Weak oil prices drag down performance, Sinopec Corp. Q3 revenue down 10.9% year-on-year, profit basically flat year-on-year | Financial Report Insights

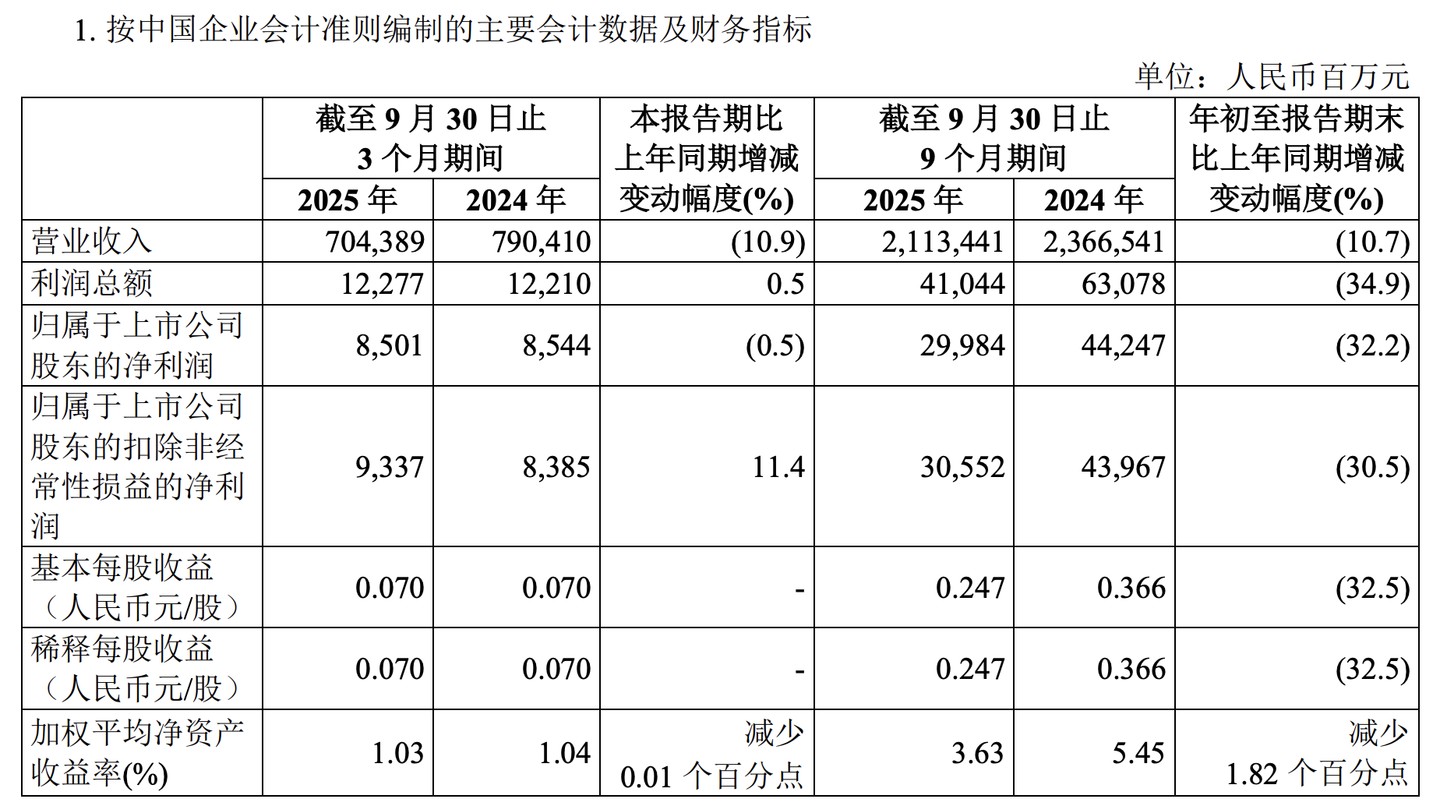

Sinopec Corp. Q3 operating revenue was 704.4 billion yuan, a year-on-year decrease of 10.9%; net profit attributable to shareholders of the parent company was 8.501 billion yuan, a year-on-year decrease of 0.5%; operating revenue for the first three quarters was 2.11 trillion yuan, a year-on-year decrease of 10.7%; net profit attributable to shareholders of the parent company was 29.984 billion yuan, a year-on-year decrease of 32.2%

On Wednesday, Sinopec Corp. released its third-quarter performance, here are the key points:

