Printing Press Engine Preheating: Is the Federal Reserve Abandoning Tightening to Pave the Way for the Next Asset Bubble?

Analysis suggests that the Federal Reserve's policy roadmap is shifting to the sequence of "interest rate cuts, stopping QT, and restarting QE." The increasingly weak job and real estate markets are forcing the Federal Reserve to pivot, as merely cutting interest rates is no longer sufficient. QT will hastily conclude while the balance sheet is far from returning to normal, and restarting QE from a high starting point of $6.6 trillion may pave the way for a new round of high inflation and asset bubbles

The Federal Reserve is sending its clearest signal yet that its quantitative tightening (QT) policy aimed at shrinking the balance sheet may come to an early end.

Federal Reserve Chairman Jerome Powell recently stated at the National Association for Business Economics conference in Philadelphia, "Our long-standing plan is to stop the balance sheet reduction when the level of reserves is slightly above what we judge to be adequate. We may be approaching that point in the coming months." This statement has been widely interpreted by the market as indicating that a key phase of the current monetary tightening cycle is about to conclude.

Analysts believe that the Federal Reserve's policy roadmap has become increasingly clear: first, interest rate cuts (currently happening), then stopping quantitative tightening (just confirmed), and finally possibly initiating a new round of quantitative easing (QE) in early 2026, commonly referred to in the market as "printing money."

This shift is not without warning signs. Increasingly weak economic data is forcing policymakers to take action. Even without ongoing pressure from political figures like Trump, a faltering job market and a strained real estate market are increasingly limiting the Federal Reserve's policy options. Analysts argue that relying solely on interest rate cuts is insufficient to meet the challenges, and ending QT to prepare for subsequent QE has become an unavoidable option.

Policy Shift Under Economic Pressure

Behind the Federal Reserve's policy shift is an increasingly severe economic reality.

The job market is showing signs of collapse. According to statistics, U.S. companies have announced layoffs of 946,426 people this year, a staggering 55% increase compared to the same period in 2024, marking the highest record since 2020.

At the same time, pressure on the real estate market is also rising sharply. Google search data shows that the public's interest in "mortgage assistance" has surged to its highest level since the 2008 financial crisis. Currently, about 6.3% mortgage rates are more than double the 3% rates most homeowners locked in during 2020-2021, compounded by 10-15% inflation over the past four years, leaving many households in a precarious financial situation.

A Balance Sheet Far from "Normalization"

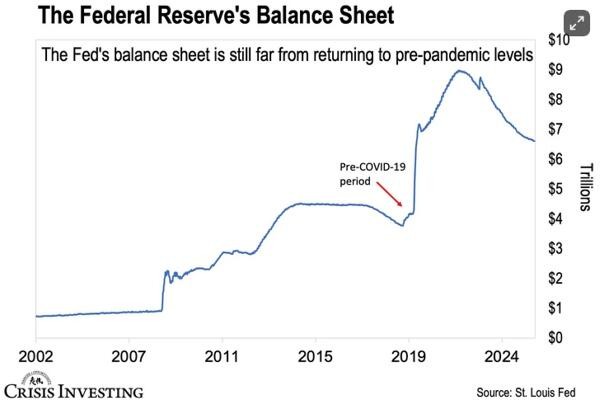

Ironically, the Federal Reserve is about to hastily end this round of quantitative tightening while its balance sheet size is far from returning to normal levels.

Since initiating QT in June 2022, the Federal Reserve's balance sheet has shrunk by $2.2 trillion. However, as of now, its total size still stands at $6.6 trillion. Compared to the pre-pandemic level of about $4 trillion, after nearly three years of "tightening," the balance sheet has only reduced by about 27%.

Reports indicate that the Federal Reserve could have opted for a more aggressive approach to shrink the balance sheet, such as directly selling the bonds it holds in the market. However, policymakers are concerned that a large-scale sell-off of bonds from its $6.6 trillion portfolio could impact the bond market, leading them to choose a "gradual" path of allowing bonds to mature without reinvestment. Yet, even this "turtle-speed" balance sheet reduction seems to be difficult to sustain Powell's remarks at the same meeting further reinforced market expectations. He stated:

"Normalizing the size of our balance sheet does not mean returning to pre-pandemic levels."

This statement is interpreted as the Federal Reserve has accepted a new "normal," which is a balance sheet of $6.6 trillion, 60% higher than pre-pandemic levels.

Higher Starting Point for QE May Trigger New Round of Inflation

For investors, the most direct risk is that when the Federal Reserve inevitably restarts QE to suppress long-term interest rates, its starting point will be an unprecedented high.

An analysis written by Lau Vegys for InternationalMan.com points out that starting a new round of monetary expansion from $6.6 trillion rather than a more "normal" $4 trillion scale, combined with the still abundant liquidity injected during the pandemic, will almost certainly trigger double-digit inflation. The analysis warns that this could lead to the dollar's purchasing power being eroded at an unprecedented scale and speed.

Therefore, as the Federal Reserve's "money printing machine" engine heats up again, investors need to prepare for the potential high inflation and new rounds of asset price volatility