U.S. Stock Market Outlook | Three major index futures all decline, Apple and Amazon to announce earnings after hours

U.S. stock index futures all fell, with Apple and Amazon set to announce their earnings after the market closes. Dow futures fell by 0.32%, S&P 500 futures dropped by 0.35%, and Nasdaq futures declined by 0.55%. Major European stock indices also generally fell, with WTI crude oil and Brent crude oil both down by 0.86%. Federal Reserve Chairman Jerome Powell stated after the interest rate cut that future rate cuts are not guaranteed, and market expectations for policy easing were hit, with Bitcoin's price briefly dropping below $108,000 before recovering to above $110,000

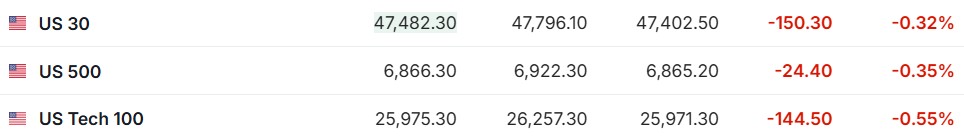

- As of October 30th (Thursday) before the US stock market opened, the three major US stock index futures all fell. As of the time of writing, Dow futures were down 0.32%, S&P 500 futures were down 0.35%, and Nasdaq futures were down 0.55%.

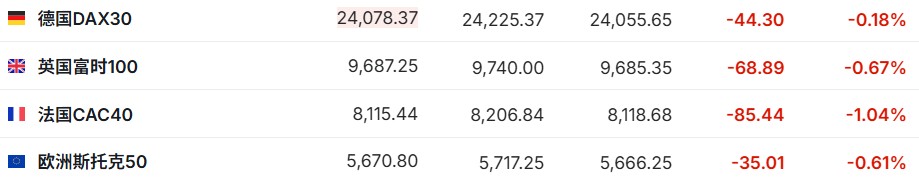

- As of the time of writing, the German DAX index was down 0.18%, the UK FTSE 100 index was down 0.67%, the French CAC40 index was down 1.04%, and the Euro Stoxx 50 index was down 0.61%.

- As of the time of writing, WTI crude oil was down 0.86%, priced at $59.96 per barrel. Brent crude oil was down 0.86%, priced at $63.77 per barrel.

Market News

The Chinese and US heads of state meet in Busan. On October 30th local time, the Chinese head of state held a meeting with US President Trump in Busan. The Chinese head of state pointed out that economic and trade relations should continue to be the ballast and engine of China-US relations, rather than a stumbling block and conflict point. Both sides should consider the big picture and focus on the long-term benefits of cooperation, rather than falling into a vicious cycle of mutual retaliation. The teams from both sides can continue to negotiate based on the principles of equality, respect, and mutual benefit, continuously narrowing the list of issues while expanding the list of cooperation.

Powell puts the brakes on easing expectations, US Treasury market falls into consolidation after a drop, Bitcoin struggles to recover above $110,000 after briefly falling below $108,000. Although the Federal Reserve cut interest rates by 25 basis points as expected, Powell bluntly stated at the press conference that "another rate cut this year is far from a done deal," dousing the hopes of traders who had bet on accelerated easing. The US Treasury market consolidated after a significant drop on Wednesday, as the market questioned whether the Fed Chairman Jerome Powell would support a third consecutive rate cut in December. Specifically, the yield on the 10-year US Treasury remained flat at 4.08% on Thursday, after surging 10 basis points the previous trading day. Bitcoin continued its downward trend after Powell's hawkish remarks, briefly falling 3.1% below the $108,000 mark, but later during the European session, demand from buyers pushed the price back above $110,000. As of the time of writing, Bitcoin was trading around $111,315.

Powell voices support for the AI boom: This is not a replay of the internet bubble! On Wednesday local time, Federal Reserve Chairman Powell clearly stated that the current AI boom is not another internet bubble. At the press conference following the Fed's policy meeting, he candidly pointed out that the current wave of AI investment is rooted in profitable companies and real economic activity, rather than speculative frenzy "I won't name specific companies," Powell emphasized, "but these enterprises are indeed profitable. They possess mature business models, stable profits, and other core elements, which is fundamentally different from the internet bubble era." This statement marks Powell's first direct acknowledgment that the expansion of companies in the artificial intelligence sector—covering hundreds of billions of dollars in data center and semiconductor investments—has become a true engine driving U.S. economic growth.

