Software stocks make a comeback! ServiceNow expects strong revenue growth, with AI helping to reduce costs

ServiceNow raised its quarterly revenue guidance, expecting subscription revenue to reach $3.43 billion, exceeding market expectations, benefiting from AI-driven cost reduction and efficiency improvement. The company's stock price rose about 4% in after-hours trading. Analysts say this marks the beginning of AI demonstrating substantial commercial value in the enterprise software sector, but the company still faces challenges from competitors like Salesforce

ServiceNow released strong revenue growth guidance, indicating that its artificial intelligence strategy is helping the company cut costs and improve profitability, providing a boost to the software sector, which has recently been under pressure due to unclear returns from AI commercialization.

The software manufacturer stated in a press release on Wednesday that it expects subscription revenue for the quarter ending in December to reach approximately $3.43 billion. The average analyst expectation was $3.41 billion. Meanwhile, the metric measuring recent contract sales (current remaining performance obligations) is expected to grow by 23%, also exceeding market expectations.

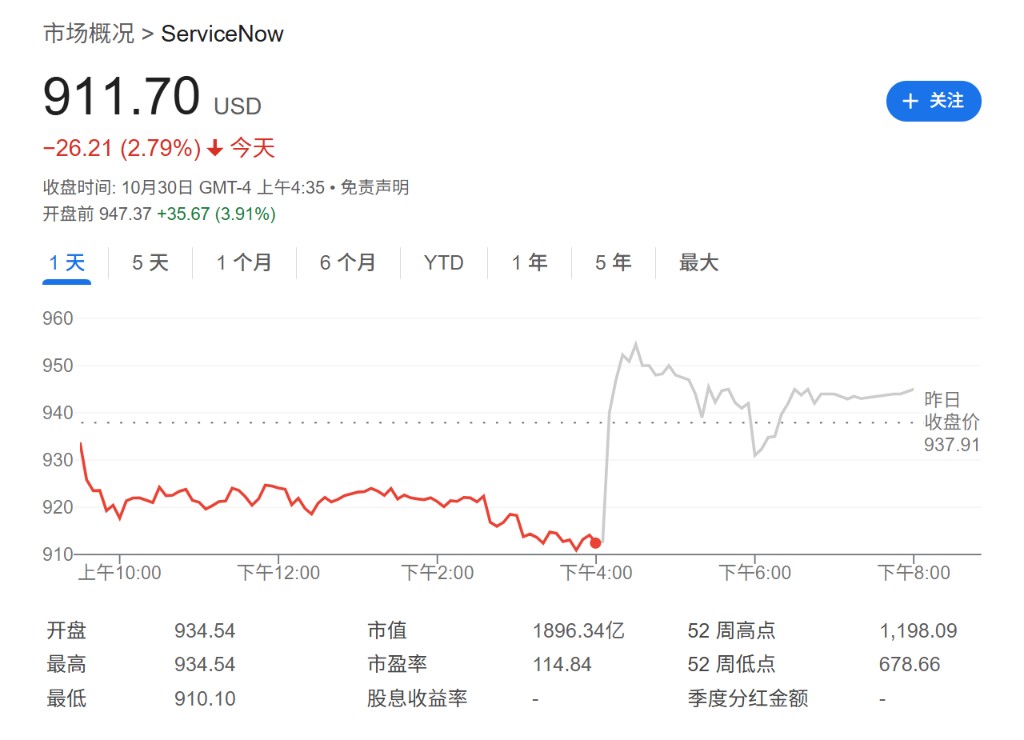

Boosted by this news, ServiceNow's stock price rose about 4% in after-hours trading. Prior to this, the company's stock had fallen 14% year-to-date due to investors' deepening concerns about whether application software vendors could achieve substantial financial returns from AI.

The company's Chief Financial Officer Gina Mastantuono noted in the statement that the internal implementation of AI is helping the company cut costs and increase profits, providing strong evidence of the practical commercial value of AI in enterprise applications. Subscription sales account for nearly all of ServiceNow's revenue.

Performance Exceeds Expectations, Boosting Investor Confidence

Along with the optimistic guidance, ServiceNow's third-quarter performance also exceeded Wall Street expectations. The earnings report showed that the company's third-quarter subscription revenue grew nearly 22% year-over-year, reaching $3.3 billion. Adjusted earnings per share, excluding certain items, were $4.82. Both key metrics surpassed market expectations. Analysts had previously estimated ServiceNow's third-quarter subscription revenue at $3.27 billion and adjusted earnings per share at $4.27.

CFO Gina Mastantuono's statement clarified the role of AI in helping the company reduce expenses, directly enhancing investor confidence in AI investment returns.

Currently, leading technology platforms, including ServiceNow, Salesforce Inc., and Microsoft Corp., are fiercely competing to integrate generative AI capabilities into their product lines. ServiceNow's key strategy is to apply AI to its core business of providing software that organizes and automates human resources and information technology (IT) operations for enterprises.

Intensifying Competition in Core Market

Despite the optimistic outlook, ServiceNow may soon face intensified competition in its core IT operations market. Reports indicate that its competitor Salesforce announced earlier this month that it would focus on developing IT service management software, signaling a direct entry into ServiceNow's territory.

Meanwhile, ServiceNow has also been working to expand its toolkit into new product categories, such as customer management. Notably, in July of this year, ServiceNow and Salesforce each invested approximately $750 million in contact center software company Genesys Cloud Services Inc It shows the complex relationship between the two parties, which includes both competition and cooperation in certain areas