Sanhua Q3 net profit increased by 43.81% year-on-year, revenue grew by 12.77% | Financial Report Insights

Sanhua's Q3 net profit increased significantly by 43.81% year-on-year, and operating revenue grew by 12.77% to 7.767 billion yuan. The performance announcement coincided with the company's recent completion of its Hong Kong stock issuance. As of the end of the reporting period, the company's monetary funds increased by 194.48% compared to the beginning of the year, and the net cash flow from financing activities turned from a net outflow in the same period last year to a net inflow of over 8 billion yuan

In the field of global refrigeration appliances and new energy vehicle thermal management, industry leader Sanhua's net profit in Q3 increased significantly by 43.81% year-on-year, with operating revenue rising by 12.77% to 7.767 billion yuan. The performance announcement coincided with the company's recent completion of its Hong Kong stock issuance. As of the end of the reporting period, the company's cash and cash equivalents increased by 194.48% compared to the beginning of the year, and the net cash flow from financing activities turned from a net outflow of the same period last year to a net inflow of over 8 billion yuan.

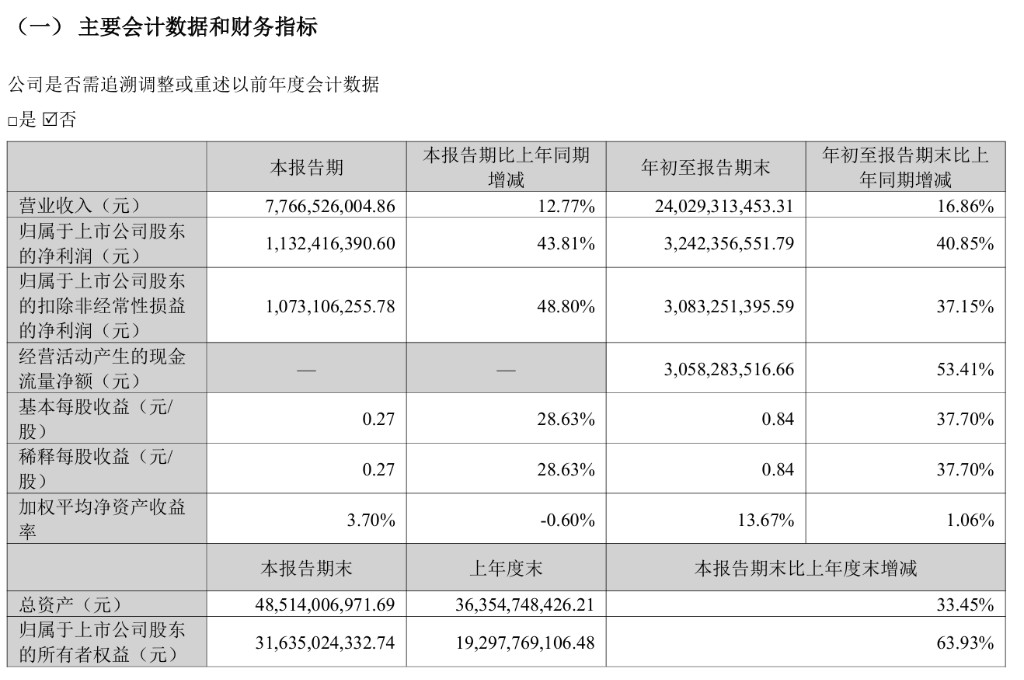

On the 30th, Sanhua released its Q3 2025 report:

- In the third quarter, operating revenue reached 7.767 billion yuan, a year-on-year increase of 12.77%;

- Net profit attributable to shareholders of the listed company was 1.132 billion yuan, a year-on-year increase of 43.81%.

Strong Growth in Core Profitability

From the beginning of the year to the end of the reporting period, Sanhua achieved a cumulative operating revenue of 24.029 billion yuan, a year-on-year increase of 16.86%; net profit attributable to shareholders of the listed company reached 3.242 billion yuan, a year-on-year increase of 40.85%. Excluding non-recurring gains and losses such as government subsidies and changes in the fair value of derivatives, the company's core profitability remains outstanding. In the first three quarters, the company's net profit excluding non-recurring items was 3.083 billion yuan, a year-on-year increase of 37.15%.

The company's operational quality also remained at a high level. During the reporting period, the net cash flow from operating activities reached 3.058 billion yuan, a year-on-year increase of 53.41%. The company explained that this was mainly due to an increase in cash received from sales of goods, reflecting good market sales and collection conditions.

Successful Hong Kong Listing, Significant Improvement in Cash Flow and Capital

Sanhua completed its Hong Kong stock issuance during the reporting period. According to the balance sheet, as of the end of September, the company's capital reserve surged by 9.271 billion yuan compared to the beginning of the year, with the company clearly stating that this was "mainly due to the completion of the Hong Kong stock issuance."

In the first three quarters, cash received from "investment absorption" reached 9.803 billion yuan. Driven by this, the net cash flow from financing activities reached 8.499 billion yuan, contrasting sharply with a net outflow of 403 million yuan in the same period last year.

As of the end of the reporting period, the company's cash and cash equivalents amounted to 15.456 billion yuan, an increase of 194.48% compared to 5.249 billion yuan at the beginning of the year. In addition, according to the company's announcement, international underwriters have fully exercised their over-allotment option, further enhancing the company's capital reserves.

Derivative Income Boosts Profit, Exchange Gains Reduce Some Growth

From the breakdown of the income statement, the use of certain financial instruments and non-operating items had a certain impact on the current profit and loss. Data shows that in the first three quarters, the company's "fair value change income" reached 112 million yuan, a significant increase of 95.67 million yuan compared to the same period last year. The company explained in its financial report that this was mainly due to increased floating income from foreign exchange derivative instruments. At the same time, "other income" also increased by 52.33 million yuan year-on-year due to an increase in government subsidies However, exchange rate fluctuations also bring negative impacts. During the reporting period, the company's financial expenses increased by more than 22 million yuan year-on-year, mainly due to a decrease in exchange gains. This partially offset some of the profit growth. In addition, the company also disclosed in its non-recurring profit and loss statement that its derivative business, including futures and foreign exchange forward contracts, recorded overall gains, but the exchange losses related to operations reached 68.85 million yuan