U.S. Stock Market Outlook | Futures for the three major indices rise together, Federal Reserve interest rate decision approaching, Microsoft, Alphabet - C, and Meta Platforms to announce earnings after hours

U.S. stock index futures are all up, with the market generally expecting the Federal Reserve to cut interest rates by 25 basis points. Powell will hold a press conference after the interest rate decision, which may not provide much forward guidance. SK Hynix's Q3 profit increased by 62%, and orders for its entire range of memory chips are already full for next year, indicating strong demand for AI

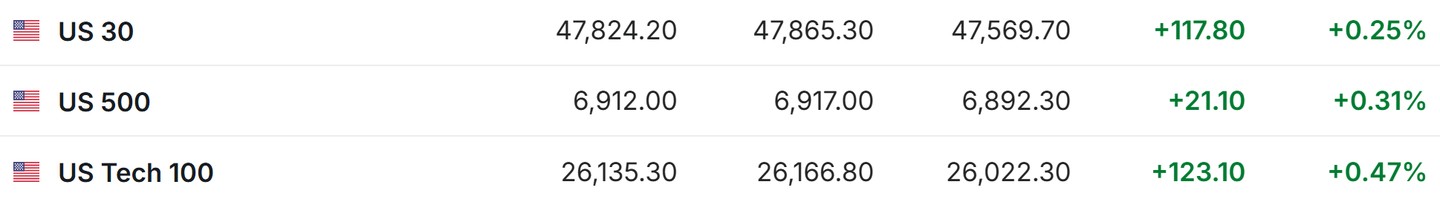

- As of October 29th (Wednesday) before the US stock market opens, the three major US stock index futures are all up. As of the time of writing, Dow futures are up 0.25%, S&P 500 futures are up 0.31%, and Nasdaq futures are up 0.47%.

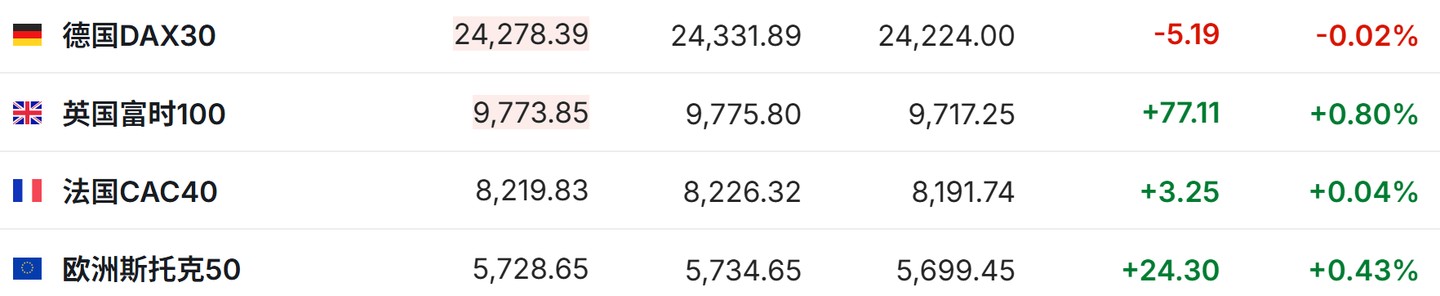

- As of the time of writing, the German DAX index is down 0.02%, the UK FTSE 100 index is up 0.80%, the French CAC40 index is up 0.04%, and the Euro Stoxx 50 index is up 0.43%.

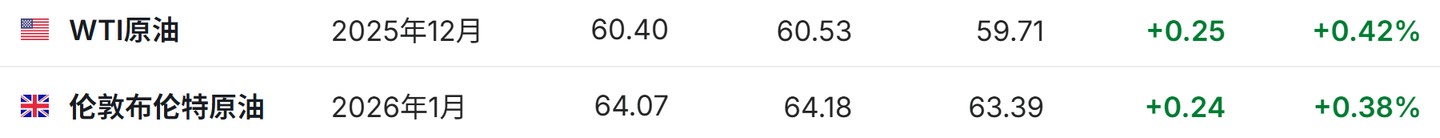

- As of the time of writing, WTI crude oil is up 0.42%, priced at $60.40 per barrel. Brent crude oil is up 0.38%, priced at $64.07 per barrel.

