In the AI boom, "black swans" are lurking: rising energy consumption in data centers may push up interest rates

In the wave of artificial intelligence, analyst Eugenio Catone warned of potential black swan events, particularly that rising energy consumption in data centers could drive up interest rates. Despite strong GDP growth in the United States and inflation impacts being lower than expected, historical inflation issues have not been resolved quickly. Catone pointed out that factors such as tariffs, geopolitical issues, and Federal Reserve policies could lead to a resurgence of inflation, necessitating vigilance against future economic fluctuations

According to Zhitong Finance APP, the current development boom in artificial intelligence is exciting, but it is also necessary to be wary of potential black swan events. Companies are investing billions of dollars in this field, the stock market continues to rise, and the Federal Reserve seems inclined to cut interest rates and end its quantitative tightening policy. Currently, the actual Gross Domestic Product (GDP) growth in the United States is strong, the impact of tariffs on inflation is lower than expected, and energy prices are also at relatively low levels.

The shadow of economic recession has never seemed so distant. Financial analyst Eugenio Catone has suggested that AI may face black swan events, and two charts are particularly noteworthy.

In the chart, the green line represents the gold price trend drawn two years in advance, while the blue line represents the yield on 10-year U.S. Treasury bonds. It is evident that gold prices often predict the direction of 10-year U.S. Treasury yields two years in advance. Currently, analysts are predicting how much the Federal Reserve will cut interest rates in its upcoming meetings, with no one anticipating the opposite scenario. Given that the current inflation rate is trending towards normal, the prediction that the Federal Reserve will adopt a more aggressive hawkish stance than in 2022 seems unfounded. This is also why Catone views the potential subsequent developments as black swan events. The other chart is as follows:

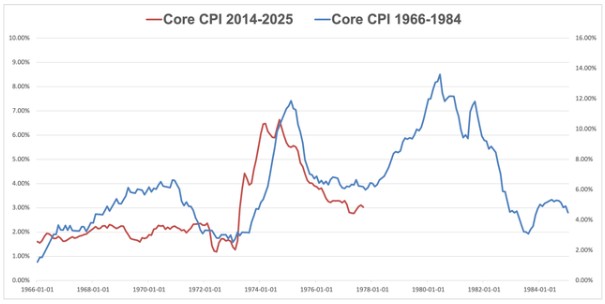

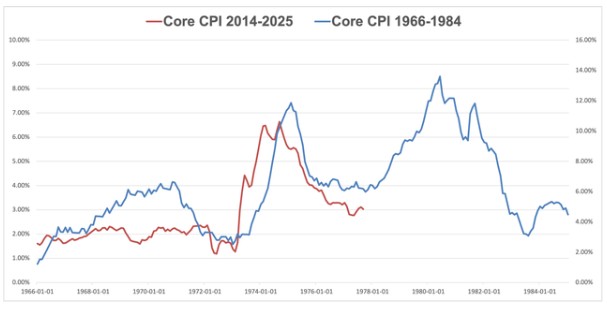

In the 1970s and 1980s, inflation was a significant problem, and it was not resolved within three years. In fact, the scale of the second wave of inflation was larger and lasted longer. When comparing the current inflation trend with that of the past, the similarities are hard to deny. It seems we are about to face a second peak of inflation, but there is a question: why can the inflation rate rise sharply in just a few quarters? In this regard, Catone has summarized four main reasons:

-

The inflation-boosting effect of tariffs takes longer to fully manifest.

-

The Federal Reserve has not learned from past mistakes. Despite strong actual GDP growth, interest rates are still planned to be lowered. By the time Powell's term ends (May 2026), the policy ideas of the new Federal Reserve Chair may align more closely with the current government's stance.

-

The geopolitical situation is far from calm, which may lead to rising prices for energy commodities, with Russia playing a key role.

-

Companies are investing hundreds of billions of dollars in building artificial intelligence infrastructure, but few truly understand the scale of energy consumption of these facilities. Such investments may drive up overall energy costs, thereby exacerbating inflation.

The following text will focus on the last reason. Research has found that these investments in the field of artificial intelligence will affect your electricity bill, the scale of investments in specific states, and even the overall electricity consumption in the United States.

