What does SK Hynix's "sold out" mean? Morgan Stanley: Aligning with the "storage super cycle" of 2017-2018, raising DRAM price expectations

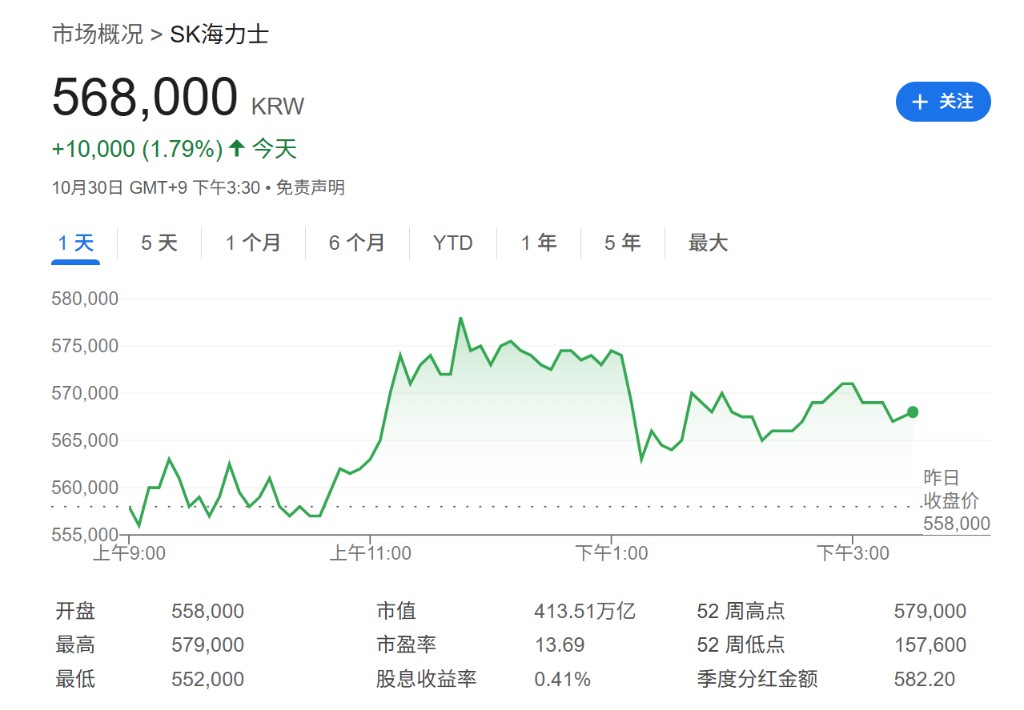

SK Hynix's "sold out" signal indicates that the storage market may enter a new cycle, and Morgan Stanley analysts have raised their 2026 DRAM price forecast to 30%. The company's third-quarter performance reached a record high, with operating profit increasing by 62%. Analysts predict that earnings per share for 2025-2027 will be raised by 5%, 14%, and 15% respectively, with the target price increased from 570,000 KRW to 630,000 KRW, maintaining an "overweight" rating. AI applications are driving a surge in storage demand, leading to a critical shortage of DRAM inventory and exacerbating the imbalance between supply and demand in the market

The wave of artificial intelligence is reshaping the global semiconductor supply chain at an unprecedented speed. The latest signals from memory chip giant SK Hynix suggest that the market may be entering a new cycle defined by supply shortages and soaring prices.

