Powell's press conference stated that a rate cut in December is not guaranteed, U.S. stocks, U.S. bonds, gold, and Bitcoin plunged during the session, and the dollar rose

After the Federal Reserve announced its interest rate decision, major assets experienced little short-term volatility. During Powell's press conference, he stated that a rate cut in December is not a foregone conclusion. U.S. stocks, Bitcoin, gold, and U.S. Treasuries saw a short-term plunge during the session, with the S&P 500 and Nasdaq 100 both turning negative; however, U.S. stocks later recovered some of their losses

On Wednesday, October 29th local time, the Federal Reserve announced its interest rate decision, lowering rates as expected and announcing a reduction in its balance sheet. After the Federal Reserve's announcement, major assets experienced little short-term volatility. Federal Reserve Chairman Jerome Powell stated at the press conference that a rate cut in December is not a certainty, and there are significant internal disagreements within the Federal Reserve, causing major assets to plunge during the session. Subsequently, U.S. stocks and cryptocurrencies recovered some losses, while U.S. Treasuries and gold showed weakness.

Before the Federal Reserve's Decision Announcement

Minutes before the Federal Reserve released its October decision statement, U.S. stocks and gold rose during the day, while U.S. Treasuries and Bitcoin fell:

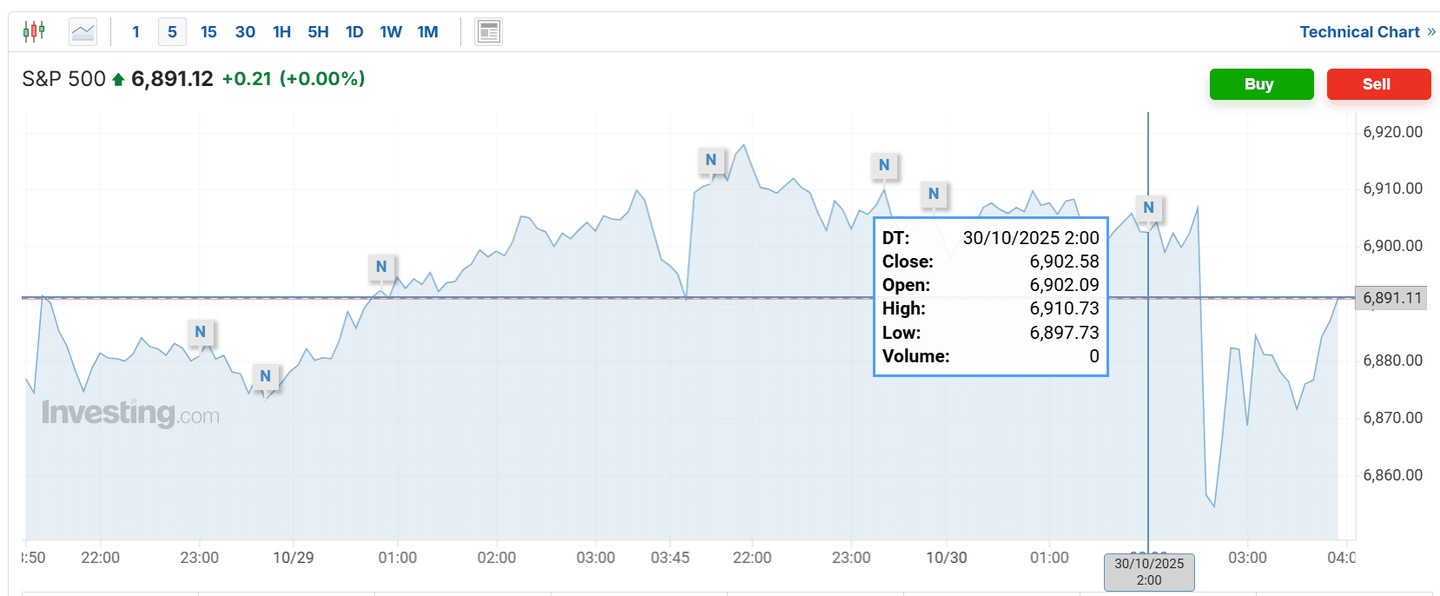

- The S&P 500 index rose by 0.1%, the Dow Jones increased by 0.2%, the Nasdaq gained 0.5%, the semiconductor index rose by 2.2%, and the bank index remained flat. Nvidia rose by 3.1%, Apple increased by 0.4%, and Tesla remained flat.