Artificial Intelligence Requires Huge Energy Consumption

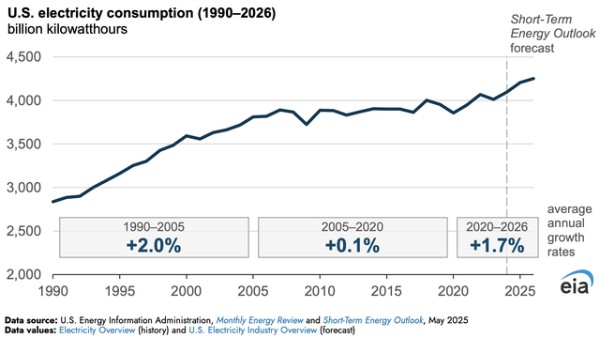

From 2005 to 2020, electricity consumption in the United States remained relatively stable, but now, driven by the popularity of artificial intelligence, U.S. electricity consumption has entered a new growth phase

Currently, people are gradually getting used to integrating artificial intelligence into their lives: consulting ChatGPT for various questions and using more cloud services. In just a few years, lifestyle habits have changed, but there is a hidden issue behind this: the demand for energy will far exceed previous levels.

The last time there was a similar surge in energy demand was during the period from 1990 to 2005, when the internet became widespread, and billions of people began to access the internet. It was a groundbreaking era, and since then, global electricity consumption has never returned to previous levels. The current rate of increase in electricity consumption is the same as it was then, as new data centers require more energy to operate normally.

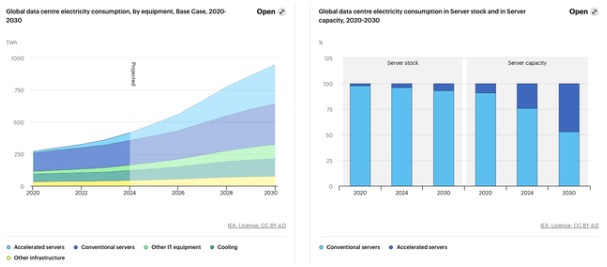

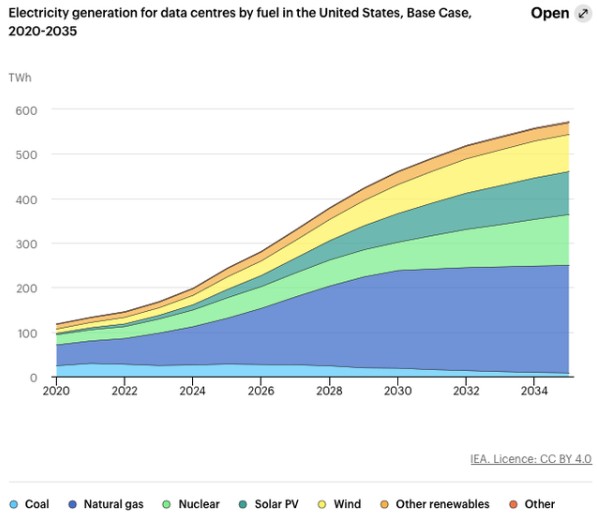

According to estimates by the International Energy Agency (IEA) for 2024, the total electricity consumption of data centers will reach 415 terawatt-hours, accounting for about 1.5% of global electricity consumption. In the IEA's baseline scenario forecast, this consumption will increase to 945 terawatt-hours by 2030, raising its share of global electricity consumption to 3%.

A 3% share may seem insufficient to trigger a significant increase in global energy demand (and thus push up related costs), but two factors must be considered: first, the forecast results may have biases; second, the current energy infrastructure may not be able to cope with such a large-scale increase in demand.

First, accurately predicting the energy consumption scale of artificial intelligence is extremely difficult.

Fatih Birol, Executive Director of the International Energy Agency, stated, "Artificial intelligence is one of the most discussed topics in the energy sector today, but so far, policymakers and the market lack adequate tools to understand its broad impacts.

In the next five years, global electricity demand from data centers will more than double, and by 2030, their consumption will be equivalent to the total electricity consumption of Japan today. Some countries will be particularly affected.

For example, in the United States, the growth in electricity demand from data centers will account for nearly half of the total growth in national electricity demand; in Japan, this proportion will exceed half; in Malaysia, it will also reach one-fifth."

