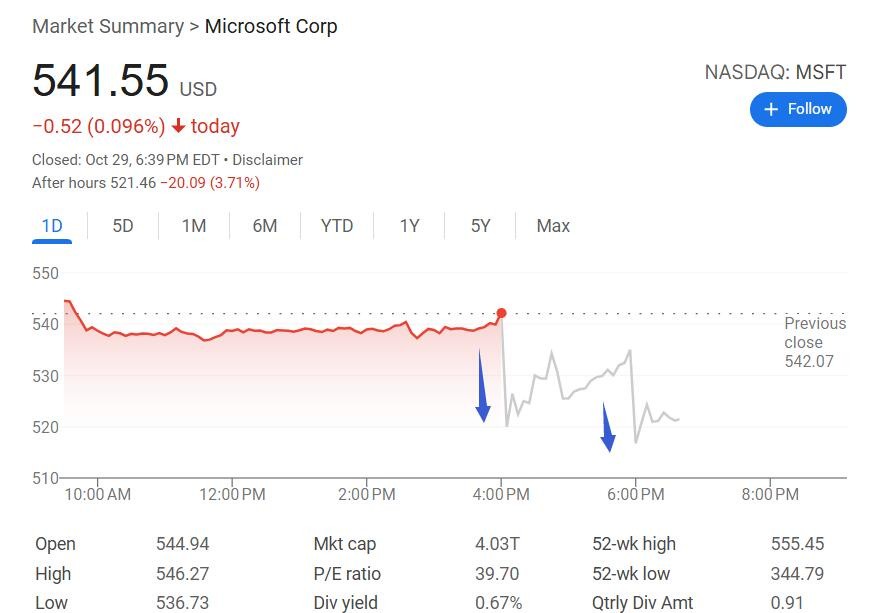

Microsoft's revenue surged nearly 20% last quarter, but Azure cloud growth was not impressive enough, and AI spending exceeded expectations significantly, dropping 5% in after-hours trading | Earnings Report Insights

In the third quarter, Microsoft's revenue increased by 18% year-on-year, matching the highest growth rate in a year and a half achieved in the second quarter, while EPS growth slowed to 13%, still exceeding analyst expectations; revenue from Azure and other cloud services grew by 39%, matching the highest growth rate in two and a half years set in the second quarter, but still below some buyers' optimistic expectations; capital expenditures in the third quarter reached a new high, up 60% from the previous record and over 74% year-on-year; the investment in OpenAI impacted the net profit by nearly $3.1 billion in the third quarter. The CFO stated that Azure demand far exceeds available capacity, and Microsoft has not been able to keep up with demand

The artificial intelligence (AI) leader Microsoft saw its sales revenue and profit maintain double-digit growth in the last fiscal quarter, but it did not impress investors.

The financial report shows that, compared to Wall Street expectations, Microsoft's cloud computing business Azure, which directly benefits from AI applications, did not show particularly bright growth in the last fiscal quarter. At the same time, including AI-related expenditures such as data centers, Microsoft's capital expenditures for the quarter surged beyond expectations. This heightened investors' concerns about the impact of AI infrastructure costs on profitability.

Despite Microsoft's significant investment in data centers, its computing power remains constrained, putting pressure on the Azure cloud business. Microsoft Chief Financial Officer (CFO) Amy Hood stated during the earnings call that the demand for Azure services "far exceeds our current available capacity," and she had initially thought they could catch up with demand, but that was not the case. She mentioned that expenditures for the current fiscal quarter would continue to increase.

After the financial report was released, Microsoft's stock price, which closed down 0.1% on Wednesday, quickly expanded its after-hours decline, dropping over 4% at one point before narrowing to within 2%. During the earnings call, the decline had widened to 5%.

On October 29, Eastern Time, Microsoft announced its financial data for the first fiscal quarter of 2026 (referred to as the third quarter) for the period ending September 30, 2025, following the previous fiscal quarter referred to as the second quarter.

