Leading brokerages release third-quarter reports, CSC's net profit increases by 80%, and investment income doubles!

Investment banking business data warms up

The performance of brokerage stocks is becoming increasingly noteworthy.

On the evening of October 30th, brokerage giant CSC disclosed its latest performance. The announcement showed that CSC achieved operating revenue of 6.549 billion yuan in the third quarter, a year-on-year increase of 55.29%; the net profit attributable to shareholders of the parent company was 2.580 billion yuan, a year-on-year increase of 79.21%.

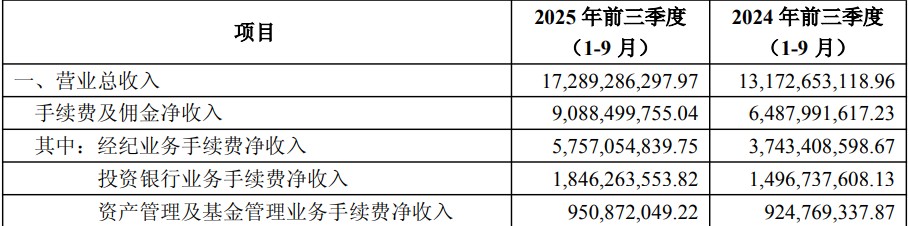

In the first three quarters, this brokerage achieved operating revenue of 17.289 billion yuan, a year-on-year increase of 31.25%; the net profit attributable to shareholders of the parent company was 7.089 billion yuan, a year-on-year increase of 64.95%.

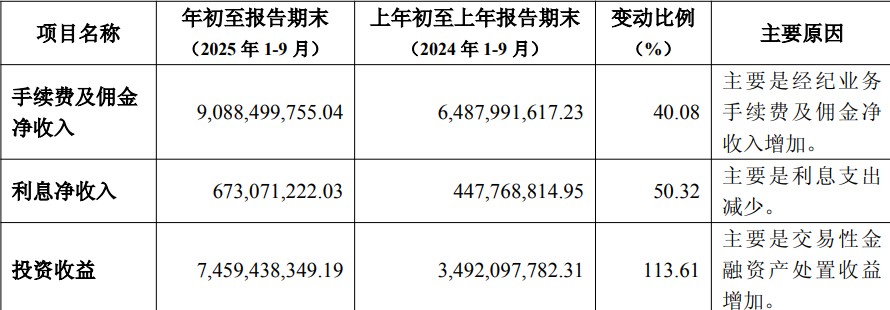

Regarding the growth of the above core indicators, CSC explained: “Mainly due to the increase in investment income, net income from fees and commissions.”

Investment Income Increased by Over 100%

Breaking it down: The most noteworthy aspect of CSC this year is the recovery of its investment business, which recorded 7.46 billion yuan in the first three quarters, with a year-on-year increase of 113.61%.

CSC explained this as: “Mainly due to the increase in gains from the disposal of trading financial assets.”

In other words, the company's proprietary business and various assets held by the company have significantly improved overall returns after experiencing this year's stock market rally, and the company team seized market opportunities.

Brokerage Business “Spring River Water Warm”

CSC's wealth (brokerage) business also performed impressively.

The third-quarter report showed that the company's net income from fees and commissions “accounted for” 9.09 billion yuan in the first nine months of this year, a year-on-year increase of 40%.

Among them, the net income from brokerage business fees grew particularly significantly, reaching 5.757 billion yuan, a year-on-year increase of 53.68%.

In addition, net interest income was 673 million yuan, a year-on-year increase of 50%.

This reflects the activity in the stock market and the company's increase in trading volume.

Investment Banking Business Warming Up

In the first three quarters of 2025, CSC's overall performance was strong, especially with the recovery of investment banking and brokerage businesses.

However, it is undeniable that the net income from investment banking also showed good growth, reaching 1.846 billion yuan, a year-on-year increase of 23.37%. This growth indicates that the company's underwriting business in the capital market is gradually recovering.

Finally, the net income from asset management and fund management business was relatively stable, increasing by 2.81% to 951 million yuan.