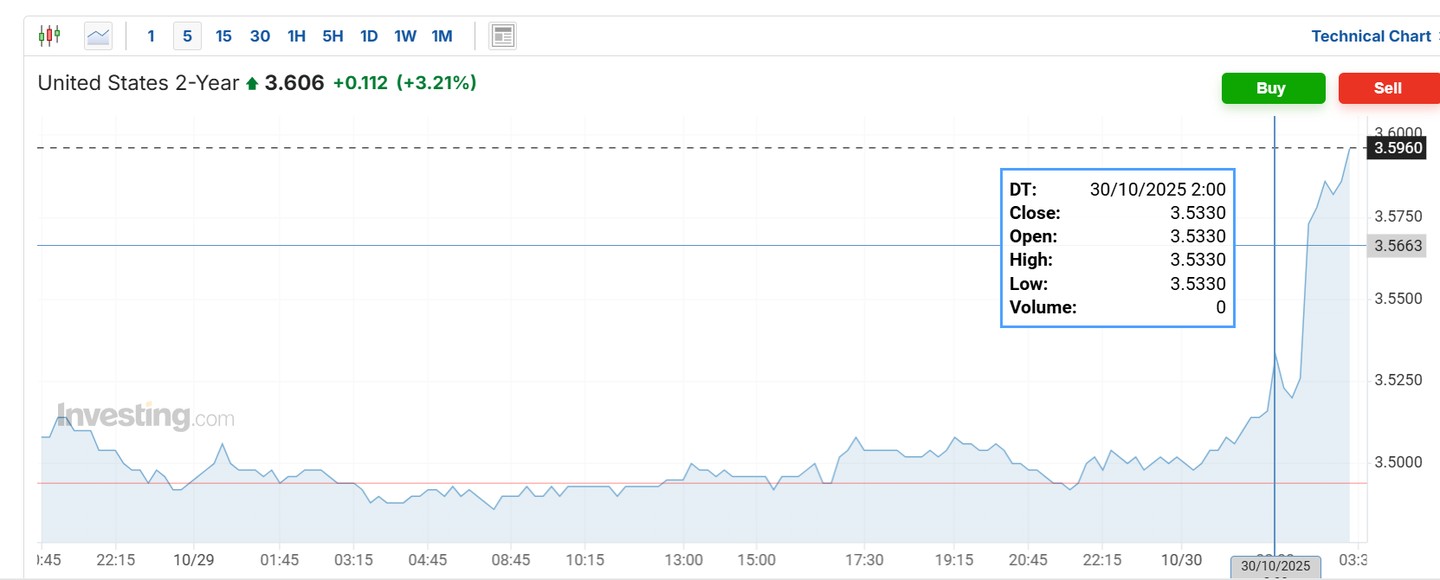

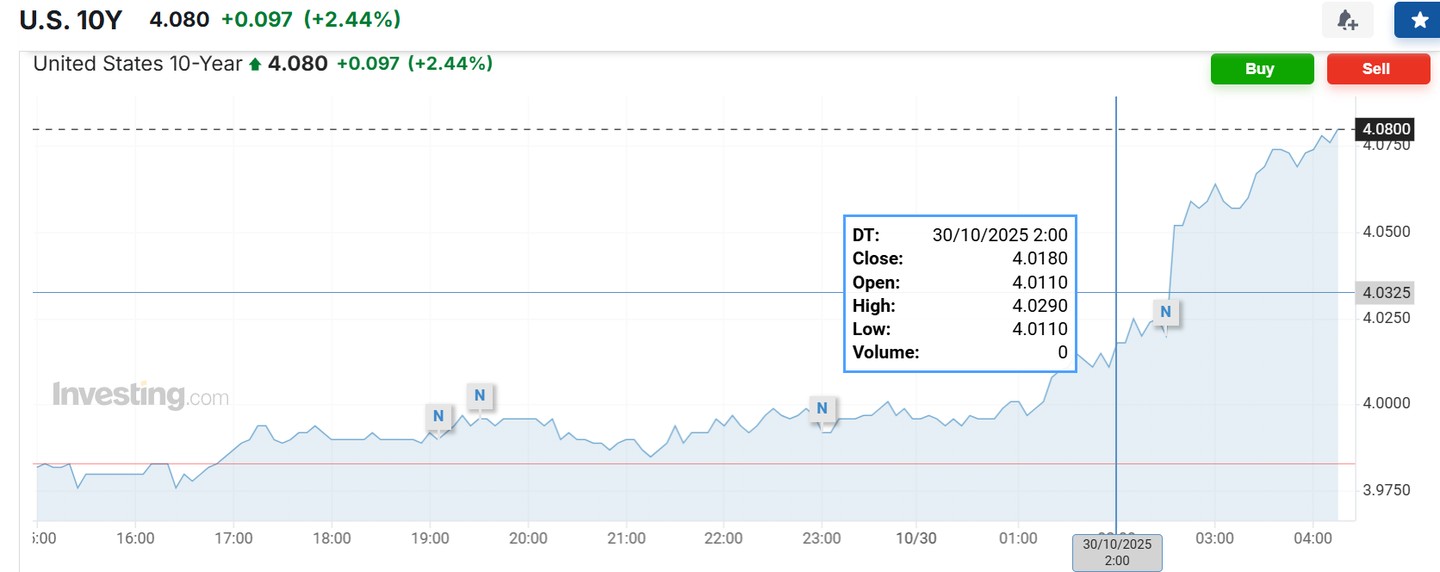

- The yield on the U.S. 10-year Treasury bond rose from around 3.995% to above 4.01%, with an overall increase of about 4 basis points during the day. The yield on the 2-year Treasury bond rose by more than 2 basis points, breaking through 3.5150%.

