"Federal Reserve News Agency": Powell's press conference "rarely tough" highlights the "internal turmoil" of the Federal Reserve, and a rate cut in December is "far from certain"

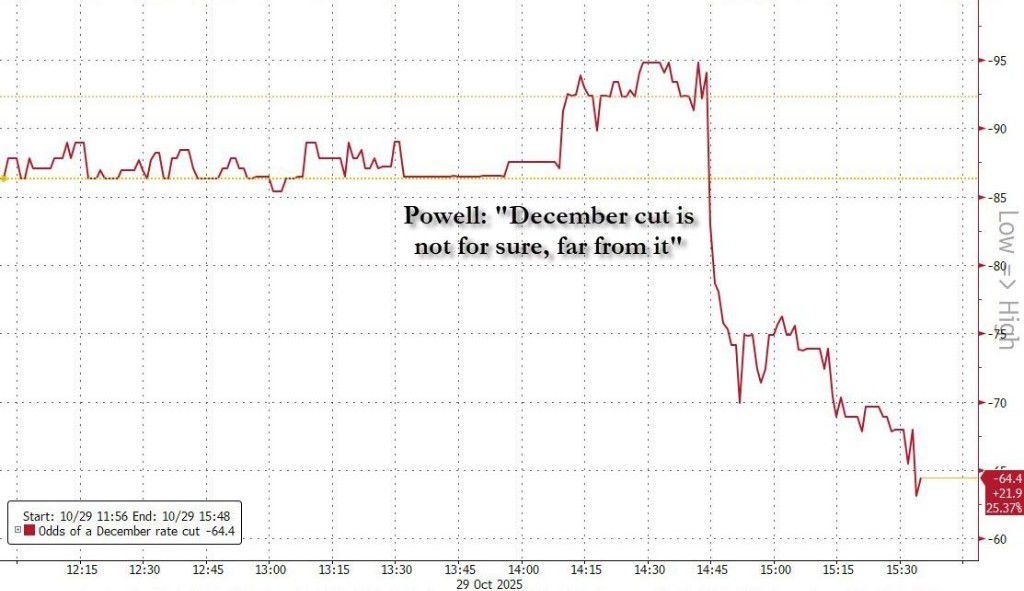

The Federal Reserve cut interest rates as expected, but Powell sent a hawkish signal at the press conference, cooling market expectations for rate cuts by the end of the year. Powell made it clear that a rate cut in December is "far from certain," leading to a reversal in market optimism, with the probability of a rate cut dropping from 95% to 65%. Both the Dow Jones and the S&P 500 indices closed lower, and the 2-year Treasury yield recorded its largest single-day increase. The latest rate decision shows significant internal divisions within the committee, with a voting result of 10 in favor and 2 against, reflecting doubts about the necessity for further rate cuts

The Federal Reserve lowered interest rates as expected, but the hawkish signals sent by Powell at the post-meeting press conference doused the market's widespread expectations for another rate cut before the end of the year.

Nick Timiraos, a reporter for The Wall Street Journal, known as the "new Federal Reserve correspondent," stated in a recent article that Powell's unusually tough stance not only highlights the increasing divisions within the FOMC but also indicates that the future path of monetary policy is fraught with high uncertainty against the backdrop of "blind flying" economic data.

On Wednesday local time, the Federal Reserve announced a 25 basis point cut to the benchmark interest rate, lowering the target range for the federal funds rate to 3.75% to 4%, the lowest level in three years, marking the second consecutive meeting with a rate cut. However, the focus of the press conference quickly shifted to Powell's views on future policy. He explicitly refuted the market's belief that a rate cut in December was a "done deal," stating that this prospect was "far from certain."

Powell's remarks had an immediate impact, reversing the market's optimistic sentiment, with the probability of a December rate cut plummeting from 95% to 65%. The Dow Jones Industrial Average and the S&P 500 erased their intraday gains, with the Dow closing down 0.2% and the S&P 500 slightly lower. The 2-year U.S. Treasury yield, which is most sensitive to interest rate expectations, surged by 0.092 percentage points to 3.585%, marking the largest single-day increase since early July.

Timiraos analyzed that Powell's speech clearly indicated that as "more and more officials" question the necessity of further rate cuts, the easiest part of this easing cycle may have already ended. Meanwhile, with each rate cut, the question of when to stop cutting rates becomes increasingly urgent.

Internal Divisions Emerge, Decision Voting "Three-Way Split"

The latest rate decision passed with a vote of 10 in favor and 2 against, revealing significant divisions within the committee. Kansas City Fed President Jeffrey Schmid cast a dissenting vote, preferring to keep rates unchanged; while Fed Governor Stephen Miran held a different view, advocating for a larger cut of 50 basis points.