Market News

The Federal Reserve's rate cut of 25 basis points is almost a certainty, and Powell's forward guidance may fall into a "silent moment." The Federal Reserve will announce its interest rate decision at 2:00 AM Beijing time on Thursday. Powell will hold a press conference 30 minutes after the announcement of the interest rate decision. This meeting will not release new economic forecasts or dot plots. The market has a general expectation for two things from this week's Federal Reserve policy meeting - policymakers will decide to lower interest rates by 25 basis points; Powell may not provide much forward guidance, as the widening divergence among decision-makers makes the future policy path unclear. Earlier this month, Powell stated that the Federal Open Market Committee (FOMC) will continue to focus on the threats facing the labor market. The US September CPI data released last Friday showed inflation weaker than expected, which may temporarily suppress the hawkish officials within the Federal Reserve.

The "super cycle" of memory has arrived! AI demand is off the charts, SK Hynix's Q3 profit hits a record high, and orders for the entire series of chips for next year are already full. SK Hynix reported a 62% increase in profit and revealed that orders for its entire series of memory chips for next year are sold out, indicating that the construction of global AI infrastructure is significantly boosting demand across the industry. In the third quarter, the company achieved a record operating profit of 11.4 trillion won (approximately $8 billion), a historic high, slightly above the average analyst expectations. Sales reached 24.5 trillion won. On Wednesday morning, in Seoul, the company's stock rose by as much as 5%. As a supplier of HBM chips to NVIDIA (NVDA.US), SK Hynix plans to invest more next year to increase capacity, striving to accelerate production growth to catch up with the unprecedented wave of investment led by industry leaders such as OpenAI and Meta Platforms (META.US) AI Profit Verification Arrives: Performance Defies Bubble Theory, This Friday's Earnings Reports from Major US Stocks Will Set the Tone for the Next Wave. The market is concerned that the global stock market rally led by artificial intelligence has entered a bubble zone after reaching historic highs, while the brighter profit outlook for AI companies is alleviating investors' worries. SK Hynix and Advantest both reported stronger financial performance on Wednesday, joining a series of companies showing synchronized increases in demand and valuation. The focus now shifts to the US tech giants—five companies that will report earnings this week account for about a quarter of the S&P 500 index constituents—whose performance this week will reveal whether the massive capital expenditure boom in the AI sector is translating into higher returns. The five tech giants—Microsoft, Amazon, Apple, Alphabet, Meta—will all report earnings this week.

US Government Shutdown Triggers Market "Data Vacuum," Inflation-Linked Securities Activate Dormant Backup Mechanism. In a $7 trillion market, traders are facing an unprecedented situation: they must price inflation-linked securities without any consumer price index (CPI) data available. The US government has been shut down since the beginning of this month, and this data void may continue to extend, especially after the White House indicated that the US may not release October inflation data. This has prompted investors to begin activating the "backup mechanism" embedded in the legal documents of inflation-linked bonds and derivatives decades ago, which are now becoming an alternative solution. These emergency plans were originally aimed at "tail risks" (low probability, high impact risks), and until recently, such risks were unimaginable given the systematic importance of US economic data.

Ending QT Fails to Lift Liquidity Alarm! JPMorgan: The Fed May Need to Restart "2019-style" Massive Infusion. JPMorgan strategists indicated that the Federal Reserve may take additional measures to address pressures in the funding market, even if it ends its balance sheet reduction (quantitative tightening, QT) as early as this week. Several Wall Street banks, including JPMorgan, generally expect the Fed to stop reducing its $6.6 trillion portfolio of US Treasuries and mortgage-backed securities (MBS) as early as this month. However, JPMorgan strategists Jay Barry and Teresa Ho stated that even so, market volatility during key payment periods will persist. They wrote in a report to clients on Tuesday: "The impending end of QT will prevent further liquidity loss in the system, but funding pressures may still continue. Therefore, we believe the Fed may take actions similar to those in September 2019."

Individual Stock News

UMC (UMC.US) Q3 Revenue Increased by 1.6% Year-on-Year. UMC's revenue for the third quarter was $1.94 billion, an increase of 1.6% year-on-year, with a GAAP earnings per share of $0.197, exceeding expectations by $0.08; gross margin fell to 29.8%, and the company guided that capital expenditures for 2025 will remain at $1.8 billion, with a capacity utilization rate of about 70%, and an annual gross margin maintained above 20% Verizon (VZ.US) Q3 earnings exceed expectations. Verizon's third-quarter revenue was $33.8 billion, slightly below the market expectation of $34.28 billion, but adjusted earnings per share were $1.21, exceeding the expected $1.19; during the period, 44,000 postpaid users were added, far exceeding the expected 19,000, thanks to iPhone promotions and the three-year price lock appeal of the myPlan package, with over 18% of mobile users bundling broadband. The company reaffirmed its full-year profit and free cash flow guidance and expects capital expenditures to fall at or below the lower end of the $17.5-18.5 billion range.

