The Federal Reserve has reasons for hawkish statements, but over time it will still be dovish

The Federal Reserve mentioned in its hawkish remarks that it faces a complex economic situation in the future, including inflation, unemployment rates, and the impact of AI on employment. Large companies are hiring while small companies are laying off, leading to different market reactions. The stock market performance is mixed, with rising short-term interest rates benefiting the US dollar and US Treasury yields, while gold is negatively affected. Overall economic growth is between 1.5% and 2%, with inflation maintained around 2%

So I will discuss the following issues:

-

The asset trends and narrative changes of the day

-

Inflation and unemployment rate

-

The differing voting views of Miran and Schmid, as well as Powell's possible stance

-

In the bigger picture, for the Federal Reserve, in 2025 they face a complex scenario, with concerns about the asset bubble of 2000 and worries about high deficit rates and interest rate cuts in 2019. There are even two unprecedented issues: the independence of the Federal Reserve and the impact of AI on employment.

-

Future outlook

This change has different impacts on various assets, and on the day, for stocks, a good economy but no decrease in interest rates is a mixed bag. Of course, we are talking about the overall situation; locally, we see that large companies represent a good economy, while small companies are looking forward to interest rate cuts. Thus, we can see different trends for Nasdaq and Russell 2000 today.

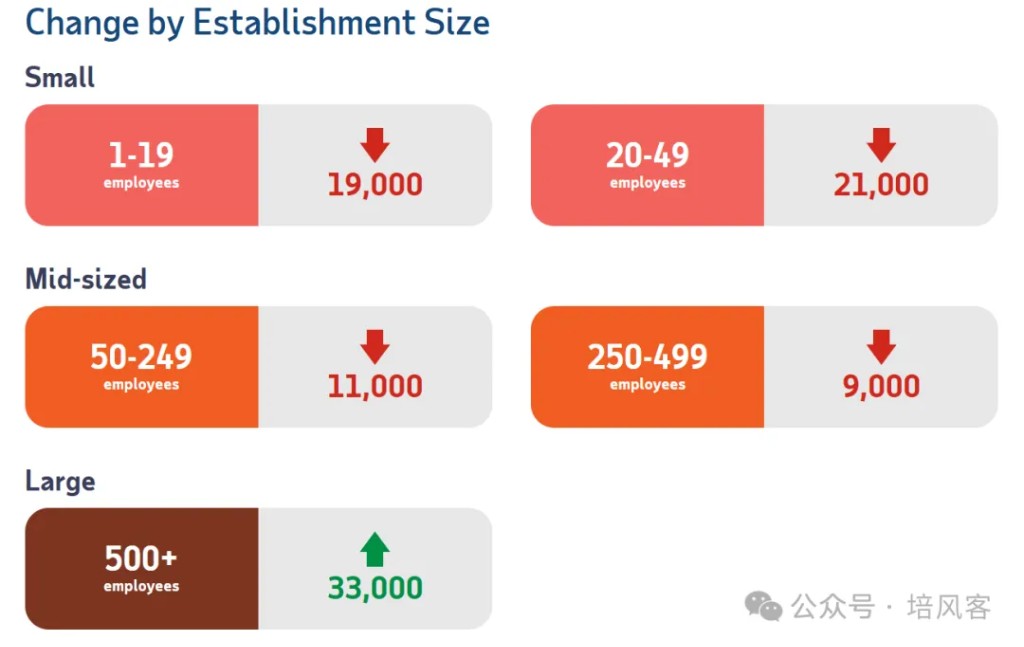

Moreover, this is not just a reaction from stocks; we can see this distinction in economic data as well, with small businesses laying off workers while large companies are hiring.

In a few days, there will be earnings reports from other large tech companies, which may provide a better outlook for AI overall. However, from today's Meta and Google, it seems that AI's Capex is still quite good.

Of course, the factors influencing stock prices go far beyond fundamentals; we are only discussing from one perspective. But if we say that stocks are good for the economy and short-term interest rates rising is a mixed bag, then for the US dollar and US Treasury yields, they clearly benefit more directly.

Gold, on the other hand, is a victim of this combination, not to mention the Federal Reserve's efforts to demonstrate its independence in this meeting, which is something gold bulls do not want to see.

Returning to the Federal Reserve itself, the two economic indicators it focuses on are inflation and unemployment rate. We need to look at its numbers and its logic.

