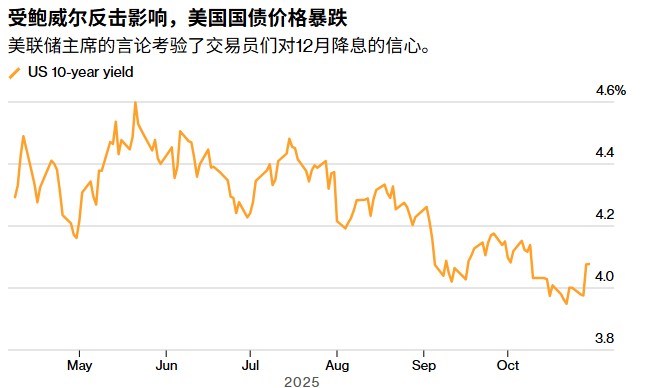

Powell slams the brakes on easing expectations, U.S. Treasury market falls into a sideways trend after decline

The U.S. Treasury market consolidated after a sharp decline on Wednesday, as the market questioned whether the Federal Reserve Chairman Jerome Powell's remarks indicated a third consecutive rate cut in December. Specifically, the yield on the 10-year U.S. Treasury remained flat at 4.08% on Thursday, after soaring 10 basis points in the previous trading session. Although the Federal Reserve cut rates by 25 basis points as expected, Powell bluntly stated at the press conference that "another rate cut this year is far from a certainty," dousing the hopes of traders who had bet on accelerated policy easing. Nicholas Mastoyani, a portfolio manager at Western Asset Management, noted that Powell's reiteration of the "inflation still above target, labor market cooling but not collapsing" tug-of-war situation, along with his hawkish tone, "put the market at a disadvantage." Interest rate futures indicated that traders' pricing for another rate cut before the end of the year plummeted from about 90% before the meeting to 60%, equivalent to an additional rate cut of about 15 basis points

According to the Zhitong Finance APP, the U.S. Treasury market consolidated sideways after a sharp decline on Wednesday, as the market became skeptical about a third consecutive rate cut in December following comments from Federal Reserve Chairman Jerome Powell. Specifically, the yield on the 10-year U.S. Treasury remained flat at 4.08% on Thursday, after surging 10 basis points in the previous trading session.

Although the Federal Reserve cut rates by 25 basis points as expected, Powell bluntly stated at the press conference that "another rate cut this year is far from a done deal," dousing the hopes of traders who had bet on accelerated policy easing.

Nicholas Mastoyani, a portfolio manager at Western Asset Management, noted that Powell reiterated the tug-of-war situation of "inflation still above target, and the labor market cooling but not collapsing," and his hawkish tone "put the market at a disadvantage."

Interest rate futures indicate that traders' pricing for another rate cut before the end of the year has plummeted from about 90% before the meeting to 60%, equivalent to an additional rate cut of about 15 basis points