BYD Q3 revenue declines, net profit drops by 32.60%, aggressive expansion weighs on profitability | Financial Report Insights

BYD's revenue in the third quarter was 195 billion yuan, a year-on-year decrease of 3.05%, marking the first negative growth in single-quarter revenue in recent times; net profit attributable to the parent company was 7.82 billion yuan, a year-on-year plunge of 32.6%. The construction in progress amounted to 48.8 billion yuan, a staggering increase of 144.51% compared to the beginning of the year, indicating large-scale capacity expansion

On Thursday, BYD released its third-quarter performance announcement, here are the key points from the report:

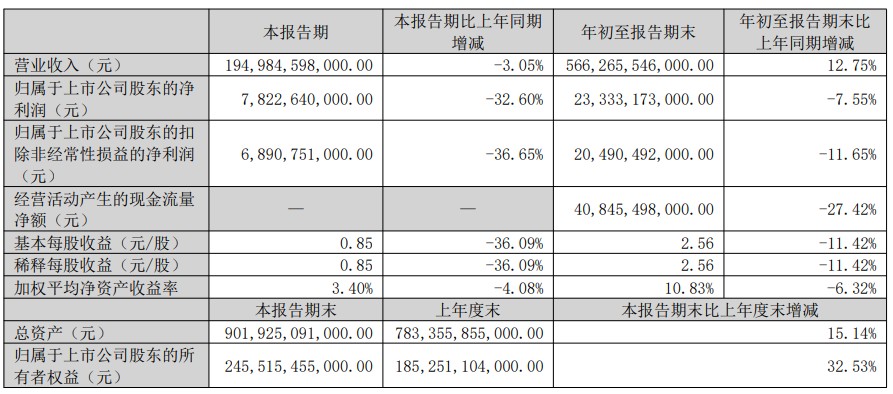

- Third-quarter revenue was 195 billion yuan, a year-on-year decrease of 3.05%, marking the first negative growth in single-quarter revenue in recent times; net profit attributable to shareholders was 7.82 billion yuan, a year-on-year plunge of 32.6%

- Revenue for the first three quarters was 566.3 billion yuan, a year-on-year increase of 12.75%; net profit attributable to shareholders was 23.3 billion yuan, a year-on-year decrease of 7.55%

- Net profit excluding non-recurring items was 20.5 billion yuan, a year-on-year decrease of 11.65%; operating cash flow was 40.8 billion yuan, a year-on-year decrease of 27.42%

In terms of financial structure:

- Total assets were 901.9 billion yuan, an increase of 15.14% compared to the beginning of the year; inventory was 153 billion yuan, a surge of 31.83% compared to the beginning of the year

- Construction in progress was 48.8 billion yuan, a dramatic increase of 144.51% compared to the beginning of the year, indicating large-scale capacity expansion

- Long-term borrowings were 61.2 billion yuan, a staggering increase of 641.10% compared to the beginning of the year; other current liabilities were 21.7 billion yuan, an increase of 300.18% compared to the beginning of the year

- Return on equity was 10.83%, a year-on-year decrease of 6.32 percentage points

Revenue Growth Slows, Profitability Declines Sharply

BYD's third-quarter operating revenue was 195 billion yuan, a year-on-year decrease of 3.05%, which is a rare instance of negative growth in single-quarter revenue for the company in recent years. Even more concerning for investors is that net profit attributable to shareholders was 7.82 billion yuan, a year-on-year plunge of 32.60%, with the decline far exceeding the revenue drop.

Net profit excluding non-recurring items was 6.89 billion yuan, a year-on-year decrease of 36.65%, indicating that the profitability of the company's main business is under significant pressure. In terms of profit quality, the weighted average return on equity was 3.40%, a substantial year-on-year decrease of 4.08 percentage points.

The performance for the first three quarters is similarly bleak. Although operating revenue was 566.3 billion yuan, a year-on-year increase of 12.75%, net profit attributable to shareholders was 23.3 billion yuan, a year-on-year decrease of 7.55%, with the gap between revenue growth and profit decline continuing to widen.

More concerning is the cash flow situation. The net cash flow generated from operating activities was 40.8 billion yuan, a significant year-on-year decrease of 27.42%, with the deterioration of cash flow occurring even faster than the decline in profits, which typically indicates issues such as increased accounts receivable, inventory backlog, or difficulties in collections.

Cost Pressure: Declining Gross Margin, Soaring Expenses

A deep dive into the financial data reveals the cost pressures the company is facing. Operating costs for the first three quarters were 465.1 billion yuan, a year-on-year increase of 14.70%, with the growth rate exceeding that of revenue by nearly 2 percentage points, resulting in a gross margin of approximately 17.86%, down about 1 percentage point from the same period last year.

The pressure on expenses is also significant. Research and development expenses were 43.7 billion yuan, a year-on-year surge of 31.30%, accounting for as much as 7.72% of revenue. Selling expenses were 18.5 billion yuan, a year-on-year increase of 11.21%; administrative expenses were 15.3 billion yuan, a year-on-year increase of 23.04%. The total of these three expenses reached 77.5 billion yuan, a year-on-year increase of 22.37%, exceeding the revenue growth rate It is worth mentioning that financial expenses were -2.94 billion yuan, a significant improvement compared to the 1.03 billion yuan expense in the same period last year, mainly due to exchange gains this period, while the same period last year experienced exchange losses. However, this improvement is more attributed to exchange rate factors rather than the main business operations.

Balance Sheet: Aggressive Expansion, Surge in Debt

On the asset side, total assets reached 901.9 billion yuan, an increase of 15.14% compared to the beginning of the year. Among them, inventory was 153 billion yuan, a staggering increase of 31.83% compared to the beginning of the year, with inventory growth far exceeding revenue growth. Construction in progress was 48.8 billion yuan, a dramatic increase of 144.51% compared to the beginning of the year, and development expenditures were 3.15 billion yuan, a staggering increase of 519.65%, indicating that the company is aggressively expanding capacity and increasing R&D investment.

Trading financial assets amounted to 55.5 billion yuan, an increase of 37.06% compared to the beginning of the year, mainly due to an increase in wealth management business. Accounts receivable were 39.4 billion yuan, a decrease of 36.81% compared to the beginning of the year, primarily due to an increase in accounts receivable factoring business.

The changes on the liability side were even more drastic. Long-term borrowings reached 61.2 billion yuan, a staggering increase of 641.10% compared to the beginning of the year; bonds payable were 5 billion yuan, which was zero at the beginning of the year; and other current liabilities were 21.7 billion yuan, an increase of 300.18% compared to the beginning of the year, mainly due to the issuance of short-term financing bonds this period.

The sharp expansion of debt is directly related to the company's aggressive expansion. Cash flow from investment activities shows that in the first three quarters, cash payments for the purchase of fixed assets, intangible assets, and other long-term assets amounted to 114.9 billion yuan, a year-on-year increase of 64.72%