- Q3 operating revenue of 704.4 billion yuan, a year-on-year decrease of 10.9%; net profit attributable to shareholders of the parent company of 8.501 billion yuan, a year-on-year decrease of 0.5%;

- Operating revenue for the first three quarters of 2.11 trillion yuan, a year-on-year decrease of 10.7%; net profit attributable to shareholders of the parent company of 29.984 billion yuan, a year-on-year decrease of 32.2%;

- Operating cash flow of 114.8 billion yuan, a year-on-year increase of 13.0%

Performance by segment:

Exploration and Development: EBITDA of 38.1 billion yuan, oil and gas equivalent production increased by 2.2%

Refining: EBITDA of 7 billion yuan, crude oil processing volume decreased by 2.2%

Marketing and Distribution: EBITDA of 12.8 billion yuan, refined oil sales volume decreased by 5.7%

Chemicals: EBITDA loss of 8.2 billion yuan, significant pressure from industry overcapacity

Declining Oil Prices Weigh on Performance, Q3 Barely Maintains Last Year's Level

Sinopec's performance in the first three quarters fully reflects the cyclical challenges of the energy industry. The net profit attributable to shareholders of the parent company for the first three quarters was 29.984 billion yuan, a year-on-year plunge of 32.2%, a decline that far exceeds the 10.7% drop in operating revenue.

In terms of single quarters, the third quarter achieved a net profit of 8.501 billion yuan, a year-on-year decrease of only 0.5%, basically flat compared to the same period last year. The average spot price of Brent crude oil for the first three quarters was $70.9 per barrel, a year-on-year decrease of 14.4%. The price of the company's self-produced crude oil was $66.38 per barrel, a year-on-year decrease of 13.3%.

Uneven Performance Across Segments: Upstream Supports the Scene, Chemicals Become Hard Hit

The exploration and development segment is one of the few bright spots. Despite the pressure on oil prices, this segment achieved an EBITDA of 38.085 billion yuan in the first three quarters, becoming the company's largest source of profit. Oil and gas equivalent production reached 394.48 million barrels, a year-on-year increase of 2.2%, with natural gas production of 1,099.31 billion cubic feet, a year-on-year increase of 4.9%. The company's exploration breakthroughs in areas such as Jiyang shale oil and Sichuan Basin ultra-deep shale gas show that its continued investment in resources is beginning to pay off.

The refining segment, on the other hand, is relatively difficult. The crude oil processing volume in the first three quarters was 186.41 million tons, a year-on-year decrease of 2.2%. Company statistics show that domestic refined oil consumption decreased by 4.0% year-on-year.

The marketing and distribution segment is also under pressure. The total refined oil sales volume in the first three quarters was 171.4 million tons, a year-on-year decrease of 5.7%, with domestic retail volume of 82.67 million tons, a year-on-year decrease of 3.7%.

The biggest problem lies in the chemicals segment. In the first three quarters, this segment reported an EBITDA loss of 8.223 billion yuan, becoming the main factor dragging down overall performance. Although ethylene production reached 11.588 million tons, a year-on-year increase of 15.4%, the continuous release of new domestic chemical production capacity has led to depressed product prices. The loss in the chemicals segment for the third quarter expanded from 5.6 billion yuan in the same period last year to 7.4 billion yuan

Cash Flow Remains Acceptable, But Rising Debt Pressure Is Worth Noting

Against the backdrop of a significant decline in profits, Sinopec Corp.'s cash flow performance is relatively robust. The net cash flow generated from operating activities in the first three quarters was CNY 114.8 billion, a year-on-year increase of 13.0%, mainly due to improvements in working capital management—inventory decreased from CNY 256.6 billion to CNY 239.2 billion, releasing some cash.

However, changes in the balance sheet reveal some concerns. Non-current liabilities due within one year surged from CNY 64.6 billion to CNY 106.2 billion, an increase of 64.5%. At the same time, the company has increased its bond financing efforts, with bonds payable rising from CNY 25.6 billion to CNY 52.6 billion, an increase of over 100%, while the total asset-liability ratio is maintained at a reasonable level of 54.7%.

In terms of investment, the company’s capital expenditure in the first three quarters was CNY 71.6 billion, of which the exploration and development segment accounted for CNY 41.6 billion, continuing to maintain a high intensity of upstream investment. Notably, exploration expenses (including dry well costs) reached CNY 8.4 billion, a year-on-year increase of 31.9%.

Additionally, the company strategically invested in equity of CATL, with other equity instrument investments surging from CNY 416 million to CNY 8.114 billion, indicating its layout in the direction of new energy transformation