Weak job market and cooling real estate hide concerns beneath the strong performance of US stocks

The U.S. real estate market is under pressure, with a weak job market undermining consumer confidence and demand, potentially triggering an economic recession and stock market adjustment. Despite U.S. stocks reaching new highs, deteriorating employment data and cooling housing prices have potential homebuyers waiting on the sidelines due to uncertainty. High housing prices are shrinking household wealth, leading to decreased consumer spending and creating a vicious cycle. Market sentiment is shifting, with buyers waiting for lower interest rates, which may lead to further declines in housing prices

Despite the fact that U.S. stocks seem to be hitting new highs every day, there are significant concerns regarding the U.S. job market and housing prices. In recent months, employment data has deteriorated significantly, and housing prices have also cooled considerably. As consumers need to have confidence in job security when purchasing homes, uncertainty may deter potential buyers. This worsening data and lack of confidence in the job market may further deteriorate in the coming months, and more layoffs related to artificial intelligence may follow.

There is a viewpoint that the Federal Reserve lowering interest rates would inject new vitality into the real estate market, but analysis from the Mortgage Bankers Association indicates otherwise. If the job market worsens, it may reduce demand for housing, while housing prices are already at historical highs for many Americans, making them unaffordable. When housing prices fall, American household wealth shrinks, and consumer spending often declines. All of this could lead to a vicious cycle of economic recession, with the economy gradually weakening and ultimately falling into recession.

Dramatic Changes in the U.S. Real Estate Market in 2025

The spring housing sales season of 2025 is very different from the past few years. During and even after the pandemic, extremely low mortgage rates of 3% or even lower triggered bidding wars for homes ranging from starter homes to luxury properties. Buyers in California often bid hundreds of thousands of dollars above asking prices, with some bids exceeding $500,000 and $1 million. But now, all of that has changed, and in many areas of the U.S., sellers are being forced to lower prices and make concessions to close deals. There has been a significant shift in market sentiment.

When housing prices were rising and bidding prices were hitting new highs, buyers felt it was best to buy now to avoid further price increases, which triggered a buying frenzy and pushed prices higher. However, the situation has now reversed, with prices falling and many buyers waiting for rates to drop. This has led many potential buyers to adopt a wait-and-see attitude, as they believe it is not worth buying now with prices falling and future rates possibly lower.

As more potential buyers wait for better deals, housing prices may further decline, while at the same time, sellers are facing increased pressure as inventory rises. This dynamic could lead sellers to flood the market with new listings, and more inventory would put greater downward pressure on prices. Many potential sellers were previously reluctant to sell due to their low mortgage rates, but if prices fall, they may sell their properties before prices drop further.

The Mortgage Bankers Association Expects High Mortgage Rates and Falling Prices in 2026

Many home buyers and sellers originally thought that rates would be much lower by now. However, due to concerns about inflation, the Federal Reserve has delayed rate cuts. Although the Fed cut rates by 25 basis points in September and is expected to cut more, the problem is that the yield on the 10-year U.S. Treasury has not fallen significantly, which is a key factor affecting mortgage rates. In summary, more rate cuts may lower short-term rates, but due to concerns about inflation and the U.S. government's high debt, they may not help reduce long-term rates like mortgages. The Mortgage Bankers Association recently released some forecasts for 2026, with its economists believing that mortgage rates will remain above 6% in 2026. The association's Deputy Chief Economist Joel Kan believes that inventory will increase, prices will fall, and mortgage rates will remain high He expects that housing prices across the United States will continue to decline for several quarters in the coming years.

A recent article detailing his views pointed out: "Although mortgage rates are not expected to decline further, the increase in housing supply in recent months will ease the upward pressure on housing prices and provide potential buyers with more housing options. The increase in inventory will put downward pressure on national housing prices."

Analysis indicates that mortgage rates will remain high in 2026, and once home sellers realize that relief measures will come in the form of lower mortgage rates, they will lower prices in 2026; new home developers have made significant concessions, which may signal what is about to happen in the second-hand housing market in 2026.

U.S. Housing Prices Are at Unsustainable High Levels

U.S. housing prices are close to historical highs, and coupled with high mortgage rates, most people cannot afford to buy a home. This is especially true for first-time homebuyers or those who have not previously benefited from any asset appreciation in real estate. A recent media article noted that since the pandemic began, U.S. housing prices have risen by more than 40%, with historically low mortgage rates from 2020 to 2022 triggering a buying frenzy, but a long-term nationwide supply shortage has conflicted with this. This shortage continues, leading to a significant surge in housing prices over the past five years, making it more difficult for millions of Americans to purchase homes.

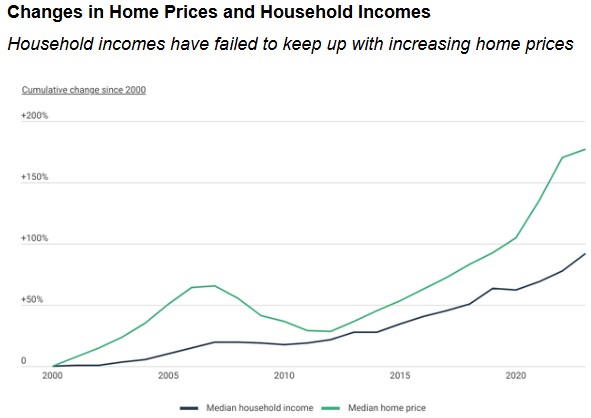

The rapid increase in housing prices over the past few years has far exceeded household income levels. Analysis indicates that this disconnect from the economic reality of household income is clearly visible, and housing prices are about to return to reality.

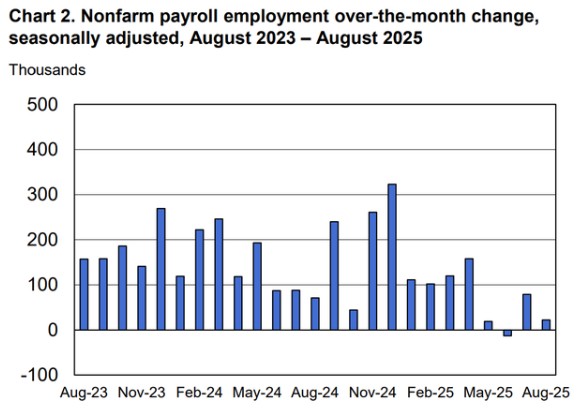

Concerns about the U.S. job market and ongoing layoffs related to artificial intelligence may harm the real estate market and the economy. The non-farm payroll report on September 5 confirmed the weakness in the labor market, and data from previous months was also revised downward. The expected increase in non-farm payrolls for August was 75,000, but only 22,000 jobs were added, with the unemployment rate rising from 4.2% to 4.3%. Additionally, data from March had also been significantly revised downward.

In just the past few days, several large companies in the U.S. have announced large-scale layoffs, some of which have been attributed to artificial intelligence. For example, Chegg (CHGG.US) announced it would cut 45% of its workforce due to "the reality of artificial intelligence." United Parcel Service (UPS.US) also announced it has recently cut 48,000 jobs. Amazon (AMZN.US) also recently announced it would cut about 30,000 jobs These news reports may lead American households to be more cautious in their daily spending, especially for large purchases such as home buying. Moreover, this might just be the beginning of large-scale layoffs related to artificial intelligence, with some estimates suggesting that the total number of such layoffs could reach 100 million jobs over the next decade. Currently, new job opportunities are mainly concentrated in some high-end positions. Additionally, analysis indicates that the U.S. government shutdown will have some tangible effects on the economy, as it has lasted nearly a month. The longer it continues, the greater the potential damage to the economy and consumer confidence, which may be reflected in data over the coming months.

However, the Federal Reserve lowered interest rates in September and is expected to announce further rate cuts. This could be enough to boost the economy and stabilize the sluggish job and real estate markets. If the job market and real estate market no longer continue to deteriorate, the economy may accelerate again, and the upward trend in the U.S. may also expand. President Trump has signed several trade agreements, including large-scale new investments and potential job creation in the U.S., which also helps stabilize the job market.

Conclusion

Consumers are anxious about the uncertainty in the job market, and more potential homebuyers are postponing their home buying plans, while some home sellers feel it is necessary to significantly lower prices. The situation in the real estate market and job market has changed, and momentum is a powerful force. Once the process in one direction begins to advance, it is difficult to stop its further strengthening, especially in large markets like real estate and employment. The combined effects of the deterioration of the U.S. job market and persistently high mortgage rates are likely to put pressure on housing prices before 2026. In turn, this is also likely to put pressure on the economy in the coming months. This could lead to economic growth panic or recession, triggering significant adjustments in the U.S. stock market