Benefiting from the AI frenzy, "engineering machinery leader" Caterpillar's performance exceeded expectations, and its stock price soared to a record high

Caterpillar's latest quarterly performance far exceeded expectations, with revenue reaching $17.6 billion. Sales in the energy and transportation sectors grew by 17% year-on-year, primarily driven by the power demand from AI data centers, leading to a single-day surge of 12% in its stock price to a new historical high. The company is transforming from a traditional construction machinery manufacturer to a key supplier of AI energy solutions, but there are disagreements on Wall Street regarding its high valuation, while also facing macro challenges such as weak traditional construction demand and tariff costs

The rapid development of artificial intelligence (AI) is unexpectedly reshaping the industrial landscape, with traditional engineering machinery giant Caterpillar becoming a key beneficiary of this wave due to its deep layout in the energy sector.

The company's latest quarterly performance far exceeded market expectations, with strong profitability primarily driven by the surge in power demand from data centers. This positive news propelled its stock price to a historic high, while also prompting Wall Street to scrutinize its high valuation.

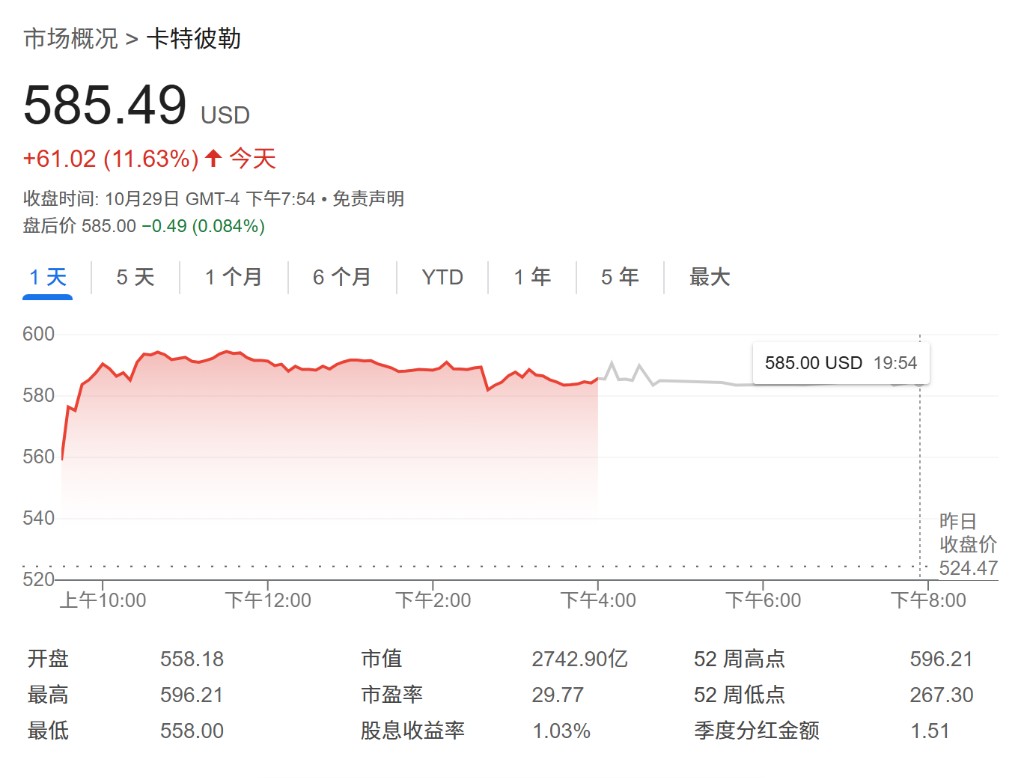

Caterpillar's third-quarter financial report, released on October 29, showed that the company achieved revenue of $17.6 billion, with adjusted earnings per share of $4.95, both surpassing analysts' expectations. Following this news, its stock price soared 12% on the same day, reaching an intraday high of approximately $528. This performance marks a shift in the market's perception of Caterpillar from a traditional manufacturer of construction and mining equipment to an energy solutions provider playing a significant role in AI infrastructure.

The standout segment of the financial report was the Energy and Transportation (E&T) division, which saw sales increase by 17% year-on-year to approximately $7.2 billion. According to Reuters, the development of AI technology has led to a surge in power-hungry data centers, driving strong demand for Caterpillar's generators and backup power systems. This emerging growth engine is helping the company withstand some of the macroeconomic pressures in its traditional business areas.

