The largest banks with the highest year-to-date growth have released their third-quarter reports, with ABC's net profit exceeding 220 billion, and the growth rate improving quarter-on-quarter

Agricultural Bank of China announced its third-quarter report for 2023, with a net profit of 220.859 billion yuan, a year-on-year increase of 3.03%. The stock price has risen over 57.7% this year, surpassing Industrial and Commercial Bank of China in market value. The operating income for the first three quarters was 550.774 billion yuan, with an annualized return on equity of 10.47%. Although net interest income decreased by 2.40%, net income from fees and commissions grew by 13.34%, becoming an important driver of revenue growth

This year, which bank stock has the largest price increase? The answer is Agricultural Bank of China!

According to WIND statistics, Agricultural Bank of China is the bank stock with the highest increase in the A-share market this year. As of October 30, the increase has exceeded 57.7%. By the end of the third quarter, the total market value of Agricultural Bank has surpassed that of the "universe bank," Industrial and Commercial Bank of China.

What kind of performance lies behind this rising trend?

On the evening of October 30, Agricultural Bank of China released its third-quarter report for 2025, revealing this secret.

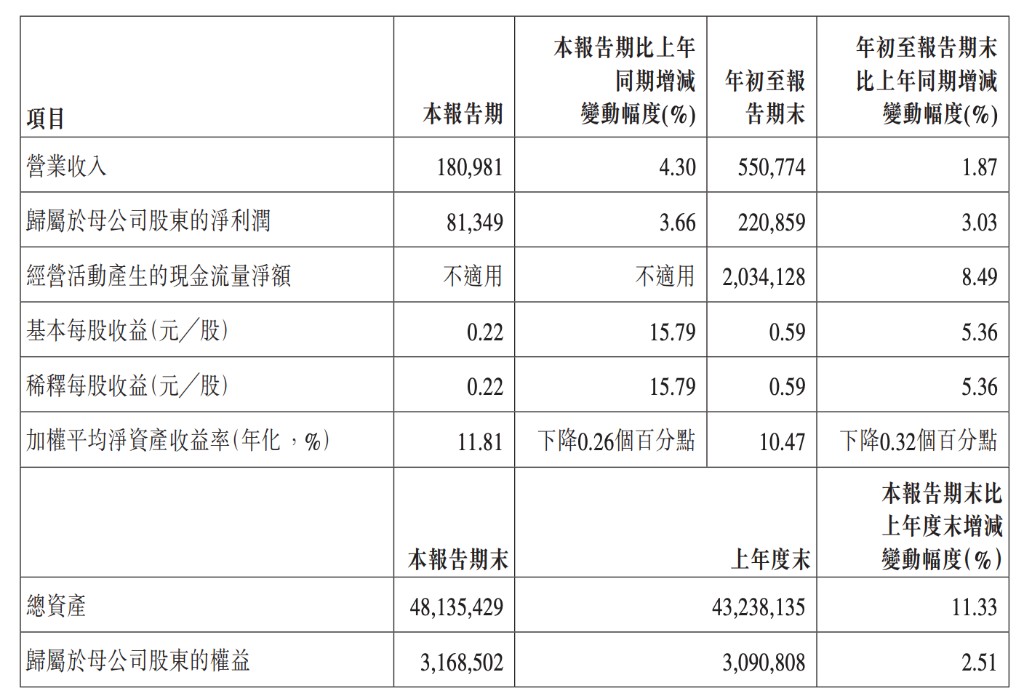

The report shows that Agricultural Bank has delivered a solid growth performance in the first three quarters. From January to September, it achieved operating income of 550.774 billion yuan, a year-on-year increase of 1.87%. The net profit attributable to shareholders of the parent company reached 220.859 billion yuan, a year-on-year increase of 3.03%.

The year-on-year growth rate of Agricultural Bank has further improved compared to the mid-year report, with the net profit growth rate slightly better than that of the previously announced profits of Bank of China. From this perspective, market funds are quite insightful.

Annualized Return on Equity: 10.47%

According to the third-quarter report, in the first three quarters of this year, Agricultural Bank's total assets exceeded 48.14 trillion yuan, an increase of 11.33% compared to the end of last year’s 43.24 trillion yuan, achieving "the elephant dancing."

With relatively stable overall business, Agricultural Bank's annualized average return on total assets is 0.65%, nearly flat year-on-year; the annualized weighted average return on equity is 10.47%, maintaining above 10%. The basic earnings per share reached 0.59 yuan, an increase of 0.03 yuan year-on-year.