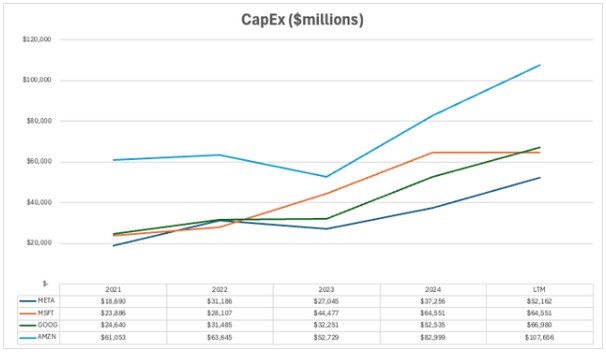

Currently, the investment scale in the artificial intelligence data center sector is growing rapidly, making it difficult to track all related investment dynamics in real-time.

Can Infrastructure Support Demand Growth?

Bank of America points out that the existing transmission and distribution network cannot meet the energy demand brought by artificial intelligence, so utility companies need to invest heavily in upgrading infrastructure. However, these companies are unwilling to bear the entire investment cost alone and have shifted some of the costs to consumers. Clearly, without the demand from artificial intelligence, utility companies would not need to accelerate the renovation process of existing infrastructure.

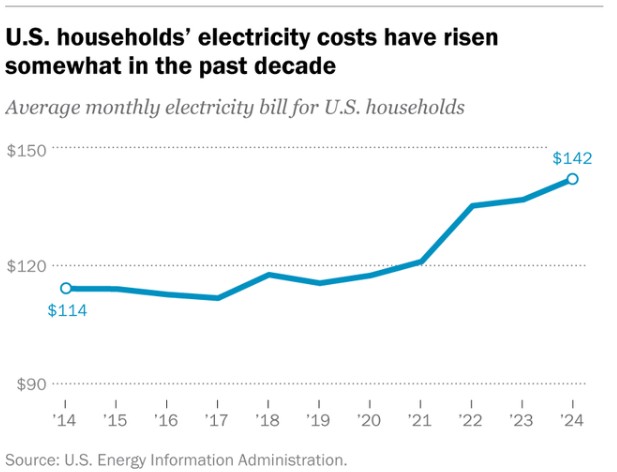

Bank of America Global Research believes that the rising electricity demand driven by data center construction and manufacturing growth has begun to be reflected in residential electricity prices. Its impact is mainly manifested in the fact that the expenditures required to upgrade the transmission and distribution network for data center construction will be incorporated into the electricity prices for all users (residential, commercial, and industrial) under that grid system, thereby driving up energy prices and capacity prices.

Bank of America Global Research believes that the rising electricity demand driven by data center construction and manufacturing growth has begun to be reflected in residential electricity prices. Its impact is mainly manifested in the fact that the expenditures required to upgrade the transmission and distribution network for data center construction will be incorporated into the electricity prices for all users (residential, commercial, and industrial) under that grid system, thereby driving up energy prices and capacity prices.

The setting of capacity prices is to ensure that future electricity demand can be reliably met. The Bank of America research department uses the capacity auctions of the PJM Interconnection in the Mid-Atlantic region of the United States as an example to illustrate the pressure of rising costs. PJM is a regional transmission organization that serves approximately 65 million users in the eastern United States, responsible for electricity dispatch and system reliability in 13 states, and determines the electricity capacity prices for these states through public competitive auctions.

PJM's capacity auction prices have increased fivefold: the auction price for the delivery period of 2023-2024 (from June to May of the following year) was $34 per megawatt-day, which has risen to $269 per megawatt-day by 2025-2026. In the auction for the 2026-2027 delivery period, influenced by the price cap agreed upon between the Governor of Pennsylvania and PJM, the capacity price was ultimately set at $329 per megawatt-day; without this cap, the price would have reached $388 per megawatt-day.

The rise in electricity prices alone is not enough to trigger an economic recession, but it is undoubtedly a factor that needs attention. Currently, companies are still increasing capital expenditures in the field of artificial intelligence, and the market has already seen preliminary impacts such as rising energy costs.