Caterpillar (CAT.US) Q3 revenue increased by 10% year-on-year. Caterpillar's Q3 revenue from its main business segments increased by 10% year-on-year to $16.7 billion, with adjusted EPS reaching $4.95, significantly exceeding the market expectation of $4.51. The energy and transportation business led the growth due to demand for AI data center energy storage and backup generators; the company expects to incur an additional tariff cost of $650-800 million in Q4, raising the total tariff amount for the year to $1.6-1.75 billion, and reaffirmed that the full-year adjusted operating profit margin will be close to the lower end of the target range.

Boeing (BA.US) Q3 cash flow turns positive, 777X incurs an additional $4.9 billion in costs. Boeing's Q3 revenue was $23.27 billion, exceeding the expected $22.3 billion, but it recorded an additional non-cash charge of $4.9 billion for the 777X, leading to an expanded loss per share of $7.47, far exceeding the market estimate of $4.44; during the period, free cash flow was $238 million, marking the first positive cash flow since the end of 2023, significantly better than the analyst estimate of -$880 million. The 777X has been delayed for seven years due to regulatory reviews and is expected to enter service in 2027, with cumulative project costs nearing $16 billion, and the company maintains its full-year positive cash flow guidance.

Bloom Energy (BE.US) Q3 turns profitable year-on-year, revenue and profit both exceed expectations. Power generation and hydrogen production company Bloom Energy's third-quarter revenue exceeded market expectations, growing 57.1% year-on-year to $519 million. Its non-GAAP earnings per share were $0.15, higher than the general analyst expectation of $0.10. Adjusted EBITDA was $59.05 million, while analysts expected $46.02 million. The operating profit margin was 1.5%, up from -2.9% in the same period last year. Free cash flow was $7.37 million, an increase from -$83.76 million in the same period last year. Bloom Energy has operated under a robust model for eight years, designing, manufacturing, and selling solid oxide fuel cell systems for on-site power generation. Bloom Energy's annualized revenue growth rate over the past five years has reached 19.1%, outpacing the average growth rate of most industrial companies.

Strong consumer spending boosts Visa (V.US) Q4 performance! Revenue and EPS both exceed expectations. Visa's fourth fiscal quarter revenue grew nearly 12% year-on-year to $10.7 billion, better than the market expectation of $10.6 billion. Adjusted net profit was $5.8 billion; adjusted earnings per share were $2.98, slightly higher than the market expectation of $2.97 Visa's Chief Financial Officer Chris Suh stated during the earnings call that consumer spending on luxury goods and necessities remains strong. He mentioned that as long as travel and e-commerce spending remain active and the economic environment is stable, the company expects a strong performance in this year's holiday quarter. In the fourth fiscal quarter, Visa ended its open banking operations in the United States. This business had provided technical support to third parties, such as fintech companies, to access customer account data. The company stated that this move was due to increased regulatory uncertainty and changes in the competitive landscape.

Booking (BKNG.US) raises full-year booking outlook above expectations, concerns over slowing travel demand "turning crisis into safety." In the quarter ending in September, Booking's sales grew by 13% year-on-year to USD 9.01 billion, exceeding analysts' previous expectations of USD 8.73 billion. The company's adjusted earnings per share for the quarter were USD 99.50, a 19% increase from the same period last year, surpassing analysts' expectations of USD 95.85 per share. Booking stated in a statement on Tuesday that the company expects the full-year "room night" growth rate to be around 7%. According to market data, analysts had previously expected this growth rate to be 6.7%. This optimistic outlook is attributed to strong performance in the third quarter, where the company's room night sales and total bookings exceeded analysts' expectations. In the three months ending September 30, room night sales grew by 8% to 323 million nights, while analysts' average expectation was 316 million nights.