Bessent: The Federal Reserve is still living in the past; its predictive models have failed. U.S. Treasury Secretary Bessent praised the Federal Reserve's decision to cut interest rates by 25 basis points, but also pointed out that the Fed's skeptical remarks about whether to cut rates again this year indicate that the institution urgently needs significant reform. Bessent stated that he will conduct a second round of interviews for candidates to replace Powell in early December, allowing Trump to make an appointment before Christmas. Bessent said, "The current Federal Reserve is stuck in the past. Their inflation predictions this year have been very poor, and their models have failed."

Is the biggest AI IPO coming? Reports suggest OpenAI may file as early as the second half of next year, with a valuation potentially reaching $1 trillion. AI startup OpenAI is preparing to submit its initial public offering (IPO) application as early as next year, which could value the company at $1 trillion. The media reports that the company is preparing for one of the largest IPOs in history and is considering filing with regulators as early as the second half of 2026. Reports indicate that the company has discussed raising at least $60 billion through the IPO. Meanwhile, Microsoft (MSFT.US) and OpenAI announced a new agreement, with Microsoft stating it will support OpenAI in advancing the formation and capital restructuring of its profit-oriented division, OpenAI Group PBC (OpenAI Group Public Benefit Corporation).

Individual Stock News

Three games go viral, Roblox (RBLX.US) Q3 daily active users and bookings both exceed expectations! Gaming company Roblox reported record quarterly results, with strong performance from three popular games leading to daily active users far exceeding analyst expectations. Data shows that the company's daily active users in the third quarter reached 151.5 million, significantly surpassing the analyst estimate of 132.3 million, with a year-on-year growth rate of 70%. The booking amount, which measures sales performance, reached $1.92 billion, also higher than the analyst estimate of $1.7 billion. Revenue reached $1.4 billion, a year-on-year increase of 48%, with a net loss of $257 million and adjusted EBITDA of $45.7 million.

Microsoft (MSFT.US) Q1 results exceed expectations, data center spending surges, raising concerns over "burning money" in AI. In the first fiscal quarter, Microsoft’s total revenue grew by 18% to $77.7 billion; earnings per share were $3.72. Analysts had previously expected revenue of $75.6 billion and earnings per share of $3.68. The company stated that capital expenditures for the first quarter, including leasing (which reflects data center spending), reached $34.9 billion, up from $24 billion in the previous quarter. Microsoft CEO Satya Nadella stated in a statement, "To seize the enormous opportunities of the future, we will continue to increase our investments in AI in both capital and talent." AI business momentum is strong! Alphabet (GOOGL.US) raises capital expenditure guidance again, Q3 cloud backlog rises to $155 billion. Alphabet reported better-than-expected third-quarter results. Q3 revenue was $102.35 billion, a year-on-year increase of 16%, exceeding market expectations of $99.89 billion. Adjusted earnings were $3.10, compared to an expected $2.33. Sales also surpassed analyst expectations, primarily due to the strong performance of its cloud division, which is thriving as AI startups seek Google's support and computing power. Third-quarter sales (excluding traffic acquisition costs) rose to $87.5 billion. Data shows this figure is higher than the analyst average expectation of $85.1 billion. Net profit was $2.87 per share, higher than Wall Street's expectation of $2.26.

Meta (META.US) plunges after earnings! One-time tax expense drags Q3 net profit down 83%, ongoing AI investment raises market concerns. Due to a nearly $16 billion one-time non-cash income tax expense recorded in Q3 2025, Meta Platforms (META.US) saw a significant decline in profits for the quarter. Meanwhile, the company stated it would significantly increase total spending in 2026 and plans to maintain historically high levels of investment in data centers and other infrastructure to drive its artificial intelligence (AI) development goals. As a result of this news, Meta's stock fell over 9% in pre-market trading on Wednesday. Thanks to strong performance in Facebook and Instagram advertising, Meta's Q3 revenue grew 26% year-on-year to $51.24 billion, exceeding market expectations of $49.6 billion. Q3 net profit plummeted 83% year-on-year to $2.709 billion; earnings per share were $1.05, far below the market expectation of $6.72.