Currently, data centers are highly dependent on natural gas, and it is expected that natural gas demand will continue to rise until 2030. Renewable energy cannot fully replace fossil fuels (even in ten years, this is unlikely), and the construction and commissioning of nuclear power plants require a long time. However, the demand for energy from artificial intelligence is urgent, and it is best to obtain it at a low cost—fossil fuels happen to meet these conditions, especially oil.

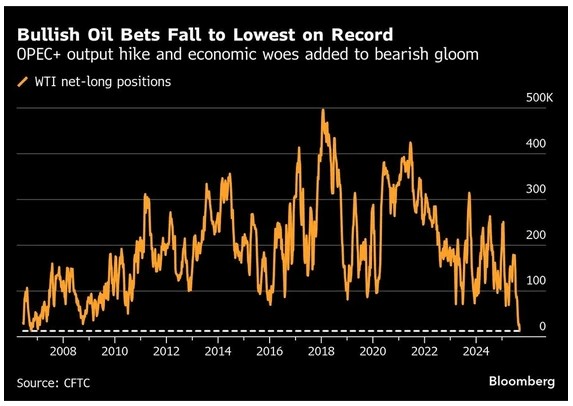

Over the past 20 years, crude oil prices have remained relatively stable, and when considering actual purchasing power, oil prices are even lower. It seems that no one favors oil anymore, but in a society with unprecedented energy demand, this indifferent attitude may be difficult to sustain. During the period of internet expansion, U.S. energy consumption surged, and oil prices also saw a significant increase—between 1997 and mid-2008, oil prices rose by nearly 600% This is not a prediction that oil prices will experience such astonishing increases in the coming years, but it would not be surprising if oil prices start to rise again. It is well known that oil is an important factor affecting inflation rates, so if this prediction comes true, the number of interest rate cuts by the Federal Reserve in the coming year may be less than expected. In the worst-case scenario, if oil prices double from current levels, it would trigger a second wave of inflation peaks, making interest rate cuts completely hopeless.

At that time, the Federal Reserve may be forced to raise interest rates rapidly, which would lead to a sharp decline in both the stock and bond markets. Once this happens, the government will be unable to refinance maturing debt at low costs, and interest expenses will exceed expectations, creating a huge problem that will not only affect the United States, as the interconnectedness of the global economy is well known.

Overall, this bearish view largely depends on the trend of oil prices: if oil prices remain stable, the so-called second wave of inflation peaks may not occur. However, the following chart is also worth noting.

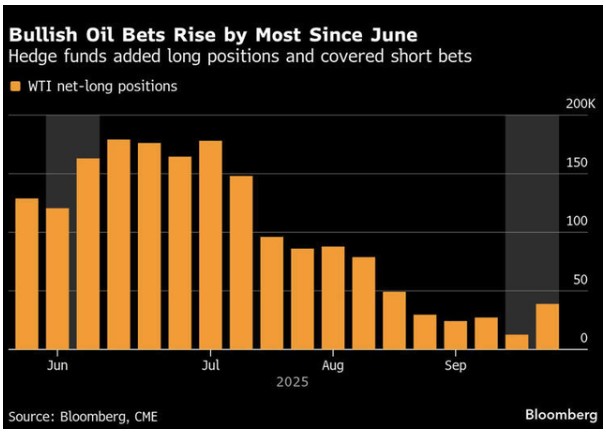

Currently, market sentiment towards oil ("black gold") is at a historical high of bearishness, which is quite unusual, especially since we are in a period of extremely high energy consumption demand. However, some institutions have noticed this contradiction: hedge funds have begun to increase their net long positions in oil.

Conclusion

The AI boom is driving the stock market to record highs, but the significant correlation between gold prices and the 10-year U.S. Treasury yield suggests that the economic situation in 2026 may not be so optimistic. It is uncertain whether this correlation will persist, but if it does, rising energy prices will be a major reason for increasing interest rates.

Although current oil prices are relatively low, inflation rates are still slightly above target levels. If the construction of AI infrastructure leads to increased electricity demand, thereby pushing up oil prices, this will become a significant issue that needs to be addressed. Additionally, tariffs, interest rate cut policies, and geopolitical tensions may further accelerate inflation.

Historical experience shows that the inflation problem has not been completely resolved, and a second wave of inflation could become a black swan event—currently, no one is factoring in the possibility of rising interest rates in 2026 into pricing considerations