"King of Retail" China Merchants Bank released its third-quarter report, with steady growth in net profit and double-digit growth in both Jin Kui Hua and private banking clients

China Merchants Bank released its Q3 2025 financial report, with a net profit of 113.772 billion yuan, a year-on-year increase of 0.52%. Operating income was 251.42 billion yuan, a year-on-year decrease of 0.51%. Retail customers reached 220 million, with total managed assets of 16.6 trillion yuan, an increase of 11.19%. The number of Gold Sunflower and above customers grew by 10.42%, and private banking customers increased by 13.20%. The return on equity was 13%, and the net interest margin was 1.77%

On the evening of October 29, "King of Retail" China Merchants Bank released its financial report for the third quarter of 2025.

The report shows that China Merchants Bank's various businesses are operating steadily, with a steady growth in asset and liability scale, an improving trend in operational efficiency, and overall stable asset quality.

From January to September 2025, China Merchants Bank achieved an operating income of CNY 251.42 billion, a year-on-year decrease of 0.51%; the net profit attributable to shareholders of the bank was CNY 113.77 billion, a year-on-year increase of 0.52%.

Among them, net interest income reached CNY 160.04 billion, a year-on-year increase of 1.74%, fulfilling its role as a "ballast."

Retail business, as a traditional strength of China Merchants Bank, continues to play a "moat" role. As of the end of the reporting period, China Merchants Bank had 220 million retail customers (including debit and credit card customers), an increase of 4.76% compared to the end of the previous year; the total assets under management (AUM) of retail customers reached CNY 16.6 trillion, an increase of CNY 1.67 trillion compared to the end of the previous year, with a growth rate of 11.19%. The number of Gold Sunflower and above customers increased by 10.42% compared to the end of the previous year, among which private banking customers increased by 13.20%.

Return on Equity 13%

From January to September 2025, China Merchants Bank achieved an operating income of CNY 251.42 billion, a year-on-year decrease of 0.51%, with the decline further narrowing.

The net profit attributable to shareholders was CNY 113.77 billion, a year-on-year increase of 0.52%.

The annualized average return on average total assets (ROAA) attributable to shareholders of China Merchants Bank and the annualized average return on equity (ROAE) attributable to ordinary shareholders of China Merchants Bank were 1.22% and 13.96%, respectively, down 0.11 and 1.42 percentage points year-on-year.

Net Interest Margin Remains Resilient

In operating income, net interest income reached CNY 160.04 billion, a year-on-year increase of 1.74%, accounting for 63.66% of operating income.

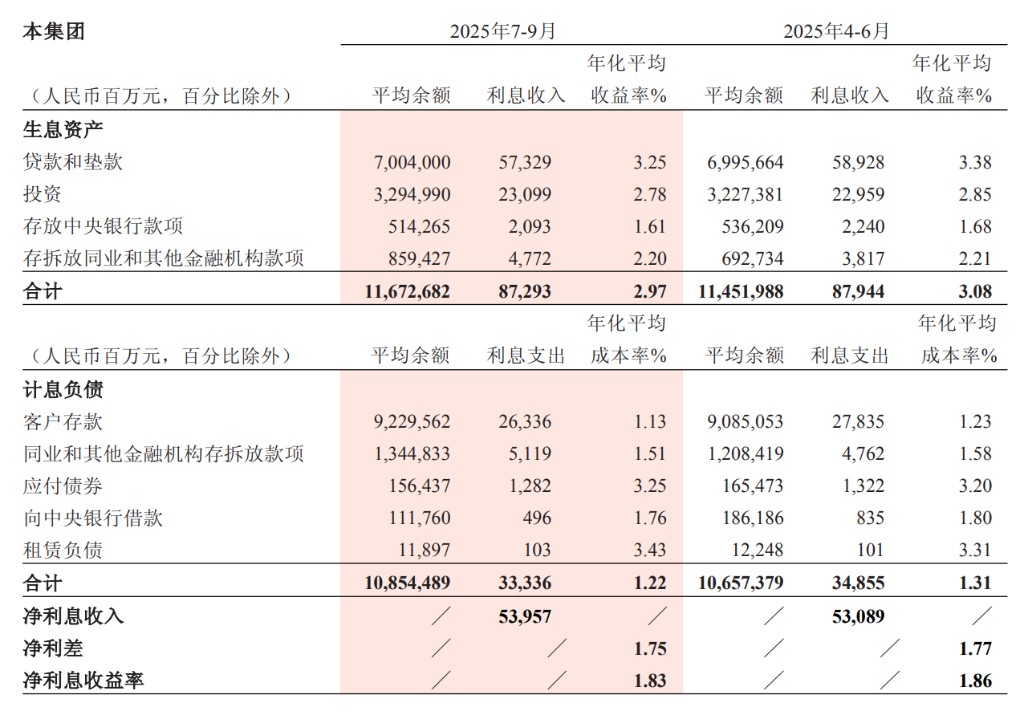

From January to September 2025, the net interest spread was 1.77%, and the net interest yield was 1.87%, slightly down year-on-year, but overall controllable.

