Meta plummets after earnings! One-time tax expenses drag Q3 net profit down by 83%, continuous surge in AI investments raises market concerns

Meta's net profit plummeted 83% to $2.709 billion in the third quarter of 2023 due to a one-time non-cash income tax expense. Although revenue grew 26% year-on-year to $51.24 billion, exceeding market expectations, earnings per share were only $1.05, far below the expected $6.72. Meta plans to significantly increase spending in 2026, continuing to invest in data centers and infrastructure to drive AI development. Following this news, Meta's stock price fell more than 7% in after-hours trading

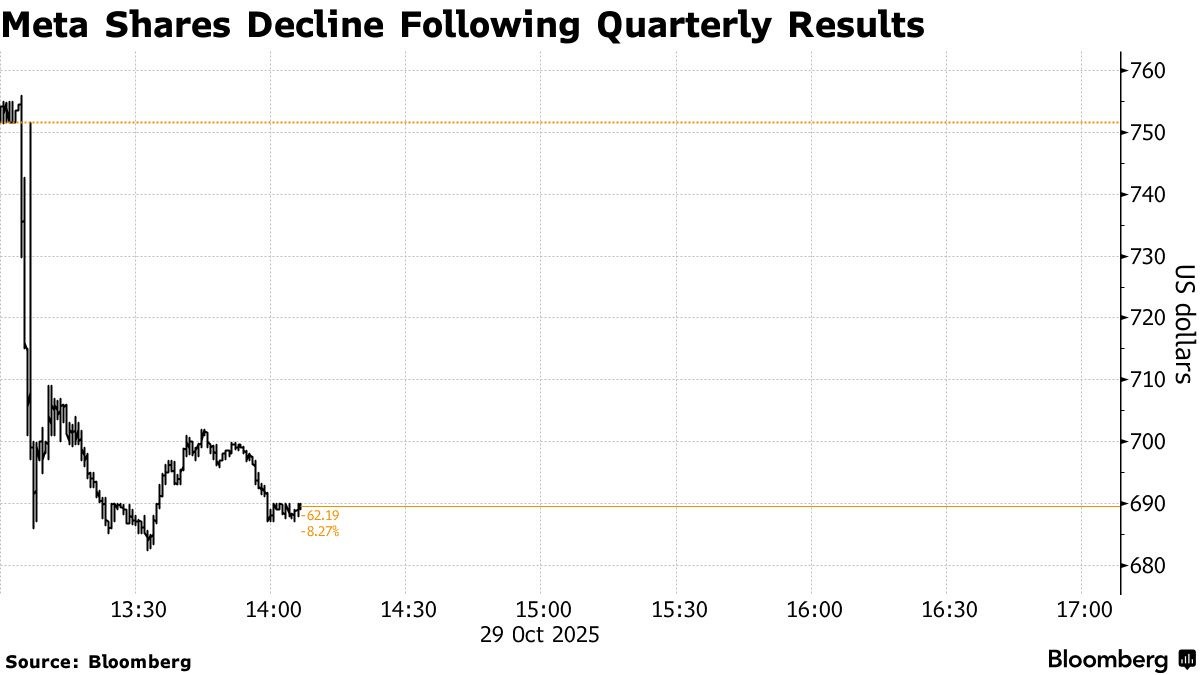

According to the Zhitong Finance APP, Meta Platforms (META.US) saw a significant decline in profits for the third quarter of 2025 due to a one-time non-cash income tax expense of nearly $16 billion. Meanwhile, the company stated that it would significantly increase total expenditures in 2026 and plans to maintain historically high levels of investment in data centers and other infrastructure to drive its artificial intelligence (AI) development goals. As a result of this news, Meta's stock fell over 7% in after-hours trading on Wednesday.

The financial report shows that thanks to the strong performance of Facebook and Instagram's advertising business, Meta's revenue in the third quarter increased by 26% year-on-year to $51.24 billion, exceeding market expectations of $49.6 billion. Among them, advertising revenue was $50.082 billion, a year-on-year increase of 26%; other business revenue was $690 million, a year-on-year increase of 59%. The revenue of the Reality Labs department responsible for the metaverse business increased by 74% year-on-year to $470 million, but the operating loss reached $4.432 billion, roughly the same as the same period last year.

Due to the implementation of the "Big and Beautiful Act," Meta recorded a one-time non-cash income tax expense of $15.93 billion in the third quarter, leading to a year-on-year plunge in net profit of 83% to $2.709 billion; earnings per share were $1.05, far below the market expectation of $6.72.

Excluding this impact, the company's net profit for the quarter would be $18.64 billion, and earnings per share would reach $7.25. However, Meta indicated that due to the implementation of the new tax law, it expects federal cash tax expenditures in the United States to "significantly decrease" in 2025 and the following years.

More importantly, Meta raised its capital expenditure expectations. The company's Chief Financial Officer Susan Li stated in a press release that capital expenditures are expected to reach $70-72 billion this year, up from the previous expectation of $66-72 billion. So far this year, Meta's capital expenditures have reached $50 billion, and the upward revision of the full-year capital expenditure expectation indicates that the company will continue to increase investment.

Susan Li also mentioned that capital expenditures in 2026 will be "significantly higher" than in 2025, and total expenditures next year will grow at a "significantly faster percentage rate." Susan Li stated, "As we begin planning for next year, it is clear that our computing needs have significantly increased compared to last quarter's expectations. We are still formulating next year's capacity plans but expect to continue investing actively to meet these needs— including building our own infrastructure and signing contracts with third-party cloud service providers. We expect this will further increase next year's capital expenditures and overall expense plans."

Meta believes that its AI investments are already showing results, helping the company achieve more precise placements in advertising and content recommendations. However, CEO Mark Zuckerberg still faces pressure to prove that this investment, which will accumulate to hundreds of billions of dollars by the end of this decade, can deliver higher returns During the conference call following Meta's earnings report, Mark Zuckerberg expressed a continued thirst for computing resources. He stated that the company will expand its infrastructure next year, striving to "actively build capacity in advance" to ensure that Meta has industry-leading computing power in the AI field. Zuckerberg mentioned, "We need to ensure that we are not falling behind in our investments." However, the company is still controlling costs in certain areas. Last week, Meta laid off about 600 employees from its AI division—Meta Superintelligence Labs—to improve departmental efficiency.

In contrast to Zuckerberg's optimistic attitude, many Wall Street analysts are cautious about Meta's potential overspending. Analyst Jesse Cohen stated, "Meta's earnings report reveals an increasing tension between the company's massive AI infrastructure investments and investors' expectations for short-term returns. Despite solid performance in the core business, the increase in AI investment spending is still dampening market sentiment."