- Spot gold maintained a 1.1% increase, ending the previous days' downward trend, but still remained below the psychological level of $4,000.

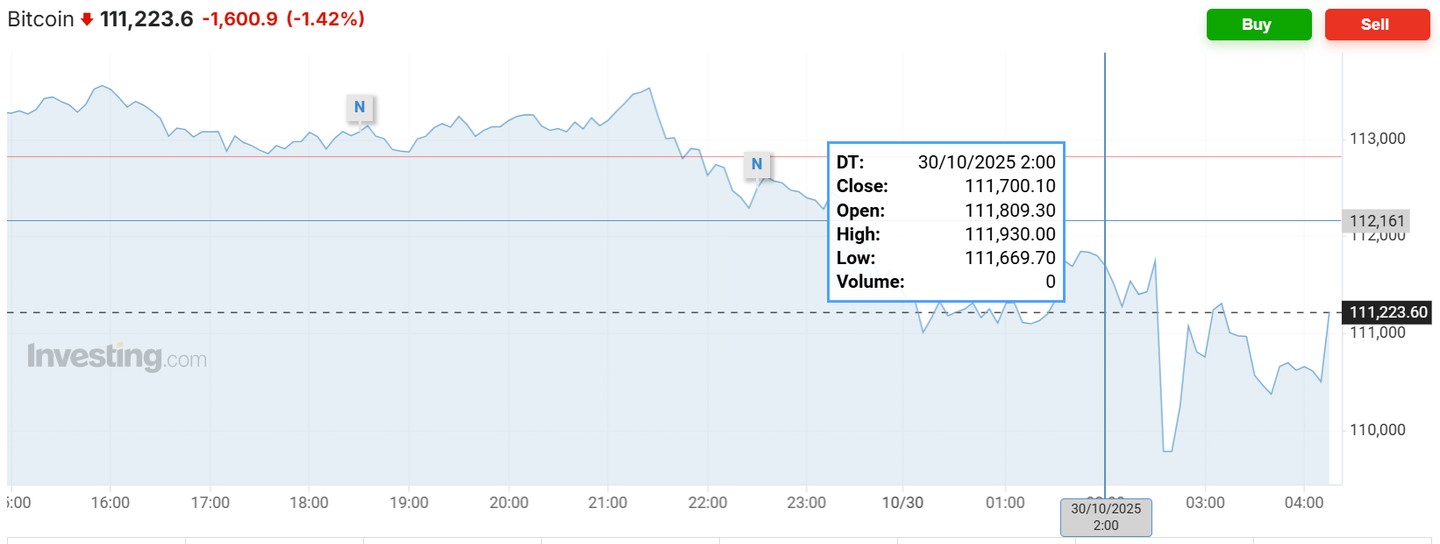

- Bitcoin briefly rose from around $111,200, approaching $112,000, with the overall decline narrowing to 0.8%.

