Nomura Securities: The Federal Reserve will not cut interest rates this year

Nomura Securities believes that after the interest rate cut in October, the Federal Reserve's rate cuts for this year have ended, but it may restart rate cuts in 2026 and complete them in three phases. Employment data in the coming months may be slightly dovish, but it may not be enough to trigger concerns from the FOMC about a deterioration in the labor market

After the Federal Reserve's hawkish rate cut, Powell stated that a further rate cut in December is "far from certain." Nomura Securities updated its outlook on the Fed's policy, believing that after Wednesday's rate cut, the Federal Open Market Committee (FOMC) has concluded its easing actions for this year and will not cut rates again in December.

Nomura Securities stated in a report on Wednesday evening: "Data in the coming months may be slightly dovish, but we doubt whether the extent of this weakness is enough to reignite the FOMC's concerns about the deterioration of the labor market."

According to Wall Street Insight, it was previously mentioned,

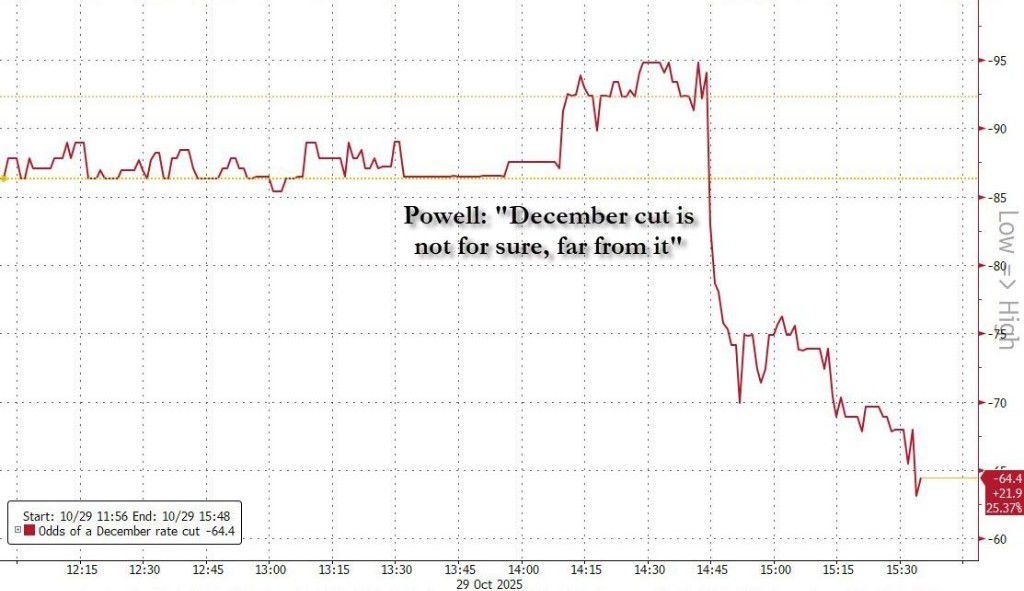

At the post-meeting press conference, Powell explicitly refuted the view that a rate cut in December was a "done deal," stating that this prospect is "far from certain," instantly reversing the market's optimistic sentiment.

The market's betting probability for a rate cut in December plummeted from 95% to 65%, with the Dow Jones Industrial Average and the S&P 500 erasing their intraday gains and turning to losses. The yield on the 2-year U.S. Treasury bond, which is most sensitive to interest rate prospects, surged by 0.092 percentage points, marking the largest single-day increase since early July.

In this context, Nomura Securities updated its forecast. The Japanese brokerage now expects the Fed to maintain interest rates at its December policy meeting. Previously, Nomura had anticipated that the Fed would cut rates by another 25 basis points before the end of the year.

The rate cut cycle is not over, predicting three cuts in 2026

After the latest policy meeting, Fed Chairman Powell's remarks became key in changing market expectations. He indicated that internal policy disagreements within the committee and insufficient federal data may hinder further rate cuts this year.

Powell weighed two sides of the risks in his remarks: on one hand, the downside risks facing the labor market, and on the other hand, the dangers of taking action in an unclear economic outlook. This cautious statement has been interpreted by institutions like Nomura as the Fed entering a period of policy observation rather than taking immediate follow-up actions.

Powell's firm stance marks a deepening concern within the Fed regarding further easing of policies. Wall Street Insight previously mentioned that according to Wall Street Journal reporter Nick Timiraos, Powell's remarks clearly indicate that as "more and more officials" question the necessity of further rate cuts, the easiest part of this easing cycle may have already ended.

Nomura Securities' adjustment of expectations reflects a reassessment of the market's view on the Fed's policy path. In Wednesday's meeting, the Fed clearly identified "mitigating further weakness in the labor market" as the main basis for rate cuts, indicating that labor market performance remains the core focus of current monetary policy Although the short-term outlook has turned cautious, Nomura still maintains its judgment on the Federal Reserve's long-term accommodative stance. The institution's analysts expect that the Fed's rate-cutting cycle is not over; it will just be more gradual and dispersed.

According to its latest forecast, Nomura expects the Federal Reserve to cut rates three times in 2026, each by 25 basis points, specifically in March, June, and September of that year. This ultra-long-term forecast indicates that the market is shifting its focus from short-term policy fluctuations to a much longer macroeconomic and interest rate cycle