This "three-way split" voting pattern confirms Powell's assertion that there are "strongly differing views" within the committee. Powell acknowledged at the press conference that there is a "growing chorus" among decision-makers who are skeptical about the need for further policy easing.

Although a slim majority of officials in the September economic forecast anticipated two more rate cuts this year, leading the market to believe that a December cut was likely, a considerable number of officials at that time felt that no further action should be taken after the September cut. These officials were more concerned about inflation issues—over the past few years, inflation rates have consistently exceeded the Fed's 2% target and have stopped declining this year, partly due to tariffs imposed by Trump that raised commodity prices Powell's tough stance has surprised the market, which had highly anticipated a rate cut in December, and analysts' views on the subsequent path have also diverged.

Vincent Reinhart, chief economist at BNY Mellon Investment Management and former senior advisor to the Federal Reserve, believes that given the data vacuum, "the data must prove that further easing is unreasonable, which is a very high bar." He added, "It will be really hard for them (the Fed) not to cut rates in December. Continuing is easier than stopping."

However, James Bullard, dean of the Purdue University College of Business and former president of the St. Louis Fed, thinks the prospects for a December rate cut are "more nuanced than the market currently believes." He pointed out that strong consumer spending and economic growth, combined with recent inflation setbacks, could provide reasons to slow the pace of rate cuts. "You have bet too much on a slowdown in the non-farm payroll report," Bullard said. He also questioned whether policymakers have truly adapted to the new normal of "a monthly addition of 50,000 jobs being completely acceptable."

Government Shutdown Leads to Data "Blind Flying," Increasing Uncertainty and Difficulty in Rate Cuts

What makes decision-making more challenging is the economic data vacuum caused by the government shutdown. Powell noted that if the lack of data leads officials to face "very high uncertainty" about the economic outlook, that itself could become a reason "to support cautious action."

Typically, economic reports between meetings help bridge the gaps among officials. However, now, especially with the absence of key labor market indicators, they have lost the information needed to resolve their differences.

An article by Timiraos cited William English, a professor at Yale School of Management and former senior advisor to the Fed, stating that the lack of data means "they haven't learned much since September, which makes their positions likely similar to those in September, but the range of uncertainty around that is wider."

In this regard, Wall Street Journal previously mentioned that Bank of America has outlined several possible scenarios:

Scenario 1: If the government reopens before the end of November, the market could see an "outdated" September employment report before the December meeting. A weak report could reduce the risk of hawkish opposition, but even strong data might be difficult to persuade Powell to pause rate cuts due to its "outdated" nature.

Scenario 2: If the government ends the shutdown in early November, allowing the Bureau of Labor Statistics to release both September and October reports before the meeting. In this case, if the unemployment rate remains stable and economic activity is robust, then a "pause in rate cuts" in December would become a real option.

Scenario 3: Ideally, if the government quickly reopens and the Bureau of Labor Statistics releases all three employment reports for September, October, and November before the meeting. Bank of America proposed a decision "rule of thumb": if the November unemployment rate is less than or equal to 4.3%, the Fed may hold steady; if it is greater than or equal to 4.5%, it would prompt a rate cut; if the unemployment rate is 4.4%, the decision would be a "close call."

The Balancing Act Between Inflation Concerns and Slowing Employment

Timiraos' article points out that the core of the current debate at the Federal Reserve revolves around how to balance controlling inflation with responding to economic slowdown. On one hand, some officials do not want to excessively cut interest rates to avoid overheating the economy, which could lead to inflation remaining persistently above target. Recently, the stock market has reached new highs driven by expectations of interest rate cuts, which has increased their concerns about financial stability.

On the other hand, other officials worry that the changes in trade policy and the lagging effects of past interest rate hikes on interest-sensitive sectors like housing should not be overlooked, as these factors are squeezing spending by low-income consumers and small businesses. In recent weeks, several large employers in the U.S. have announced plans to lay off white-collar workers.

The job market is at the center of this debate. Although inflation readings appear somewhat resilient, labor reports from this summer show that job growth has sharply slowed, prompting the Federal Reserve to return to a path of interest rate cuts. Data shows that in the three months ending in August, the average monthly job additions were about 29,000, far below the 82,000 in the same period last year. Policymakers are trying to clarify whether the slowdown in job growth is due to a decrease in the number of people entering the U.S. job market or a decline in labor demand.

Timiraos states that without clear evidence of a substantial deterioration in the job market, it is difficult to garner enough support for a rate cut exceeding 25 basis points. Meanwhile, as each rate cut progresses, the question of when to stop cutting rates becomes increasingly urgent.

Risk Warning and Disclaimer

Markets are risky, and investments should be made cautiously. This article does not constitute personal investment advice and does not take into account the specific investment goals, financial situation, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article align with their specific circumstances. Investing based on this is at one's own risk