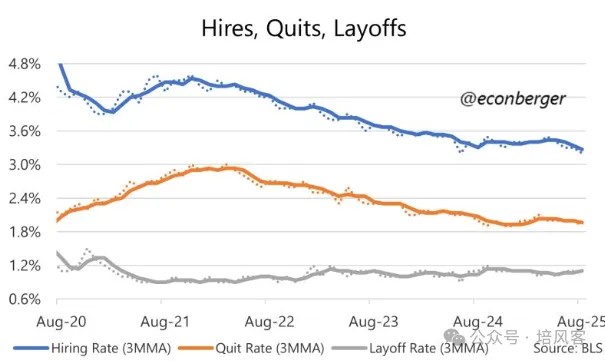

Starting with the unemployment rate, without discussing the differences between large and small companies, looking at the overall situation, the US is currently in a combination of fewer hires, fewer resignations, and fewer layoffs

Large companies are hiring but also starting to lay off employees (as everyone has seen, tech giants have been laying off workers in recent days, and more will follow in the future). Small companies have already begun layoffs, so the number of hires is not large, which is understandable.

Layoffs have occurred, but the overall scale is still small, as this is a 1.5-2% economic growth, while inflation is above the 2% target. It’s not accurate to say the economy is in terrible shape. Therefore, both hiring and layoffs are not frequent, and employment is in a "frozen" state.

In this situation, it is natural that the number of people voluntarily leaving their jobs has decreased, unlike in 2021 when everyone was frantically switching jobs for salary increases.

This is the current picture of the unemployment rate, which is not hard to understand. The question is, what will happen in the future?

If interest rates do not decrease (as shown above, long-term rates are rising), I do not believe that small businesses in the U.S. will have the motivation to hire. They are facing high interest rates + the strong getting stronger + the trickle-down effect supported by the Republican Party, which does not favor small businesses over large enterprises. In other words, in the current environment, if large companies are laying off employees, I do not believe small businesses will be hiring.

Currently, the layoff plans of large companies are evident on paper. Amazon has already laid off 15,000 employees and may lay off another 15,000. This is a significant number, as the monthly job additions, even when data is inflated, are only about 100,000, and there may not be many new jobs now, leading to unemployment. These individuals may not be able to find jobs quickly. This is just one company; there are many others with layoff plans.

Therefore, I do not believe employment will improve in the future. There is also a viewpoint regarding employment: is it caused by the supply side or the demand side? The supply side means that the U.S. has expelled immigrants, resulting in fewer job seekers, hence fewer hires. The demand side means that the U.S. economy is not doing well, leading to fewer hires. According to Powell himself, both views exist, but he believes the demand side is more likely, which is a thought-provoking perspective because it implies that Powell is indeed more dovish regarding the unemployment rate issue.

Returning to inflation

Inflation mainly consists of several parts, according to Powell:

- Commodity inflation is rising, but this is due to tariffs.

- In the service sector, housing inflation is declining, which is structural.

- Other than housing, inflation remains stable, but the largest components of U.S. inflation are housing, transportation, food, and healthcare. Services outside of housing mainly refer to healthcare.

Assuming Powell is correct, then commodity inflation will likely decrease in the future, and housing will also decline, meaning inflation will still come down. He may eventually lower interest rates after commodity inflation decreases.

I believe the economic analysis above has been done by many before, so not many people think the Fed will not cut rates in December. Historically, there seems to be no precedent for stopping after cutting rates twice This is also why I think he will lower interest rates later, because the current U.S. economy is largely supported by AI's Capex, and this expectation has not changed, but concerns are indeed arising. This is undeniable, whether you look at it from statements or from the market.

In the history of 2000, a classic combination is that stocks rise while bonds fall.

I believe AI can bring productivity improvements, but even so, AI investments must have a limit. Even if it has no limit in the long term, its short-term growth rate must have a peak at some stage. Currently, I feel that according to market sentiment, people do not want to see this growth peak, and from today's after-market situation, people even hope that large companies can generate enough profits when investing in AI. This is actually a bit absurd; I understand this is why they are laying off employees, but it is still very absurd.