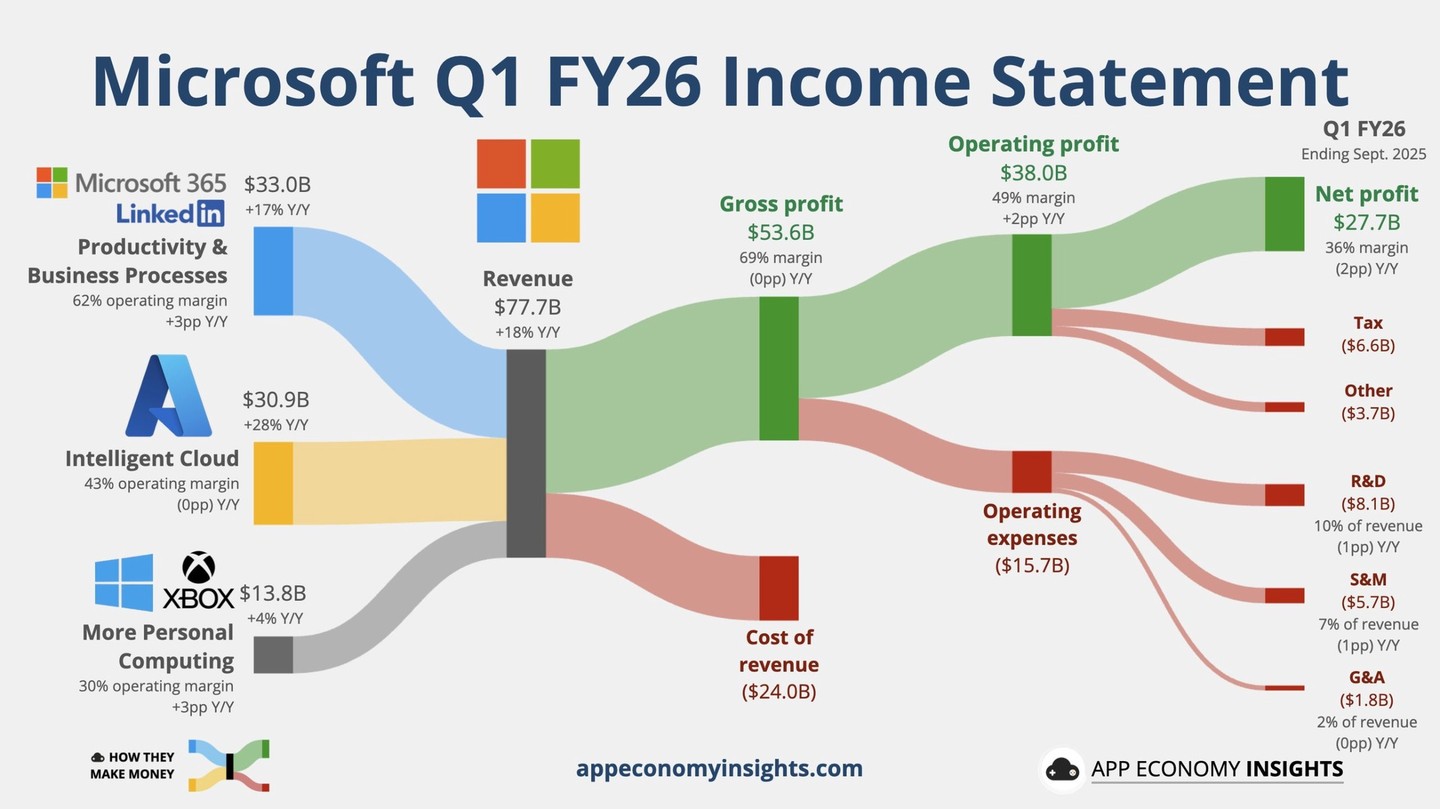

1) Key Financial Data

Revenue: Third quarter operating revenue was $77.67 billion, a year-on-year increase of approximately 18%, with analysts expecting $75.55 billion, and a year-on-year growth of 18% in the second quarter.

EPS: The diluted earnings per share (EPS) for the third quarter was $3.72, a year-on-year increase of approximately 13%, with analysts expecting $3.68, and a year-on-year growth of 24% in the second quarter.

Operating Profit: The operating profit for the third quarter was $37.96 billion, a year-on-year increase of approximately 24%, with analysts expecting $35.1 billion, and a year-on-year growth of 23% in the second quarter.

Net Profit: The net profit for the third quarter was $27.75 billion, a year-on-year increase of 12%, with a year-on-year growth of 24% in the second quarter.

Capital Expenditure: Including assets obtained through financing leases, total capital expenditure for the third quarter was $34.9 billion, a year-on-year increase of 74.5%, with analysts expecting $30.06 billion, and a growth of 27% in the second quarter; among them, cash expenditures related to real estate and equipment were $19.39 billion, a year-on-year increase of 30.2%, with analysts expecting $23.04 billion, and a year-on-year growth of 23% in the second quarter.

