GF SECURITIES Q3 revenue increased by 51.82% year-on-year, net profit surged by 86%, driven by investment and brokerage business growth | Financial Report Insights

GF SECURITIES Q3 net profit increased by 85.86% year-on-year to 4.46 billion yuan. The performance growth was mainly driven by proprietary investment business and brokerage business, with fair value change gains increasing by 343.24% year-on-year, and net commission and fee income growing by 38.09%, of which net income from brokerage business increased by 74.96%, indicating a significant rise in market trading activity

GF Securities' Q3 operating revenue increased by 51.82% year-on-year, and net profit attributable to shareholders rose by 85.86% to 4.46 billion yuan. The performance growth was mainly driven by proprietary investment and brokerage businesses, with fair value changes in income increasing by 343.24% year-on-year, and net commission and fee income rising by 38.09%, among which net income from brokerage business grew by 74.96%, indicating a significant increase in market trading activity.

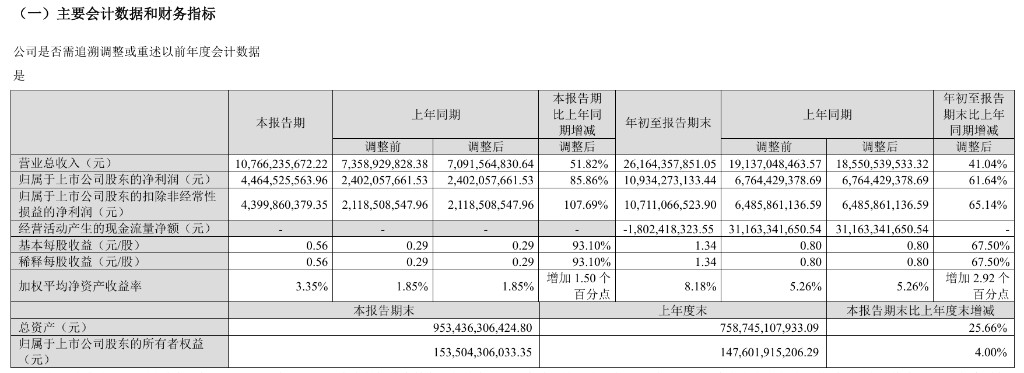

On the 31st, GF Securities released its Q3 2025 report:

- The company achieved total operating revenue of 10.77 billion yuan in the quarter, a year-on-year increase of 51.82%.

- Net profit attributable to shareholders was 4.46 billion yuan, a substantial increase of 85.86% compared to the same period last year.

Investment and Brokerage Business Drive Growth

From the cumulative data of the first three quarters, the company achieved a cumulative net profit of 10.93 billion yuan, a year-on-year increase of 61.64%; cumulative total operating revenue reached 26.16 billion yuan, a year-on-year increase of 41.04%. Strong performance was mainly driven by two core businesses: fair value changes in income (i.e., investment income) and net commission and fee income.

In the first three quarters of this year, the company achieved fair value changes in income of 4.29 billion yuan, a staggering increase of 343.24% compared to 968 million yuan in the same period last year. The financial report explained that this was mainly due to "the fair value changes of financial instruments during the period," indicating that the company's proprietary trading business has achieved great success.

At the same time, as a traditional business pillar, net commission and fee income in the first three quarters reached 13.64 billion yuan, a year-on-year increase of 38.09%. Among them, the increase in net income from brokerage fees was the main contributing factor, reflecting the improvement in market trading activity and the company's market competitiveness in this field.

The company's total asset scale grew by more than 25% compared to the end of last year, with multiple balance sheet items related to investment and financing recording rapid growth.

Significant Expansion of the Balance Sheet

As of September 30, the company's total assets reached 953.44 billion yuan, an increase of 25.66% compared to 758.75 billion yuan at the end of 2024.

The expansion of the balance sheet is reflected in multiple items. On the asset side, "trading financial assets" surged by 45.47% compared to the end of last year, with the financial report stating that this was mainly due to "the increase in the scale of investments such as bonds at the end of the period." On the liability side, "short-term borrowings" and "borrowed funds" surged by 97.65% and 93.58%, respectively, while "trading financial liabilities" skyrocketed by 216.39%. The company previously announced that as of August 31, the cumulative new borrowings for the year accounted for 34.61% of the net assets at the end of last year, confirming its proactive financing and expansion strategy.

As of the end of the reporting period, the parent company's risk coverage ratio decreased from 276.22% at the end of last year to 226.88%; the capital leverage ratio fell from 13.29% to 11.20% In addition, the proportion of proprietary equity securities and their derivatives to net capital increased from 31.55% to 48.23%, while the proportion of non-equity securities and their derivatives to net capital surged from 296.51% to 374.27%