Rare Earth "Dual Heroes," Performance Soars!

In the rare earth sector, CHINA RAREEARTH and CNRE both reported significant growth in their Q3 2025 financial results. CHINA RAREEARTH's revenue for the first three quarters reached 2.494 billion yuan, a year-on-year increase of 27.73%; net profit was 192 million yuan, a year-on-year increase of 194.67%. CNRE's revenue for the first three quarters was 30.292 billion yuan, a year-on-year increase of 40.50%; net profit was 1.541 billion yuan, a year-on-year increase of 280.27%. Although there was a decline in performance for the third quarter, there are clear signs of overall market recovery, with the rare earth price index significantly rising in July and August

Recently, the "Southern and Northern Giants" in the rare earth sector—CHINA RAREEARTH and CNRE—successively disclosed their financial reports for the third quarter of 2025. Both companies showed significant growth in their performance for the first three quarters, demonstrating a strong recovery momentum in the industry.

"Southern and Northern Giants" Performance Surge in the First Three Quarters

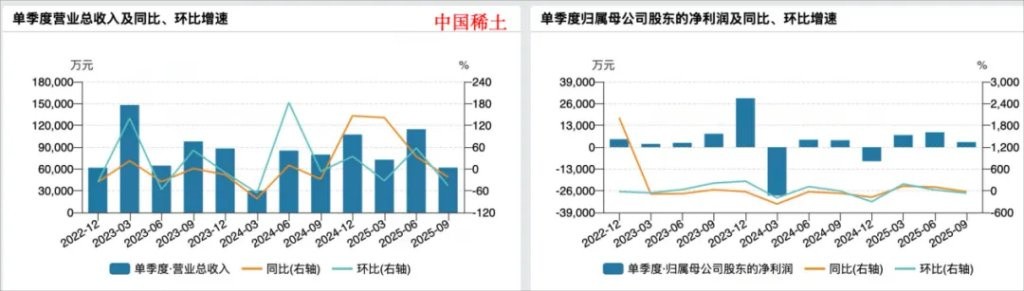

On October 29, CHINA RAREEARTH released its financial report for the third quarter of 2025. The data showed that the company achieved an operating income of 2.494 billion yuan in the first three quarters, a year-on-year increase of 27.73%; the net profit attributable to shareholders of the listed company was 192 million yuan, a year-on-year increase of 194.67%.

CHINA RAREEARTH stated that the performance growth was mainly due to the rebound in rare earth product prices, adjustments in the sales structure, and the formal production of subsidiaries.

However, from a quarterly perspective, the third quarter achieved an operating income of approximately 619 million yuan, a year-on-year decrease of 22.4%; the net profit was 30.47 million yuan, a year-on-year decrease of 26.43%.

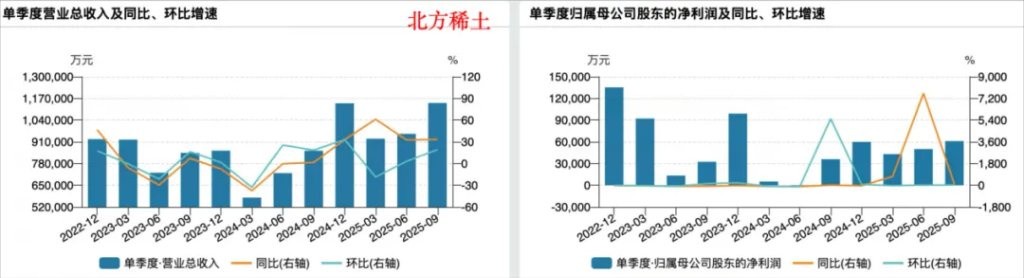

CNRE also delivered impressive results. In the first three quarters of 2025, the company accumulated revenue of 30.292 billion yuan, a year-on-year increase of 40.50%; the net profit attributable to the parent company was 1.541 billion yuan, a year-on-year surge of 280.27%.

From a quarterly perspective, CNRE achieved revenue of 11.425 billion yuan in the third quarter, a year-on-year increase of 33.32%; the net profit attributable to the parent company was 610 million yuan, a substantial year-on-year increase of 69.48%.

Regarding the limited quarter-on-quarter growth in the company's third-quarter performance, CNRE's General Manager Qu Yedong responded at the earnings briefing on October 29, stating that the product sales structure changed in the third quarter, with an increase in the sales of metals purchased and reprocessed by the market. Due to the cost differences of these products, although both sales volume and prices increased in the third quarter, the gross profit margin decreased quarter-on-quarter.

Price Stabilization Supports Industry Recovery

The rare earth market is showing signs of recovery. For example, the rare earth price index from the China Rare Earth Industry Association showed a significant upward trend in July and August of this year, reaching a new high of 233.2 points in mid-August, nearly a 43% increase compared to the end of 2024.

"Although affected by factors such as international trade, market orders and product prices have been impacted to some extent, stable domestic demand has provided strong support for the rare earth market. The overall activity level of the rare earth market is better than the same period last year, and with the continuous recovery of orders from production enterprises, the prices of mainstream rare earth products are rising." Northern Rare Earth stated in its semi-annual report.

"Although affected by factors such as international trade, market orders and product prices have been impacted to some extent, stable domestic demand has provided strong support for the rare earth market. The overall activity level of the rare earth market is better than the same period last year, and with the continuous recovery of orders from production enterprises, the prices of mainstream rare earth products are rising." Northern Rare Earth stated in its semi-annual report.

Debang Securities' research report pointed out that rare earths, as core resources for high-end manufacturing and strategic emerging industries, are showing a resonance pattern on both the supply and demand sides. On one hand, China has strengthened the strategic initiative of the industrial chain through quota management and export controls, ensuring that resources tilt towards high-end application segments; on the other hand, the global green transition and "dual carbon" goals continue to drive demand for key elements such as praseodymium and neodymium, rapidly expanding emerging applications like permanent magnetic materials. Against the backdrop of increased supply concentration and upgraded demand structure, the strategic position of the rare earth industry chain is expected to be further consolidated, injecting long-term driving force into high-end manufacturing development.

On the evening of October 10, Baotou Steel and Northern Rare Earth announced an adjustment to the related transaction price of rare earth concentrates for the fourth quarter of 2025, with the transaction price adjusted to RMB 26,205 per ton (excluding tax, dry weight, REO=50%, for every 1% increase or decrease in REO, the price will increase or decrease by RMB 524.10 per ton), a month-on-month increase of 37.13%, marking a new high in recent years.

As the fundamentals of rare earths improve and product prices rise, the stock prices of individual stocks in the rare earth sector have significantly increased.

As of the close on October 29, Northern Rare Earth's stock price has risen by 144.51% this year, ranking first in the rare earth sector. The stock prices of Shenghe Resources and Guangsheng Nonferrous have both doubled this year, and the stock price of China Rare Earth is also close to doubling.

Author of this article: Niu Siruo, Source: China Fund News, Original title: "Rare Earth 'Dual Giants', Performance Surge!"

Risk Warning and Disclaimer

The market has risks, and investment requires caution. This article does not constitute personal investment advice and does not take into account the specific investment goals, financial conditions, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article are suitable for their specific circumstances. Investment based on this is at one's own risk