2) Segment Business Data

Commercial Cloud: Including products such as Office and Azure, Microsoft's total commercial cloud revenue for the third quarter was $49.1 billion, a year-on-year increase of approximately 26%, with analysts expecting $48.6 billion, and a year-on-year growth of 27% in the second quarter.

Intelligent Cloud: Including Azure public cloud, Windows Server, voice recognition software Nuance, and GitHub, the intelligent cloud business segment's revenue for the third quarter was $30.9 billion, a year-on-year increase of approximately 28%, with analysts expecting $30.18 billion, and a year-on-year growth of 26% in the second quarter Productivity and Business Processes: Including Office software such as Microsoft 365 Copilot AI tools, the Productivity and Business Processes segment reported revenue of $33.02 billion in the third quarter, a year-on-year increase of approximately 17%, compared to analysts' expectations of $32.29 billion, with a year-on-year growth of 16% in the second quarter.

More Personal Computing: Including Windows operating system, Surface hardware, Xbox gaming consoles, and video game company Activision Blizzard, the More Personal Computing segment reported revenue of $13.8 billion in the third quarter, a year-on-year increase of 4%, compared to analysts' expectations of $12.88 billion, with a growth of 9% in the second quarter.

Third Quarter Revenue Growth Steady Compared to Previous Quarter, Azure Revenue Growth Slower than Some Buy-Side Optimistic Expectations

The financial report shows that Microsoft's total revenue in the third quarter exceeded analysts' expectations by nearly 3%, with year-on-year growth steady compared to the second quarter, maintaining the highest quarterly growth rate since the end of 2023, and not slowing down as analysts had expected compared to the second quarter.

Earnings per share (EPS) growth in the third quarter slowed from 24% in the second quarter to 13%, but still exceeded analysts' expectations by more than 1%, indicating that the degree of slowdown was not as significant as analysts had anticipated.

Operating profit growth in the third quarter not only did not slow down as analysts expected, but also slightly accelerated from 23% in the second quarter to 24%.

The Intelligent Cloud segment, including server products and Azure, saw a slight acceleration in revenue growth in the third quarter, with growth increasing from 26% in the second quarter to 28%.

Excluding the impact of exchange rates, revenue from Azure and other cloud services grew by 39% in the third quarter, steady compared to the highest quarterly growth rate of 39% since the end of 2022 achieved in the second quarter, exceeding analysts' consensus expected growth rate of 37%. However, comments pointed out that before the release of Microsoft's financial report, investors had very high expectations for Azure's growth, with some buy-side institutions even setting expected growth rates slightly above 40%.

Microsoft CFO Hood stated in the financial report announcement that the fiscal year started strong, with revenue, operating profit, and EPS all exceeding expectations. "The continued strong growth of Microsoft's cloud business reflects the growing demand from customers for our differentiated platform."

Third Quarter Capital Expenditure Hits New High, Year-on-Year Increase of Over 74%

Including leasehold improvements reflecting data center expenditures, Microsoft's capital expenditure in the third quarter not only set a new record for the highest quarterly expenditure but also surged sharply.

Total capital expenditure in the third quarter exceeded analysts' expectations by more than 8%, increasing by over 60% compared to the previous record in the second quarter, with year-on-year growth rising from 27% in the second quarter to over 74%, nearly three times that of the second quarter.

Microsoft is regarded as one of the giants in the hyperscale cloud service provider sector, with these tech companies investing billions of dollars in cloud infrastructure this year to support AI training and other technological work. The demand for Microsoft's cloud computing and AI services far exceeds its supply capacity, and this challenge has significantly driven the company's revenue growth. However, investors have been closely monitoring whether Microsoft can maintain the profitability of its cloud business while continuing to invest in Azure In the first quarter of this year, Microsoft's capital expenditure recorded its first quarter-on-quarter decline in over two years, raising analysts' suspicions about a slowdown in Microsoft's investment in AI data centers. The return to growth in capital expenditure in the second quarter alleviated concerns about a reduction in AI spending, while the third quarter's expenditure significantly exceeded expectations, reflecting that despite worries about an AI bubble, companies are still investing heavily in AI services. This has also raised investor concerns about the high costs of Microsoft's AI infrastructure.

Anurag Rana, an analyst at Bloomberg Industry Research, commented that while the capital expenditure indicators may raise some concerns, they indicate that the demand for AI workloads is increasing. He also noted that the growth rate of Azure being flat compared to the second quarter may be due to limited data center capacity.

Microsoft CEO Satya Nadella stated in the third quarter earnings announcement that Microsoft will continue to increase its investment in the AI field, including funding and talent, to seize the enormous development opportunities in the future.