After the Federal Reserve's Decision Announcement

The Federal Reserve announced its interest rate decision, lowering rates again as expected and announcing the cessation of balance sheet reduction starting in December.

After the Federal Reserve's statement was released, major assets experienced little short-term volatility:

- The S&P 500's gains slightly expanded to over 0.2%, then the gains slightly narrowed. The Philadelphia Bank Index's decline expanded to 0.1%.

- The yield on the U.S. 10-year Treasury bond broke through 4.02%, with an increase of over 4 basis points during the day, and short-term volatility of about 2 basis points. The yield on the 2-year Treasury bond experienced short-term volatility of about 2 basis points, trading between 3.505% and 3.5265%.

- Spot gold slightly rose before retreating, with overall volatility remaining low. Spot gold fell towards $3,980 during the session, with the increase slightly narrowing after the Federal Reserve announced its second rate cut of the year.

- Bitcoin slightly rose before the daily decline slightly expanded, falling back towards $111,500, with overall volatility remaining low.

Powell's Press Conference

At the beginning of the press conference, Powell delivered a hawkish speech, stating that a rate cut in December is not a foregone conclusion, and there are significant disagreements today, with some FOMC members believing it is time to pause.

Affected by Powell's remarks, major assets plunged during the session, with U.S. stocks, Bitcoin, gold, and U.S. Treasuries experiencing sharp declines:

- The U.S. stock market turned negative, with the S&P down 0.4%, the Dow down 0.3%, the Nasdaq 100 index down 0.3%, and the Philadelphia Bank Index down 1%. Both the S&P 500 and Nasdaq 100 turned negative during the session.

- The yield on the U.S. 10-year Treasury bond briefly rose from below 4.02% to nearly 4.05%, with an increase of about 7 basis points during the day. The yield on the 2-year Treasury bond briefly surged from below 3.52% to above 3.57%, with an increase of over 8 basis points during the day.

- Spot gold turned negative, testing $3,950 during the session

- Bitcoin short-term plummeted from around $112,000 to nearly $109,000.

- Emerging market currencies fell, as Powell cast a shadow over the Fed's rate cut prospects in December.

- The Hang Seng Index main contract closed up 0.93% in the overnight session, at 26,599 points. The Hang Seng Tech Index main contract closed up 1% in the overnight session, at 6,147 points.

As Powell's press conference neared its end, U.S. stocks narrowed their losses, with the Nasdaq experiencing a brief intraday decline before rising again. Digital currencies also recovered some of their intraday losses, although U.S. Treasuries and gold remained relatively subdued:

- The S&P 500 Index fell 0.2%, the Dow Jones fell 0.3%, the Nasdaq rose 0.3%, the Philadelphia Bank Index fell 1.2%, and the Semiconductor Index rose 2%.

- The yield on the U.S. two-year Treasury note increased by 10 basis points, reaching a daily high of 3.59%. The yield on the U.S. ten-year Treasury note maintained an increase of over 8 basis points, stabilizing around a daily high of 4.0583%.

- On Wednesday, at the end of trading in New York, the ICE Dollar Index rose 0.66%, at 99.320 points, with an intraday trading range of 98.624-99.334 points. At 02:30 Beijing time, after Fed Chairman Powell discussed the prospects for a rate cut in December, it surged instantly, having traded below 99 points earlier in the day. The Bloomberg Dollar Index rose 0.39%, at 1,214.76 points, with an intraday trading range of 1,208.75-1,215.52 points.

Major Asset Trend Charts

The chart below shows the trend of the S&P 500 Index:

The chart below shows the yield on the 2-year U.S. Treasury:

The chart below shows the yield on the 10-year U.S. Treasury:

The chart below shows the trend of the U.S. dollar:

The chart below shows the trend of gold:

The chart below shows the trend of Bitcoin: