Inflation causes low-income consumers to "significantly decline," marking the third reduction in income expectations this year, as shares of American chain restaurant giant Chipotle plummet

High inflation forces American consumers to cut back on dining out, and fast-food giant Chipotle has lowered its sales forecast for the third time this year, with its stock price plummeting over 16% in after-hours trading. Analysts warn that consumer weakness is spreading from low-income groups to middle and high-income tiers, leading to an overall slowdown in the U.S. restaurant industry

Due to ongoing inflationary pressures leading consumers, especially low-income groups, to reduce dining out, American fast-food giant Chipotle Mexican Grill has lowered its sales forecast for the third time this year, raising investor concerns about its future growth.

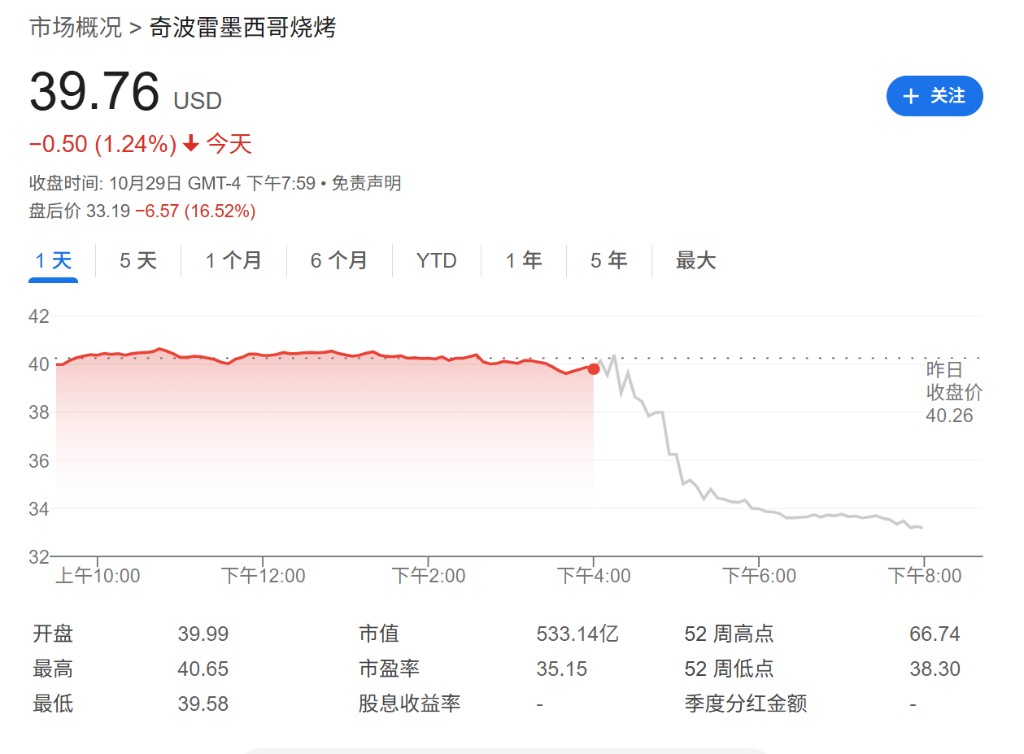

In its latest outlook released on Wednesday, Chipotle stated that due to "ongoing macroeconomic pressures" eroding its sales in the most recent quarter, the company has revised its performance guidance. Following this announcement, its stock price plummeted in after-hours trading, falling as much as 16.5%.

Company CEO Scott Boatwright said in a call with analysts, "Consumers are feeling the pressure, and we are feeling their retreat." He added that customers lost by Chipotle are turning to grocery stores rather than other chain restaurants, indicating that people are choosing to cook at home to save money.

This performance warning comes from a benchmark brand in the American dining industry, suggesting that the pressure of consumption downgrade may no longer be limited to low-income groups but is beginning to affect middle and high-income consumers. This also provides new evidence for the "widespread slowdown" that has emerged in the entire dining industry since September, casting a shadow over the outlook for industries reliant on discretionary consumer spending.

Stock Price Plunge and Pessimistic Expectations

The latest guidance released by Chipotle is at the core of its bleak outlook. The company stated that it expects comparable restaurant sales to decline in the "low single digits" by 2025. This sharply contrasts with the company's initial forecast in February, when it anticipated sales growth in the "mid to low single digits" for the year.

This is the third time Chipotle has lowered its sales forecast this year, and this series of pessimistic adjustments has shaken investor confidence, with its stock price plunging 16.5% in after-hours trading.

Behind Chipotle's lowered performance guidance is a significant change in consumer behavior. Scott Boatwright revealed that the company has observed a "substantial pullback in spending" among households earning less than $100,000, with these customers reducing their frequency of dining out. This detail indicates that the inflationary squeeze on household budgets is becoming increasingly evident.

Although Chipotle saw a 0.3% increase in comparable restaurant sales for the quarter ending in September, reversing a decline over the previous two quarters, this slight growth was offset by a 0.8% drop in transaction volume. This means that the number of customers visiting restaurants is actually decreasing, and the growth in sales may be more attributable to price increases rather than an increase in foot traffic.

Industry-Wide Slowdown and Heightened Economic Uncertainty

Chipotle's predicament is not an isolated case but a reflection of a broader industry trend. William Blair analyst Sharon Zackfia pointed out that there has been a "widespread slowdown" in the American dining industry since September According to data from mobile phone location intelligence company Placer.ai, the foot traffic of fast-casual restaurants grew only 0.7% in the third quarter, far below last year's growth of 1% during the same period.

The clouds hanging over the consumer market include "ongoing economic uncertainty" and a four-week government shutdown that resulted in over 1 million federal employees losing their paychecks, further weakening consumer spending power. This pessimism is spreading, with Brinker International, which owns chain brands like Chili's, seeing its stock price drop 7.5% on Wednesday. Although the company maintained its full-year performance guidance, this move also hinted at its expectations for a slowdown in future sales