Forget about gold, now is the shining moment for aluminum

Aluminum prices have risen to a three-year high, approaching the historical range top. The demand surge is driven by electric vehicles, solar energy, and data centers, while China's production capacity is nearing the limit of 45 million tons. The future market may oscillate between two scenarios: either aluminum prices reach new highs and push up global costs, or China stabilizes supply by expanding production through Indonesia. Analysts suggest that the reality may be a coexistence of both—rising prices alongside Chinese companies taking the lead

Aluminum, a metal lacking the vitality of copper and the geopolitical allure of rare earths, is becoming the focus of the current market.

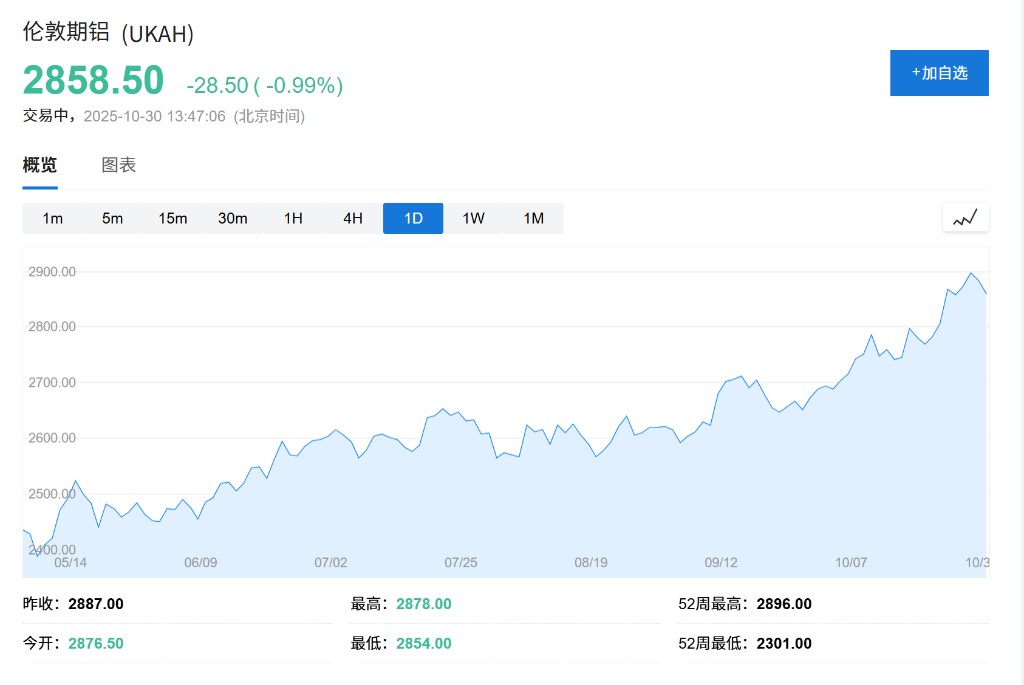

Recently, aluminum prices are trading near a three-year high of nearly $2,900 per ton. Although it is still some distance from the historical record, the current price is at the top 5% of the price range from 1990 to 2025, reaching a historical high. From an annual average perspective, this year's price level is heading towards the fourth highest on record.

According to a previous article by Wall Street Insight, Citigroup analysts predict that the global surplus of primary aluminum supply will rapidly narrow by 2026, and a supply gap of about 1.4 million tons will emerge starting in 2027, accounting for 2% of total primary aluminum consumption. Meanwhile, rapidly growing industries such as electric vehicles, solar power generation, and data centers are driving a surge in aluminum demand. As the world's largest aluminum producer and consumer, China is approaching its annual production capacity limit of 45 million tons.

This situation brings two distinctly different expectations to the market. Bulls believe that a structural shortage is brewing, which could push aluminum prices to a historical high of $4,000 within a few years; while bears expect that aluminum production companies will manage to increase output through overseas expansion, ultimately leading to a price decline. Analysts believe that for the entire world, this seems to be a binary outcome: either aluminum prices rise and impact the global economy, or the global supply chain becomes more reliant on Chinese companies operating overseas.

Silent Price Boom

While political leaders focus their attention on metals like copper, germanium, and rare earths, aluminum rarely makes headlines. However, it is crucial to modern life, permeating every corner of the global economy—from airplanes, iPhones, window frames, and soda cans to electric vehicles and household appliances. The annual consumption value of aluminum is close to $300 billion, making it the largest market size among all nonferrous metals, second only to steel in black metals.

Electric vehicles are the biggest driver of aluminum demand growth. According to a report by CRU Group, electric vehicles use about 150 pounds more aluminum on average than internal combustion engine vehicles, mainly due to aluminum's high strength-to-weight ratio, which helps reduce vehicle weight and extend range. In the solar power generation sector, aluminum is the second largest metal input after steel. In power transmission, aluminum is becoming a substitute for copper due to its lower price, lighter weight, and suitable conductivity. In data center construction, aluminum is widely used in heat sinks, cooling systems, and structural frameworks.

Unlike other commodities, aluminum's raw materials, such as bauxite, are abundant in the Earth's crust. However, a century ago, the process of refining it into pure metal was so complex and expensive that it was considered a precious metal. However, after the invention of a new refining technology, aluminum quickly became popular. But the refining process has a key constraint: it is a massive energy-intensive process, leading to aluminum often being referred to as "solid-state electricity." The amount of electricity required to produce one ton of aluminum is equivalent to the annual electricity consumption of five German households At this time, Chinese aluminum companies have taken the stage. According to data from the U.S. Geological Survey, China has gained an energy advantage necessary for producing large quantities of aluminum, thanks to the power provided by coal-fired power plants. Over the past 25 years, China has met the incremental global demand for aluminum. Last year, China's primary aluminum production exceeded 43 million tons, compared to only 6 million tons 25 years ago, currently accounting for nearly 60% of global output. However, China is now approaching its annual capacity limit of 45 million tons.

Is Supply Tightening?

Multiple factors point to a potential supply tightness. First, demand remains strong, growing by about 2-3 million tons each year. Second, production in other parts of the world is struggling, especially in Europe, where long-term cheap electricity contracts are expiring, and smelters are still closing even with high aluminum prices. Third, global inventories are at historically low levels. Finally, with copper prices reaching all-time highs, the economic incentive to substitute aluminum for copper is very clear in any possible scenario.

A key variable in market pressure is Indonesia. Chinese aluminum production companies are looking overseas to build new smelters in Indonesia.

If all new smelters can be put into operation, Indonesia's aluminum production could increase fivefold by 2030, making it the world's fourth-largest producer after China, India, and Russia, thus maintaining ample supply in the global market.

However, past successes in the nickel market do not guarantee a complete replication in the aluminum market. On one hand, the cost of building aluminum smelters in Indonesia seems higher than in China, which may slow the pace of expansion. On the other hand, Indonesia does not have the technological breakthroughs necessary to change the aluminum metallurgy landscape.

Analysts believe that for the world as a whole, this seems to be a binary outcome: either aluminum prices rise and impact the global economy, or the global supply chain becomes more reliant on Chinese companies operating overseas.

According to Bloomberg columnist Javier Blas, the most likely outcome is a third scenario: aluminum prices will rise, but not as wildly as bulls bet; meanwhile, China's overseas production achieved through countries like Indonesia will also increase, but not to the extent that bears hope for. The market may have to adapt to both higher prices and a deeper reliance on the Chinese supply chain