In this part, I think I explained the two objectives of the Federal Reserve, discussing why previously 90% of the market believed the Fed would lower interest rates in December, and even after he said so, the market still believes there is a 60% chance it will lower rates, as well as why I think the Fed will lower rates in December. Because the current economic development model is unsustainable; relying on investment to drive the economy can bring prosperity, but this is short-term prosperity. Long-term prosperity still relies on productivity improvements. Of course, the perfect narrative is that short-term investment just ended, and long-term productivity immediately improves, but historical experience does not support such a perfect story.

So why did Schmid vote against lowering interest rates? I think there are two explanations.

The first is that he is a hawk; he did not support lowering rates in August and wanted to see more data before making a decision. In September, he saw the downward revision of unemployment data and supported lowering rates. Now, he does not see the data, so he decides to pause. This is a very logical chain, and I think it makes sense.

The second is that even if the above statement is logical, according to common sense, there is also a considerable probability that Schmid would support a 25bp rate cut for several reasons. First, to maintain policy consistency; second, as previously mentioned, waiting for data in the fall of 2000 resulted in more aggressive rate cuts in 2001.

I think Schmid's support for not lowering rates is, on one hand, his reasonable attitude, and on the other hand, it serves the purpose of offsetting Miran's certain vote for a 50bp rate cut. Because imagine, Miran is certain to vote for a 50bp rate cut, not because he supports a 50bp cut, but because the most dovish option among the three options given by Powell is a 50bp cut. I have no doubt that if Powell gave him the options of no cut, a 25bp cut, and a 250bp cut, he would support a 250bp cut. So having someone who supports not lowering rates can indeed allow Powell to present a more neutral stance in the absence of data Or to put it this way, I think if it weren't for Miran, Schmid might still support a 25bp rate cut this time and leave the bad news for Powell to address at the press conference.

I think this point is also quite important. The Federal Reserve's first hope is to maintain its independence, and second, in the current market environment and inflation concerns, it is unwilling to adopt a dovish stance on rate cuts. This actually indicates many issues.

In a larger context, the dilemma Powell faces is significant.

First, there is a tech investment, and like in 2000, there are high expectations for future growth from this tech investment. Fairly speaking, Powell does not fully believe, like Greenspan did, that technology will lead to an increase in real interest rates; instead, he is more concerned about the risks of unemployment, which he is handling better than in the second half of 2000.

Second, there is a deficit rate of 5% or even higher. When Powell mentioned Mid Cycle Adjustment in 2019, he faced this situation, where an inverted yield curve does not necessarily indicate a recession because of the high deficit rate. Therefore, there is less need for aggressive rate cuts.

From an analogical perspective, I think Powell is doing well in balancing the risks of unemployment and inflation, as well as the risks brought by tech investment and fiscal investment.

In 2000, the Federal Reserve was still raising rates, while in 2019, it cut rates three times. I think he is trying to find a middle ground, which has its own logic.

In addition to these two points, he also needs to address concerns about the independence of the Federal Reserve, which could disturb inflation expectations, and he has to face the impact of AI on unemployment, a topic that has been rarely discussed in the past. It is uncommon to see large tech companies laying off employees while simultaneously increasing Capex.

So there are many difficulties, and the final choice remains that simple question: are we more worried about inflation or unemployment? Is the risk of an overheating economy unacceptable, or is the risk of an economic slowdown even more unacceptable?

From Powell's statements, he believes that unemployment is more of a demand-side factor. He still advocates for a balanced view of inflation and unemployment risks, and he thinks that the inflation caused by tariffs is temporary, and that future wage growth is needed to alleviate concerns about prices. I believe he still leans towards a dovish stance. He just does not want to adopt a dovish approach with rate cuts in this meeting, as it would raise concerns about independence, inflation worries, and the risk of cutting rates without sufficient data, especially when existing data is relatively balanced.

Regarding future outlook, I believe there will still be rate cuts in December, as I think the layoffs in large enterprises have not ended, and small businesses will not start hiring. Meanwhile, we should be able to see tariff reductions this morning. I also think that if Trump can secure direct investments of hundreds of billions from Japan and South Korea into the U.S., it would reduce his urgency to collect money from China or other countries through tariffs. It is possible that in the next quarter, Powell will indeed see a easing of tariffs.

Author: Peifengke, Source: Peifengke, Original Title: "The Fed Has Reasons for Hawkish Statements, but Over Time I Think It Will Still Be Dovish" The market has risks, and investment requires caution. This article does not constitute personal investment advice and does not take into account the specific investment goals, financial situation, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article are suitable for their specific circumstances. Investment based on this is at one's own risk