After a 30% surge in stock price, facing a major earnings report, can the "super cycle" of iPhone 17 help Apple continue to rise?

Apple Inc. will announce its earnings report after the market closes on Thursday, with investors eager to confirm strong demand for the iPhone. Since early August, Apple's stock price has risen over 30%, with its market capitalization increasing from $3 trillion to $4 trillion. The sales performance of the iPhone 17 has been strong, and analysts expect earnings to exceed expectations, suggesting that Apple may have significant moves ahead. Despite facing challenges, Apple stock performs best during the upward phase of the iPhone cycle, driven by upgrades from old devices, price increases, and the introduction of AI features

The Zhitong Finance APP noted that Apple (AAPL.US) has performed strongly in the stock market over the past few months, with optimism surrounding the iPhone driving its stock price to new highs. Investors will assess whether this enthusiasm is justified in Thursday's after-hours earnings report.

Since early August, Apple's stock price has risen by more than 30%, with its market capitalization increasing from $3 trillion to $4 trillion. Strong sales of the iPhone 17 have boosted investor confidence, while smartphone prices are also on the rise. An analysis by Counterpoint Research shows that the sales of the iPhone 17 series in the first 10 days of its launch in the U.S. and China were 14% higher than those of the iPhone 16.

This seems to confirm signs of strong demand, at least initially. This is crucial because, in the last fiscal year ending in September, the iPhone accounted for more than half of Apple's total revenue. Over the past three months, expectations for Apple's quarterly profits have been revised upward by 7%, and revenue expectations have been raised by 4.3%.

Randy Hale, the stock strategy director at Huntington National Bank, which has assets of $223 billion, stated, "These expectation adjustments indicate that analysts expect earnings to exceed expectations, and Apple may have significant moves in the remaining part of this year. But we first need to see evidence of strong iPhone demand."

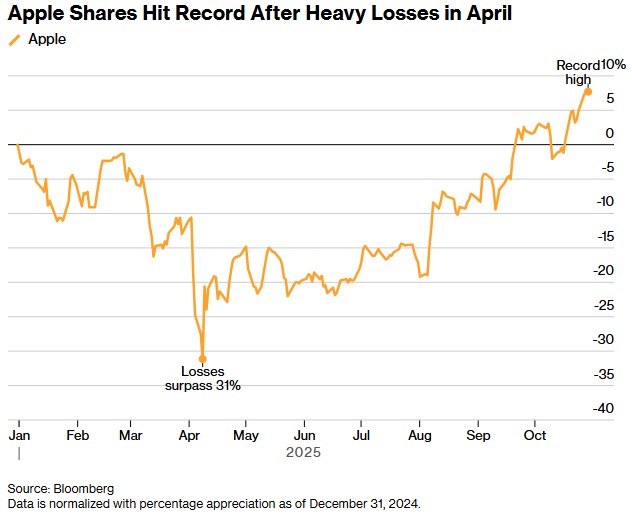

Apple's stock price reached an all-time high after a significant drop in April.

Perhaps more importantly, this year's progress may be a prelude to two major developments in the future: a foldable iPhone and enhanced artificial intelligence features.

John Belton, a portfolio manager at Gabelli Funds with assets of $35 billion, said, "Apple stock performs best during the upward phase of the iPhone cycle, and the current growth seems to have three driving forces: upgrading old devices, price increases, and more AI features about to be implemented. This suggests that the growth runway may be longer than we previously thought, and it seems to be at a fundamental sweet spot."

A Tough Year

However, this should not overshadow the recent difficulties faced by the stock. So far in 2025, Apple's stock price has only risen by 7.7%, far below the Nasdaq 100 index's 24% increase, only turning positive for the year last month.

But this level of underperformance also means that if the performance is strong, there may still be room for recent rebounds.

Belton stated, "If performance exceeds expectations, it will attract more investors because the stock has lagged this year. If the AI layout is done properly, it could bring further upside potential."

This is why bulls need to confirm that Apple products are entering an upgrade cycle. Last quarter, Apple recorded its fastest quarterly revenue growth in over three years, partly due to the strong performance of the iPhone. Last week, Loop Capital gave the stock a "buy" rating based on this assessment.

Apple's earnings report comes during a busy week for tech stocks. Microsoft, Alphabet, and Meta Platforms will release their earnings reports after the market closes on Wednesday, with Alphabet rising in after-hours trading due to better-than-expected sales, while Meta and Microsoft disappointed Amazon and Apple released their financial reports on Thursday.

However, Apple stands out among large tech companies. With a higher valuation, slower growth, and less aggressive AI investment compared to its peers, this also explains why it has achieved little in AI products.

Apple's recent rebound indicates that investor expectations have risen. Its price-to-earnings ratio is about 33 times expected earnings, significantly higher than the 10-year average of 22 times, making it the most expensive stock among the "seven giants" of U.S. stocks, except for Tesla.

Compared to its large tech peers, Apple's slow growth raises questions about its valuation. Data shows that Apple's revenue is expected to grow by 6.2% in the last fiscal year, with the same growth rate projected for the fiscal year 2026, lagging behind the tech industry's expected revenue growth of over 14% in 2025 and 13.6% in 2026.

Gabelli's Belton said, "I don't particularly like Apple because its valuation is high relative to growth prospects, but it is still worth allocating in the portfolio. As long as performance continues to exceed expectations, the stock price can keep rising. Expectations are high, and we must hope that there is a reason for those high expectations."