Earn 1 billion every day! "Universe Bank" ICBC announces third-quarter report, with both net profit attributable to shareholders and revenue showing positive growth

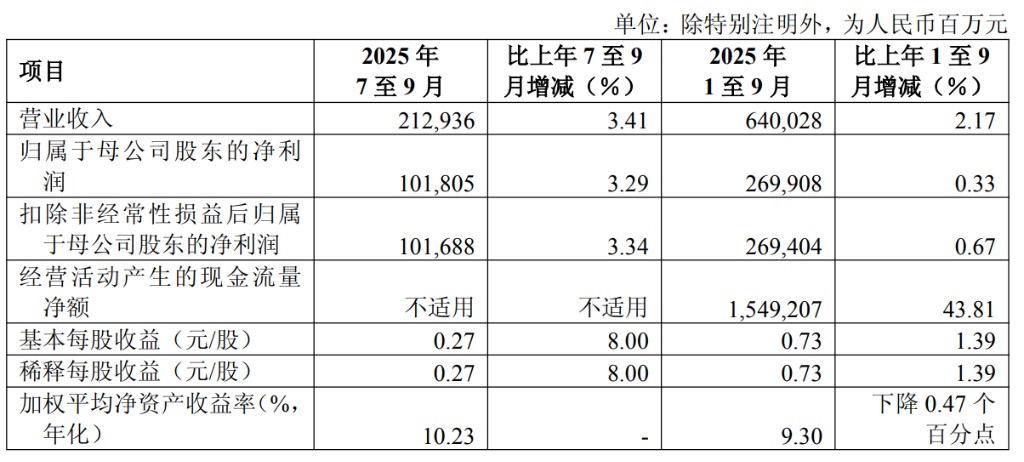

On October 30th, ICBC announced its Q3 2025 earnings report, showing operating income of CNY 640.028 billion, a year-on-year increase of 2.17%; net profit attributable to shareholders was CNY 269.908 billion, a year-on-year increase of 0.33%. The net profit for the third quarter was CNY 101.805 billion, a year-on-year increase of 3.29%. Total assets reached CNY 52.81 trillion, with total customer loans of CNY 30.45 trillion, both achieving steady growth. The non-performing loan ratio was 1.33%, and the provision coverage ratio was 217.21%

On the evening of October 30th, ICBC announced its third-quarter performance report for 2025.

The report shows that as the largest bank in the world by total assets, ICBC's total assets continue to steadily rise, exceeding 52.8 trillion yuan.

In the first three quarters of this year, ICBC's operating income and net profit attributable to shareholders of the parent company both achieved stable growth, with operating income of 640.028 billion yuan, a year-on-year increase of 2.17%. The net profit attributable to shareholders of the parent company was 269.908 billion yuan, a year-on-year increase of 0.33%.

Considering that the first three quarters of this year totaled 273 days, ICBC's net profit translates to nearly 1 billion yuan per day.

Stable Growth in Revenue and Profit

In the first three quarters of 2025, ICBC's operating income was 640.028 billion yuan, a year-on-year increase of 2.17%. The net profit attributable to shareholders of the parent company was 269.908 billion yuan, a year-on-year increase of 0.33%.

Thus, ICBC has achieved a positive year-on-year growth rate in net profit attributable to the parent company within the year.

From a quarterly perspective, the growth momentum in the third quarter (July-September) was quite evident, with a net profit attributable to shareholders of the parent company of 101.805 billion yuan, a year-on-year increase of 3.29%.

Further Consolidation of Scale Advantage

At the end of the reporting period, ICBC's total assets steadily grew to 52.81 trillion yuan, an increase of 3.99 billion yuan from the end of the previous year, representing an 8.18% growth. The scale advantage has been further consolidated. The total amount of customer loans and advances (excluding accrued interest) was 30.45 trillion yuan, an increase of 7.33%.

Total liabilities were 48.62 trillion yuan, an increase of 8.44% from the end of the previous year. Customer deposits were 37.31 trillion yuan, an increase of 7.09%.

Increase in Provision Coverage Ratio

In terms of asset quality, the balance of non-performing loans was 404.838 billion yuan, an increase of 25.380 billion yuan from the end of the previous year, with a non-performing loan ratio of 1.33%, a decrease of 0.01 percentage points. The provision coverage ratio was 217.21%, an increase of 2.30 percentage points.

The core tier 1 capital adequacy ratio was 13.57%, the tier 1 capital adequacy ratio was 14.80%, and the total capital adequacy ratio was 18.85%, all meeting regulatory requirements.

Risk Warning and Disclaimer

The market has risks, and investment should be cautious. This article does not constitute personal investment advice and does not take into account the specific investment objectives, financial situation, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article are suitable for their specific circumstances. Investment based on this is at one's own risk