Signs of recovery for Starbucks (SBUX.US)! Q4 revenue exceeds expectations, same-store sales return to positive growth. In the fourth quarter of fiscal year 2025 ending September 28, Starbucks' net revenue grew 5.5% year-on-year to $9.57 billion, better than the market expectation of $9.34 billion; same-store sales increased by 1%, better than the market expectation of a decline of 0.48%, ending six consecutive quarters of decline. The growth in same-store sales was mainly due to strong performance in international markets. International business sales grew by 3%. Sales in the Chinese market rebounded, while the U.S. market performance remained flat, in line with market expectations. However, adjusted earnings per share were $0.52, below the market expectation of $0.55. The adjusted operating profit margin decreased by 900 basis points year-on-year to 9.4%, mainly affected by coffee prices, tariffs, and labor investments during the transformation (most of which were made in the form of increased employee hours).

Oil and gas trading rebound helps Shell (SHEL.US) Q3 profit exceed expectations, stock buybacks and deleveraging proceed simultaneously. European energy giant Shell reported better-than-expected Q3 profits, despite the continued weakness of global oil benchmarks—Brent crude prices in the second half of the year. However, thanks to the substantial actual shipment volumes of oil and gas, its oil and gas trading business showed a strong rebound Despite the weakening energy prices dragging down Shell's profits, the company's third-quarter earnings exceeded analysts' expectations significantly, thanks to the unexpectedly strong performance of its oil and gas trading business. The London-based energy giant maintained its quarterly stock buyback pace of $3.5 billion, while net debt decreased from $43.2 billion at the end of June to $41.2 billion. Shell's adjusted net profit in the third quarter fell about 10% year-on-year to $5.43 billion, but was well above the average analyst expectation of $4.74 billion.

TotalEnergies (TTE.US) cuts buybacks to control debt, Q3 profits meet expectations. French energy giant TotalEnergies reported profits in line with analyst expectations, as increased oil and gas production and stronger refining margins helped offset the impact of falling prices. The financial report showed that its adjusted net profit in the third quarter fell 2.3% to $3.98 billion, matching the average expectation. TotalEnergies' third-quarter revenue was $43.84 billion, down 7.6% year-on-year, missing expectations by $510 million. Production was 2.51 million barrels of oil equivalent per day. Cash flow from operating activities in the third quarter was $8.349 billion, compared to $7.061 billion in the same period last year, benefiting from a $1.3 billion positive contribution from working capital. Oil prices during this period were lower than the same time last year, due to concerns over oversupply triggered by production increases from OPEC+ and non-OPEC countries.

Stellantis (STLA.US) revenue returns to growth, but a cost warning scares the stock price down. Automaker Stellantis reported on Thursday that its third-quarter revenue reached €37.2 billion, a 13% year-on-year increase, marking the first revenue growth in seven quarters, initially confirming the effectiveness of the reforms under new CEO Antonio Filosa. However, the group also issued a cost warning, casting a shadow over the otherwise positive third-quarter performance. The Franco-Italian-American joint venture also stated that it estimates the impact of U.S. tariff policies on 2025 to be about €1 billion ($1.2 billion), down from a previous estimate of €1 billion to €1.5 billion. Stellantis reiterated its financial expectations for the second half of 2025, including revenue growth, improved cash flow, and adjusted operating profit margins maintaining low single-digit growth. The stock fell over 7% in pre-market trading.

AI boom drives demand for memory chips, Samsung Electronics (SSNLF.US) Q3 semiconductor division profits soar 79% exceeding expectations. Samsung Electronics' semiconductor division reported profits in the third quarter that significantly exceeded expectations, demonstrating that global demand for artificial intelligence (AI) is driving a recovery in this South Korean company's most important business segment. Samsung Electronics announced on Thursday that its third-quarter sales were 86.1 trillion won, a 9% year-on-year increase. The DS (Device Solutions) division, primarily responsible for semiconductor business, saw third-quarter sales increase 13% year-on-year to 33.1 trillion won, with memory chip sales rising 20% year-on-year to 26.7 trillion won; the division's third-quarter operating profit was 7.0 trillion won, up 79% from 3.9 trillion won in the same period last year, far exceeding the average analyst expectation of 4.7 trillion won Three consecutive declines! Mexican fast-food chain Chipotle (CMG.US) lowers sales expectations for three consecutive quarters. The Mexican fast-food chain Chipotle released its third-quarter report on Wednesday Eastern Time, marking the third consecutive quarter of lowering its full-year sales expectations. The company is still dealing with a decline in customer traffic and economic pressures faced by its core customer base. Data shows that Chipotle's total revenue for the third quarter was $3 billion, below the market expectation of $3.02 billion. Adjusted earnings per share were $0.29, in line with Wall Street expectations. Digital sales accounted for 36.7% of total restaurant revenue. Same-store sales grew by 0.3%, below the expected 1%. This quarter's menu price increases and higher average transaction values offset some of the impact from the decline in customer traffic. The company stated in its third-quarter report that it currently expects same-store sales to decline in the low single digits this year.

