World Gold Council: In the third quarter, central banks around the world accelerated their gold purchases, and inflows into gold ETFs reached a new high

From July to September, central banks around the world purchased 220 tons of gold, an increase of 28% compared to the previous quarter. The National Bank of Kazakhstan became the largest single buyer, while the Central Bank of Brazil purchased gold for the first time in over four years. During the same period, inflows into gold ETFs reached a record high, with global inflows totaling $26 billion. The World Gold Council expects that geopolitical tensions, inflationary pressures, and uncertainties in global trade policies will continue to support gold demand for the remainder of this year

As gold prices "soar," gold demand is surging. In the third quarter, central banks around the world are accelerating their gold purchases, with inflows into gold ETFs reaching a record high.

On October 30, the World Gold Council released a report stating that between July and September, central banks purchased 220 tons of gold, an increase of 28% compared to the previous quarter, reversing the downward trend seen earlier this year. The National Bank of Kazakhstan became the largest single buyer, while the Central Bank of Brazil purchased gold for the first time in over four years.

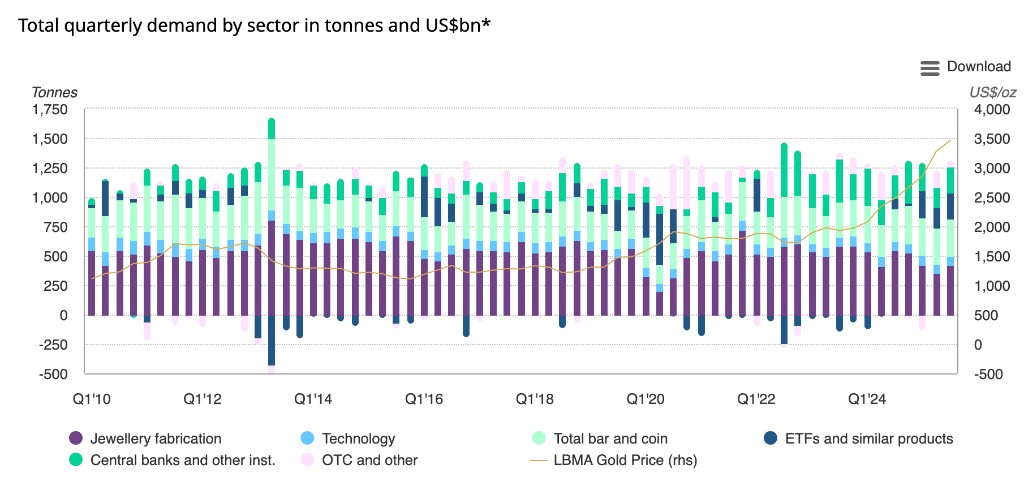

The report indicates that global gold demand (including over-the-counter transactions) reached 1,313 tons in the third quarter of 2025, with a total demand value of $146 billion, setting a record for quarterly gold demand. Notably, inflows into gold ETFs also reached an all-time high during the same period, with global inflows totaling $26 billion.

The World Gold Council expects that geopolitical tensions, inflationary pressures, and uncertainties in global trade policies will continue to support gold demand for the remainder of the year. The agency predicts that the total amount of gold purchased by central banks in 2025 will be between 750 and 900 tons.

Central Bank Gold Purchases Remain High but Below Last Year’s Levels

As of September, central banks have cumulatively increased their gold reserves by 634 tons this year, which is lower than the levels seen in the same period over the past three years, but significantly higher than the average level before the Russia-Ukraine conflict in 2022. Louise Street, a senior market analyst at the World Gold Council, stated in a report released on Thursday:

"Escalating geopolitical tensions, stubborn inflationary pressures, and uncertainties in global trade policies have all stimulated demand for safe-haven assets."

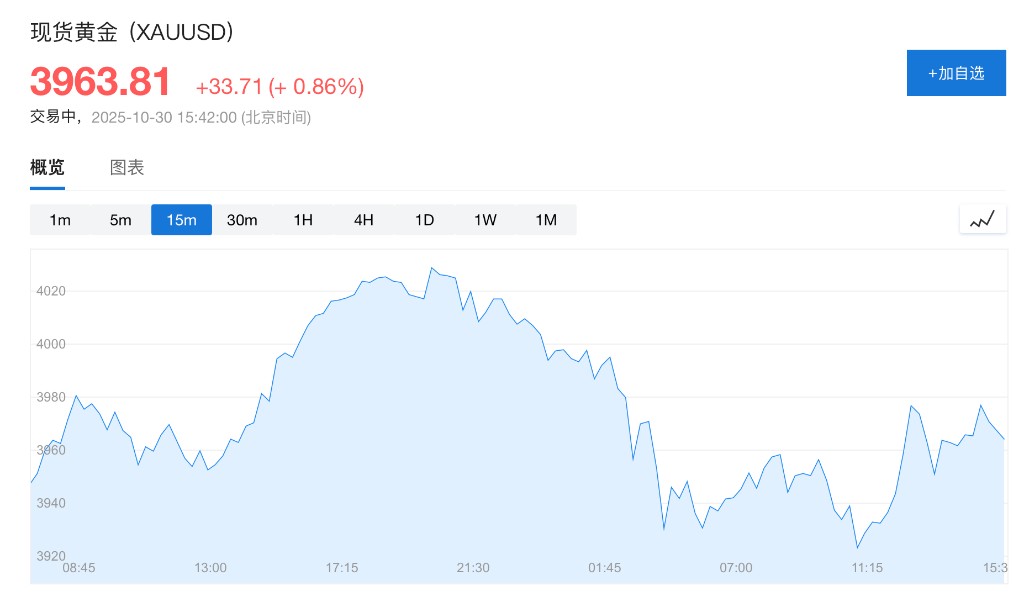

Despite a recent pullback, spot gold prices have risen by about 50% this year, reaching a historic high of over $4,380 per ounce earlier this month. The World Gold Council analyzes that the surge in gold prices may be one of the factors limiting central bank gold purchases in the first half of the year; the rebound in demand in the third quarter indicates that central banks are still strategically increasing their holdings. The agency also estimates that 66% of the gold purchase demand this quarter has not yet been publicly reported.

Gold ETF Inflows Reach New Highs

Strong demand from investors for gold ETFs is one of the main drivers of the overall increase in gold demand this quarter. In the third quarter, inflows into gold ETFs reached a record high, with global inflows totaling $26 billion. The continuous rise in gold prices has raised concerns among investors about missing out on the rally, while gold's dual attributes as a safe haven and a hedge have made it attractive to investors.

The World Gold Council stated that expectations for further monetary easing by the Federal Reserve and concerns about the health of the U.S. economy have driven investors into the gold market this quarter. On Wednesday, Eastern Time, the Federal Reserve lowered interest rates by 25 basis points as expected, but Fed Chairman Jerome Powell indicated that further rate cuts in December are "not a done deal."