Is the "floor" style interest rate cut completed? The Bank of Canada states that interest rates are roughly appropriate and may remain unchanged in the future

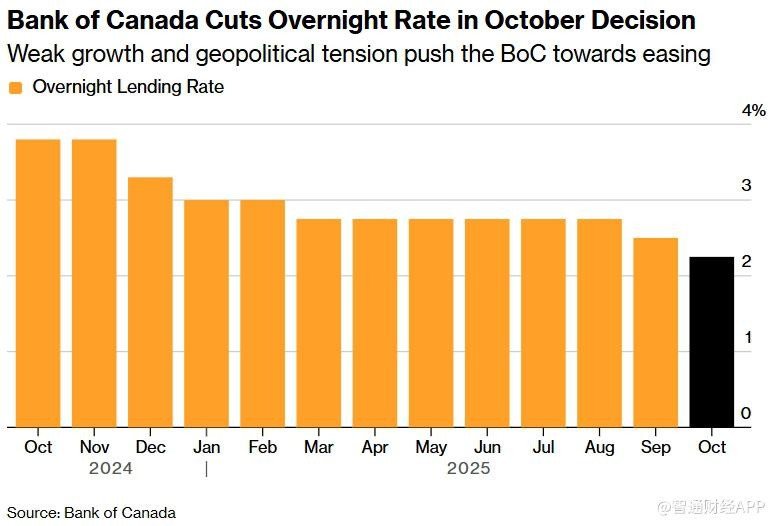

The Bank of Canada has cut interest rates for the second consecutive time by 25 basis points, lowering the benchmark overnight rate to 2.25%, the lowest level since July 2022. Governor Tiff Macklem stated that the current rate is roughly appropriate and that further rate cuts may not be forthcoming. The central bank has downgraded its economic growth forecast and expressed concerns about the long-term impact of the U.S.-Canada trade conflict. The Canadian dollar has appreciated, and market expectations for future rate cuts have diminished. Macklem emphasized that the central bank will continue to monitor economic data to respond to potential changes

According to the Zhitong Finance APP, on Wednesday, the Bank of Canada cut interest rates by 25 basis points for the second consecutive time, lowering the benchmark overnight rate to 2.25%, the lowest level since July 2022. Governor Macklem stated that the impact of U.S. tariffs has brought about a "structural turning point," weakening the Canadian economic outlook. However, given that the current growth path is roughly in line with expectations, the interest rate is considered to be at an appropriate level, and there is no need for further easing.

The central bank also significantly lowered its growth expectations and provided a pessimistic assessment of the economic outlook. Macklem noted that the U.S.-Canada trade conflict will persist in the long term, and the structural damage it causes suppresses economic potential and raises costs. Monetary policy has limited space to stimulate demand while maintaining low inflation. "If the outlook changes, we are prepared to respond."

After the announcement, the Canadian dollar strengthened to 1.3915 against the U.S. dollar, the strongest since October 1, marking the third consecutive day of gains, while Canadian government bond yields rose across the board. The swap market's expectations for a rate cut in December dropped from over 30% to about 20%.

The central bank stated that the supply-side shocks caused by tariffs have weakened its ability to support the economy. "The structural damage caused by the trade conflict reduces economic capacity and increases costs, limiting the space for monetary policy to stimulate demand." The policy announcement coincides with Canadian Prime Minister Carney's cabinet preparing to unveil its first budget, which is expected to heavily invest in infrastructure and major projects to support growth.

Macklem emphasized at the press conference that the central bank's "work is never done," and uncertainty remains high. When asked what would constitute a "significant change" sufficient to trigger further action, he stated that evidence accumulation beyond single-month data would need to be seen, and only a significant deviation from the latest forecasts would prompt action. Although core inflation remains around 3%, "upward momentum has dissipated," and a series of indicators show that underlying inflation pressures have receded to about 2.5%.

The central bank expects the Canadian economy to be in a state of excess supply for some time and has lowered its growth forecast for the second half of 2025 to 0.75%. Macklem stated that compared to the January forecast, the economy's size will be 1.5% smaller by the end of 2026. This communication indicates that policymakers remain resistant to further stimulus to avoid reigniting inflation amid global price and supply chain disruptions.

Due to the uncertain outlook regarding U.S. tariffs, the Bank of Canada will no longer use scenario analysis to address uncertainty. Macklem stated, "With tariffs already in place and U.S. protectionism solidified, their impact is clearer, although the future scope of tariffs remains uncertain." He also emphasized that the forecast range is "wider than usual," and it is necessary to maintain "humility" regarding the outlook.

Compared to January, the Bank of Canada has lowered its growth forecast for 2025 from 1.8% to 1.2%, and for 2026 from 1.8% to 1.1%, with a slight increase to 1.6% expected in 2027. The central bank stated that tariffs raise business costs and exacerbate uncertainty, while business investment will continue to be weak due to declining U.S. demand. Consumption growth is also expected to cool due to slowing population growth and weak employment, with per capita consumption averaging only about 1% growth in 2026-2027 "There is nothing to be happy about; we are cutting interest rates because the economy is under tremendous pressure," said Warren Lovely, Managing Director of Financial at National Bank of Canada, in a television interview. The vortex of geopolitical risks continues, and "it is necessary to buy some interest rate insurance." He stated, "The industrial sector is facing a 'death by a thousand cuts' from tariffs, and this economy needs support," adding that "the central bank may not be done yet."

Currently, the overnight rate of 2.25% is at the bottom of the neutral rate range assessed by the central bank, which neither stimulates nor suppresses the economy. Andrew Hencic, Senior Economist at TD Bank, stated that "a pause is reasonable" in the current environment, but the federal budget could pose an upside risk. If fiscal policy strongly pushes for structural transformation, it could change the medium-term path and the central bank's judgment.

St-Arnaud, Chief Economist at Central Alberta, believes that the neutral rate may be lower than the central bank's valuation, and further rate cuts "may still be needed." He anticipates that while a rate cut in December is still possible, "today's statement suggests it may be delayed until early 2026." The central bank acknowledges that trade frictions have raised costs, but due to Canada canceling most of its counter-tariffs, the inflation impact is weaker than previously estimated, and inflation is expected to remain around 2% until 2027