Strong demand for HIV and immunology drugs leads GlaxoSmithKline (GSK.US) to raise full-year performance guidance. Thanks to the growth in demand for its HIV and immunology drugs, GlaxoSmithKline raised its full-year profit and sales expectations. The earnings report showed that the company's Q3 revenue reached GBP 8.55 billion, a year-on-year increase of 4.9%, exceeding expectations by GBP 300 million; adjusted earnings per share, excluding certain items, grew by 11% to GBP 0.55, while analysts had previously expected GBP 0.47. GlaxoSmithKline expects that this year, adjusted earnings per share will grow by up to 12%, higher than the previously forecasted maximum increase of 8%. Revenue may grow by up to 7%, also higher than previous estimates. Chief Commercial Officer Luke Mills will take over as CEO in January, facing the same challenges as current CEO Emma Walmsley, as the company's pipeline of new drugs is expected to achieve sales exceeding GBP 40 billion (USD 53 billion) by 2031.

Q3 profits rise instead of fall! As the transformation nears completion, Deutsche Bank (DB.US) reports strong earnings that demonstrate the effectiveness of its reforms. Deutsche Bank reported a 7% year-on-year increase in profits for the third quarter. Despite market expectations for a decline in profits, the bank's global investment banking division saw significant revenue growth, ultimately reversing this expectation. As Germany's largest lending institution, Deutsche Bank's total revenue for the quarter reached EUR 8.04 billion, with a net profit attributable to shareholders of EUR 1.56 billion (approximately USD 1.82 billion). This figure increased from EUR 1.46 billion in the same period last year and also exceeded analysts' expectations of approximately EUR 1.34 billion. Investment banking once again became Deutsche Bank's largest source of income. In this quarter, strong performance in bond trading and bond issuance drove the growth of the investment banking business Investment banking and stock trading businesses are raking in money, UBS (UBS.US) Q3 profit surged 74%. Swiss financial giant UBS Group recently announced that its third-quarter profit exceeded market expectations, primarily due to significant growth in its investment banking and stock trading revenues, as well as legal costs being lower than expected, which significantly boosted overall performance. For the three months ending in September, UBS's net profit soared 74% year-on-year to $2.5 billion, compared to analysts' consensus estimate of about $1.4 billion. The key wealth management division of UBS saw net inflows of $38 billion in the third quarter, better than market expectations, although the pre-tax profit of this division was below expectations. The core revenue of UBS's investment banking division grew significantly by 23%.

Chip equipment manufacturer ASM International (ASMIY.US) Q3 orders fell short of expectations, management says Q4 will "bottom out" and rebound next year. Dutch chip equipment manufacturer ASM International reported that its third-quarter orders were below analyst expectations, mainly due to a decline in demand from advanced chip manufacturers and a decrease in orders from China. The company stated in a release on Tuesday that after adjusting for currency fluctuations, third-quarter orders fell 17% year-on-year to €636.8 million (approximately $743 million). According to surveys, analysts had previously expected average orders for the quarter to be €724.9 million. ASM indicated that the decline in orders was affected by a contraction in its Chinese business, with U.S.-China trade tensions disrupting business for Chinese clients. Additionally, some core customers producing advanced logic chips are also delaying orders.

"AI faith" creates a huge wave! Blackwell and Rubin will support a $5 trillion AI empire, Jensen Huang firmly believes the AI era has arrived. At the Washington GTC conference, especially when Jensen Huang released the significant performance signal that "Blackwell and the next-generation Rubin architecture will jointly drive NVIDIA's data center business revenue to exceed $500 billion over the next five quarters," NVIDIA's overall market value is just one step away from the record-breaking epic milestone of $5 trillion, following its previous breakthrough of $4 trillion in July. Soon, NVIDIA will become the world's first company to surpass and stabilize at a market value of $5 trillion. The "Godfather of AI," Jensen Huang, firmly believes that the so-called "AI era" has fully arrived, and NVIDIA is completely upgrading from "a chip design company" to "the strongest technological foundation of the AI era"—which includes a full-stack infrastructure and complete industrial operating system related to AI.

Important Economic Data and Event Forecasts

Beijing time 22:00: U.S. September seasonally adjusted existing home sales index month-on-month (%).

Beijing time 22:30: U.S. EIA crude oil inventory change for the week ending October 24 (10,000 barrels).

Next day Beijing time 02:00: Federal Reserve FOMC announces interest rate decision.

Next day Beijing time 02:30: Federal Reserve Chairman Powell holds a monetary policy press conference

Earnings Forecast

Thursday morning: Microsoft (MSFT.US), Alphabet (GOOGL.US), Meta Platforms (META.US), Starbucks (SBUX.US)

Thursday pre-market: Shell (SHEL.US), Total (TTE.US), Stellantis (STLA.US), Roblox (RBLX.US), Merck (MRK.US), Eli Lilly (LLY.US), Mastercard (MA.US), TAL Education Group (TAL.US)