65%! India's gold reserves are accelerating their "return home," with the domestic storage ratio doubling in four years

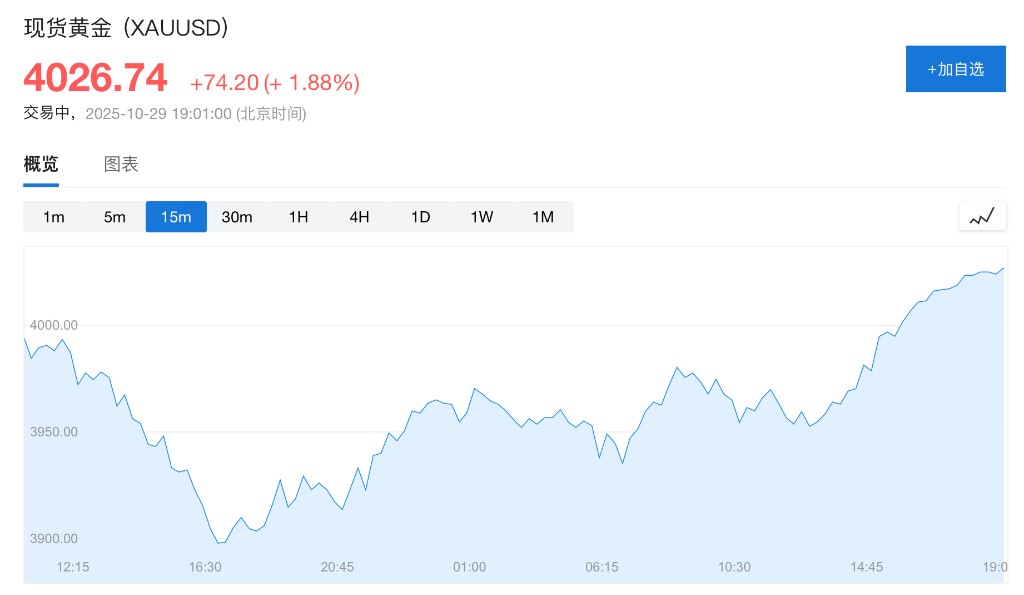

The Reserve Bank of India is accelerating the repatriation of overseas gold reserves, with the proportion of gold stored domestically now exceeding 65%, doubling from four years ago. According to the foreign exchange reserves report, the Reserve Bank of India has repatriated nearly 64 tons of gold, bringing the domestic gold reserves to 576 tons, a record high. Economists believe this move may be aimed at strengthening control over gold assets. The spot gold price has risen over 50% this year, currently reported at $4,026.7 per ounce

The Reserve Bank of India is accelerating the repatriation of overseas gold reserves back to the country. Currently, gold reserves stored domestically in India have exceeded 65%, nearly doubling compared to four years ago.

The Reserve Bank of India (RBI) disclosed in its semi-annual foreign exchange reserves report on Tuesday that nearly 64 tons of gold have been repatriated in the first six months of this fiscal year (since April). As of the end of September, gold accounted for 13.92% of the total value of foreign exchange reserves (in USD), up from 11.70% at the end of March.

Generally, the Reserve Bank of India stores part of its gold reserves in international financial institutions such as the Bank of England and the Bank for International Settlements. As of the end of September, the Reserve Bank of India held 880 tons of gold, with 576 tons stored domestically, a record high. In September 2022, gold stored domestically in India accounted for only about 38% of the total.

Although the Reserve Bank of India did not specify the reasons for the adjustment, economists believe this move may aim to strengthen control over the country's gold assets. Over the past four years, the Reserve Bank of India has repatriated nearly 280 tons of gold. Indian Finance Minister Nirmala Sitharaman stated last month that the Reserve Bank of India is "making very cautious decisions" regarding reserve diversification.

Gaurav Kapur, Chief Economist at IndusInd Bank, stated:

"Since we have the capacity to store, why not bring it back? Many central banks are doing this. In these uncertain times, it makes sense to have gold in our own hands."

The Reserve Bank of India is also one of the major buyers of gold globally, aiming to reduce dependence on the US dollar and related assets. The bank has been steadily reducing its holdings of US Treasury bonds, a process that began even before Trump imposed a 50% tariff on India for purchasing Russian oil.

Recently, spot gold prices have repeatedly hit historical highs, with spot gold rising over 50% this year, currently reported at $4026.7 per ounce.

Risk Warning and Disclaimer

The market carries risks, and investments should be made cautiously. This article does not constitute personal investment advice and does not take into account the specific investment goals, financial situation, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article align with their specific circumstances. Investing based on this is at one's own risk