However, as the stock price hits new highs, there are differing opinions among investors and analysts. Optimists are bullish on the long-term growth potential brought by AI, while cautious observers warn that Caterpillar's current stock price may have already "reflected perfect expectations," making its high valuation particularly vulnerable in the face of weak traditional construction demand and macro headwinds such as tariffs.

Performance Exceeds Expectations, Stock Price Hits Historic High

Caterpillar's latest financial report has injected a strong dose of confidence into investors. According to data compiled by the London Stock Exchange Group (LSEG), the company's third-quarter revenue of $17.6 billion significantly surpassed the Wall Street consensus estimate of $16.77 billion; the adjusted earnings of $4.95 per share also easily exceeded the average expectation of $4.52.

The strong performance quickly triggered a positive response in the market. Following the release of the financial report, Caterpillar's stock price surged 12% in trading on October 29, reaching a record high of $528.45 at one point during the day, adding approximately $10 billion to its market capitalization. Over the course of 2025, the company's stock price has cumulatively risen by about 60%, far exceeding the 17% increase of the S&P 500 Industrial Index, making it one of the best-performing components of the Dow Jones Industrial Average. Its stock price has nearly doubled over the past year, climbing from the $200 range to over $500.

AI Becomes New Engine, Energy Business Stands Out

The core driving force behind Caterpillar's rising performance and stock price stems from the "power anxiety" brought about by the AI revolution. The company's Energy and Transportation division has become the absolute mainstay of growth, contributing 40% of the total revenue Third Bridge analyst Ryan Keeney pointed out that "as CAT maintains its market leadership in backup power applications for data centers, power generation sales are expected to continue sustainable growth."

A recent report from Bank of America referred to Solar Turbines, a wholly-owned subsidiary of Caterpillar, as an undervalued "hidden gem." The report stated that due to the lengthy approval process for new data centers to connect to the grid, on-site power generation is evolving from a backup option to a necessary choice. The small modular turbines produced by Solar Turbines have a delivery cycle of only 18 to 24 months, much faster than the five to seven years required for large equipment, making them highly favored by data center developers.

Public information shows that several well-known projects, including Elon Musk's xAI, Meta, and AI infrastructure developer Crusoe Energy, have adopted products from Solar Turbines. Additionally, Caterpillar has reached agreements with companies such as Hunt Energy and Joule Capital to provide power solutions of up to several gigawatts for large AI data center projects in Texas and Utah, further solidifying its leadership in this field.

Macroeconomic Challenges and Divergence on Wall Street

Despite the bright prospects for AI business, Caterpillar still faces real macroeconomic challenges. The company warned in its financial report that the tariff policies implemented by the Trump administration continue to exert cost pressure. The company expects the adverse impact of tariffs this fiscal year to be between $1.6 billion and $1.75 billion. At the same time, mortgage rates as high as 6.2% and home sales near a 30-year low may indicate that demand in its core construction equipment sector will face ongoing weakness.

Against this backdrop, Wall Street's views on Caterpillar show significant divergence. JP Morgan raised the company's target price to $650, maintaining an "overweight" rating, citing its long-term benefits from AI and energy transition. However, Morgan Stanley warned that Caterpillar's stock price "has reflected its perfect outlook" and downgraded its rating due to signs of weak construction demand. Notably, the average target price of approximately $497 among analysts is currently below Caterpillar's stock price level, indicating that further upside may be limited without new catalysts.

In addition to seizing AI opportunities, Caterpillar is also driving business transformation through strategic acquisitions. The company recently agreed to acquire Australian mining software company RPMGlobal for approximately $1.1 billion in cash, aiming to enhance its technological capabilities in mine planning and asset management software, marking a shift from traditional heavy equipment sales to software and technology services.

For investors, the next key milestone will be the investor day on November 4, where newly appointed CEO Joseph E. Creed is expected to elaborate on the company's future growth strategy. Mr. Creed has held senior positions in the energy and transportation sectors for a long time, and the market expects him to provide clearer guidance on how to further unlock growth potential in this sector. Bank of America analysts believe that the data center business alone is expected to bring Caterpillar an incremental earnings per share of $6 to $8 in the coming years, indicating potential for revaluation In summary, Caterpillar is successfully positioning itself as a key player in AI infrastructure development, but its high stock price means it must execute perfectly to meet the market's extremely high expectations