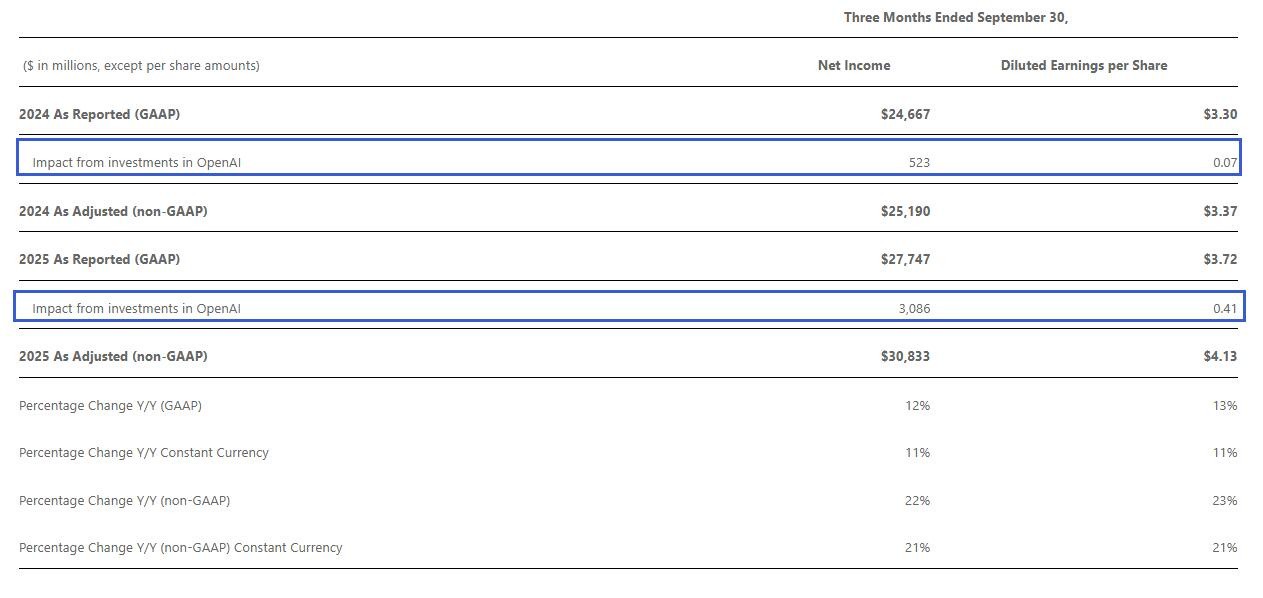

Investment in OpenAI Impacted Net Profit by Nearly $3.1 Billion in Q3

Unlike previous earnings announcements, Microsoft disclosed the impact of its investment in OpenAI on the company's profit this time.

The earnings report showed that under GAAP standards, the investment in OpenAI impacted Microsoft's net profit by $3.086 billion in the third quarter, far exceeding the $523 million from a year ago, with an impact on EPS earnings of $0.41 per share, also significantly higher than the $0.07 per share from a year ago.

The investment in OpenAI and the collaboration with it have granted Microsoft the rights to use OpenAI's products and models, which has been crucial for Azure's rapid growth in recent quarters, enabling Microsoft Cloud to better challenge Amazon Web Services (AWS).

The day before the earnings report, OpenAI and Microsoft announced a landmark agreement this Tuesday. Microsoft holds a 27% stake in the restructured OpenAI profit organization and has extended the licensing of intellectual property (IP) for OpenAI's models and products until 2032. OpenAI has committed to paying $250 billion in leasing fees to Azure cloud services over the coming period, securing long-term stable revenue for Microsoft.

The agreement provides both Microsoft and OpenAI with greater freedom to collaborate, allowing each to partner with competitors. Nadella stated on Tuesday that he is pleased to see AI models from Anthropic and even Google landing on the Azure cloud platform.

The new agreement eliminates uncertainties regarding Microsoft's future relationship with OpenAI. Microsoft's stock price rose nearly 2% on Tuesday, reaching an all-time high.

Evercore ISI analyst Kirk Materne believes that the new agreement alleviates a major concern regarding Microsoft, as it provides Microsoft shareholders with potential upside related to OpenAI's future growth Technology industry analyst Zeus Kerravala believes that although Microsoft is no longer the exclusive cloud service provider for OpenAI, Microsoft has gained some key concessions from OpenAI. "Essentially, Microsoft traded the exclusivity of cloud computing, which was already difficult to obtain, for technological certainty and long-term IP usage rights."