Weak new drug pipeline! Sales of flagship Keytruda fall short of expectations, Merck (MRK.US) lowers revenue guidance upper limit. Merck lowered its upper revenue guidance for 2025 in its latest quarterly report released on Thursday, and none of its drugs achieved outstanding sales performance. As the company prepares for the patent expiration of its star cancer drug Keytruda, this performance undoubtedly exacerbates the challenges it faces. The company stated in its financial report that it has lowered the upper limit of its 2025 revenue guidance by $300 million, now expecting sales to be between $64.5 billion and $65 billion. Meanwhile, its flagship product Keytruda and the highly anticipated rare lung disease drug Winrevair both fell short of market expectations in sales this quarter.

Leading the weight loss drug market! Eli Lilly (LLY.US) raises full-year performance guidance. Eli Lilly raised its full-year performance guidance due to its blockbuster weight loss and diabetes drugs exceeding analysts' expectations in the third quarter. This is a positive development for the pharmaceutical company, which is in fierce competition. The company's third-quarter sales reached $17.6 billion, surpassing Wall Street's average expectation of $16.1 billion. Non-GAAP earnings per share were $7.02, exceeding expectations by $1.13. Eli Lilly's better-than-expected sales in the third quarter were primarily driven by Zepbound and Mounjaro, which generated approximately $3.6 billion and $6.5 billion in revenue, respectively. The combined revenue from its diabetes drug Mounjaro and obesity treatment drug Zepbound exceeded expectations by nearly $1.3 billion, with most of the outperformance coming from the diabetes drug. Due to increased competition, the weight loss drug Zepbound has recently faced pressure.

TAL Education (TAL.US) Q2 revenue grew by 39.1% year-on-year, net profit surged by 116.1% year-on-year. TAL Education's Q2 revenue reached $861.4 million, a 39.1% increase compared to the same period last year. The net profit attributable to TAL Education was $124.1 million, compared to $57.4 million in the same period last year, a year-on-year increase of 116.1%. Under Non-GAAP standards, basic and diluted earnings per ADS were $0.24, compared to $0.12 in the same period last year Operating profit was $96.1 million, compared to $47.6 million in the same period last year. Under Non-GAAP standards, operating profit was $107.8 million, compared to $64.5 million in the same period last year. As of August 31, 2025, the total cash, cash equivalents, and short-term investments amounted to $3.2488 billion, down from $3.6184 billion as of February 28, 2025.

Tesla (TSLA.US) Cybercab will make its Asia-Pacific debut at the Shanghai Import Expo in November. Tesla Vice President Tao Lin announced on Thursday via Weibo that the company will showcase its Cybercab model at the China International Import Expo in Shanghai from November 5 to 10, marking the first appearance of this fully autonomous taxi in the Asia-Pacific region. It is still unclear whether Tesla has plans to deploy Cybercab on Chinese roads. This autonomous vehicle was first unveiled by Musk in October last year and began trial operations in Austin in June this year, initially open only to invited users and equipped with onboard safety personnel. Mass production is scheduled to start next year. Notably, as Tesla showcases Cybercab in Shanghai, Chinese companies such as Baidu (09888) and Pony.ai (PONY.US) have been conducting trial operations of autonomous taxis in multiple cities across the country for years.

Important Economic Data and Event Forecast

At 21:55 Beijing time: Federal Reserve Governor Bowman will deliver a pre-recorded speech at an online conference.

The next day at 01:15 Beijing time: 2026 FOMC voting member and Dallas Fed President Logan will speak.

Earnings Forecast

Friday morning: Apple (AAPL.US), Amazon (AMZN.US), Western Digital (WDC.US), Vale (VALE.US)

Friday pre-market: ExxonMobil (XOM.US), Chevron (CVX.US), AbbVie (ABBV.US)