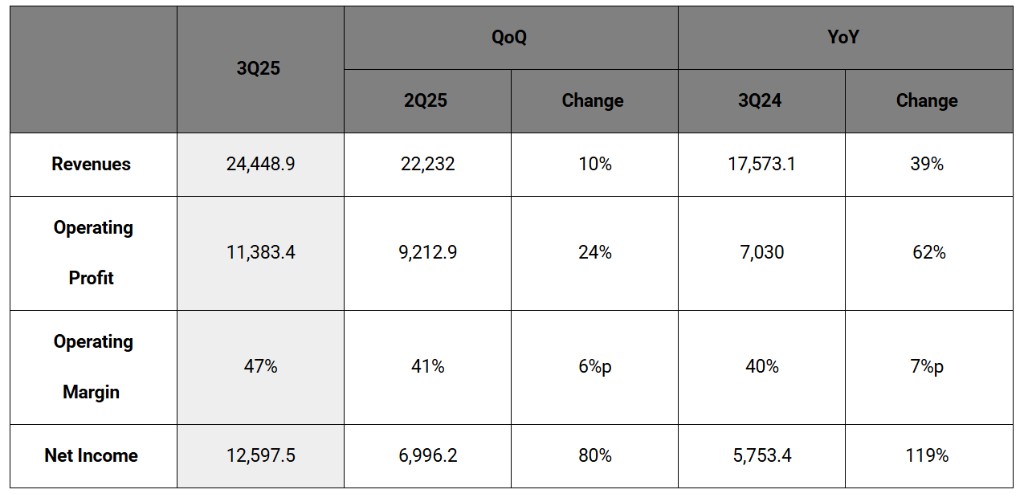

As previously mentioned by Wall Street Insights, SK Hynix's third-quarter performance reached a record high, with operating profit soaring by 62%, driven by the complete "sell-out" of its HBM high-bandwidth memory. The company has secured all DRAM and NAND customer demand through 2026, with HBM4 set to ship by the end of 2025.

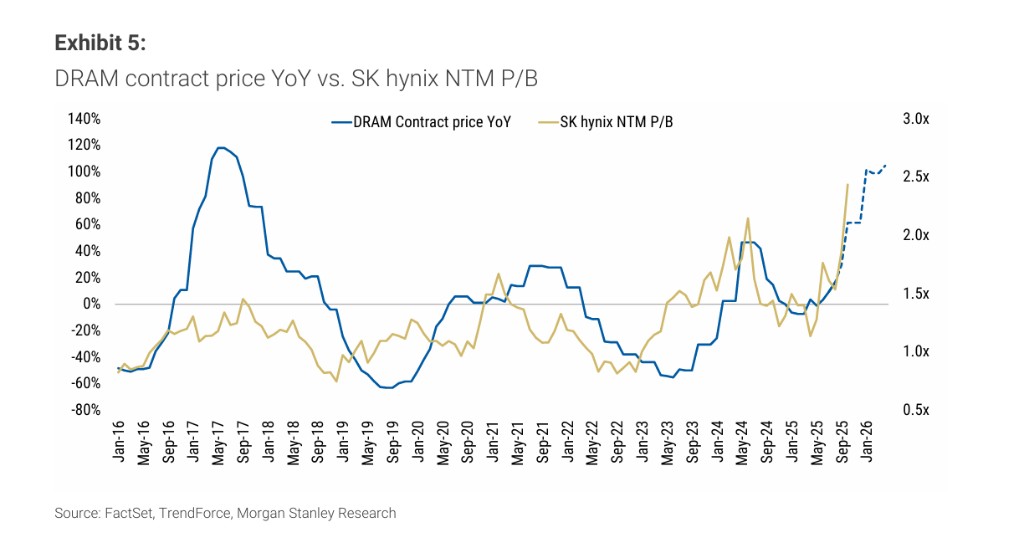

According to news from the Chase Wind Trading Desk, Morgan Stanley analysts Shawn Kim and Duan Liu pointed out in a report on the 29th that SK Hynix's "sell-out" signal indicates that supply will become tighter, and the price increase environment will persist through 2026. Analysts raised their 2026 DRAM price expectations from a previous year-on-year increase of 26% to 30%, bringing SK Hynix's outlook closer to the super cycle benchmark of 2017-2018.

This adjustment led Morgan Stanley to raise its earnings per share forecasts for SK Hynix for 2025-2027 by 5%, 14%, and 15%, respectively. Based on the residual income model, analysts raised the target price from 570,000 KRW to 630,000 KRW, equivalent to an expected price-to-book ratio of 2.6 times in 2026, representing a 15% upside from current levels. Morgan Stanley maintains an "Overweight" rating and an "Attractive" industry outlook.

