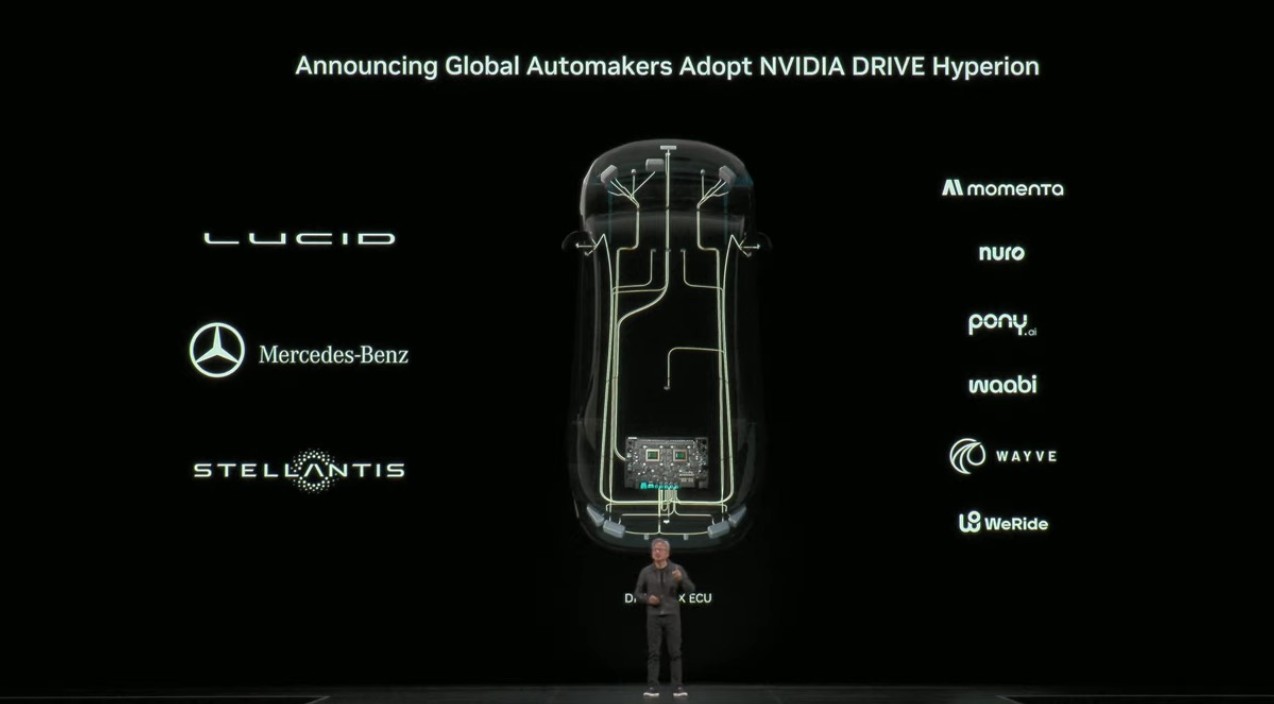

NVQlink is Jensen Huang's forward-looking layout for quantum computing, linking quantum processors, GPUs, and CPUs at high speed, and has already covered 17 quantum computing companies, with the potential to become the CUDA in the quantum computing field, continuing to maintain NVIDIA's monopoly platform advantage. NVIDIA has also launched the Bluefield-4 operating system to support AI factories; the DRIVE Hyperion autonomous driving platform empowers major automakers to develop autonomous driving technology.

A series of ambitious products, technologies, and platforms all indicate that NVIDIA's AI growth path has not yet stopped, and has not even slowed down. AI may continue to transform the operating models and business models of different industries and companies in the coming years, just as the internet transformed various sectors. The technological upgrade is unstoppable, capital expenditure is still increasing, which segments of the industrial chain may present huge marginal change opportunities?

III. What to focus on next? Which segments have opportunities

We believe that the following segments of the industrial chain still have outstanding advantages for high growth opportunities in the future.

The first area is optical modules. The iterative upgrade of industrial technology is still ongoing, from 400G to 800G to 1.6T, with value rising alongside the entire AI capital expenditure. Industry leaders that capture market share are still worth paying attention to. We have outlined the iterative logic of industrial development in our VIP article "Optical Modules Surge! What New Information is Brewing?"

The second area is energy storage. Due to the large-scale expansion of AI infrastructure and the cyclical mismatch with the U.S. power grid, a large number of giant data centers need to procure energy storage to stabilize the entire service. Whether it is CATL's third-quarter earnings call or Sungrow's explosive growth in energy storage in the third quarter report, both underscore the future explosion of the energy storage industry; this is the beginning of an industry wave, not the end. We previously outlined the core leading companies in our September 29 VIP article "Energy Storage Explosion! AI Expansion Unexpectedly Ignites Industry Growth."

The third area is nuclear energy. The White House has reached an $80 billion investment agreement with the owner of Westinghouse Electric, which will use funds provided by the trade agreement with Japan to build a batch of nuclear reactors in the United States. It is estimated that this funding is sufficient to establish eight Westinghouse AP1000 nuclear power plants. We have listed important companies and beneficiaries in our VIP article "Electric! The Next Core of AI's Leap Forward Development."

The continuous growth of the segmented industrial chain essentially benefits from the capital expenditure of NVIDIA, giant tech companies, and sovereign nations in the AI wave, with growth rates not peaking and the bubble continuing Risk Warning and Disclaimer

The market has risks, and investment requires caution. This article does not constitute personal investment advice and does not take into account the specific investment goals, financial situation, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article are suitable for their specific circumstances. Investment based on this is at one's own risk