AI benefits are greater than expected! Demand is surging, profit margins are extremely high, and "hard drive giant" Seagate Tech's stock price has soared to a new high

The surge in data storage demand driven by AI has led Seagate Tech to deliver an earnings report that exceeded expectations: quarterly revenue reached $2.63 billion, a year-on-year increase of 21%, with a gross margin target of 40% achieved ahead of schedule. The company expects revenue to hit a new high next quarter, with AI-driven large-capacity hard drive orders already booked through 2026. The company's stock price soared nearly 20%, reaching an all-time high, and analysts have raised their target prices, optimistic about its leading position in the AI storage wave

The data storage demand triggered by AI is reshaping the hard drive market landscape with unprecedented intensity. Driven by this, hard drive manufacturer Seagate Tech saw its stock price soar to an all-time high on Wednesday, thanks to significantly better-than-expected quarterly performance and strong future guidance.

The financial report shows that for the first quarter of the fiscal year ending in September, Seagate Tech's adjusted earnings per share were $2.61, a 65% year-on-year increase, significantly higher than the $2.40 expected by FactSet analysts. During the same period, sales grew by 21% to $2.63 billion, also exceeding the market's general expectation of $2.55 billion, indicating extremely strong demand in the AI and data center markets.

According to news from the trading desk, Morgan Stanley stated in a research report released on the 29th that this excellent performance was due to more favorable pricing and a shift towards a product mix of high-capacity hard drives. Data shows that over 80% of the capacity of nearline hard drives shipped in that quarter was 24TB or higher.

Looking ahead, Seagate expects sales for the current quarter to reach $2.7 billion (midpoint of the range), again higher than analysts' forecast of $2.67 billion. The company's CEO Dave Mosley revealed to analysts that AI is profoundly changing hard drive demand, with cloud market contracts for high-capacity hard drive production already booked through 2026, and visibility for demand through 2027 is "clear."

The strong performance and optimistic outlook quickly ignited market enthusiasm. Seagate's stock price closed up 19.1% on Wednesday, at $265.62, setting a new historical high. So far this year, the data storage giant's stock price has risen by over 200%. Its competitor Western Digital also benefited from this, rising 15% on Wednesday.

Performance Exceeds Expectations, Gross Margin is the Highlight

According to the data released by Seagate, its revenue for the first quarter of fiscal year 2026 reached $2.63 billion, a year-on-year increase of 21.3%, exceeding Morgan Stanley and the market's general expectation by 3%. This growth was primarily driven by the data center business, with nearline hard drive shipments reaching 159EB (Exabytes), a year-on-year increase of 39%.

Morgan Stanley stated that the most striking metric in the financial report was the gross margin. The company's non-GAAP gross margin for the quarter reached 40.1%, exceeding market expectations by 150 basis points, and achieving the company's target gross margin of 40% two to four quarters ahead of schedule.

Wedbush analyst Matt Bryson also noted that Seagate's profit margins exceeded expectations, providing upward momentum for the stock price. He pointed out:

"The previous expectation was that Seagate would achieve a 40% gross margin (GMs) by the end of the calendar year, but they reached this goal a quarter early."

More importantly, Seagate's guidance for the second fiscal quarter indicates that its gross margin will reach approximately 41%. Bryson added:

"Assuming the management remains conservative as always and the company executes as planned, we would not be surprised if Seagate ultimately exceeds this expectation."

Analysts Bullish: Market "Extremely Thirsty for Storage"

Seagate's management reiterated that there are no new plans for hard disk drive systems or head/disk capacity in the industry. "Our so-called capacity increase strategy is achieved through product transformation," Mosley said:

"We are not actually increasing unit capacity."

After Seagate's earnings report, Wall Street analysts raised their target prices and reaffirmed their optimistic outlook on the growth of AI-driven storage demand.

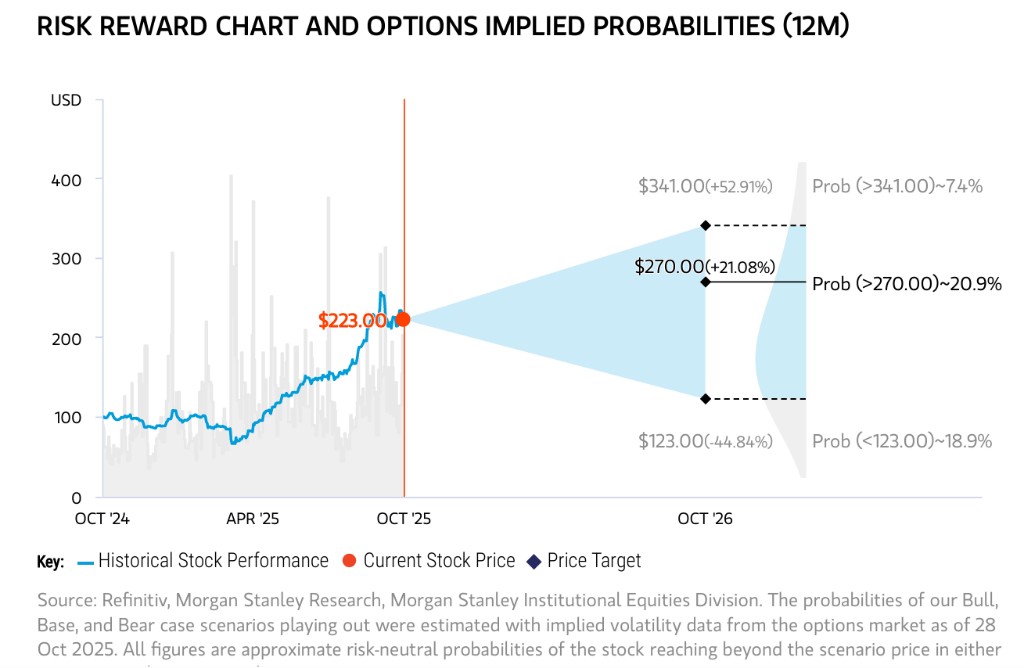

Morgan Stanley raised its net profit expectations for Seagate for the fiscal years 2026 and 2027 by 5-7%, increasing the target price from $265 to $270, and reaffirmed its "Overweight" rating. This target price is based on its earnings forecast of $15.40 per share for fiscal year 2027 and a price-to-earnings ratio of 17.5 times. Analysts also noted that despite raising their profit forecasts, they believe their models "are still conservative."

Evercore ISI analyst Amid Daryanani reaffirmed his "Outperform" rating on Seagate stock, setting a target price of $330. He believes:

"Seagate is well-positioned to profitably capture the growing demand for high-capacity storage driven by AI workloads."

Barclays analyst Tom O'Malley stated that the latest performance indicates the market is still "extremely thirsty for storage." Although he maintains a "Neutral" rating on Seagate stock, he has raised his target price from $200 to $240. Wedbush analyst Matt Bryson also reaffirmed his "Outperform" rating, raising the target price from $260 to $290