Supply-Demand Imbalance Intensifies, DRAM Inventory in Urgent Situation

The comprehensive explosion of artificial intelligence applications is the core driving force behind the surge in demand in the storage market. According to Morgan Stanley's report, the demand for AI inference computing is significantly boosting the general storage chip market, rapidly consuming industry inventory and providing momentum for sustained price increases.

Statements from SK Hynix's management confirm the extent of supply tightness. It is reported that the inventory of DDR5 memory chips has dropped to an extremely low level of about two weeks, almost "produced and shipped immediately." Meanwhile, NAND flash inventory has also returned to a normalized level of 4-5 weeks. This situation directly reflects the strong market demand, especially the surging demand for eSSD storage from hyperscale data center servers and AI-generated content.

Based on this, Morgan Stanley predicts that **the industry-wide DRAM contract prices will achieve high double-digit (high-teen-digit) quarter-on-quarter growth in the fourth quarter of 2025, while NAND prices will see a quarter-on-quarter increase of 10-15%**

Analysts emphasized in the report that the market seems ready to continue rewarding SK Hynix—expanding an AI business (HBM) that essentially accounts for 20% of revenue to 100% of revenue (DRAM, NAND), a sustainable expansion with substantial pricing power.

HBM Leadership Solidified, Capital Expenditure Set to Surge

According to Morgan Stanley, SK Hynix's capital expenditure in 2026 is expected to significantly exceed previous levels, increasing by about 30% from approximately 27 trillion won in 2025 to about 35 trillion won. The ratio of wafer fabrication equipment (WFE) to infrastructure is expected to rise from 55% in 2025 to 60% in 2026, primarily to support the capacity ramp-up of the M15X plant. DRAM still accounts for about 90% of total WFE spending.

The launch of the M15X plant is ahead of schedule, with equipment installation already underway for HBM production in 2026. The expansion of DRAM and NAND will be driven by technology migration, including the transition to 1c DDR5 and 321-layer QLC (from 238-layer TLC). Morgan Stanley estimates that total capital expenditure will grow by about 42% to 35 trillion won in 2026.

The report also noted that the surge in demand for AI inference computing is driving growth in commodity memory demand, consuming inventory and maintaining price momentum. Strong quarterly performance is expected to be dominated by AI demand, including the boost in commodity memory demand from inference computing. SK Hynix's leadership in the HBM field and the leap in demand for all commodity memory provide greater pricing opportunities.

Morgan Stanley summarized in the report that the recent unexpected surge in commodity DRAM and NAND demand lays the groundwork for a severe supply shortage in 2026, with stronger market conditions likely to persist into 2026.

Morgan Stanley Raises Expectations, Reiterates "Overweight" Rating

The Morgan Stanley team has raised its key financial forecasts. The firm has increased its annual growth rate expectation for the average selling price of DRAM in 2026 from +20% to +30%, noting that this level is comparable to the last super cycle.

This adjustment directly boosts earnings expectations for SK Hynix. Morgan Stanley has raised its earnings per share (EPS) estimates for the company for the fiscal years 2025, 2026, and 2027 by 5%, 14%, and 15%, respectively.

Under the new valuation model, Morgan Stanley has raised SK Hynix's target price to 630,000 won, corresponding to a price-to-book ratio (P/B) of 2.6 times for 2026, and maintains an "Overweight" ratingThe bank believes that, given SK Hynix's leadership position in the HBM field and the sharp rebound in general storage prices, its stock price still has room for growth.

The above wonderful content comes from the Wind Trading Platform.For more detailed interpretations, including real-time analysis and frontline research, please join the【 **Wind Trading Platform ▪ Annual Membership**】Risk Warning and DisclaimerThe market has risks, and investment requires caution. This article does not constitute personal investment advice and does not take into account the specific investment goals, financial conditions, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article are suitable for their specific circumstances. Investing based on this is at your own risk