The reduction in the Loan Prime Rate (LPR) and the decrease in existing mortgage rates, combined with insufficient effective credit demand, especially for retail loans, and the year-on-year decline in the yield of newly issued credit business, are the main factors leading to the decrease in the yield on interest-earning assets, which lowered the net interest yield. At the same time, the market-oriented reduction in deposit rates and the continuous strengthening of the group's control over funding costs have shown ongoing effects, with the cost rate of interest-bearing liabilities decreasing year-on-year, which has a certain positive effect on the net interest yield.

Wealth Management Fee and Commission Income Increased by 18.76% Year-on-Year

From January to September 2025, China Merchants Bank achieved non-interest net income of 91.378 billion yuan, a year-on-year decrease of 4.23%.

Among the non-interest net income, net fee and commission income was 56.202 billion yuan, a year-on-year increase of 0.90%; other net income was 35.176 billion yuan, a year-on-year decrease of 11.42%, mainly due to reduced returns from bond and fund investments.

In key projects, wealth management fee and commission income was 20.670 billion yuan, a year-on-year increase of 18.76%. Among them, income from agency sales of wealth management products was 7.014 billion yuan, a year-on-year increase of 18.14%, mainly driven by the growth in agency sales scale and optimization of product structure; income from agency insurance was 5.326 billion yuan, a year-on-year decrease of 7.05%, mainly affected by changes in business structure; income from agency funds was 4.167 billion yuan, a year-on-year increase of 38.76%, mainly influenced by the increase in the scale and sales of equity funds; income from agency trust plans was 2.519 billion yuan, a year-on-year increase of 46.79%, mainly due to the growth in agency sales trust scale; income from agency securities trading was 1.378 billion yuan, a year-on-year increase of 78.50%, mainly influenced by the increased demand for securities trading from clients in the Hong Kong capital market.

Asset management fee and commission income was 7.989 billion yuan, a year-on-year decrease of 1.86%, mainly affected by market fluctuations.

Custody business commission income was 3.937 billion yuan, a year-on-year increase of 6.66%, mainly due to the growth in custody scale.

Bank card fee income was 10.526 billion yuan, a year-on-year decrease of 17.07%, and settlement and clearing fee income was 11.111 billion yuan, a year-on-year decrease of 4.55%, both mainly affected by the decline in credit card income.

Golden Sunflower and Private Banking Clients Achieved Double-Digit Growth

Retail business, as a traditional strength of China Merchants Bank, continues to play a "moat" role.

As of the end of the reporting period, China Merchants Bank had 220 million retail customers (including debit and credit card customers), an increase of 4.76% compared to the end of the previous year; the total assets under management (AUM) of retail customers was 16.6 trillion yuan, an increase of 1.67 trillion yuan compared to the end of the previous year, with a growth rate of 11.19%.

As of the end of the reporting period, there were 5.7812 million Golden Sunflower and above clients (referring to retail customers with an average total asset of 500,000 yuan or more in the company) which increased by 10.42% compared to the end of the previous year, among which private banking clients (referring to retail customers with an average total asset of 10 million yuan or more in the company) numbered 191,400, an increase of 13.20% compared to the end of the previous year.

As of the end of the reporting period, the total asset management business scale of China Merchants Bank's subsidiaries, including China Merchants Bank Wealth Management, China Merchants Fund, China Merchants Xinnuo Asset Management, and China Merchants International, was 4.59 trillion yuan, an increase of 2.59% compared to the end of the previous year. Among them, the balance of wealth management products of China Merchants Bank Wealth Management was 2.54 trillion yuan, an increase of 2.83% compared to the end of the previous year; the asset management business scale of China Merchants Fund was 1.59 trillion yuan, an increase of 1.27% compared to the end of the previous year; The asset management business scale of China Merchants Cigna Asset Management is 305.669 billion yuan, which is basically flat compared to the end of last year; the asset management business scale of China Merchants Bank International is 156.29 billion yuan, an increase of 19.92% compared to the end of last year.

Asset Quality Remains Stable

As of the end of the reporting period, the total assets of China Merchants Bank amounted to 12.6 trillion yuan, an increase of 4.05% compared to the end of last year; the total loans and advances amounted to 7.14 trillion yuan, an increase of 3.60% compared to the end of last year; the total liabilities amounted to 11.37 trillion yuan, an increase of 4.12% compared to the end of last year; the total customer deposits amounted to 9.52 trillion yuan, an increase of 4.64% compared to the end of last year.

As of the end of the reporting period, the non-performing loan balance was 67.425 billion yuan, an increase of 1.815 billion yuan compared to the end of last year; the non-performing loan ratio was 0.94%, a decrease of 0.01 percentage points compared to the end of last year; the provision coverage ratio was 405.93%, a decrease of 6.05 percentage points compared to the end of last year; the loan provision ratio was 3.84%, a decrease of 0.08 percentage points compared to the end of last year; the credit cost (annualized) for January to September 2025 was 0.67%, an increase of 0.02 percentage points compared to the entire last year.

Risk Warning and Disclaimer

The market has risks, and investment should be cautious. This article does not constitute personal investment advice and does not take into account the specific investment objectives, financial situation, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article are suitable for their specific circumstances. Investing based on this is at your own risk