As the earnings per share continue to rise in the first three quarters, it can be anticipated that after the market opens on October 31, Agricultural Bank's current dynamic price-to-earnings ratio will further decrease, potentially returning to 10 times after dilution (the closing price on October 30 was 10.1 times).

Significant Growth in Net Fee and Commission Income

From the revenue structure, there are many aspects worth discussing in Agricultural Bank's quarterly report.

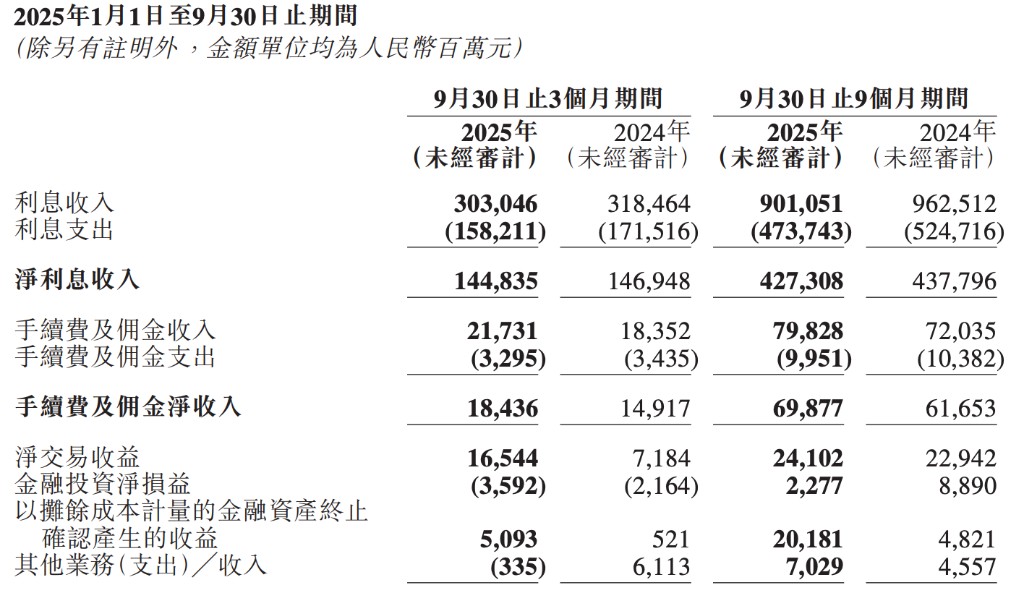

Among them, net interest income was 427.308 billion yuan, a year-on-year decrease of 2.40%, but net fee and commission income saw a significant year-on-year increase of 13.34%, reaching 69.877 billion yuan, effectively compensating for the fluctuations in net interest income and becoming an important engine for revenue growth.

Additionally, the income generated from the derecognition of financial assets measured at amortized cost was 20.181 billion yuan, a year-on-year increase of over 318%, showing a significant contribution Since the beginning of this year, Agricultural Bank of China's operating expenses amounted to 174.669 billion yuan, a year-on-year increase of 3.84%; the cost-to-income ratio (Chinese accounting standards) was 29.14%, an increase of 0.20 percentage points year-on-year. Credit impairment losses were 127.403 billion yuan, a year-on-year decrease of 3.643 billion yuan.

Total liabilities increased by 12% compared to the beginning of the year

As of the end of the reporting period, Agricultural Bank of China's total assets have surpassed 48 trillion yuan, reaching 48.14 trillion yuan, an increase of 11.33% compared to the end of last year, further enhancing its scale and strength. Among them, the total amount of customer loans and advances was 26.99 trillion yuan, an increase of 8.36% compared to the end of last year.

At the same time, the liability side remains quite robust, with total liabilities of 44.96 trillion yuan, an increase of 12.01% compared to the end of last year. The total amount of deposits reached 32.07 trillion yuan, an increase of 5.82% compared to the end of last year, providing strong support for the steady expansion of business.

As of the end of September, Agricultural Bank of China's non-performing loans amounted to 341.404 billion yuan, with a non-performing loan ratio of 1.27%, a decrease of 0.03 percentage points compared to the end of last year. The provision coverage ratio reached 295.08%, a decrease of 4.53 percentage points compared to the end of last year.

Risk warning and disclaimer

The market has risks, and investment should be cautious. This article does not constitute personal investment advice and does not take into account the specific investment objectives, financial conditions, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article are suitable for their specific circumstances. Investment based on this is at one's own risk